Altcoin

Ethereum Retail sentiment touches the bottom of the rocks – is a breakout rally brewing?

Credit : ambcrypto.com

- The US authorities agrees with institutional buyers in promoting ETH in giant portions, in order that downward stress is added to the worth.

- Retailers additionally take part within the Golf, however this ETH is confronted with the potential of a steeper market loss.

Ethereum [ETH]Buyers are beginning to see the Bearish Gulf of the market, as a result of monumental sale is being registered throughout the board.

Within the final 24 hours alone, it has been lively by 5.75%, with the potential of falling even decrease.

The evaluation of Ambcrypto reveals {that a} historic pattern that helps an ETH breakdown after a sale not exists. If market individuals proceed to promote throughout the board, losses will improve.

The US authorities sells en masse, ETH Tart earlier catalysts

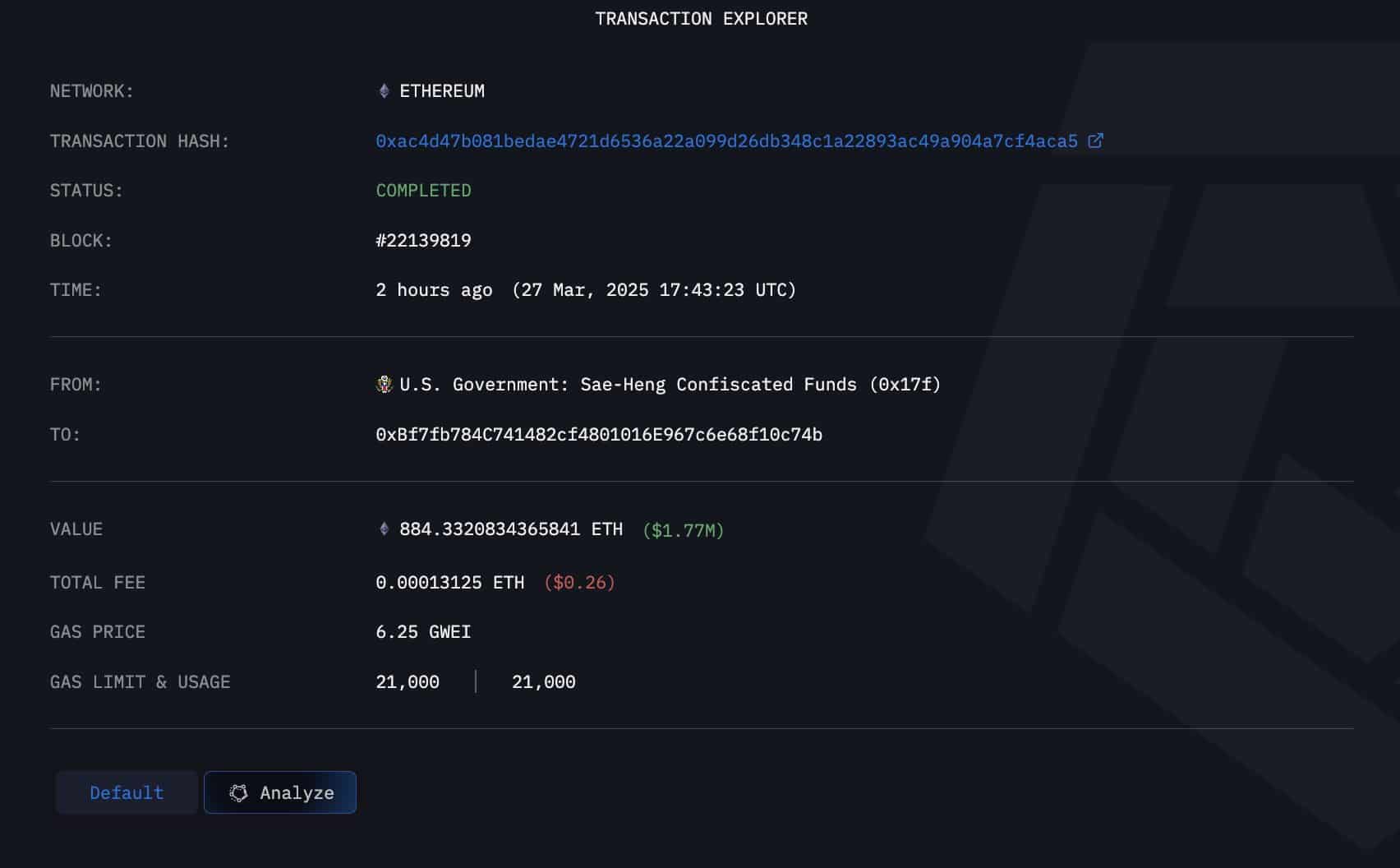

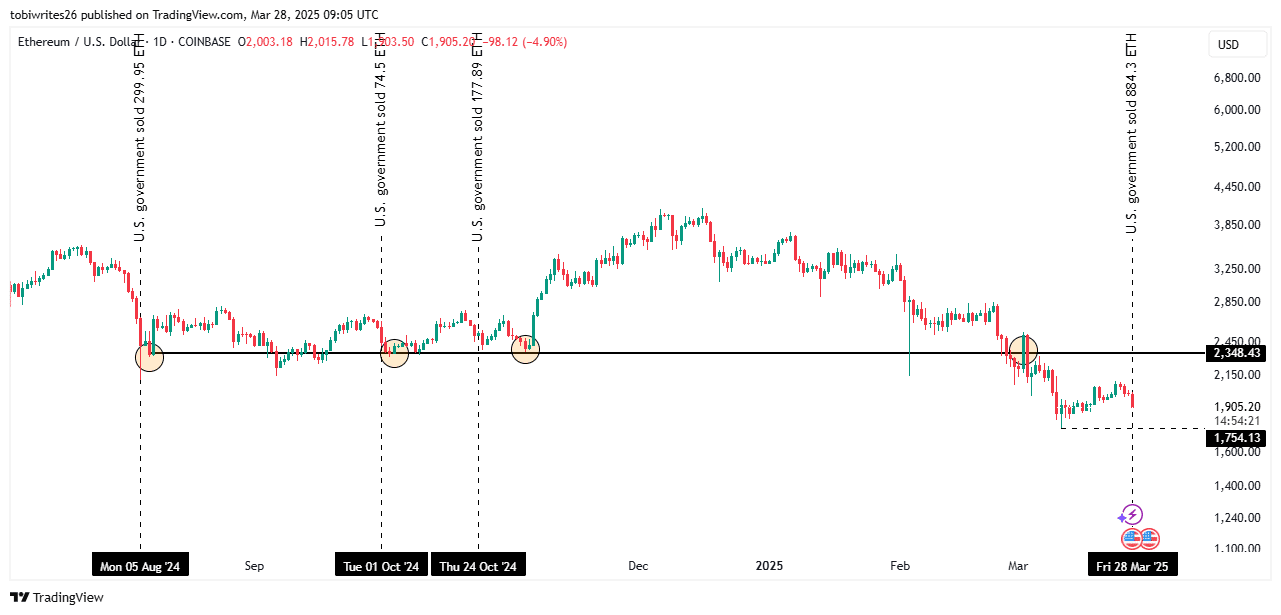

Within the final 24 hours, the US authorities has offered an infinite quantity of ETH available in the market – 884.33 ETH value $ 1.77 million on the time of the commerce.

A outstanding sale of enormous buyers such because the US authorities, which owns 59,965 ETH in its stability, normally signifies a insecurity within the lively and tends to negatively affect the broader market.

