Ethereum

Ethereum set for a $3k breakout? What on-chain data shows

Credit : ambcrypto.com

- The on-chain metrics confirmed that bulls have been desirous to go lengthy.

- The age consumption metric indicated warning, whereas different metrics confirmed this.

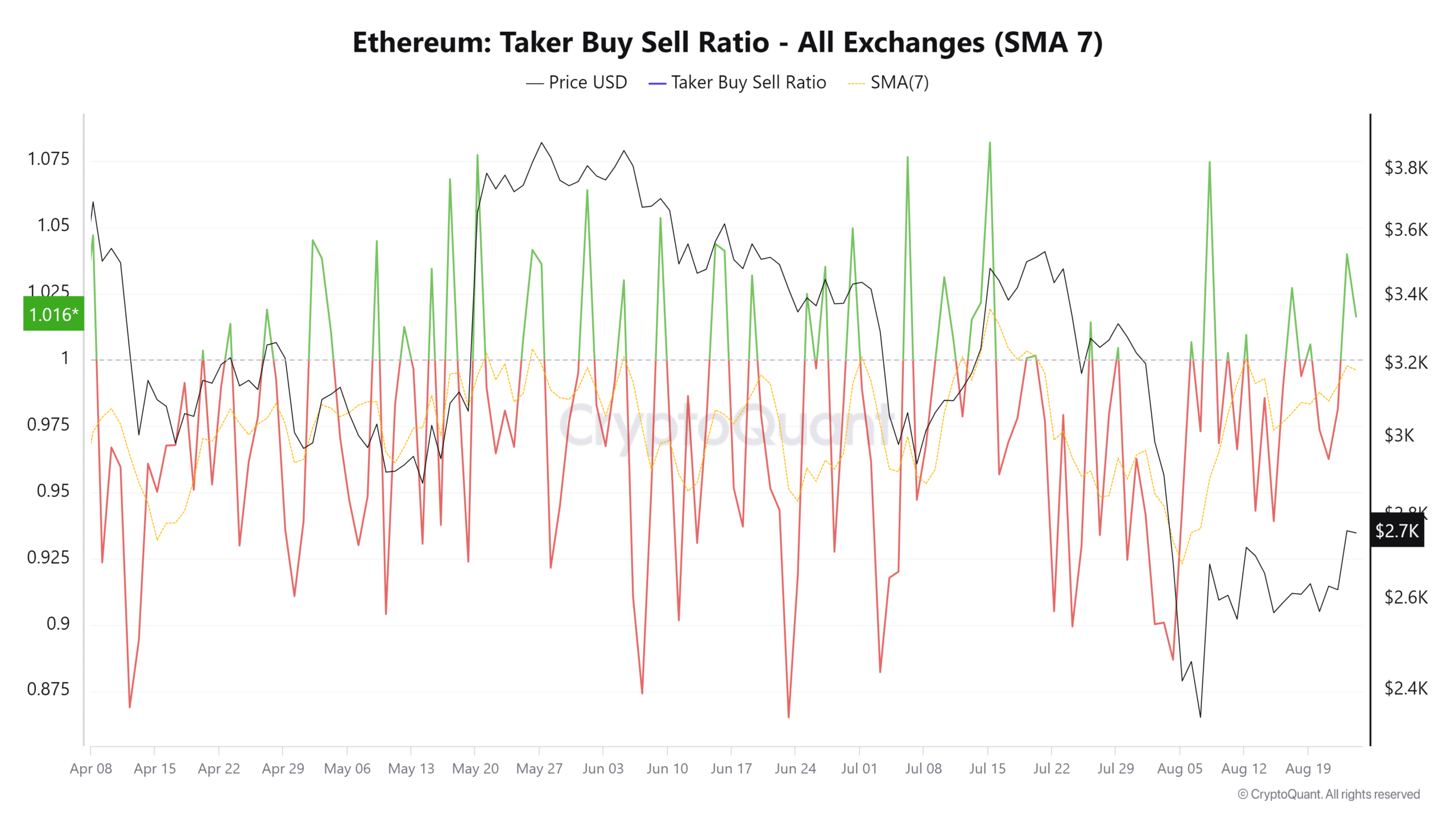

The taker purchase/promote ratio skyrocketed for Ethereum [ETH] the previous few days. This metric tracks the connection between the taker’s shopping for quantity and promoting quantity. Values beneath 1 point out bearish sentiment.

