Altcoin

Ethereum selling pressure dominates on Binance.

Credit : ambcrypto.com

- Ethereum promoting strain dominated on Binance

- ETH is down 18.61% over the previous month.

Since reaching a latest excessive of $3746 per week in the past, Ethereum [ETH] has skilled robust downward strain.

Throughout this era, ETH fell to an area low of $3,157. Though the altcoin has posted reasonable positive factors, it’s nonetheless declining.

On the time of writing, Ethereum was buying and selling at $3,196, down 2.17% on the day by day charts. ETH can be down 12.67% on the weekly charts and 18.61% on the month-to-month charts.

This decline within the ETH charts is basically attributed to elevated promoting strain, in keeping with CryptoQuant.

Ethereum promoting strain dominates

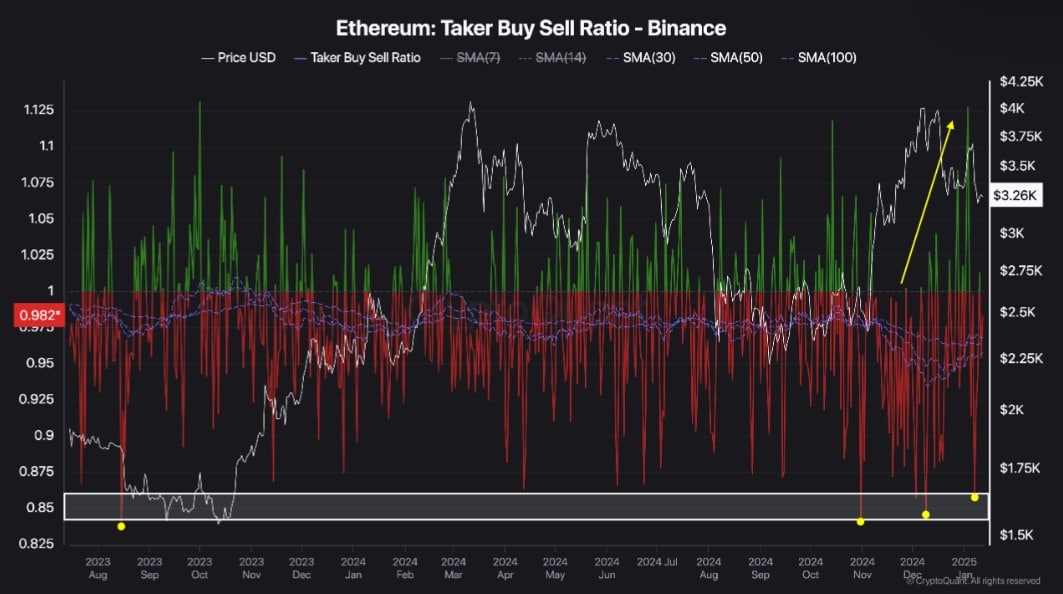

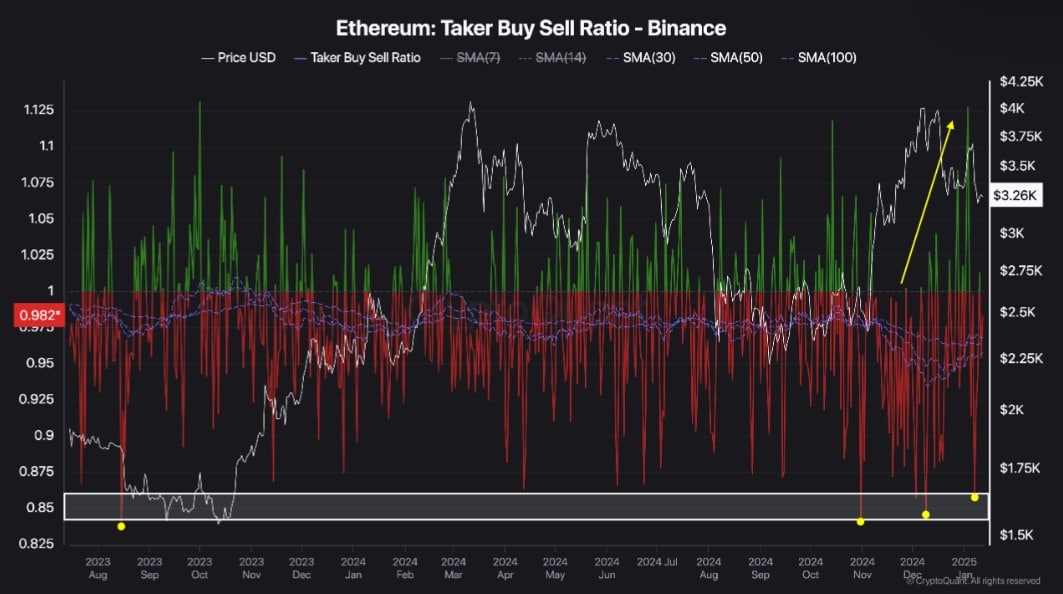

Based on CryptoQuant Based on evaluation, ETH is experiencing robust promoting strain on Binance. As such, Ethereum has been experiencing important promoting strain on the change since November 2024.

