Ethereum

Ethereum price prediction – Will rising leverage drive or weaken ETH’s rally?

Credit : ambcrypto.com

- Ethereum has risen to a three-month excessive above $2,900 as bullish sentiment strengthens.

- The rising estimated leverage ratio and funding charges point out rising speculative exercise by derivatives merchants.

Ethereum [ETH] has risen 20% in simply two days, with the worth fluctuating between $2,400 and $2,950. On the time of writing, ETH was buying and selling at $2,922, its highest degree in additional than three months.

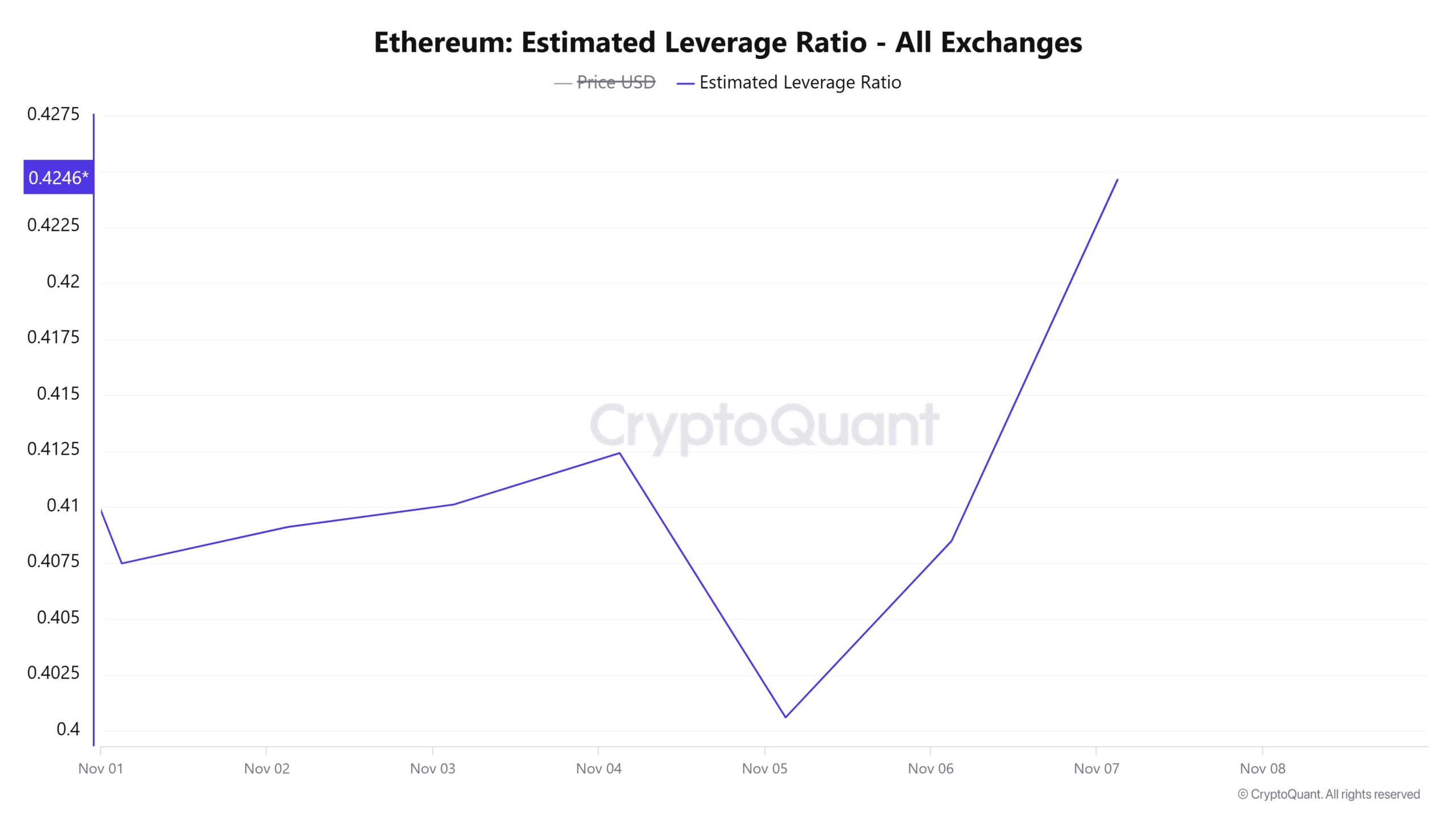

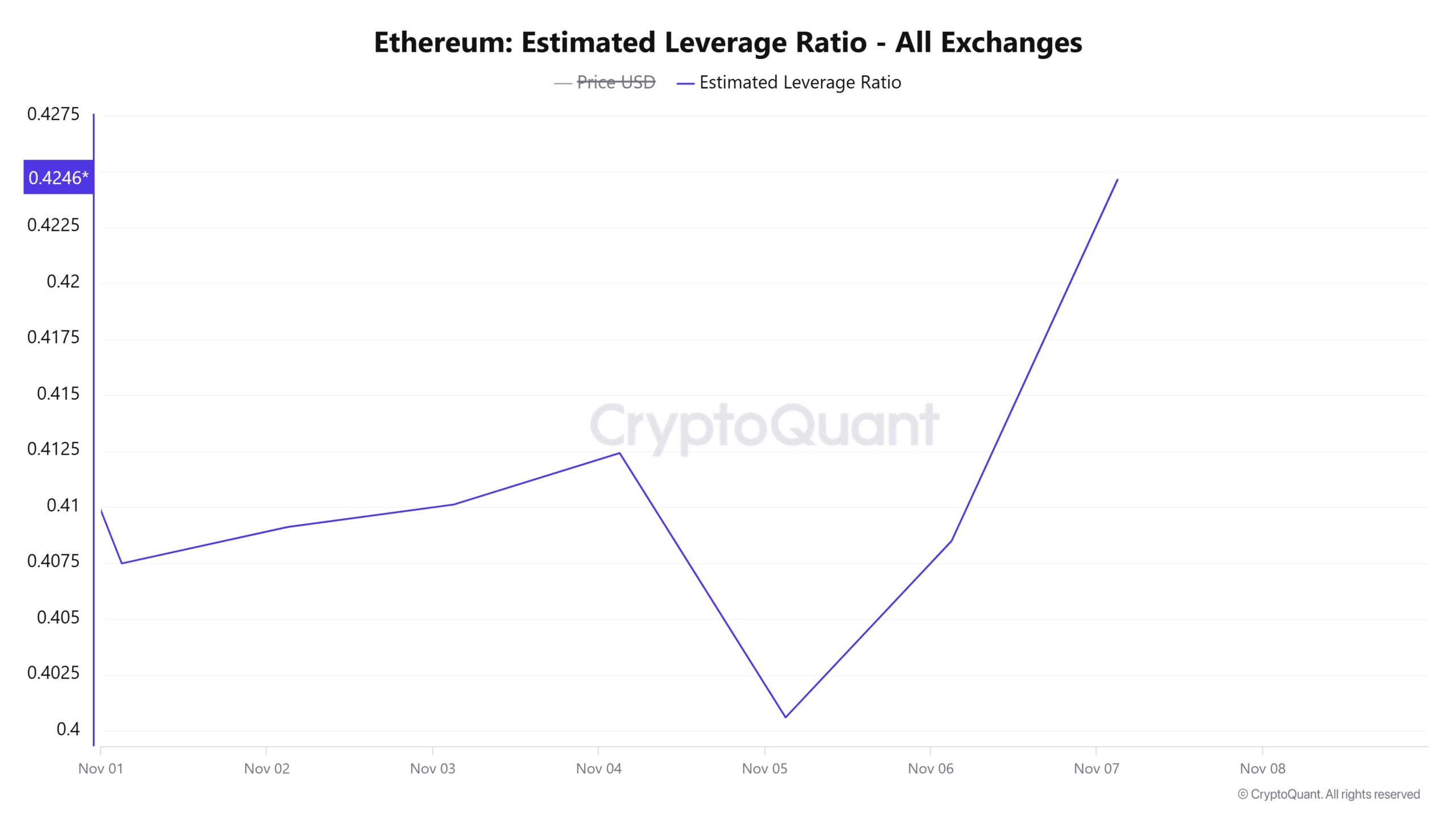

The current beneficial properties have been accompanied by rising volatility. In truth, the estimated leverage ratio rose considerably this week to a seven-day excessive.

On the time of scripting this worth stood at 0.42. This reveals that 42% of open positions within the derivatives market are lined by leverage. A rise in leverage tends to extend worth volatility.

