Bitcoin

Ethereum struggles as investors shift to SOL, BTC – Will 2025 offer relief?

Credit : ambcrypto.com

- ETH attracted low curiosity from buyers in comparison with BTC and SOL.

- Per crypto hedge fund, ETH might see renewed curiosity in 2025.

Ethereums [ETH] has struggled this cycle amid document excessive FUD, and investor consideration shifted elsewhere.

In keeping with Zaheer Ebtikar of crypto hedge fund Cut up Capital, ETH has lagged behind others as a result of ‘center youngster syndrome’.

“$ETH is de facto fighting center youngster syndrome. The asset is just not in vogue amongst institutional buyers, the asset has misplaced favor in crypto non-public capital circles, and the retail sector is nowhere in sight providing something of this magnitude.”

Buyers are leaving ETH

Among the many crypto majors, ETH supplied buyers simply 8% on a YTD (year-to-date) foundation, in comparison with double digits in Bitcoin [BTC] And Solana [SOL].

Ebtikar linked the underperformance to buyers’ concentrate on BTC and different ETH opponents equivalent to SOL and Sui [SUI].

The chief famous that there are three sources of capital within the crypto area: institutional (through ETFs/futures), non-public capital (liquid funds, VCs), and eventually retail. However proper now, solely the primary two mattered.

He added that institutional capital was closely targeted on BTC (through ETFs). ETH ETFs have seen it net negative flows of $546 million since they debuted in July, underscoring the low curiosity.

Then again, Ebtikar said that personal capital considered ETH as overvalued and redirected capital to different ETH opponents that have been perceived as undervalued, equivalent to SOL and Celestia. [TIA]and SUI.

“$ETH is simply too massive for its personal capital to assist, whereas on the similar time it might probably assist different index property like $SOL and different massive caps like $TIA, $TAO and $SUI.”

Coinbase analysts too echoed the above sentiment of their September report.