Supply: CryptoQuant

The rising dominant promoting strain on Binance is mirrored in ETH’s Taker Purchase/Promote ratio. This measure has remained unfavorable since November 2024, indicating a higher variety of promote orders than purchase orders.

Throughout this era, the Taker Purchase/Promote Ratio has fallen to ranges not seen since August 2023, reflecting the prevailing bearish sentiment.

As consumers tried to take management in December, sellers rapidly regained the higher hand, reinforcing the downward momentum.

The continued promoting strain in latest months underlines a market that’s each bearish and cautious.

Then again, a rising gross sales ratio gives a possible shopping for alternative for long-term holders.

Impression on ETH value charts?

As famous above, Ethereum is experiencing robust promoting strain, which has negatively affected the altcoin’s value actions.

Supply: Tradingview

For starters, we may even see elevated promoting strain now that ETH Chaikin Cash Circulation (CMF) has turned unfavorable. Now that the CMF is at -0.08, it implies that sellers are dominating the market.

This market habits is confirmed by a declining Relative Power Index (RSI), which has fallen to close oversold territory and settled at 38. Such a dip implies that sellers are in command of the market.

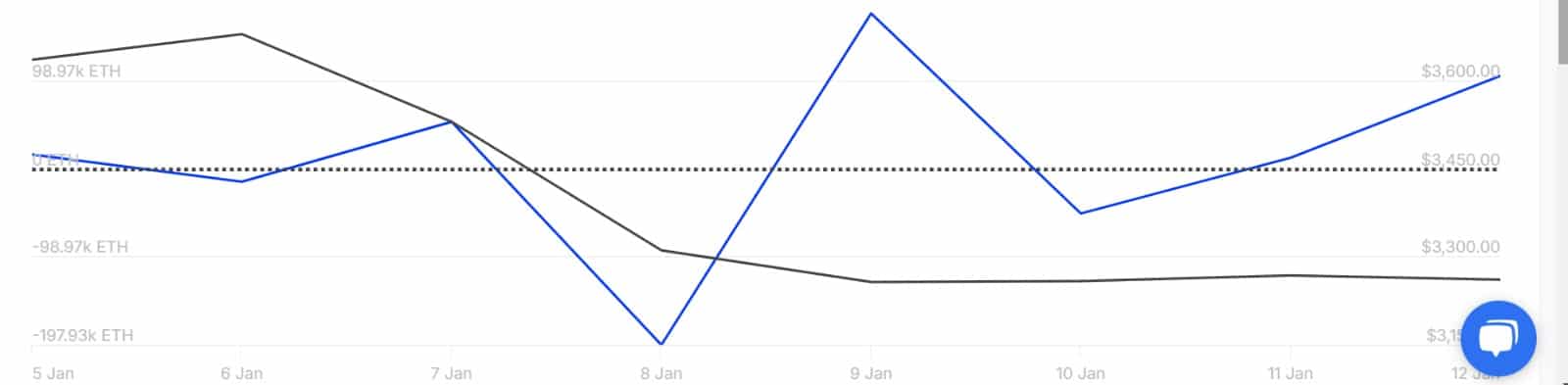

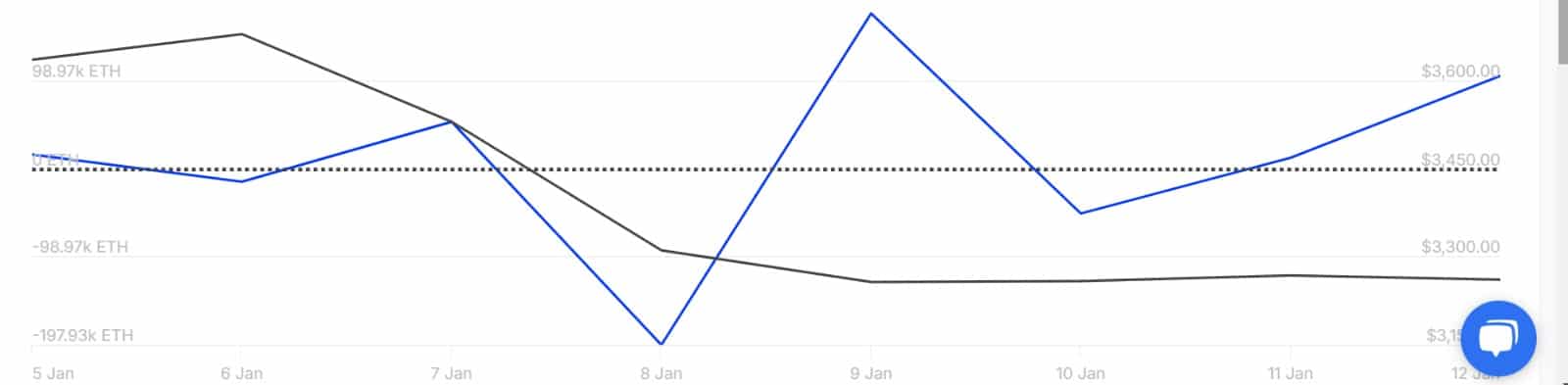

Supply: IntoTheBlock

Trying additional, Ethereum inflows onto the exchanges have skyrocketed over the previous week. This has elevated from -50.77k to 103.77k, indicating that there are extra ETH inflows to exchanges than outflows.

Sometimes, increased inflows into the inventory markets precede higher promoting strain, as traders are inclined to promote once they make these transfers.

