Ethereum

Ethereum Stays Steady Above Realized Value

Credit : www.newsbtc.com

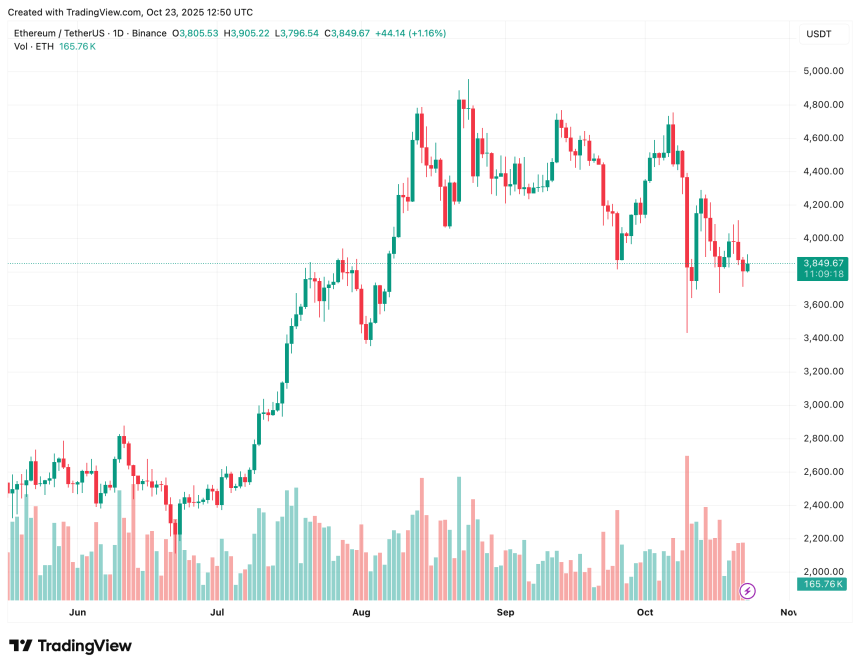

Ethereum (ETH), the second largest cryptocurrency by market capitalization, continues to commerce gentle under the psychologically necessary value stage of $4,000, following the brutal drop on October 9, which noticed the digital foreign money check assist round $3,435.

Ethereum Stays Above Realized Value – Bullish Momentum Quickly?