Taker refers back to the nature of the order positioned, being a market order moderately than a restrict order. Which means that these merchants are prepared to pay a small premium to execute the commerce at market costs. Subsequently, this ratio helps gauge sentiment.

Ethereum on the street to restoration

On July 31, Ethereum was buying and selling at $3.2k. Since July 20, the taker’s purchase/promote ratio has been destructive, indicating that bearish sentiment was dominant. After the August 5 dump, the market rebound stimulated lengthy positions.

The metric’s peaks on August 8 and August 23, whereas bullish, will not be indicative of a sustainable restoration.

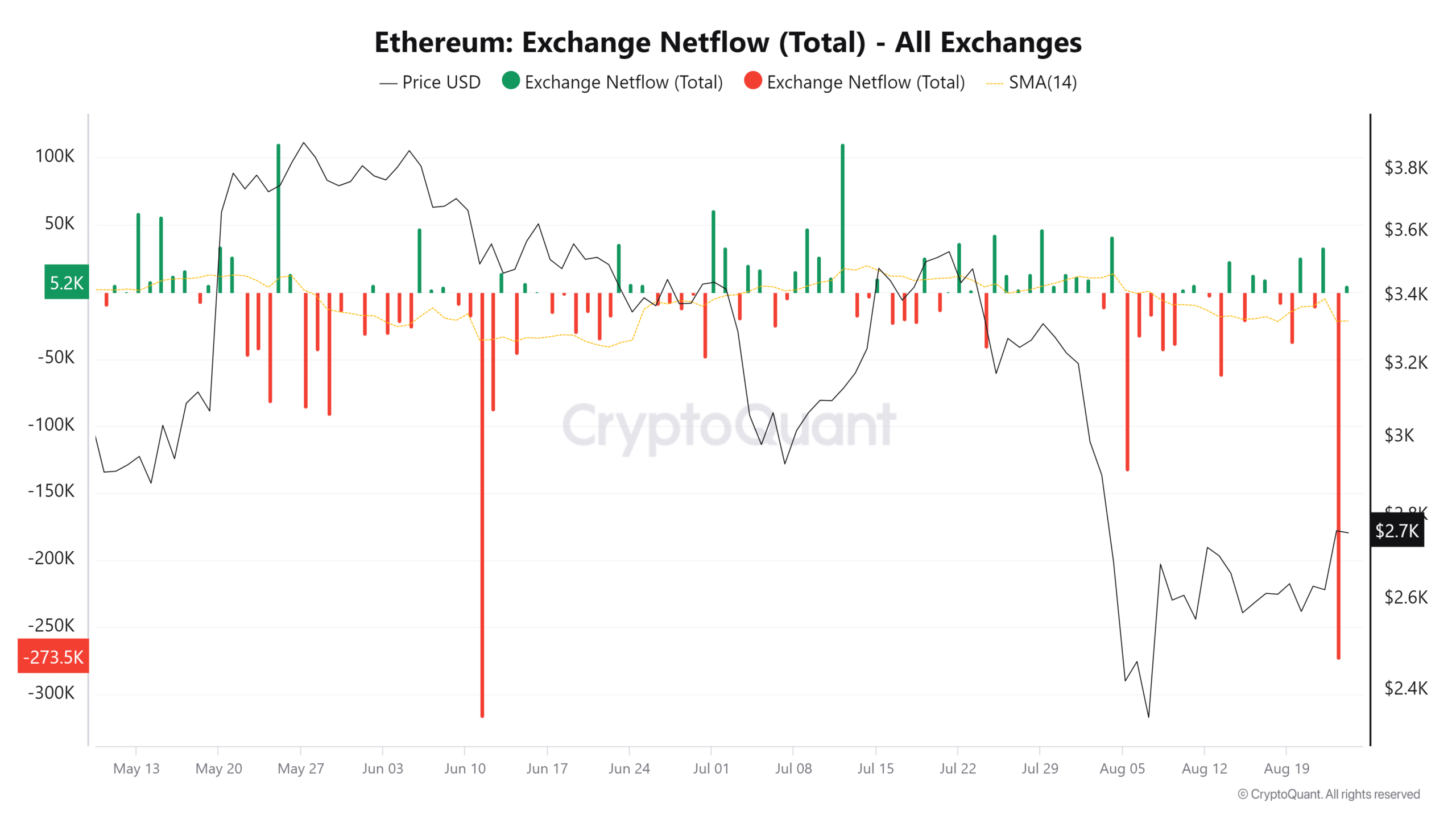

The circulation of Ethereum from the exchanges may shed extra gentle on this. On the twenty third, there was an enormous outflow of ETH, indicating accumulation. The 14-day easy shifting common has resumed its downward development following the early August worth drop.

This was an encouraging signal and will push costs in direction of the $3k resistance zone.