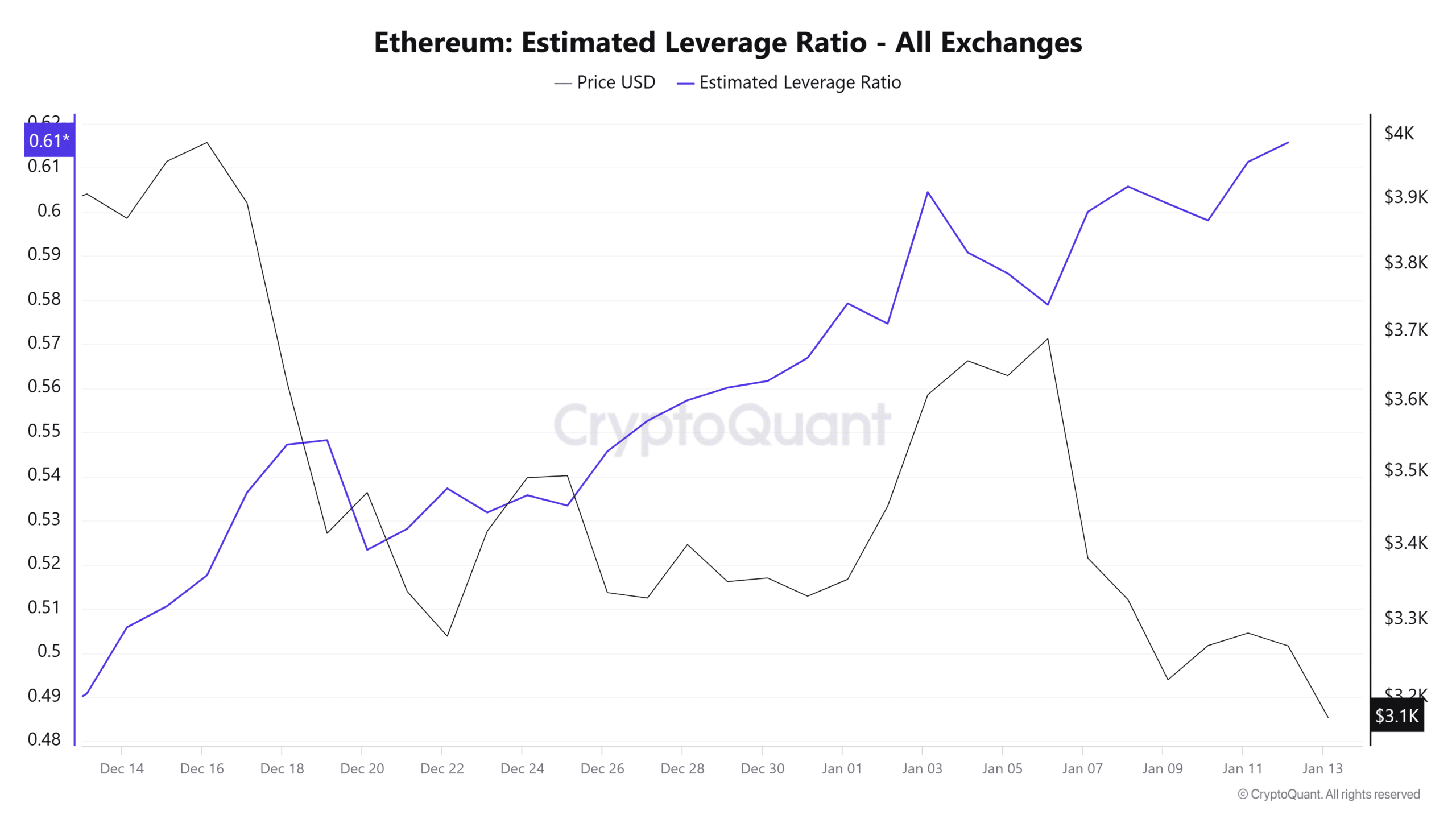

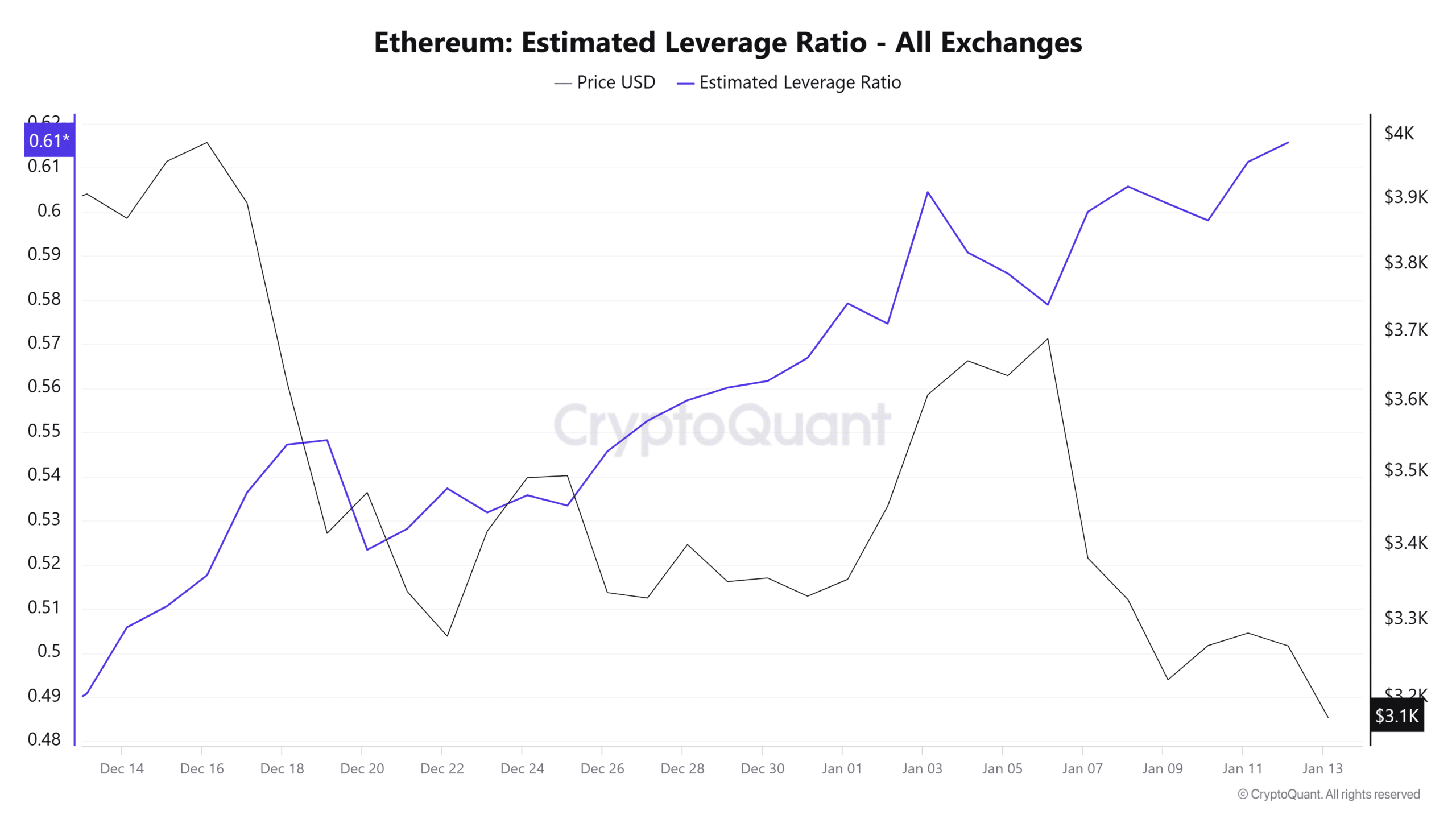

Supply: CryptoQuant

Ethereum’s Estimated Leverage Ratio (ELR) has seen a sustained enhance over the previous month. When the ELR rises throughout a downtrend, it signifies bearish sentiment, rising the chance of a long-term squeeze.

If costs fall additional, lengthy positions could also be liquidated, leading to an extended squeeze and additional value declines.

Learn Ethereum’s [ETH] Worth forecast 2025–2026

In conclusion, Ethereum is underneath robust promoting strain as bearish sentiments persist. If present market circumstances persist, ETH might fall to $3,030 and probably fall beneath $3,000 to seek out help round $2,810.

Nonetheless, if the downtrend is exhausted and a reversal happens, the altcoin might reclaim $3,300.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024