Altcoin

Ethereum reserves dive up to 9 years of low-is a huge price that is on your hands?

Credit : ambcrypto.com

- The alternate inventory of Ethereum has fallen to the bottom degree in 9 years.

- May this supply SQUeze trigger a value improve?

The provide from Ethereum [ETH] On exchanges, the bottom degree has fallen since 2016, indicating a liquidity chopping that helps a bullish outlook within the medium time period.

With the sale of the gross sales aspect and accumulation, rise, Can ETH reclaim the important resistance of $ 3.5k within the quick time period?

Key Technicals Flash Bullish

Regardless of no indicators of overheating, Ethereum stays 32% under the height after the $ 4,016 elections after 4 consecutive decrease lows.

This time, nevertheless, the RSI is on the underside and a Bullish Macd -Crosover takes form – which means that the consolidation of ETH might construct up for an outbreak.

But historic patterns of warning recommend. Earlier restoration didn’t achieve breaking in the important thing resistance, as a result of the demand had issue absorbing the gross sales strain.

Supply: TradingView (ETH/USDT)

Ethereum’s Spot Trade, nevertheless delivery has fallen to a low of 9 years of 8.2 million ETH.

With tightening of the liquidity and potential acceleration, the circumstances are tailor-made to a provide shock – one that may feed a breaking of crucial resistance ranges.

Mapping the following most vital resistance zone of Ethereum

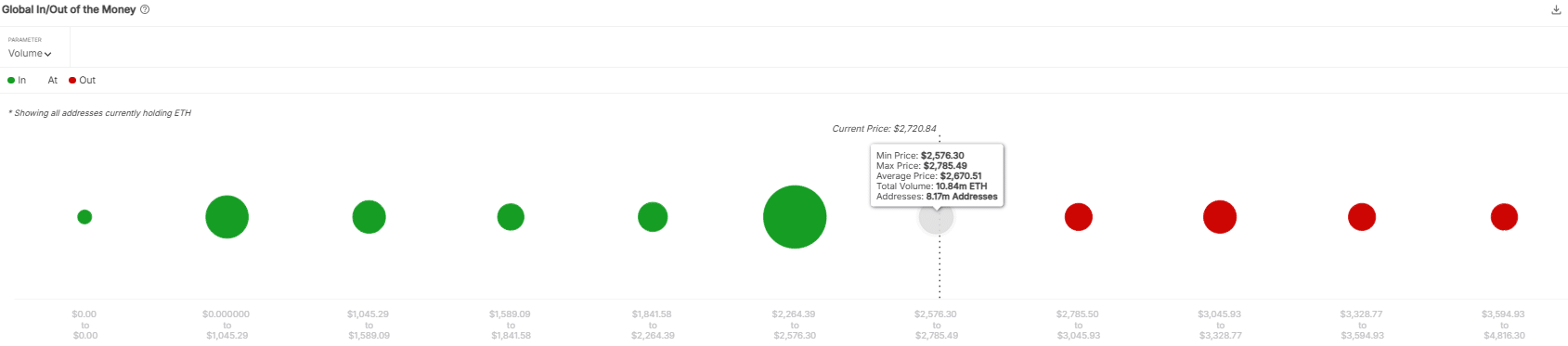

Ethereum is confronted with a important resistance at $ 2,785, the place 8.10 million addresses would flip profitably, which uncovered $ 20 billion to potential gross sales strain.

Supply: Intotheblock

Whereas spot reserves turned a lowest layer of 9 months, signaling accumulation, traders unloaded Greater than 2 million ETH in inventory exchanges in February, in order that she expressed concern about mounting gross sales strain.

Weak question Of the US and Korean traders, the upward momentum additionally threatens, in order that the leverage might be taken care of on the futures market.

If the query doesn’t get better, Ethereum can get a withdrawal to $ 2,264, the place 62.38 million ETH is concentrated.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now