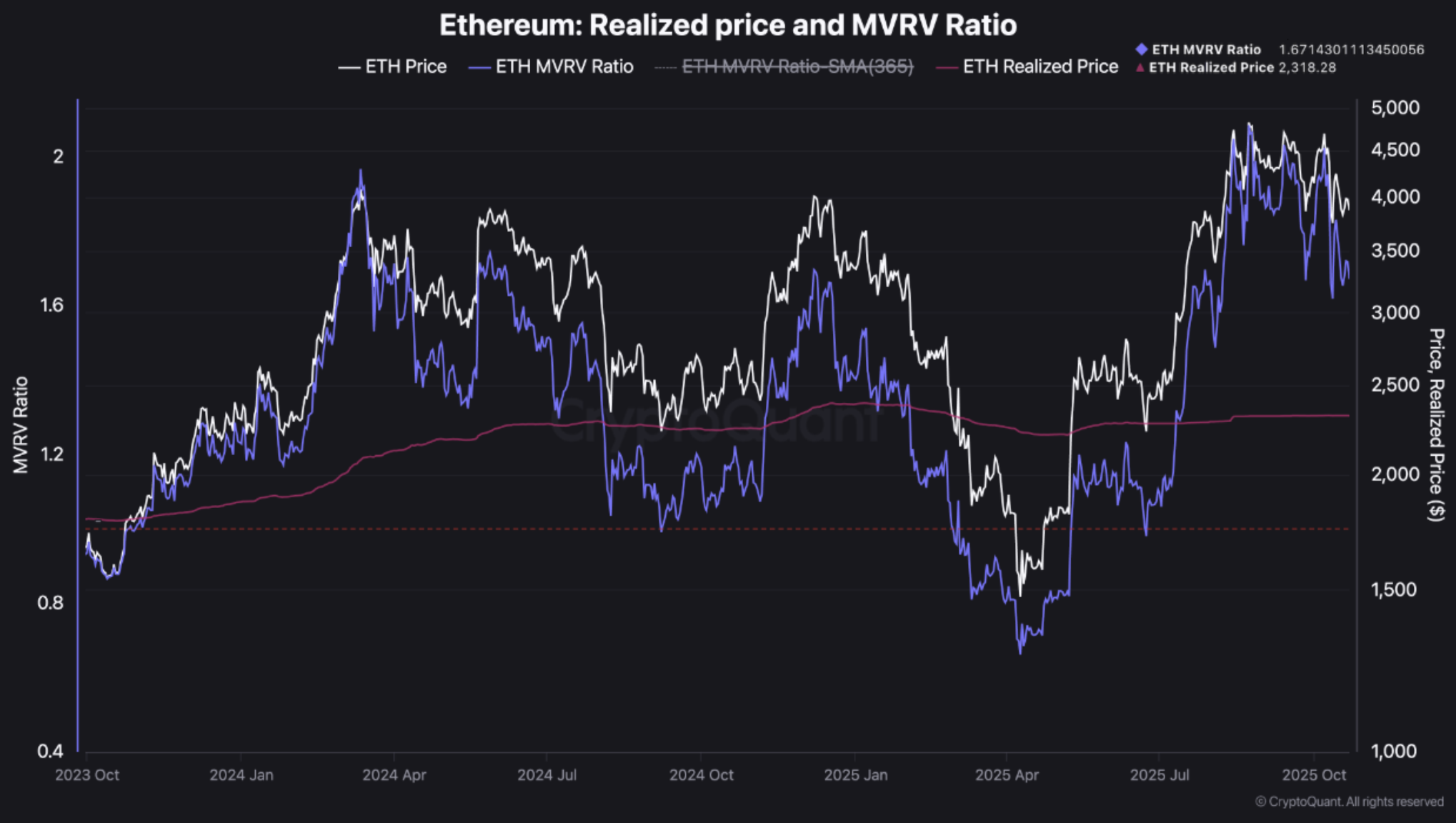

In line with a CryptoQuant Quicktake publish by contributor TeddyVision, Ethereum is buying and selling above its realized value of round $2,300. The analyst referred to as the value stage a “basic assist zone” and mentioned that traditionally, any dip under this stage marked a capitulation part.

Associated studying

For the uninitiated, the realized value represents the common value foundation of all ETH holders, calculated by dividing the entire worth of all ETH on the time they final moved on-chain by the present circulating provide.

Realized value successfully reveals the ‘actual’ common value that buyers paid, and serves as a key indicator of whether or not the market is making a revenue or a loss. So long as ETH trades above the realized value, the market construction will probably stay bullish.

The analyst additionally highlighted Ethereum’s market worth to realized worth (MVRV) ratio. Notably, ETH holders at present have a median achieve of 67% in opposition to their value foundation. This statistic gives two necessary hints in regards to the present market.

First, it reveals that whereas the market is worthwhile, it’s removed from overheated. Second, it signifies that market members are assured out there’s upward momentum, however not utterly euphoric.

To elucidate, the MVRV ratio compares the market worth of an asset to its realized worth. A better MVRV signifies that holders are sitting on bigger unrealized positive aspects – which is commonly a sign of potential overvaluation – whereas a decrease MVRV suggests undervaluation or market concern.

Moreover, TeddyVision famous Ethereum’s response from the Higher Realized Value Band, which is at present round $5,300. The analyst famous:

The worth retreated earlier than reaching the “Overheating Zone”. This isn’t a reversal – it’s a post-distribution consolidation part, a wholesome cooling with out structural injury.

Lastly, spot flows of ETH to crypto exchanges are additionally slowing, suggesting that the following step ahead for the digital asset will probably rely on new liquidity, not leverage. In brief: Ethereum is slowly transferring from the distribution part to the consolidation part.

Is it a superb time to purchase ETH?

Whereas offering dependable future predictions within the crypto market stays a difficult job, new on-chain and change knowledge signifies ETH is regaining its bullish momentum. Just lately, for instance, the Binance financing charges hinted that ETH may rise to $6,800.

Associated studying

Likewise, ETH reserves on exchanges proceed to say no at a fast tempo. Earlier this month, ETH was listed on exchanges hit a multi-year low, rising the chance of a possible “provide disaster” that would dramatically improve the value of ETH.

Crypto analyst Nik Patel lately mentioned this warned that ETH’s value correction is probably not utterly over but. On the time of writing, ETH is buying and selling at $3,849, up 0.3% within the final 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now