Ethereum

Ethereum struggles at $1,750 – Assessing odds of ETH recovery

Credit : ambcrypto.com

ETH is sharp from BTC because the Q1 marker units will increase

Ethereum bore the sufferer of the crypto correction of Q1 and left 44.83% of its worth in comparison with Bitcoin’s extra reasonable lower of 14.67%, as proven in information from Intotheblock.

Supply: Intotheblock

The divergence underlines the vulnerability of Ethereum as the chance urge for food shifts, taking good care of the laws and the demand for property -based property.

Though the decline of Bitcoin displays a wider macro -economic volatility, the sharper fall in Ethereum signifies a reliability hole. Merchants appear to be capital to result in Bitcoin, thought of the “safer” cryptocurrency possibility.

Even conventional markets such because the S&P 500 surpassed Ethereum, with an emphasis on underperformance as some of the hanging traits of the quarter.

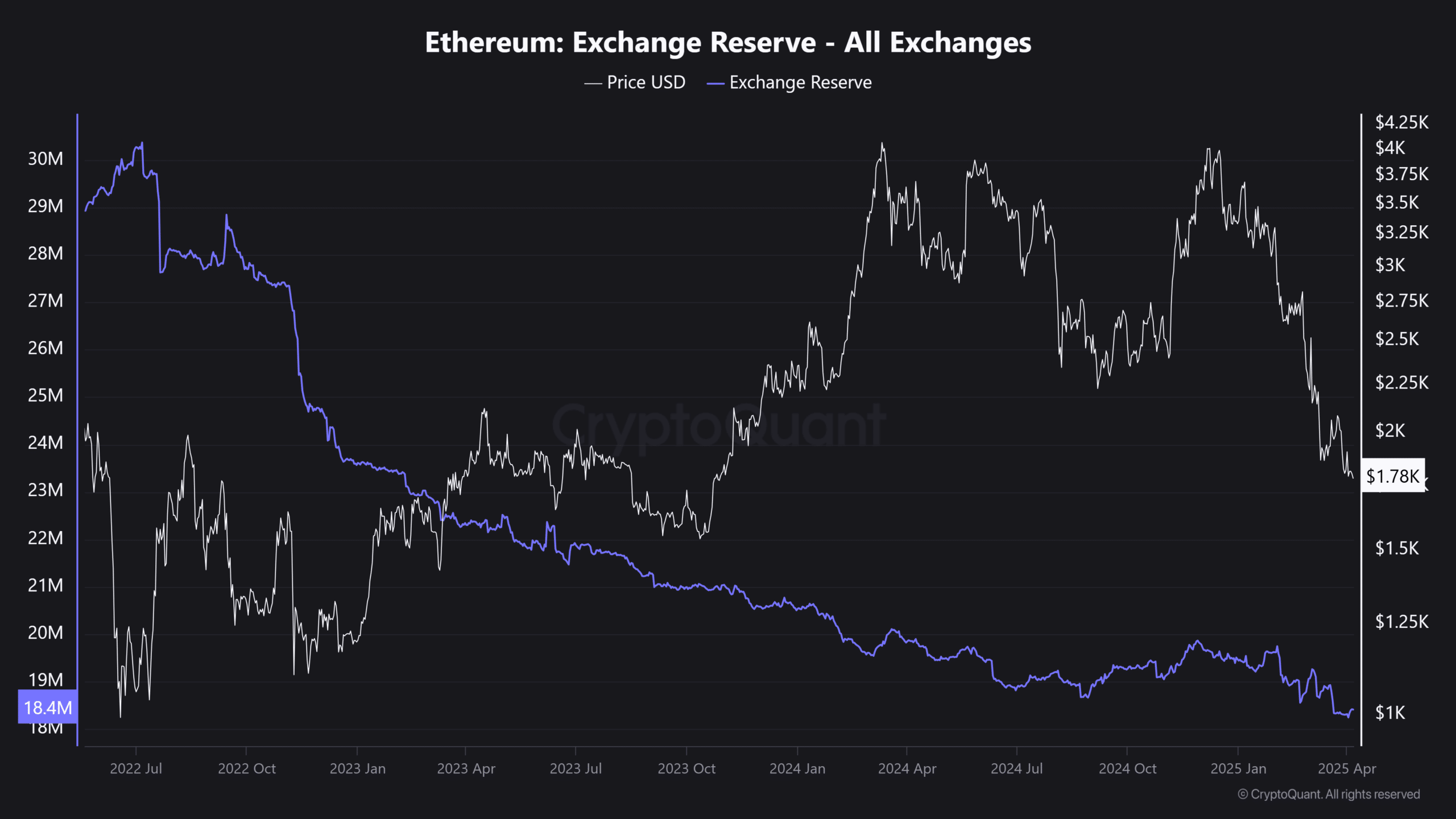

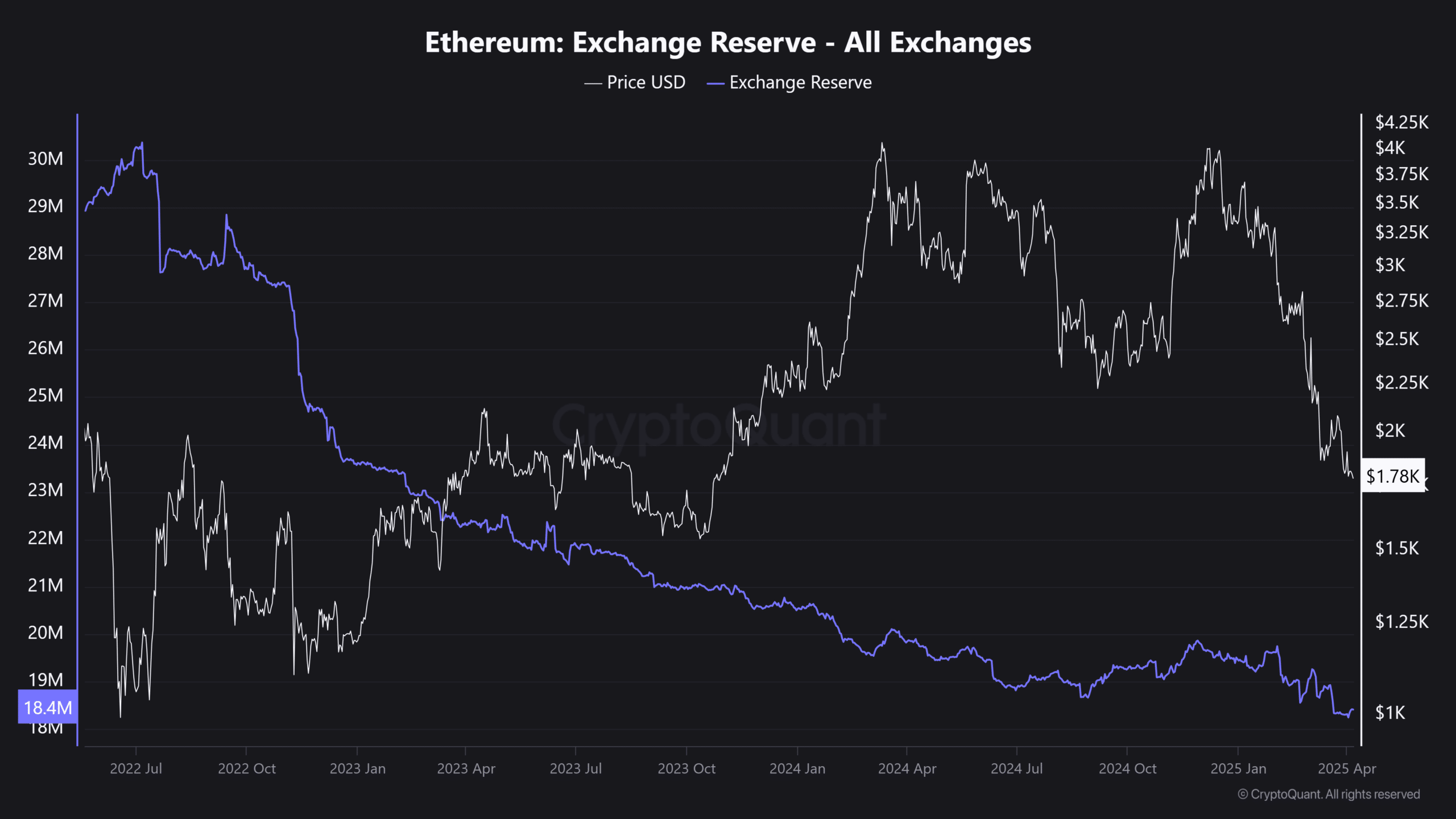

Alternate -Reserves contact new lows

Including to the quarterly of Ethereum is a continuing lower in trade reserves, which have now fallen to solely 18.4 million ETH – the bottom degree in additional than three years, in line with cryptoquant information.

