Ethereum

Ethereum: Retail traders bet against ETH—Will it see a short squeeze?

Credit : ambcrypto.com

- The brief place of Ethereum is growing as lungs within the midst of rising OI signaled retail buyers are bearish.

- Binance dumps big quantities of ETH and different cryptos regardless of The MacD confirms a bullish crossover.

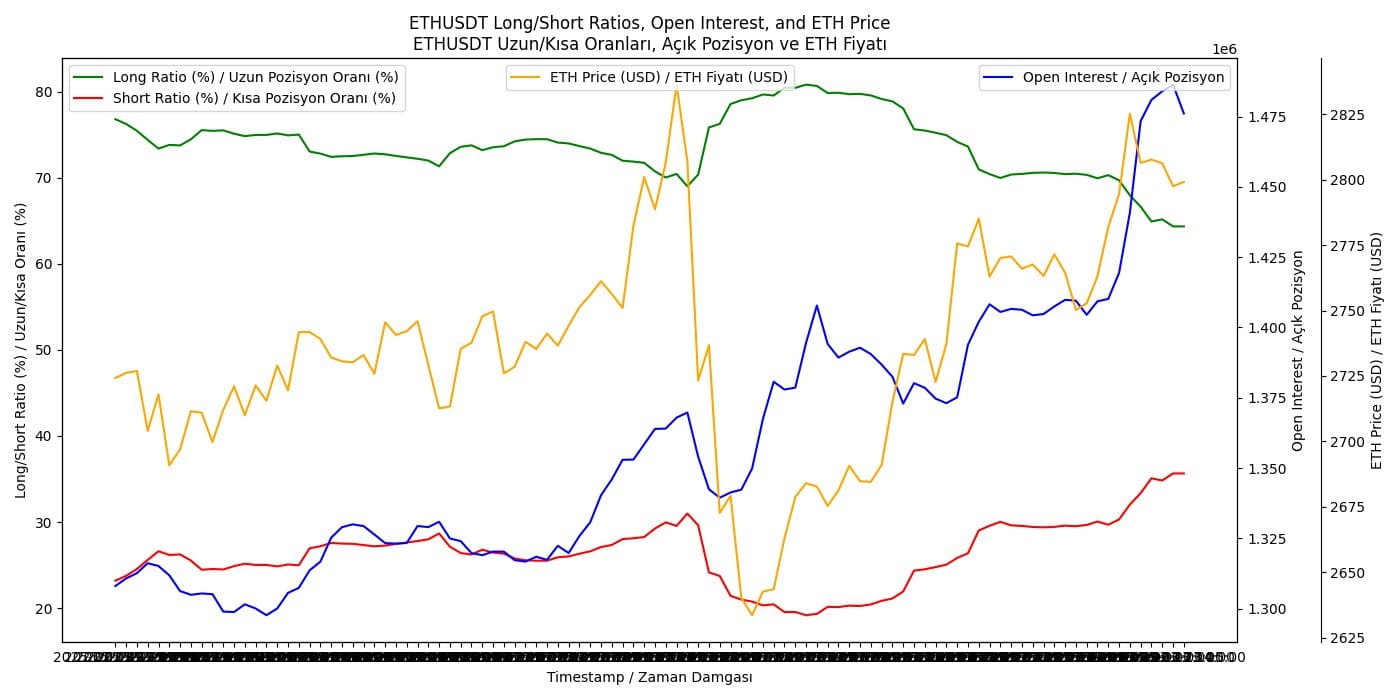

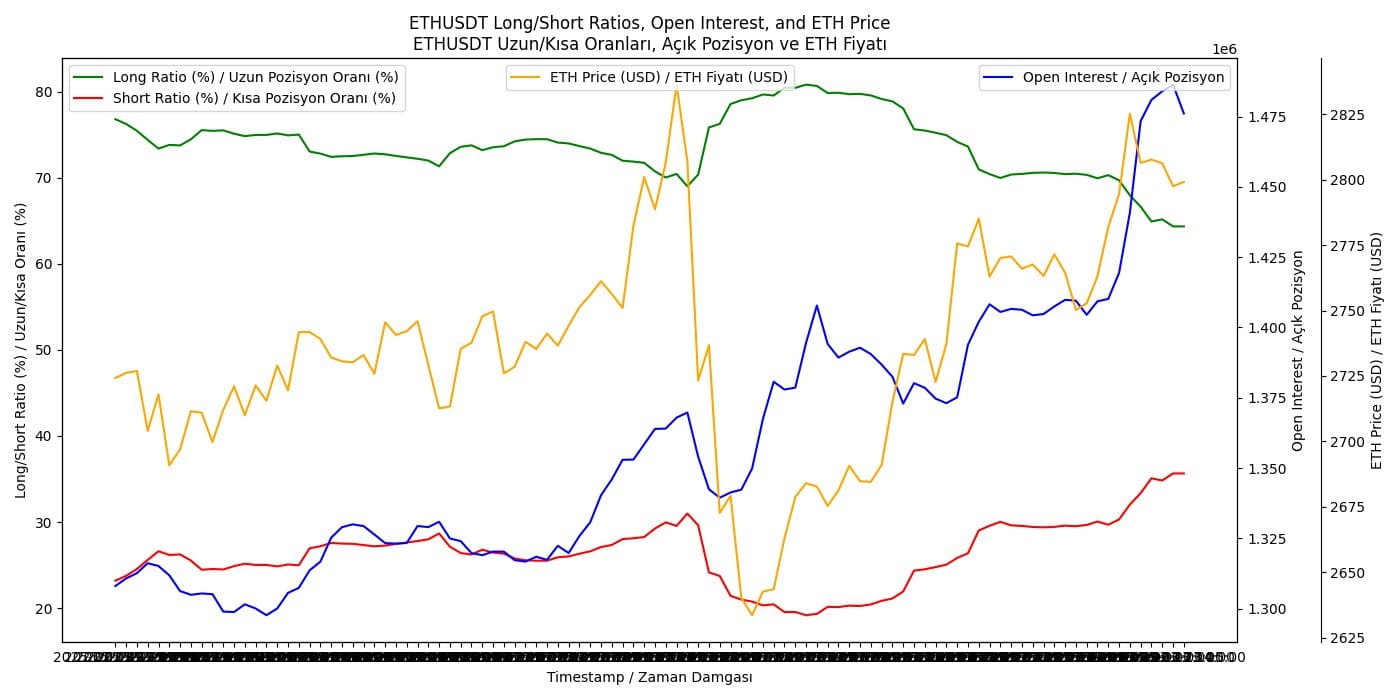

The share of brief positions within the retail commerce for Ethereum [ETH] has risen whereas that of lengthy positions is lowering. The brief ratio has risen above 30%, whereas the lengthy ratio has fallen under 75%.

This shift is accompanied by enlarging open curiosity (OI), which means that retail buyers wager on Ethereum.

From the second of the press, the worth of ETH has risen larger than $ 2,775, but when this Bearish sentiment has the higher hand, a withdrawal to $ 2,700 is feasible.

Conversely, if OI continues to rise whereas shorts are pressed, ETH can break $ 2,825 and attempt for larger ranges. Because the lengthy positions lower, this will imply concern of the expansion potential of Ethereum within the brief time period.

Supply: X

If this pattern continues, ETH can take a look at decrease help ranges. Conversely, if the market sentiment shifts and lengthy positions begin to rise, we are able to observe a rebound to $ 2800 or larger.

Binance continues to discharge ETH en masse

The sentiment of retail buyers corresponds to Binance, which has transferred important quantities of Ethereum to centralized change bridges and market makers. The quantities differ from 1.003k ETH value $ 2.79 million to 1.52k ETH value $ 4.25 million.