Supply: Arkham Intelligence

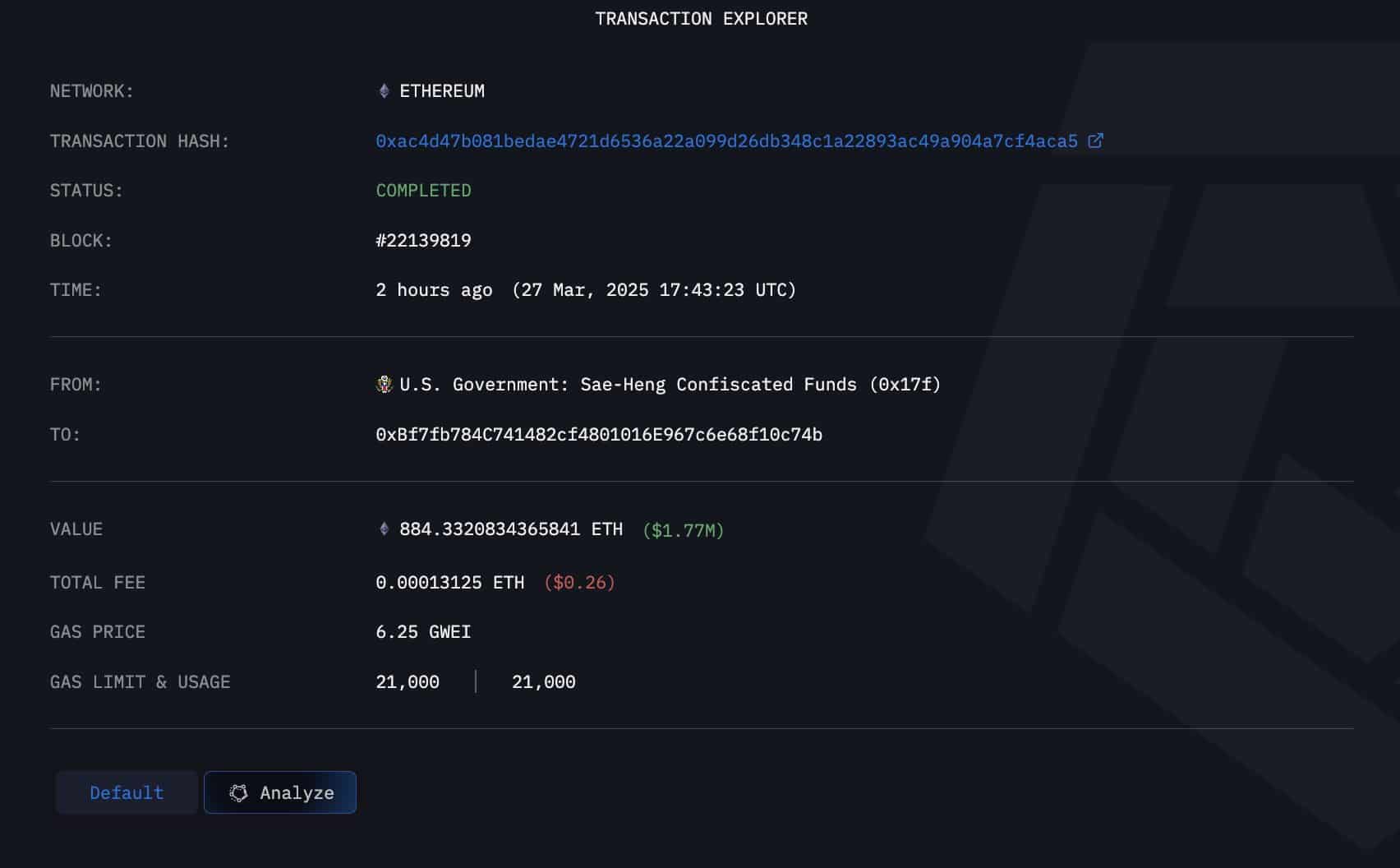

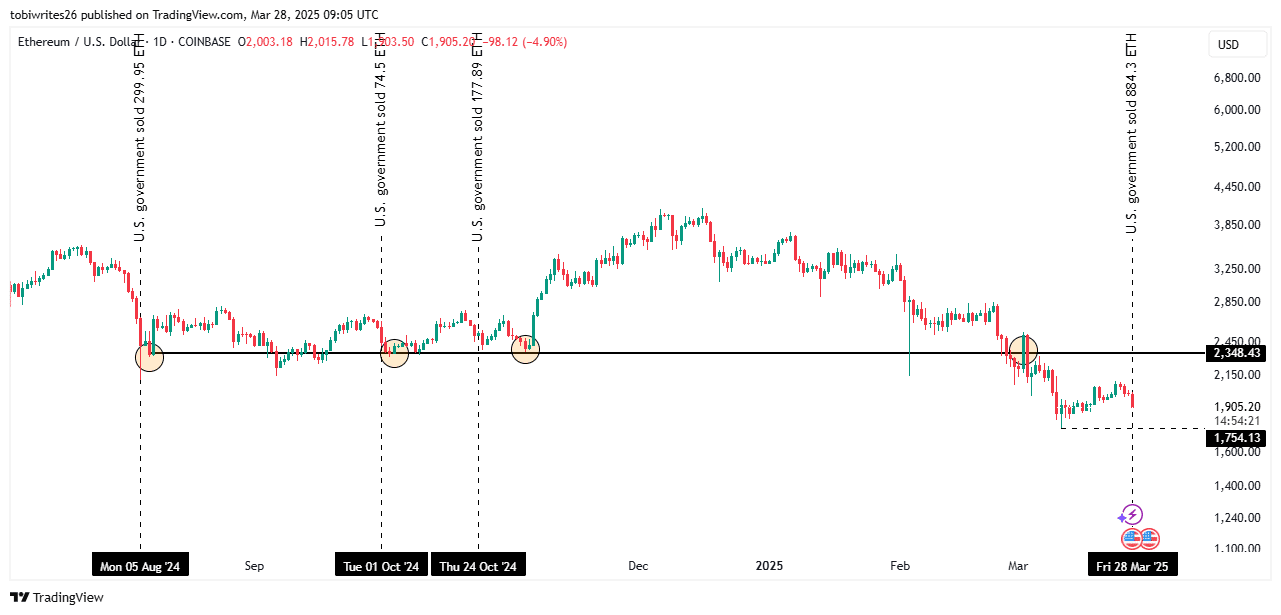

To grasp the affect of this, Ambcrypto studied the sooner ETH sale of the US authorities and their results in the marketplace.

The US authorities normally sells when the market is already falling, which is the present case. In distinction to the previous, ETH could not see any bouncing.

At thrice prior to now – August 5, 1 October and 24 October – the US authorities offered 299.95, 74.5 and 177.89 ETH respectively respectively. Every time it actively fell to an necessary stage of assist at $ 2,348.43, which acted as a catalyst for a return.

Supply: TradingView

