Ethereum

Ethereum price stalls despite positive ETF shift – What’s happening?

Credit : ambcrypto.com

- Spot Ethereum ETFs recorded inflows of $11.4 million for the primary time in nearly three weeks.

- It is because outflows from exchanges have elevated considerably, easing short-term promoting stress.

Place Ethereum [ETH] exchange-traded funds (ETFs) recorded annual inflows of $11.4 million as of September 10. SoSoValue details. This was the primary time in nearly three weeks that the flows turned optimistic.

Wall Road giants BlackRock and Constancy dominated the numbers with $4.31 million and $7.13 million inflows, respectively.

Regardless of the current shift in sentiment, ETH ETFs have underperformed their friends Bitcoin [BTC] counterparts with cumulative web outflows of $562 million since launch.

Based on Glass junctionEthereum ETF efficiency has been “comparatively tepid” as a consequence of withdrawals from the Grayscale product. Nonetheless, these merchandise have a smaller impression on buying and selling volumes on the ETH spot market.

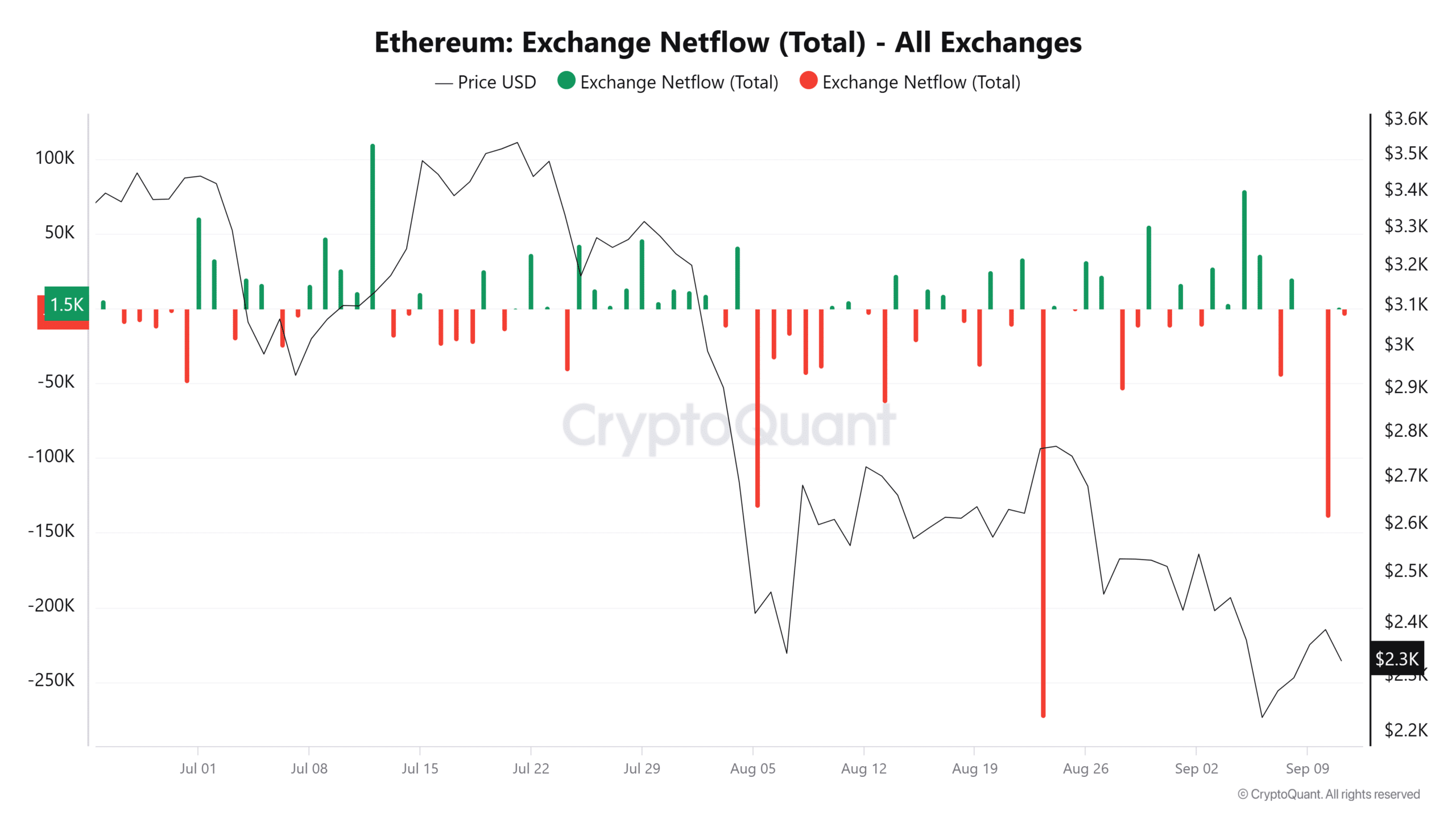

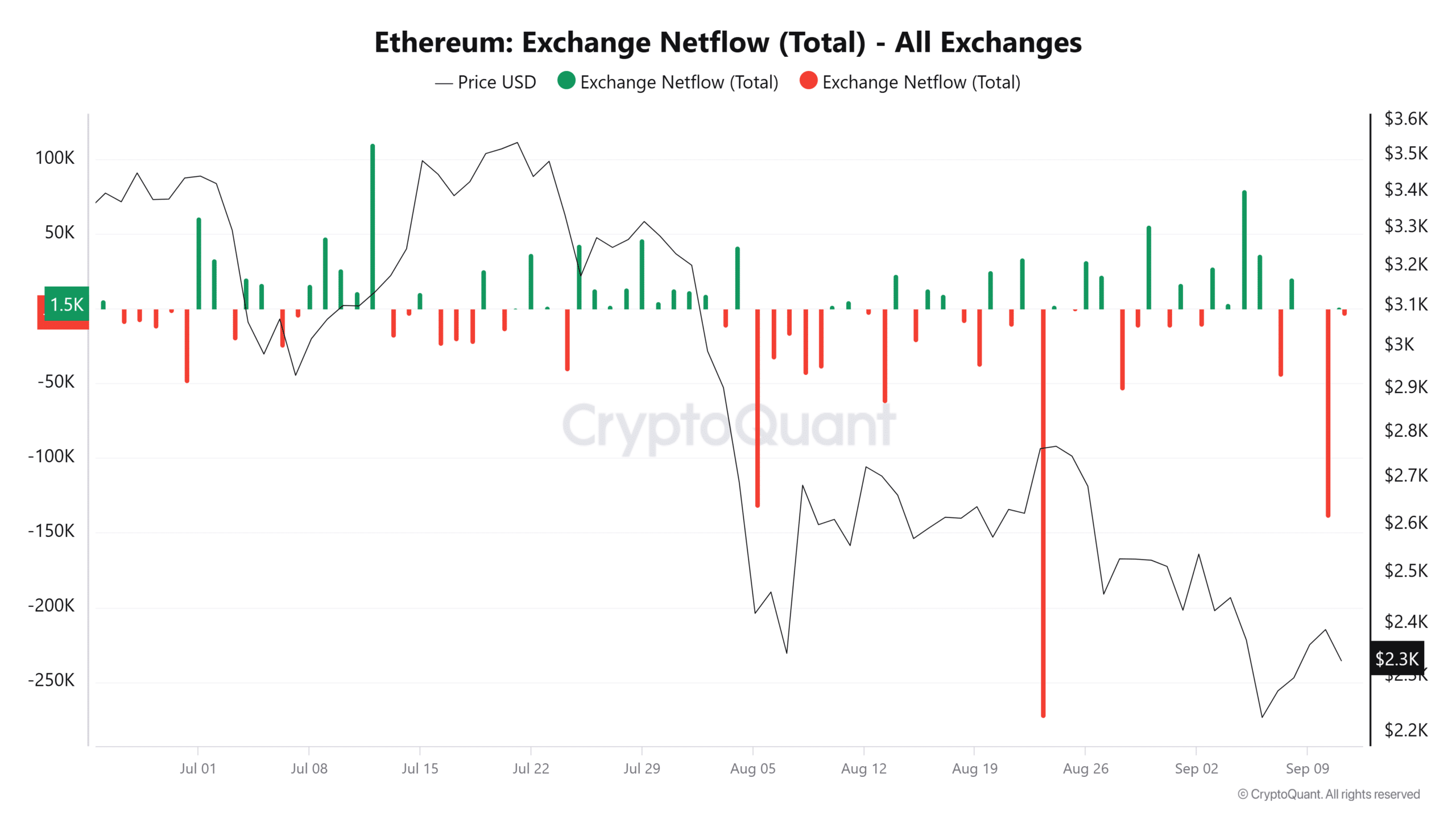

Outflows from Ethereum exchanges peak for a number of weeks

Knowledge from CryptoQuant exhibits a pointy enhance in Ethereum outflows from exchanges. Internet flows from ETH exchanges reached 139,548 on September 10, the very best degree in weeks.

