Ethereum

Ethereum reclaims $2.4K support – But why momentum is fading

Credit : ambcrypto.com

- Optimistic financing charges and Temer purchase dominance assist ETH’s climb over $ 2.4k.

- Weak point within the chain and the influx of trade price categorical the priority a few potential delay within the brief time period.

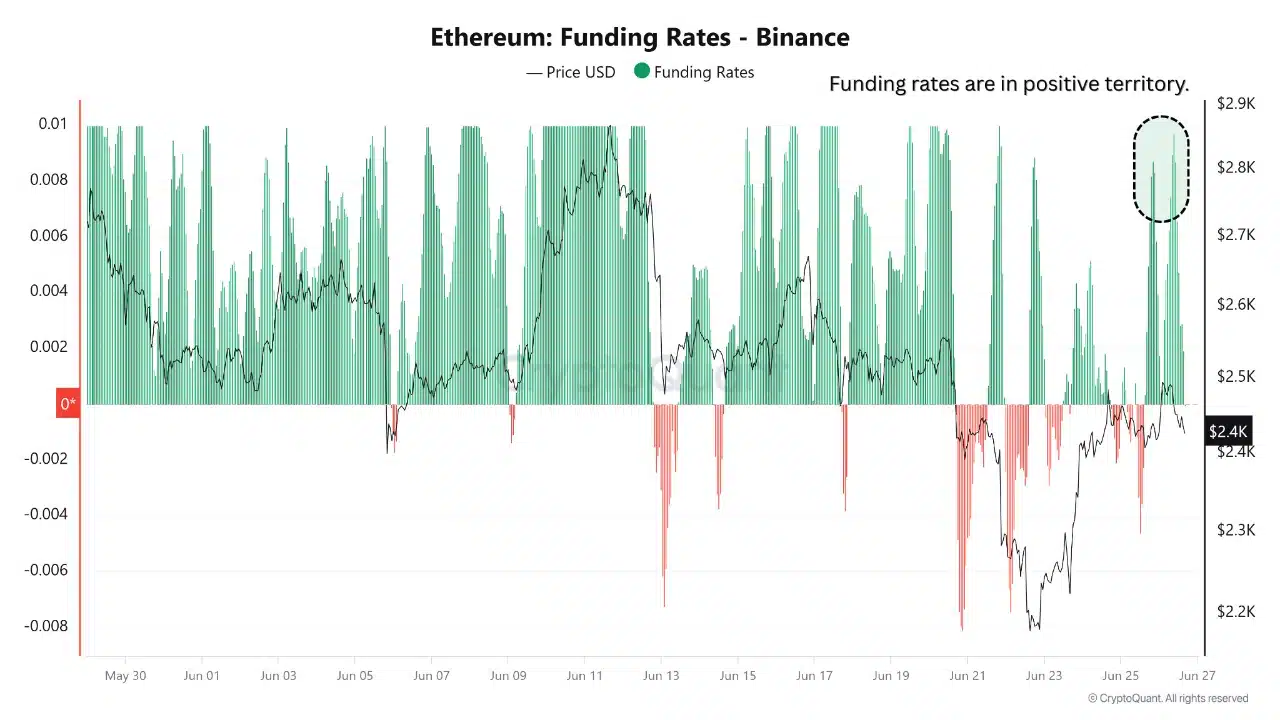

Ethereum [ETH] Has posted a robust rebound in current classes, whereby the $ 2,400 stage is recovered if by-product financing charges on Binance grew to become optimistic.

This shift revealed an inflow of lifting tree positions as merchants on additional the other way up.

Greater than 177,000 ETH, nevertheless, has flowed in Binance for the previous three days and identified doable revenue by massive holders. This elevated brief -term dangers regardless of a structural bullish bias.

Though the sentiment has been reversed for consumers, the rising influx of the trade subsequently recommend warning, as a result of market individuals re -assess the upward potential within the brief time period.

One other leg increased

ETH continued to behave inside an rising channel sample, after a strout of its decrease trendline close to $ 2,195 and consolidated above $ 2,400 on the time of the press.

The RSI remained impartial at 47, indicating that it had lively room to maneuver in each instructions with out being overbought or being offered over.

This channel construction has supported historic bullish continuation patterns. Nevertheless, consumers should defend this zone to forestall them from slipping below $ 2,200.

That’s the reason the continual worth stability inside this vary can function a springboard if a broader sentiment stays intact.

Supply: TradingView

Does Ethereum lose energy on-chain?

The exercise on the chains of Ethereum confirmed a weakening divergence between worth and every day lively addresses. On the time of the press, the DAA Divergency, which beforehand positively enriched, started to withdraw.

This implied that the expansion of tackle development didn’t hold tempo with the value motion, which weakens the underlying assist for the present restoration.

Though ETH ranges have maintained above $ 2,400, the fading divergence can restrict the continued bullish momentum.

That’s the reason Ethereum wants renewed community participation to forestall stagnation and to strengthen the current worth erosion.

The transaction exercise of ETH collapses

Regardless of the bullish technical construction, the every day transaction counting of Ethereum has fallen sharply to 337k – a steep lower in comparison with current averages.

This lower in exercise suggests a doable decoupling between worth motion and the precise community use.

Due to this fact, even when merchants take a lever opening, the actions of the chains in chains appears to weaken. If this continues, the dearth of transactional demand can undermine the value rally.

Consequently, the subsequent step from Ethereum can strongly depend upon whether or not consumer involvement returns shortly.

Are aggressive consumers Ethereum standing?

Spot Taker CVD indicators confirmed that Ethereum skilled the dominant buy-side stress on the press. This mirrored steady belief amongst market individuals, who carried out extra market purchases than sells.

Such conduct normally corresponds to bullish developments within the brief time period and strengthens the present worth ranges.

Nevertheless, given the conflicting lower within the by-product quantity and on-chain statistics, this Taker Purchase Dominance should preserve to forestall a reversal.

Bulls will stay below management in the meanwhile, however Momentum requires broad assist to come back alongside.

Can ETH retain its soil within the midst of blended indicators?

The restoration of Ethereum above $ 2,400 reveals technical and by-product market energy, however fading on-chain statistics and rising rising inflow create warning.

If the Taker continues to exist and the community exercise restores, ETH can proceed its upward course of. Nevertheless, until the expansion in development and the transaction quantity bounces again, the value momentum can get caught beneath $ 2,500.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now