Ethereum

Ethereum Rockets 5% Higher, $2B Shorts on the Edge—What’s Next for ETH?

Credit : coinpedia.org

Ethereum prize continues its bullish momentum with one other 5% soar, which implies that the value involves new short-term heights and brings round $ 2 billion briefly positions with a danger of liquidation. Market optimism is fed by rising institutional significance, elevated community exercise and rising anticipation of the upgrades of Ethereum. Merchants hold an in depth eye on, whereas each retail and institutional members assess the potential for additional upward evaluation. The query for merchants now: how far can ETH rise earlier than he’s confronted with the subsequent main correction?

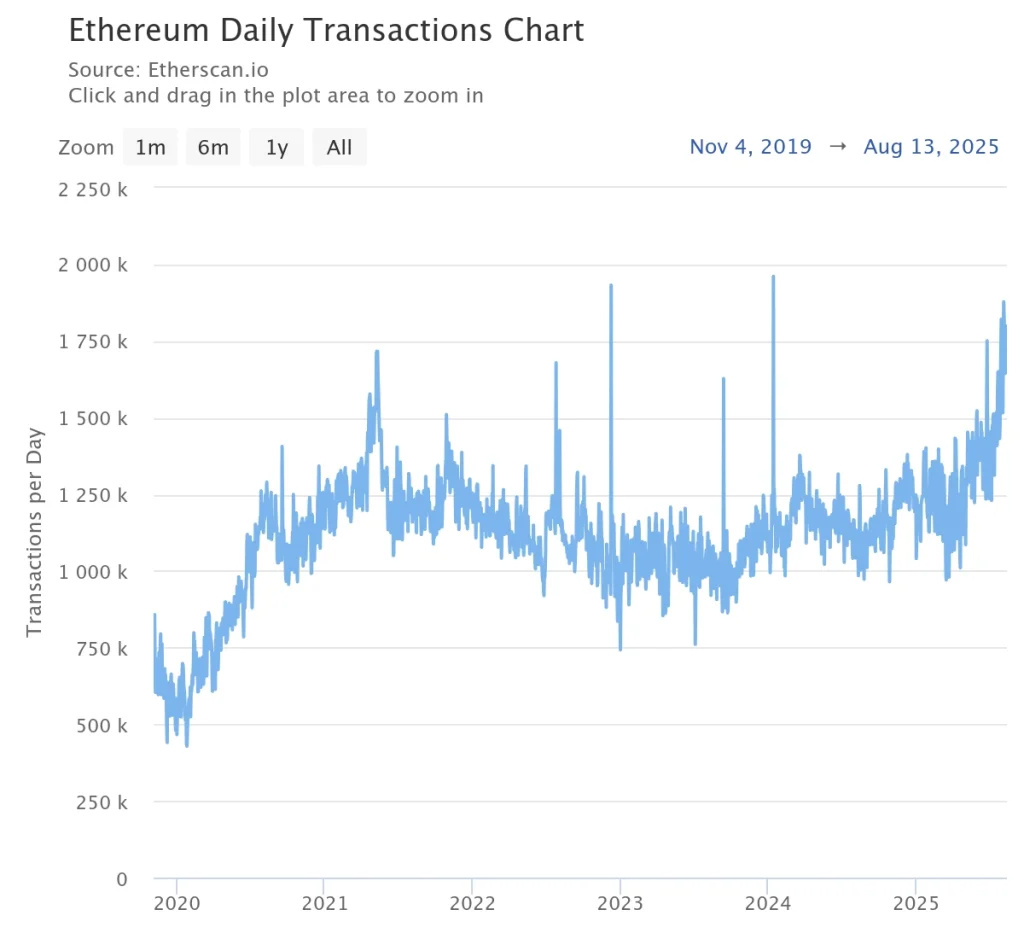

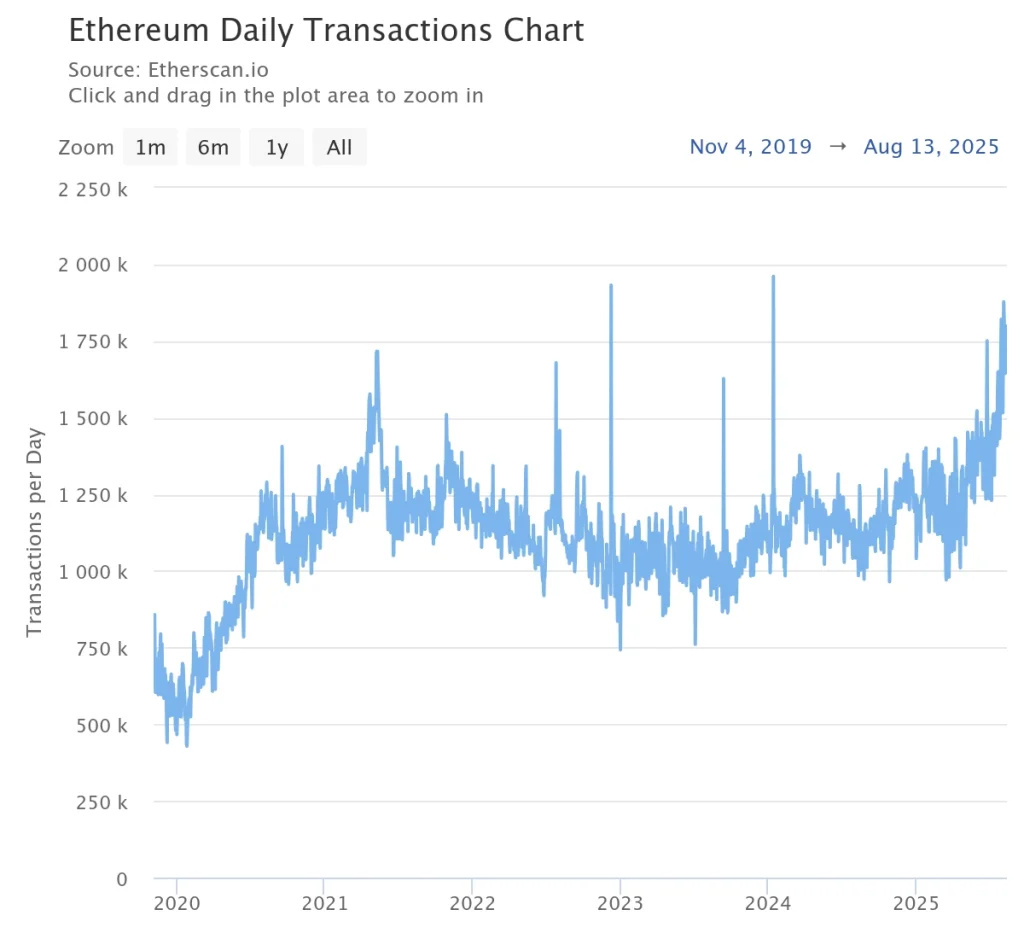

Ethereum -transactions go parabolic

The current improve in Ethereum will not be executed in seclusion – there are a variety of vital most vital market elements for the optimism of traders and feeding the rally. From institutional accumulation to rising community exercise and upcoming protocolupgrades, these forces type the brief -term prize motion of ETH and set the stage for potential additional revenue.

The each day transaction exercise of Ethereum has demonstrated a powerful upward route and achieved ranges that haven’t been seen since 2021. The current peak in transactions signifies rising community consumption and elevated market participation, which displays higher retail and institutional involvement. Increased exercise on the chain usually correlates with bullish sentiment, as a result of it indicators a powerful demand for ETH on Defi, NFTs and good contract purposes. This improve in exercise most likely contributes to the current worth rally, to assist the upward momentum of Ethereum and within the brief time period bullish prospect.

Will the Ethereum worth attain $ 5000 this week?