Supply: CryptoQuant

A rise in forex outflows signifies that fewer merchants are concerned with promoting ETH within the brief time period. This eases the promoting stress on the altcoin, and if demand will increase, it might trigger a value enhance.

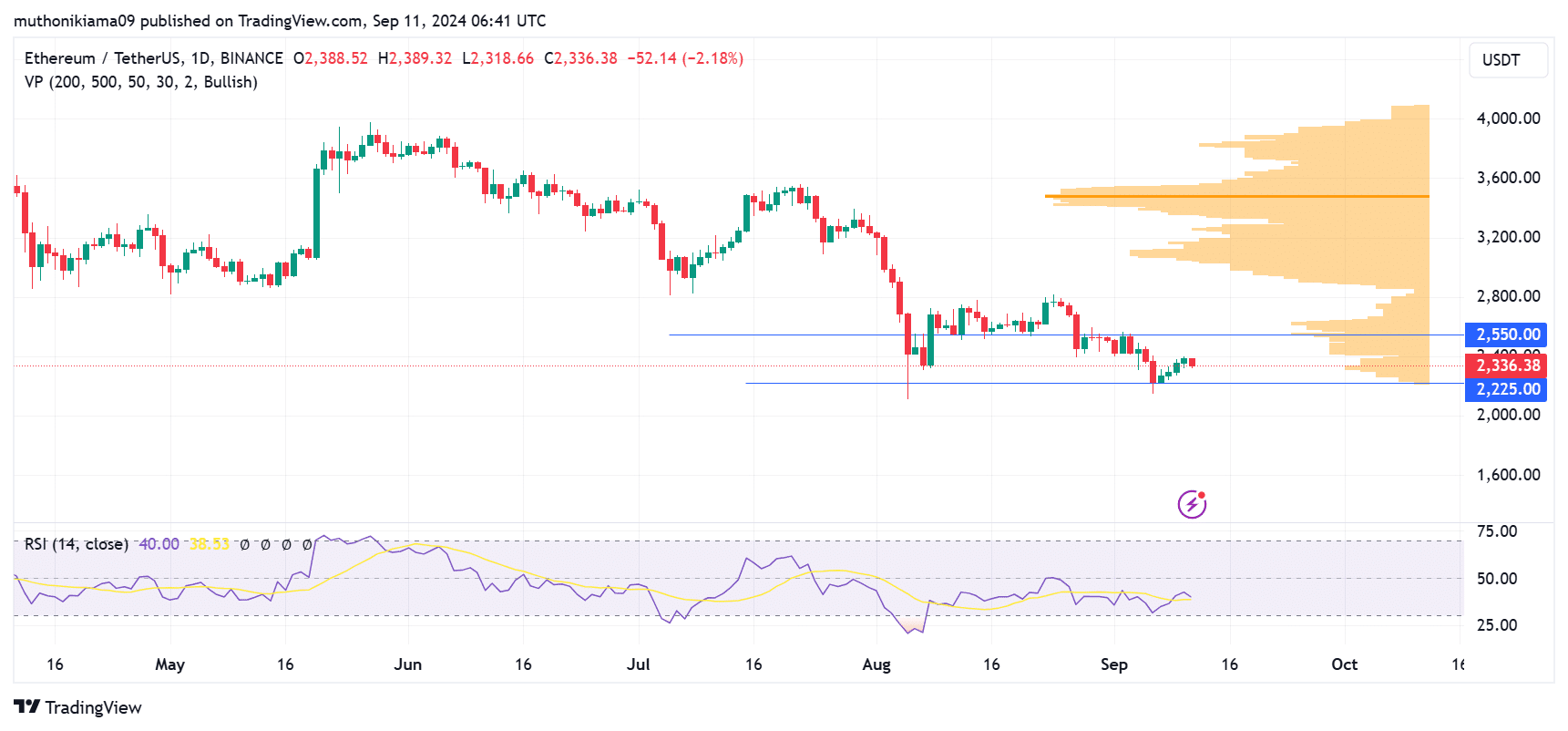

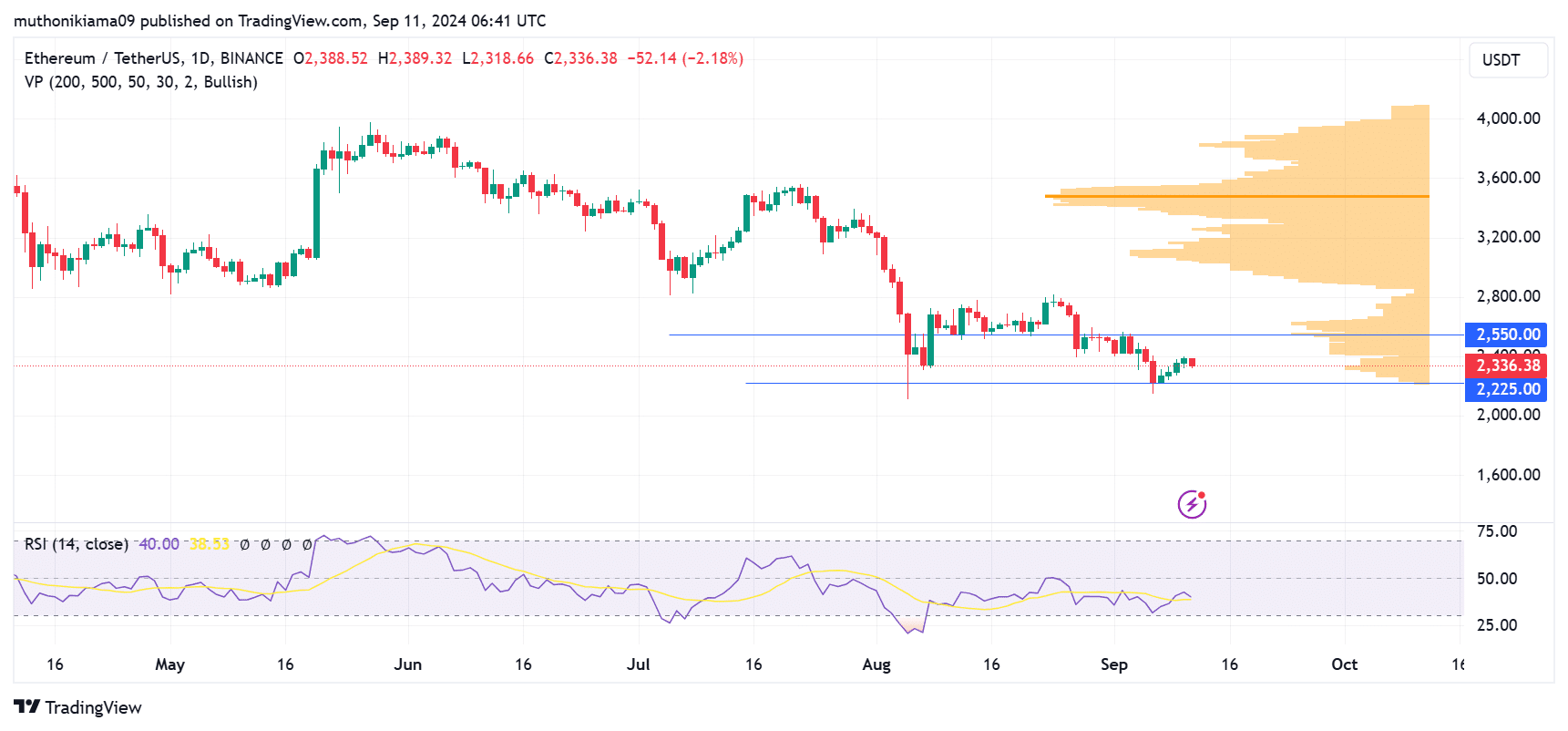

Nonetheless, this enhance in demand has not materialized. The Relative Energy Index at 40 exhibits that gross sales momentum is considerably excessive. Moreover, the RSI is tilting south and threatening to cross under the sign line, which might create a promote sign and set off additional declines.