This time, nevertheless, is totally different. ETH is at the moment buying and selling under this assist stage and types a sequence of decrease lows. If gross sales stress is growing, the ETH dangers fall beneath $ 1,754. If it doesn’t bounce again from this stage, additional decline might be.

The additional evaluation of Ambcrypto confirmed {that a} steady decline may very well be the present market pattern, as a result of the retail feeling has reached a brand new layer in opposition to the lively – a stage that was not too long ago seen a 12 months in the past.

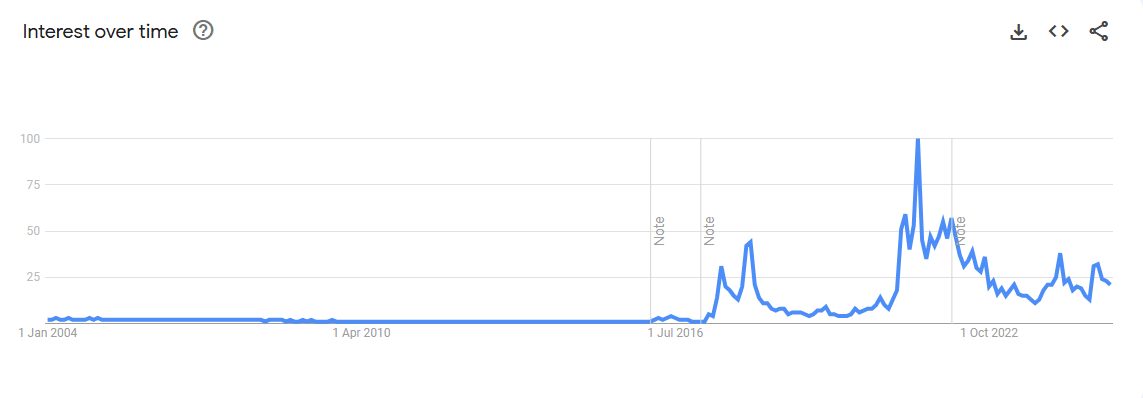

Supply: Google Development

This was confirmed by Google Search Curiosity in the midst of time, which reveals that curiosity within the ETH shops has fallen significantly, an indication that’s typically attributed to the sale.