Usually such a decline can be learn as bullish, signaling of lengthy -term beliefs and diminished gross sales stress.

Supply: Cryptuquant

The continual lower within the worth of ETH tells a unique story. A discount of tokens on exchanges has not led to an elevated shopping for momentum.

As a substitute, it may possibly point out broader investor elimination, a shift to passive persistent, dedication and even potential exit methods.

Whereas the provide is lowering, the arrogance of traders additionally appears to fade.

Ethereum: Caught in no man’s land?

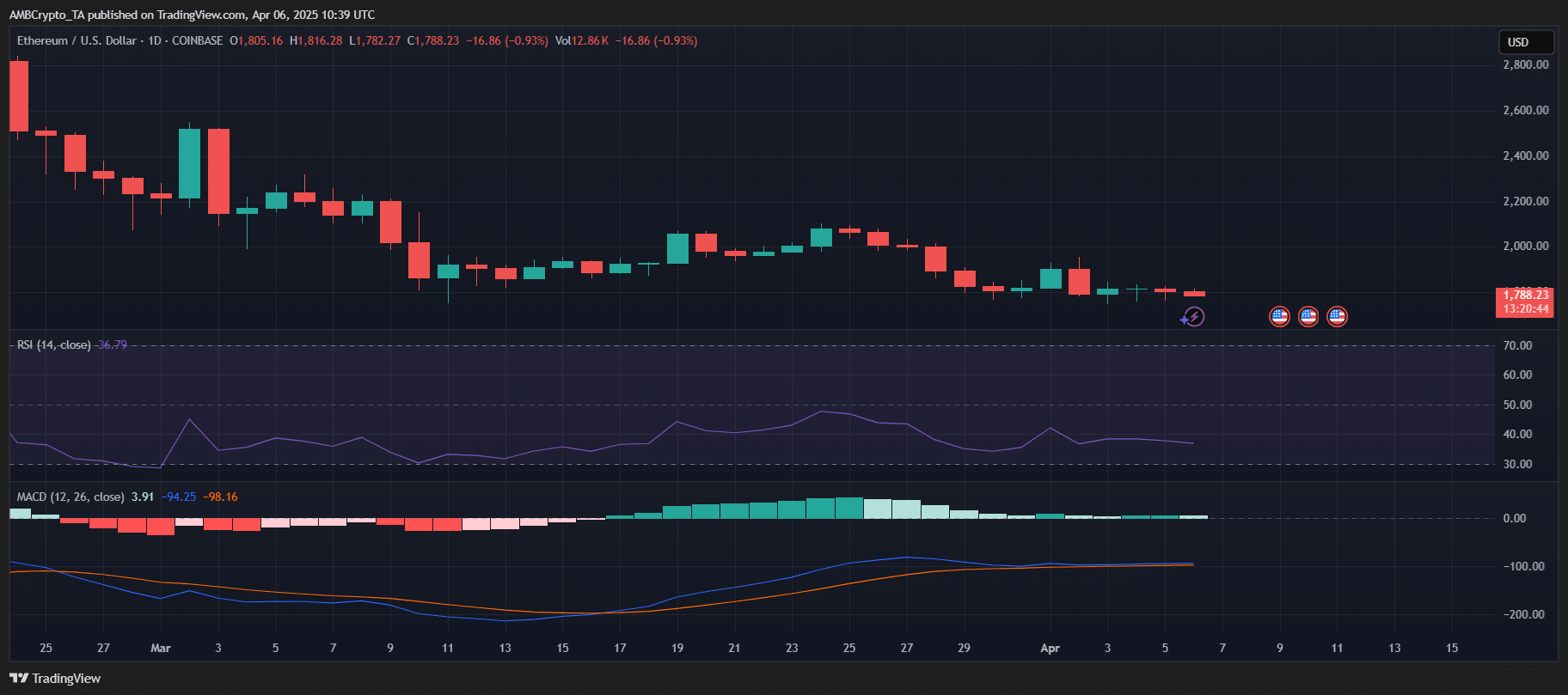

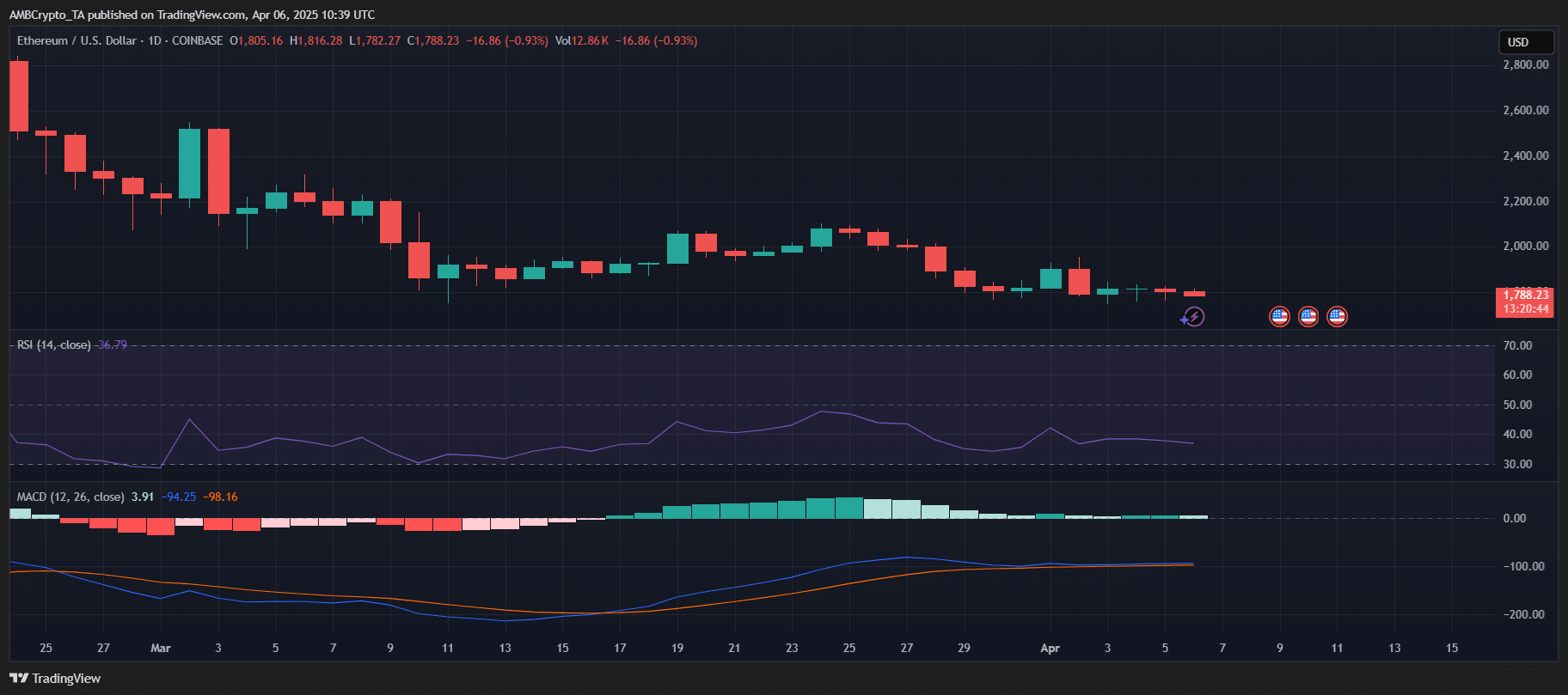

On the $ 1,788 press, ETH was simply above an essential psychological degree of $ 1,750, with out clear indicators of Bullish Momentum.

The RSI was floating at 36.7 – edge to over solder territory, however lacked ample buying stress to trigger a reversal. Within the meantime, the MACD confirmed a weak up momentum, with the histogram hardly any inexperienced flipping.

Supply: TradingView

The value has been in attain for greater than two weeks, and hints on indecision as a substitute of accumulation.

Except ETH can get better the $ 1,850- $ 1,900 zone with quantity help, the chance of downward descent stays. Within the quick time period, a break below $ 1,750 might trigger a retest of $ 1,650.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024