Ethereum

Ethereum price prediction – Holding on to $3K may be key because…

Credit : ambcrypto.com

- Ethereum’s funding charge has fallen sharply to $4,000 because the rejection

- Value-wise, ETH is down 10.08% over the previous seven days

Over the previous three weeks, Ethereum [ETH] has struggled to keep up any upward momentum on the charts. Actually, the altcoin has skilled excessive value swings whereas buying and selling sideways throughout this era.

On the time of writing, Ethereum was buying and selling at $3,232. This marked a decline of 10.08% on the weekly charts, with an extension of this bearish development with one other 1.85% dip on the day by day chart.

With ETH struggling to submit any sustained good points, the crypto group has expressed some concern as analysts see uncertainty. For instance, cryptoquant analyst Shayan means that ETH ought to maintain its $3k assist stage to assist an uptrend.

Ethereum’s funding charge is falling

In keeping with CryptoquantIn keeping with Shayan, Ethereum’s funding charge has fallen sharply because the altcoin was rejected because of its $4k resistance.

This notable drop in funding charge is an indication of decreased demand, weakening Ethereum’s bullish momentum. With out renewed market confidence amongst traders, it is going to due to this fact be troublesome to maintain an upward development.

Because the funding charge drops, ETH threatens to fall beneath $3,000. As such, the $3k assist stage is important for ETH’s stability and reigniting a northward rally. If it exceeds this stage whereas the funding charge continues to say no, ETH will see extra intense promoting and a deeper correction.

Due to this fact, the general outlook for Ethereum hinges on the altcoin regaining a better funding charge to defend the $3,000 assist stage. These two will decide the subsequent course Ethereum takes.

What it means for ETH’s charts

When financing charges fall sharply, this primarily signifies that traders shut lengthy positions. Merely put, the findings for ETH hinted at a attainable shift in market sentiment in the direction of bearishness.

Supply: Tradingview

We are able to see this weakening uptrend from the decline within the Relative Vigor Index. This has declined over the previous 4 days, indicating sturdy draw back momentum and a weakening uptrend.

This phenomenon may be additional confirmed by a lowering +DI and an growing -DI.

Supply: Coinglass

Trying additional, this shift in market sentiment could also be mirrored within the rising demand for brief positions. In keeping with Coinglass, most merchants have shorted ETH with 52% of complete accounts.

When quick place holders rise, it’s a signal of bearish sentiment as they count on the value to fall.