Bearish Traits beneath Retail and Institutional Buyers

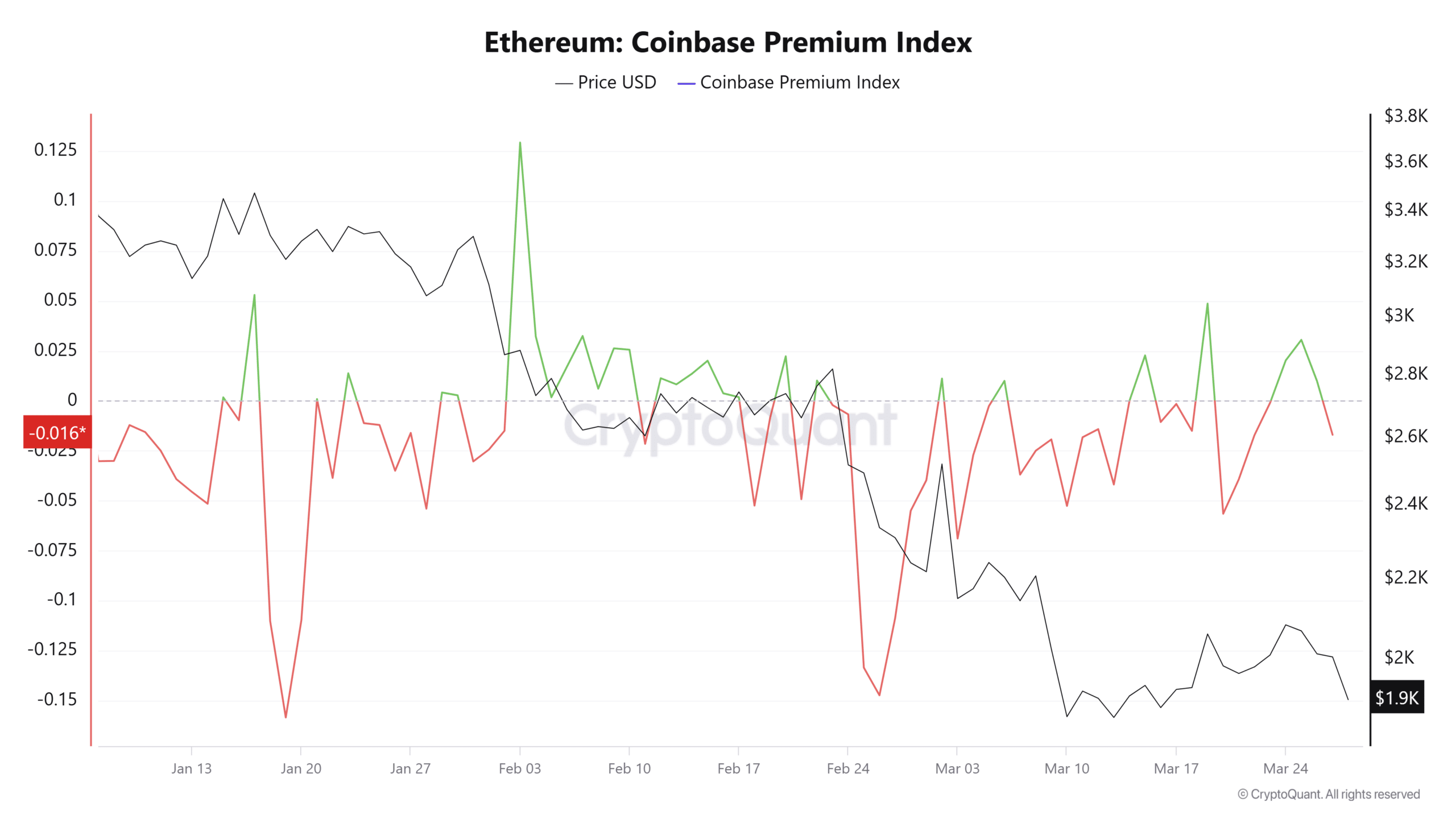

The sale of the US authorities has pressured retailers within the nation to promote aggressively. In response to the Coinbase Premium Index, which follows this conduct, that is the primary time since March 23 that that is promoting this cohort of merchants.

That is clear when the index is in a destructive space. On the time of the press it had a lecture of -0.0016, indicating that the gross sales stress is progressively mounted.

Supply: Cryptuquant

Institutional buyers who’ve round $ 8.83 billion in Ethereum on Ethereum, as a result of property in management additionally proceed to promote for the reason that starting of March, including downward stress to the lively.

A complete of $ 402.6 million was offered to Ethereum between 3 March and now.

If institutional buyers proceed to promote, ETH might attain the goal stage of $ 1,754, as indicated on the graph.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024