Ethereum

Ethereum price prediction – Netflows, break-even price, and key levels to watch!

Credit : ambcrypto.com

- The whole change of ETH has historically given essential insights into investor habits

- ETH/USD -Liquidatie HeatMap hinted the place merchants have been most susceptible to pressured liquidations

On the time of writing, Ethereum’s [ETH] Worth motion signaled uncertainty, as a result of on-chain statistics and commerce knowledge combined sentiment to traders. Change Netflows steered that accumulation was underway, whereas liquidation zones have been on resistance ranges that might dictate the following step of ETH.

Buyers even appeared to place a possible rally. Nonetheless, essential limitations have to be deleted for persistent upward impulse.

The whole change community flows of Ethereum have given traditionally essential insights into the habits of traders. For instance – between January 2021 and January 2025, ETH noticed varied consumption cycles and outsource, because of the altering market sentiment.

Supply: Cryptuquant

In Might 2021, Netflows reached a peak at 1.28K, as a result of ETH was traded at $ 4,000. By September 2022, the influx had risen to -1.5 million, tailor-made to a value drop to $ 1,200.

By Might 2024 the Netflows have been stabilized virtually zero, with ETH commerce at $ 3,800. In the beginning of 2025 the outflows elevated, and reached 250k when ETH fluctuated round $ 1,800.

Traditionally, sturdy streams have indicated accumulation indicated, which means that traders count on larger costs. If this pattern continues, ETH can quickly go to $ 2,000. Nonetheless, a shift to internet influx could point out the revenue, which signifies that ETH could fall to $ 1500.

Right here it’s value indicating that the parable with the battery part 2021 has indicated on a doable rally if the demand stays steadily.

Crucial ranges to view are …

The ETH/USD liquidation warmth offered perception into the place merchants can be essentially the most susceptible for pressured liquidations. The information revealed critical liquidation clusters between $ 1,850 and $ 1,900, with the publicity to leverage reaching 87.62 million.

Further clusters existed at $ 1,800 (64.54 million) and $ 1,750 (45.4 million). With ETH buying and selling at $ 1,894.11, it appeared to have a powerful resistance within the neighborhood of $ 1,900.

Supply: Coinglass

If ETH succeeds in breaking above this stage, the momentum can push it to $ 2,000. Nonetheless, not sustaining greater than $ 1,850 could cause cascade studying, enhance gross sales strain and attracts ETH to $ 1,700.

The Heatmap additionally steered that merchants ought to observe the vary of $ 1,750 – $ 1,800 intently as a possible battery zone. The liquidation sample additionally mirrored Bitcoin’s resistance clusters, indicating broader market correlations.

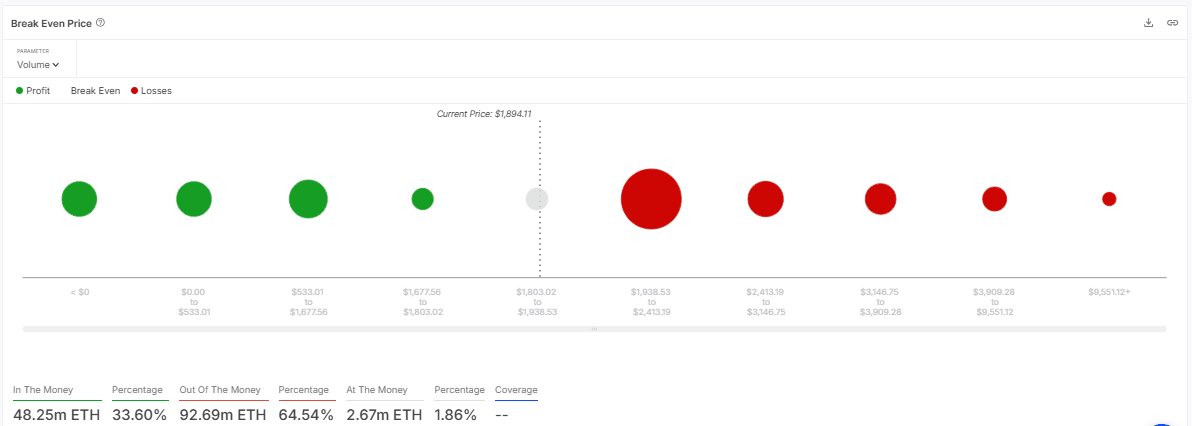

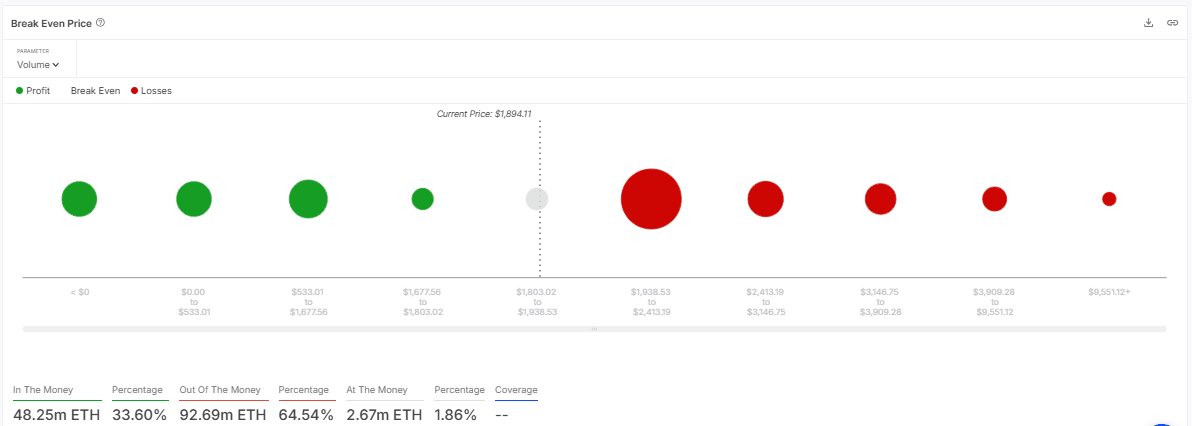

Break-even value evaluation and market route

Lastly, on 14 March, the break-even value evaluation of Ethereum added a layer to market forecasts. Knowledge confirmed that 33.60% of ETH holders within the cash was of $ 48.25 million ETH, with the break-even value for $ 1,803.02.

Supply: Intotheblock

Within the meantime, 64.54% of the holders from the Cash, with a break-even value of $ 1,985.53. The AT-the-Cash positions amounted to 1.86%, a complete of $ 2.67 million ETH at $ 1,894.11.

With the Altcoin commerce close to $ 1,894.11 on the press, the value was above the edge within the cash, however below the out-of-the-money sequence. If consumers don’t help $ 1,850, a lower as much as $ 1,800 or decrease can be probably.

Conversely, an outbreak above $ 1,985.53 may proceed to activate to $ 2,100. The numerous proportion of out-of-the-money positions steered persistent bearish strain, in distinction to the bullish accumulation pattern of the Netflow. This dynamic indicated that volatility can in all probability be within the quick time period.

Merely put, the market indicators of Ethereum introduced a contradictory however insightful image. Change Netflows confirmed sturdy circulate of 250k and hints to the buildup of traders. Liquidation knowledge recognized resistance to $ 1,900, with secure zones close to $ 1,800. The break-even value evaluation emphasised 64.54% of merchants from the Cash at $ 1,985.53-one signal of probably downward danger.

If ETH maintains help above $ 1,850, this will break the resistance from the previous and try for $ 2,000 or larger. Nonetheless, if it doesn’t comprise key ranges, step -by -step liquidations can deliver the value to $ 1500.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now