Ethereum

Ethereum risks $11B sell-off if it falls below THIS price level

Credit : ambcrypto.com

- Ethereum didn’t achieve changing $ 3.9k into help and dropped 14% under that degree.

- The priority grows in regards to the lengthy -term value motion from Ethereum.

The Cryptomarkt is in ‘Excessive’ Volatility and Ethereum [ETH] Is the right instance. After a lower of 37% after Trump’s pro-Tarife perspective, it rose after Eric Trump’s pro-eth put up. Two large fluctuations in 4 days.

The deployment is excessive

Ethereum has solely risen 15% in comparison with the opening of the election day, however remains to be 30% underneath the height of $ 4,016 throughout the Trump rally.

IN Final week, ETH broke his help zone, which dropped underneath $ 2,800, thrice the drop bitcoin. Although the RSI confirmed over and primarily based on life, the steep decline has worn out greater than 14% of its revenue and pushed 6.18 million addresses in purple.

Why? Trump’s robust financial policy Has activated the biggest 24-hour crypto liquidation and wiped $ 10 billion in a single fell swoop. But it surely did not cease there.

The ETH/BTC purple reached a low of 4 years, with a every day fall of greater than 3%. With little capital that flows from BTC to ETH, the longer term value motion of Ethereum seems extra unsure daily.

Supply: TradingView

In the meantime, mid-caps dominate the weekly gainer’s graphicWith Dexe in entrance with a revenue of 44%. Buyers shift away from high-caps, depart the cycle or transfer funds to smaller property.

So, is the latest dip of Ethereum solely a short lived setback, or will the rising insecurity stop it from breaking by way of the $ 4,000 resistance?

The way forward for Ethereum unfolded

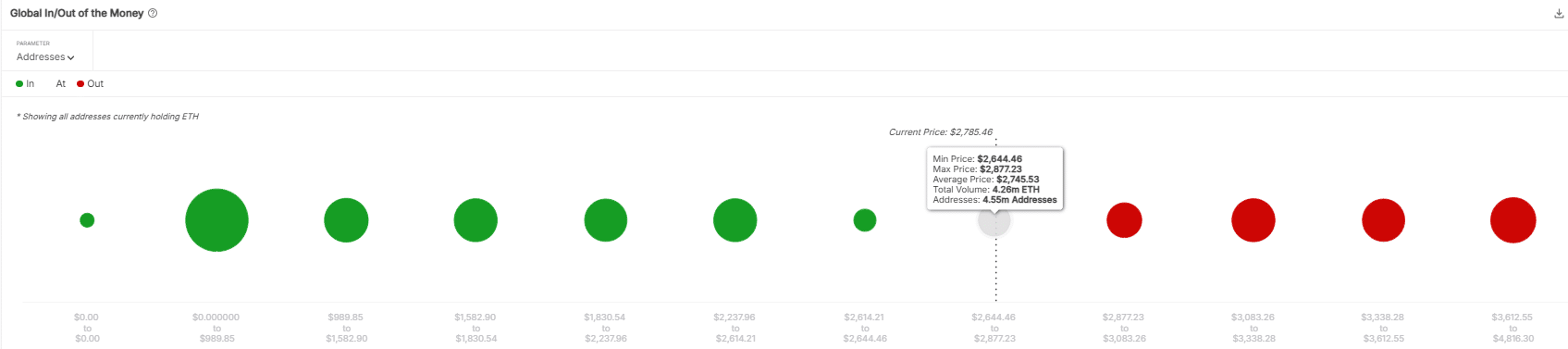

ETH ETFs have been robust runWith a four-day streak and a file of $ 307.8 million in influx into only one day-the highest this yr. Blackrock’s Ethha alone attracted an enormous $ 276.2 million.

This institutional purchase is the important thing to stop ETH from falling lower than $ 2,745. At this degree, 4.26 million ETH could be within the purple and a sale of $ 11 billion risk-ik to control within the coming days.

Supply: Intotheblock

With a powerful marketbound nonetheless nowhere in sight, inflation faltering and investor sentiment that cools in Ethereum throughout these risky instances, as ETF consumption staggered, ETH might lose the remaining 15% of the election every day rally final yr.

Is your portfolio inexperienced? Examine the Ethereum successful calculator

And in the case of breaking $ 4,000? The above situations should shift. Till then, maintain – The dedication to Ethereum is larger than ever.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024