Ought to merchants anticipate a breakout above $3k?

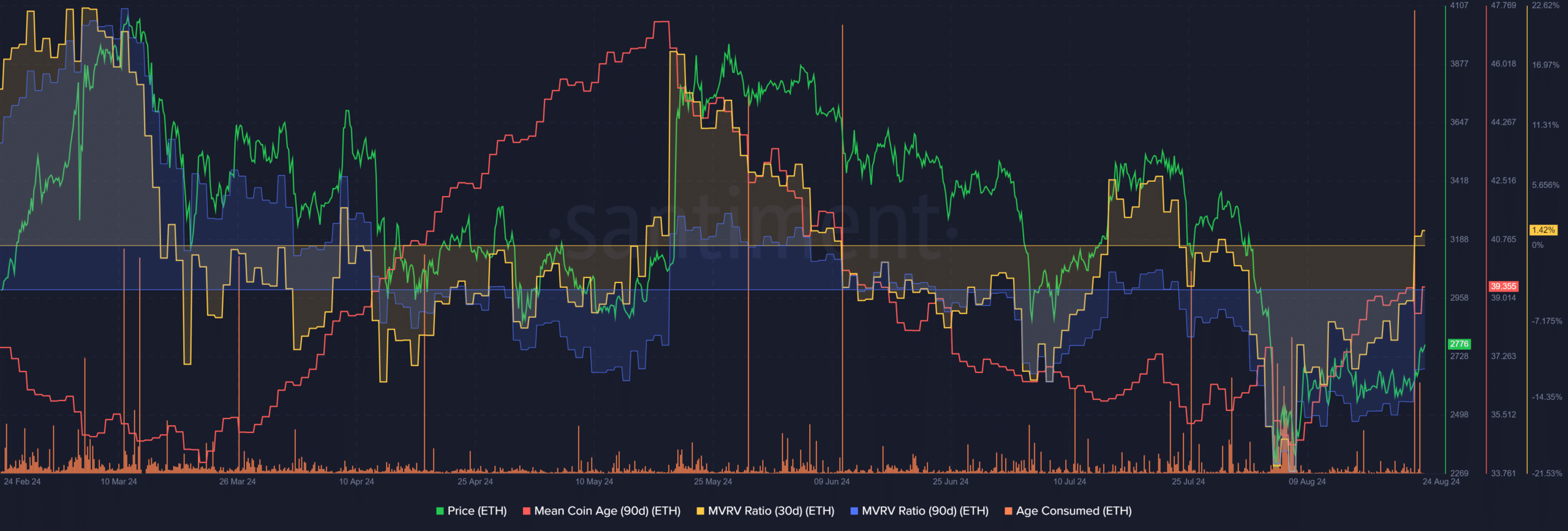

The 30-day MVRV moved into constructive territory to point short-term holders with marginal positive aspects. The 90-day MVRV was nonetheless deeply destructive. In the meantime, the common coin age has moved increased over the previous three weeks.

This indicated network-wide accumulation, reinforcing the bullish view of the netflows metric. Nevertheless, the age consumed metric noticed an enormous spike, demonstrating elevated token motion.

Is your portfolio inexperienced? Examine the Ethereum revenue calculator

The decline within the community gasoline price meant that ETH provide may change into inflationary over time, which may negatively affect ETH in the long run.

Such actions often point out a sell-off. Merchants must be cautious of promoting strain over the weekend and be cautious throughout Monday’s buying and selling session.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now