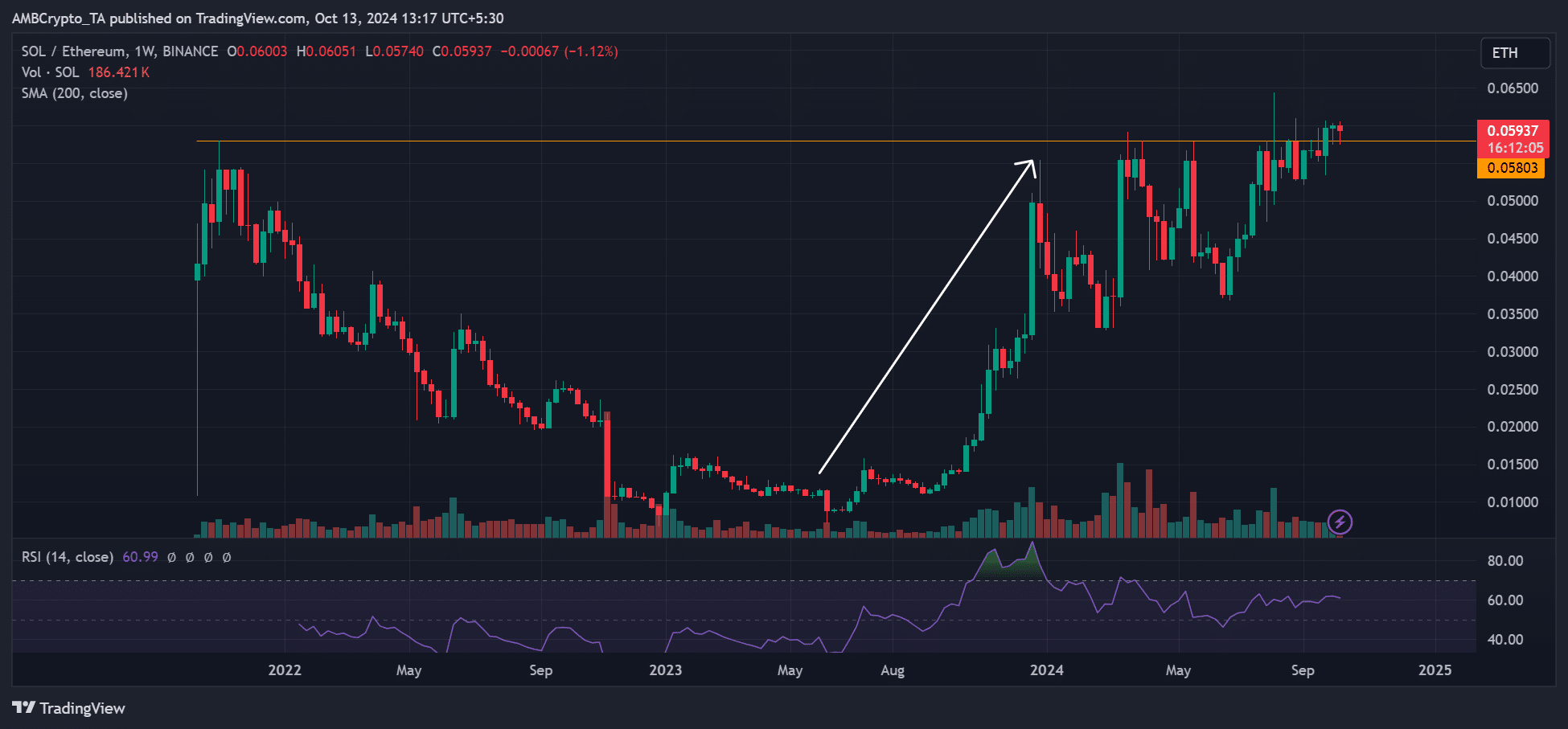

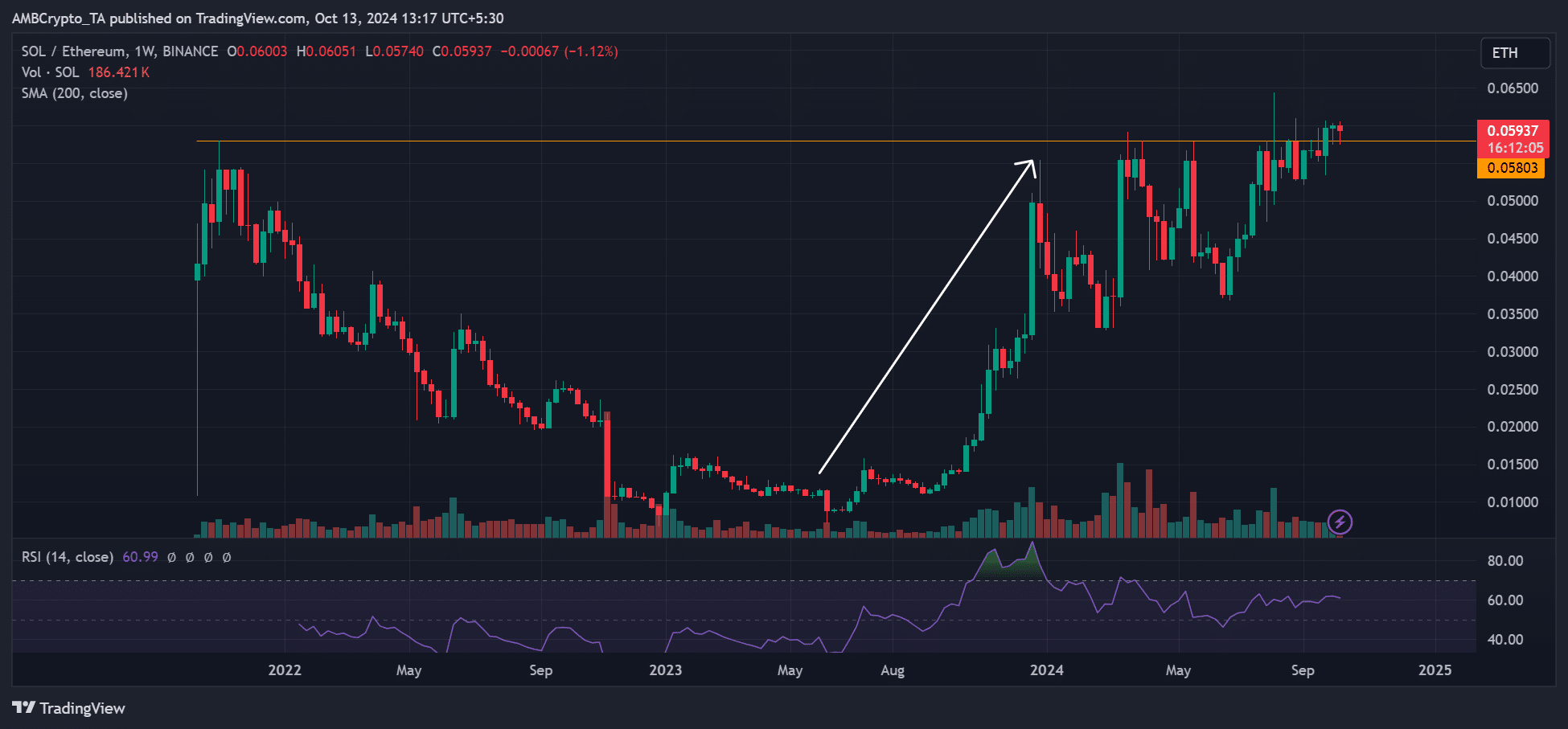

Supply: SOLETH ratio, TradingView

The SOLETH ratio, which tracks the worth of SOL to ETH, has exploded since final 12 months, confirming Ebtikar’s thesis that buyers might have switched from ETH to SOL.

That stated, Ebitaker additionally acknowledged that ETH was the one altcoin with an authorised ETF within the US.

As such, he predicted that the asset might see renewed curiosity from 2025, particularly from institutional buyers.

He talked about seemingly elevated demand from ETF consumers, modifications throughout the Ethereum Basis and Trump’s victory.

On the time of writing, ETH was valued at $2.4k and has been consolidating between $2.3K and $2.5K since early October.

Supply: ETH/USDT, TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September