Supply: CryptoQuant

Nonetheless, the estimated leverage ratio has not but reached excessive ranges, leaving room for Ethereum to proceed its uptrend.

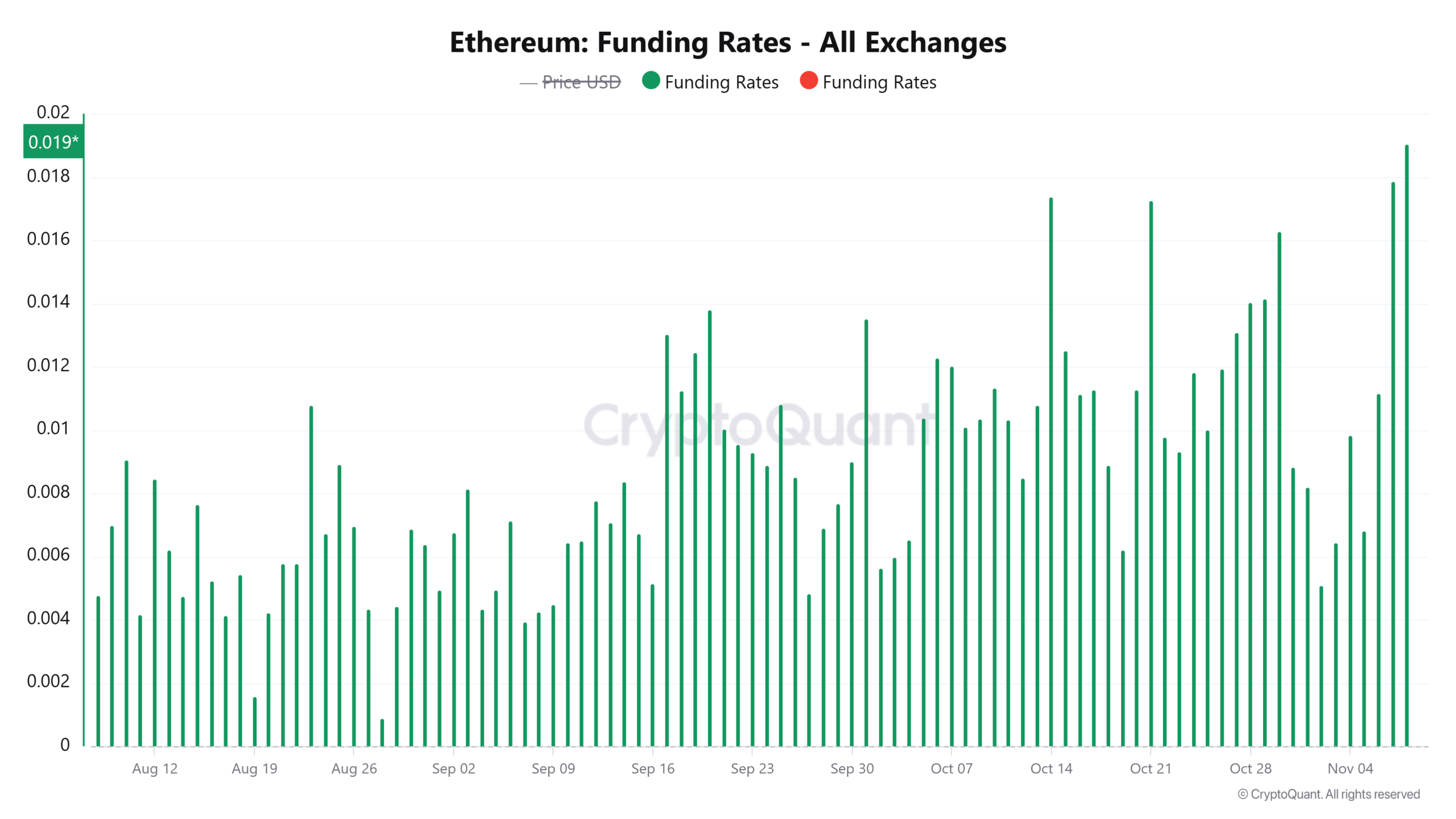

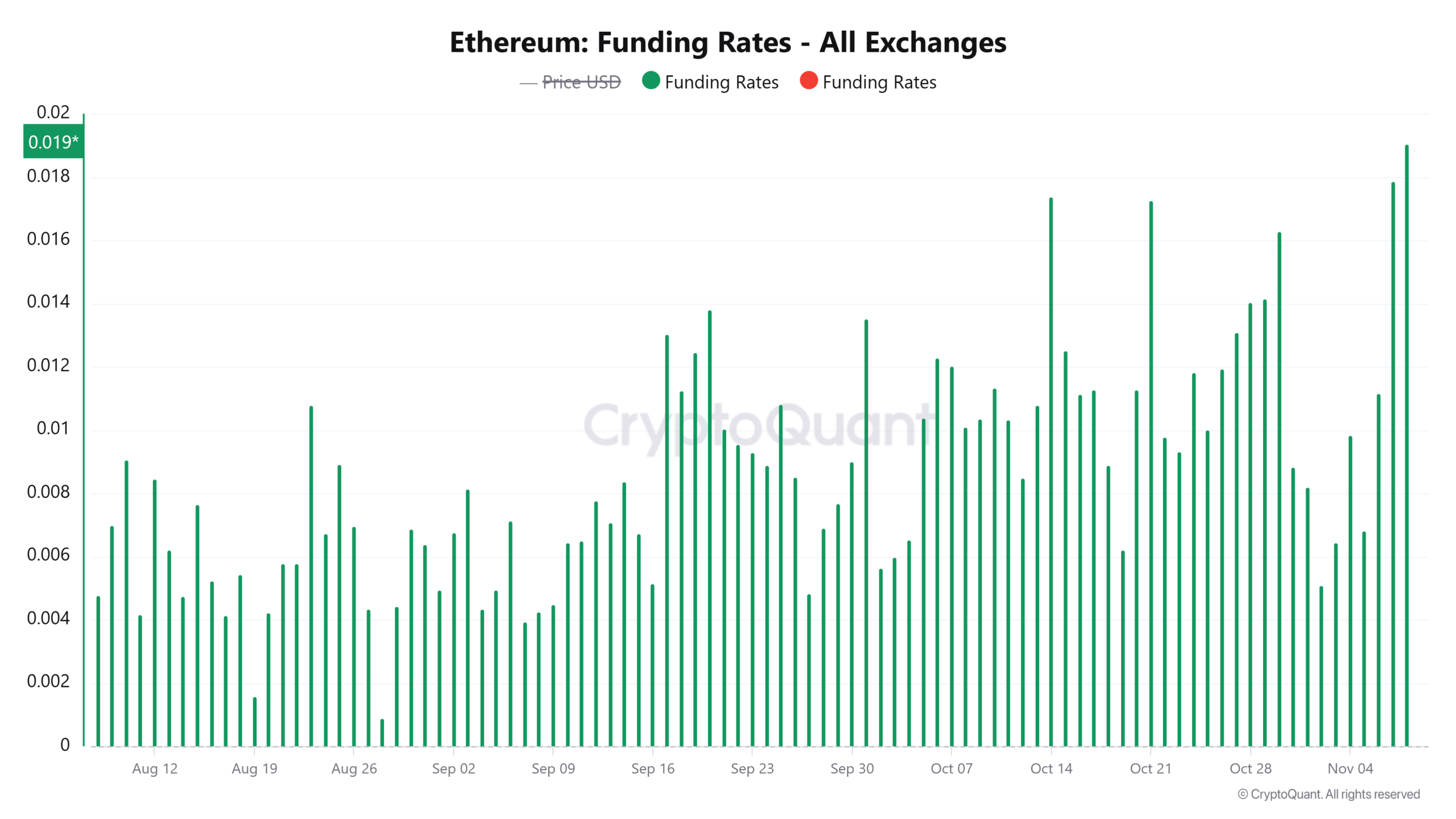

Financing charges and open curiosity reached multi-month highs

The newly opened positions on the derivatives market look like lengthy. That is evident from the rising financing charges to the best degree in three months.

When funding charges rise, it indicators an inflow of lengthy positions. It additionally signifies that lengthy merchants are prepared to pay a better charge to carry their positions, additional indicating that there’s a bullish bias out there.

Supply: CryptoQuant

On the identical time, Ethereum’s open curiosity continues to rise, and on the time of writing was at a five-month excessive of $16.61 billion per thirty days. Mint glass information.

Prior to now two days, Ethereum open curiosity has elevated by greater than $3 billion, additional demonstrating that speculative curiosity in ETH is excessive.

The spike in buying and selling exercise and open positions within the derivatives market enhance the probability of excessive volatility. It might additionally point out that ETH could possibly be on the verge of an overheated market.