This excessive degree of exercise, together with giant influx for market makers and exchanges, might point out that Binance facilitates liquidity or probably reduces its participations in response to market situations.

The potential implications for the worth of Ethereum are blended.

Supply: Arkham

On the one hand, if these transfers are meant to satisfy the growing demand for commerce festivals or for making market merchandise, it may stabilize and even improve the ETH worth on account of larger liquidity and commerce quantity.

If that is Binance that liquidates its participations, this will result in a worth drop as a consequence of an elevated vary in the marketplace.

Which means additional Promote-Facet Stress of exchanges may verify a bearish pattern or, if paid with enough buy-side requirement, can result in a bullish reversal.

MacD confirms a bullish crossover

The worth motion of Ethereum, nevertheless, unveiled a bullish sign, the place the MACD crosses its sign line.

This bullish crossover, mixed with stabilization at a very powerful help degree round $ 2,650 after the Bybit -hack, suggests potential for a worth discount.

The direct goal after this bullish sign may very well be the current resistance to $ 3,000. If Ethereum breaks this barrier, the subsequent essential degree might be round $ 4,000 after which.

Supply: TradingView

Conversely, if the bullish momentum decreases and doesn’t suffice, ETH can re -test the help at $ 2,650.

A break under this level can result in additional falls, with the next appreciable help at $ 2,490.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024