Supply: Tradingview

Furthermore, the quantity profile information exhibits that bears might proceed to dominate the ETH value. There are considerably low shopping for volumes on the present value, which might see ETH consolidate at present costs.

If the promoting exercise continues, the altcoin might drop to check the assist at $2,225 earlier than making a decisive transfer.

Consumers seem like satiated at $2,550. This value acts as a key resistance degree, with merchants ready for a breakout to verify an uptrend.

ETH’s rally can also be depending on the efficiency of the Ethereum community if broader market assist fails.

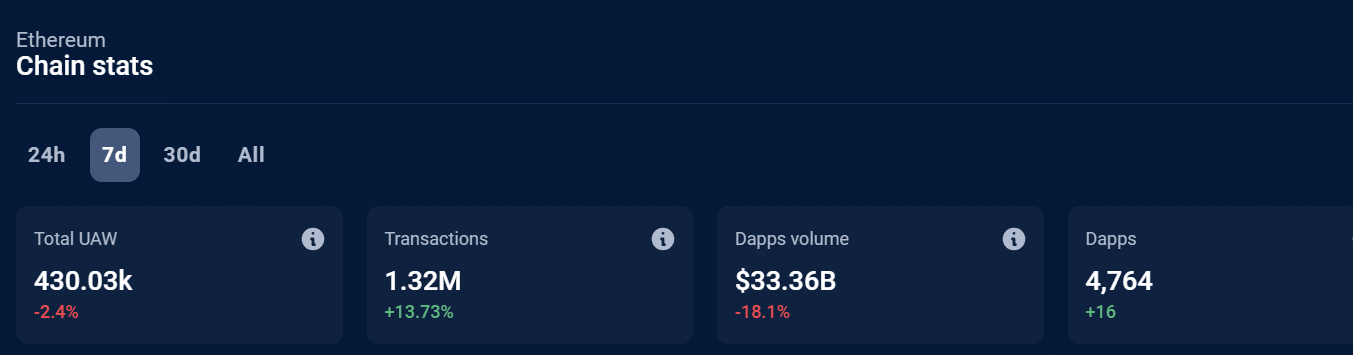

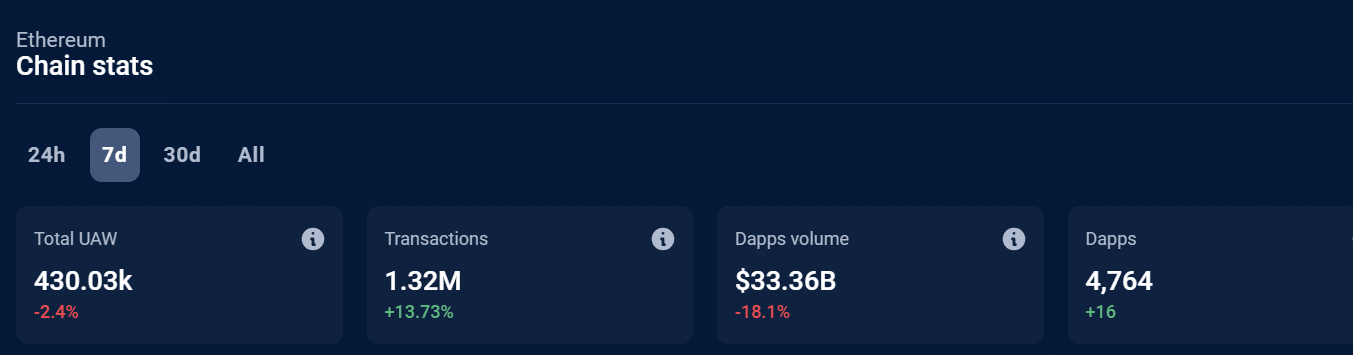

Knowledge from DappRadar exhibits that the Ethereum community is lagging behind by way of volumes. Over the previous seven days, volumes for decentralized purposes (DApps) created on Ethereum have fallen 18% to $33 billion.

Nonetheless, the blockchain noticed a 13% enhance in transactions throughout the identical interval. This means that buying and selling exercise is growing, however there are fewer interactions on the community.

Supply: DappRadar

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now