Nonetheless, technical indicators recommend that an ETH bull run may be underway.

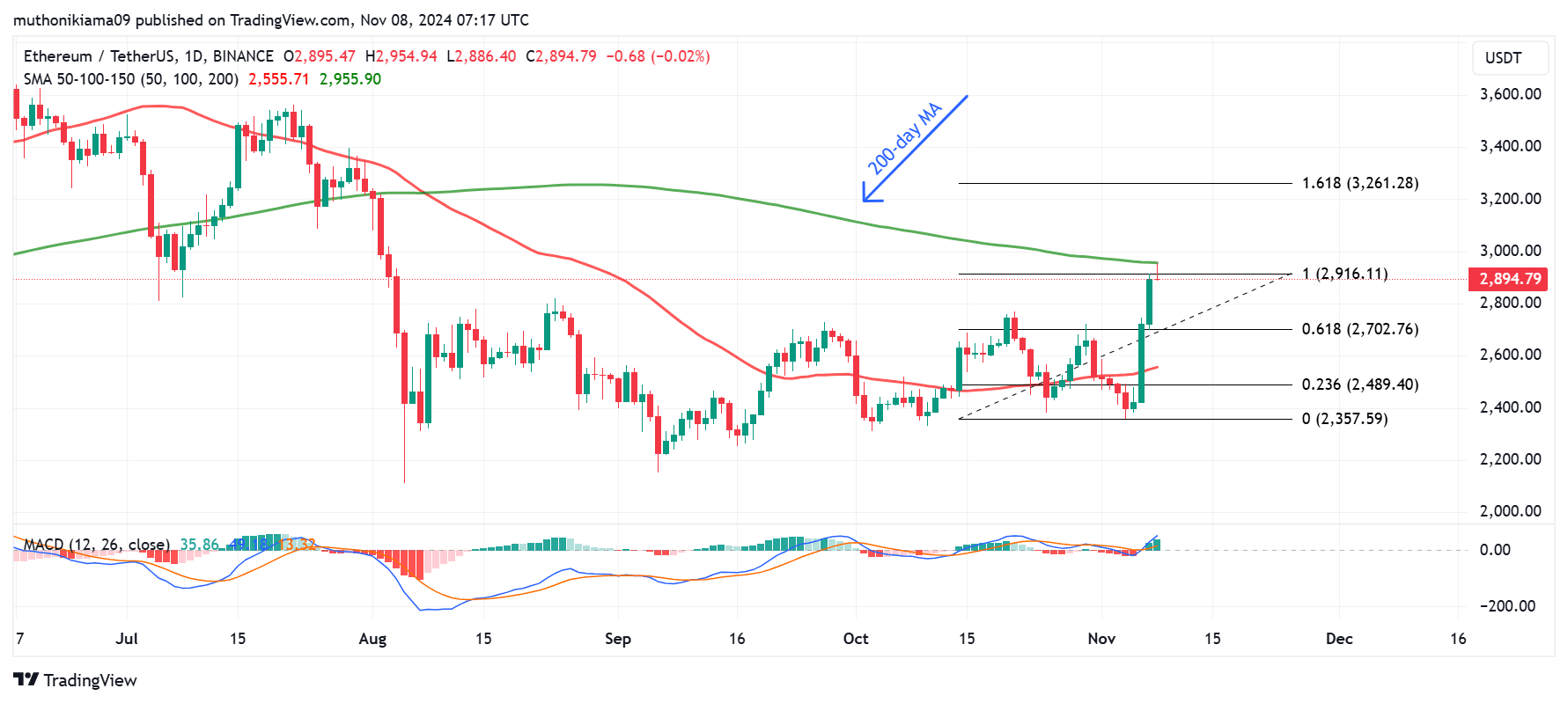

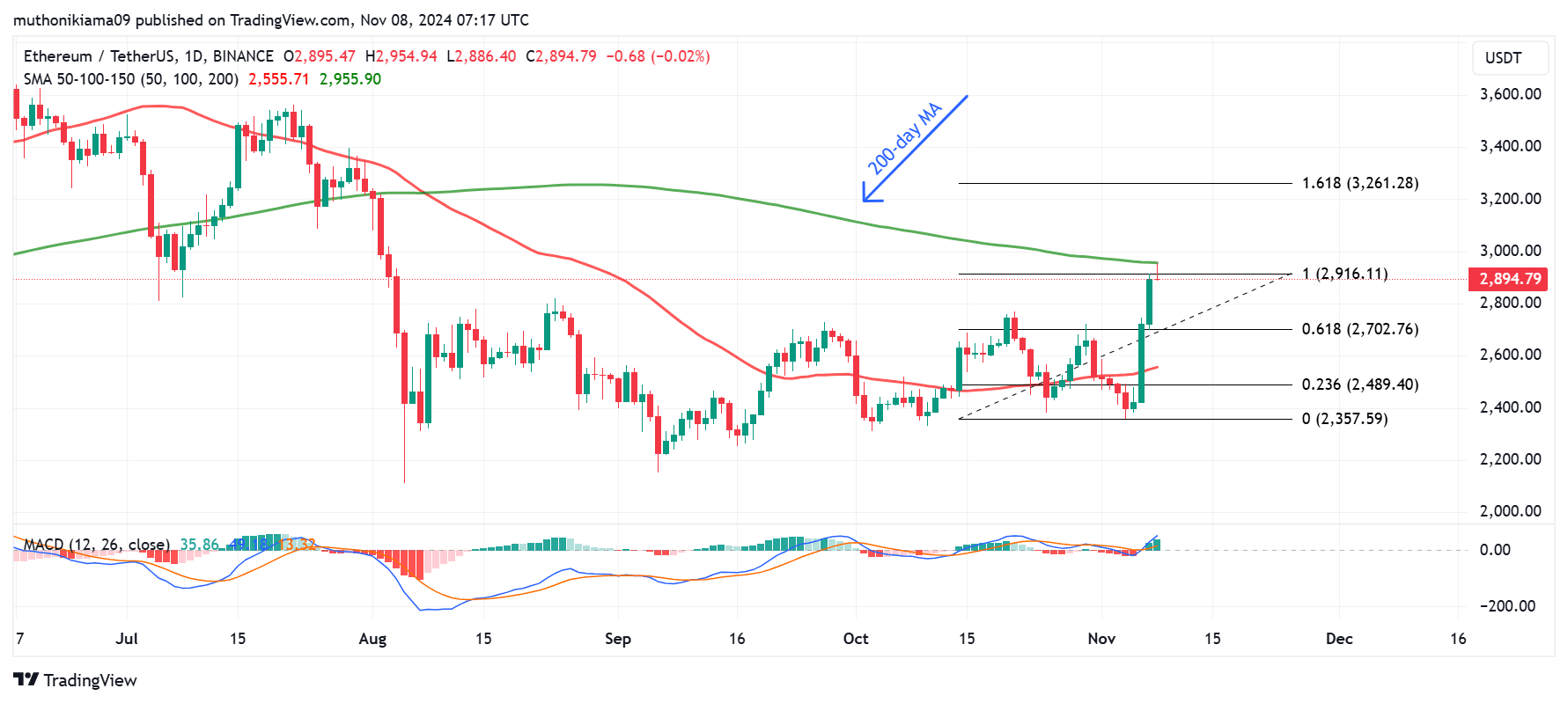

Ethereum exams the 200-day transferring common

Ethereum is at present testing essential resistance on the 200-day Easy Shifting Common (SMA) on its one-day chart. If ETH manages to reverse this worth degree to $2,955, it might result in a sustained uptrend.

Reversing this resistance might additionally pave the best way for a 12% rally to the Fibonacci degree of 1,618 ($3,260).

Supply: Tradingview

The Shifting Common Convergence Divergence (MACD) means that extra beneficial properties are in retailer. This measure has turned optimistic and has additionally made a pointy transfer north, exhibiting that the uptrend is gaining power.

Nonetheless, merchants ought to be careful for indicators of revenue taking as promoting stress might push the worth decrease to check the help at $2,700. A drop under this help might sign a downtrend.

Are inflows into ETH ETFs driving the rally?

On November 7, complete inflows into Ethereum exchange-traded funds (ETFs) reached $79.74 million, the best degree since August in accordance SoSoValue.

The Constancy Ethereum Fund (FETH) ETF had the best inflows of $28 million, adopted by the BlackRock iShares Ethereum Belief with inflows of $23 million.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

The VanEck Ethereum Belief additionally recorded an influx of $12 million, which was the primary influx in two weeks.

If demand for ETH ETFs continues, this might bode nicely for Ethereum’s worth.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024