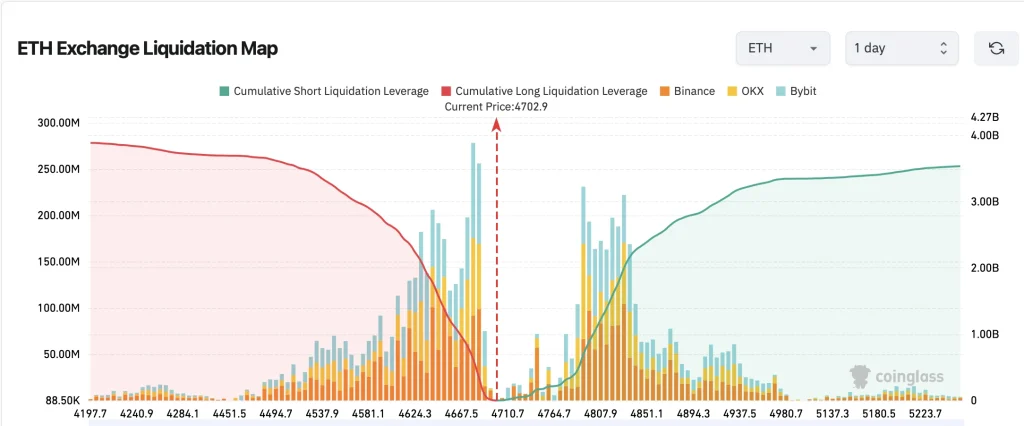

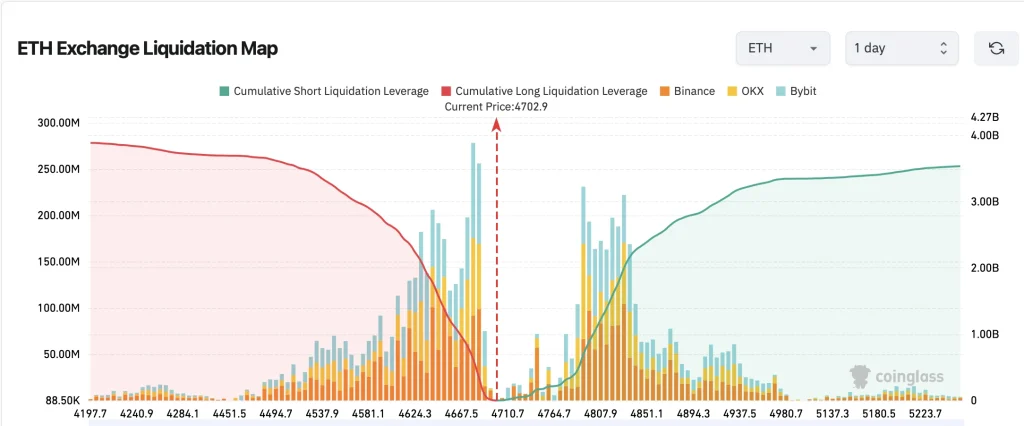

The most recent Trade Liquidatiekaart from Ethereum reveals crucial leverage factors whereas the prize is floating close to $ 4,702. The info emphasizes clusters of each lengthy and brief liquidation ranges in giant festivals akin to Binance, OKX and Bybit. With substantial brief liquidations above present ranges and noteworthy lengthy liquidations under, the market is at a vital second. Merchants pay shut consideration to potential liquidity wipe that may trigger sharp volatility in each instructions, relying on the stops on the facet, are first hunted.

The map exhibits a heavy cumulative constructing with brief liquidation above $ 4,710, which implies that a breakout could cause quick brief protection to greater worth zones. The cardboard exhibits a significantly brief liquidation cluster close to $ 4,870-Ethereum’s all-time high-where greater than $ 2 billion is positioned in shorts. An outbreak to this stage can unleash an enormous brief squeeze, in order that ETH is rapidly pushed for worth detection. Primarily based on Fibonacci extensions from the earlier Ath-to-Low Cycle:

- 1,272 extension → ~ $ 5,250

- 1,414 Extension → ~ $ 5,480

- 1,618 Extension → ~ $ 5,800

Value goal: A practical preliminary purpose after liquidation for the value rally of Ethereum (ETH) is $ 5,250 – $ 5,300, with Momentum which will prolong to $ 5,800 as FOMO accelerates.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September