Ethereum

Ethereum Risks 15% Drop If It Doesn’t Reclaim Key Resistance

Credit : www.newsbtc.com

Purpose to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and thoroughly assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum (ETH) has seen a lower of 17% up to now month and has traded underneath $ 1,850 in latest days. Within the midst of his present efficiency, an analyst has warned traders the cryptocurrency dangers that fall to 17 months of lows if it doesn’t reside as much as vital resistance ranges.

Associated lecture

Ethereum might see a lower to $ 1,550

For the previous two days, Ethereum has traded underneath an vital assist zone and fluctuates between $ 1,750- $ 1,840 after he recovered the $ 1,900 on Wednesday on Wednesday. The second largest cryptocurrency per market capitalization misplaced its 15-month attain in the beginning of March and fell underneath $ 2,100 for the primary time since December 2023.

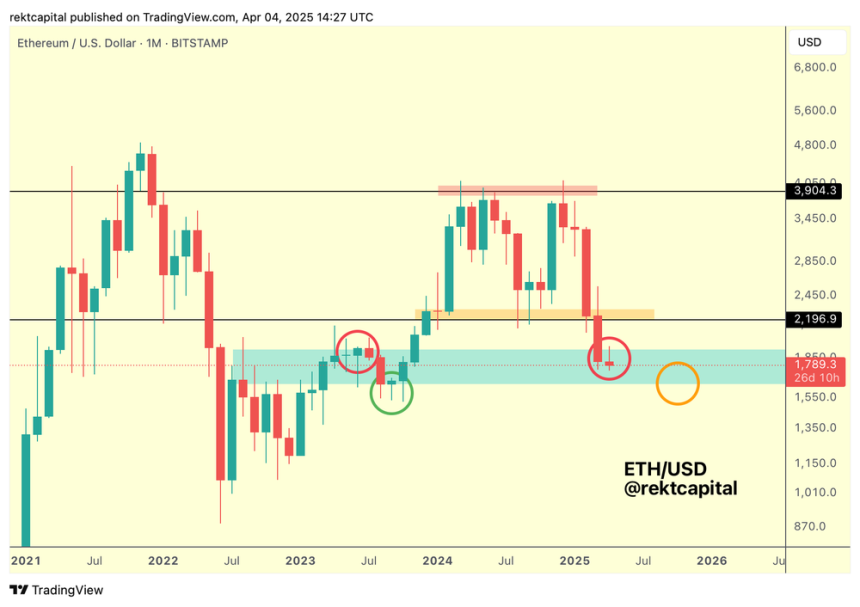

Since shedding this stage, ETH has seen its worst efficiency in seven years they usually registered a detrimental month-to-month closure for the fourth consecutive month. Analyst stretches Capital marked That these efficiency validated the double prime formation of Ethereum that developed inside his macro vary of $ 2,196- $ 3,904.

After breaking down this attain, Ethereum is traded in a historic liquidity pool, between $ 1,640- $ 1,930 vary, and “has successfully positioned itself for a Bearish Hertest” of the high quality with its month-to-month closure inside this space, which might change this stage into a brand new resistance.

Because the analyst explains, altering this stage in resistance to the worth of ETH to the decrease zone of the present attain. “In different phrases, the conversion of the pink stage into resistance (pink circle) has historically been preceded by a drop in supporting the underside of the sunshine blue historic demand space (orange circle),” he described.

As such, Ethereum should reclaim the highest of this demand space “to problem a transfer to the outdated macro vary of $ 2,196.” Within the meantime, a rejection of the $ 1,930 determine, which couldn’t regain it final week, would see ETH danger a lower of 15% to the $ 1,550 space.

Is a rally of 20%?

Additionally stretches capital pointed The dominance of ETH has fallen from 20% to eight% since June 2023, traditionally an inverted space for the cryptocurrency. When Ethereum’s dominance hit the vary of $ 7.5% -8.25%, it turned “to turn into extra market dominant”, which might point out a reversal for the king of Altcoins.

Varied analysts imagine that crucial ranges to view are $ 1,750 assist and the resistance of $ 2,100, since a break above or beneath these ranges will decide the subsequent vital transfer of ETH.

Associated lecture

Analyst Sjuul van Altcryptogems suggested That Ethereum might view a 20% rally based mostly on an influence of three setup in ETH’s decrease timetables. The analyst emphasised that the cryptocurrency had a battery part after falling underneath assist of $ 2,150, which since 10 March floats throughout the ranges of $ 1,840 and $ 2,100.

After the $ 1,840 immersed, the cryptocurrency has been within the manipulation part, the graph reveals, which might trigger a push to the resistance of $ 2,150 when ETH breaks out and the distribution part begins.

Ethereum is at present performing at $ 1,808, a rise of two.2% within the every day interval.

Featured picture of unsplash.com, graph of TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now