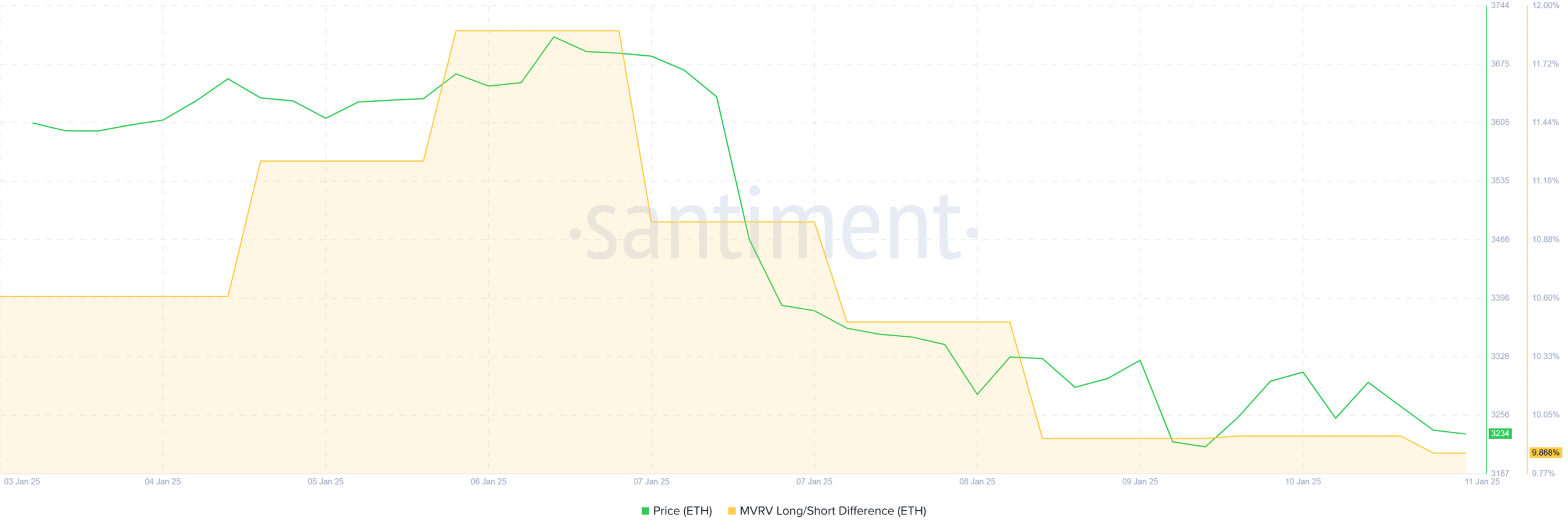

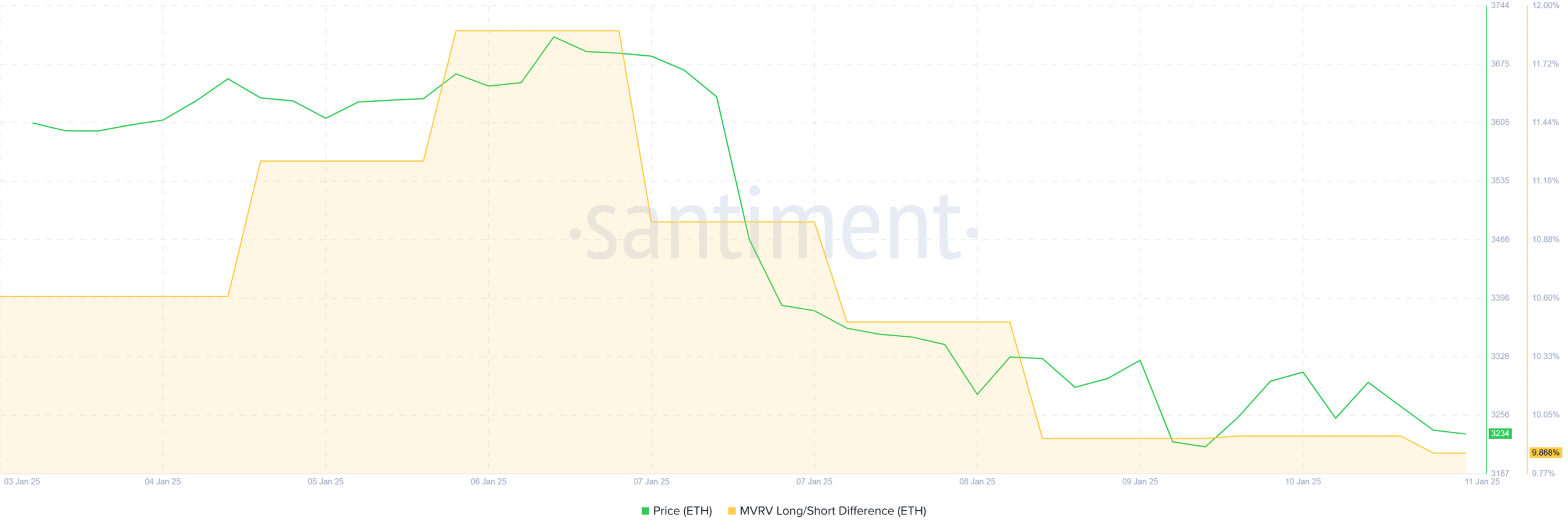

Supply: Santiment

Lastly, the MVRV long-short distinction in Ethereum fell to 9.86% over the previous week. Such a decline signifies not solely decreased profitability for long-term house owners, but in addition an growing insecurity amongst long-term house owners. When long-term house owners lose confidence, they have a tendency to promote.

In conclusion, falling funding charges place Ethereum in a weak place, which might see the altcoin fall. If this development continues as traders harbor bearish sentiments, ETH might see a drop to $3,160.

To keep up the bullish momentum, the $3k assist stage should maintain. A transfer beneath $3,026 might see ETH drop to $2,800.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now