Ethereum

Ethereum supply hits historic lows – How it might impact the market

Credit : ambcrypto.com

- The alternate reserves of Ethereum stay at historic lows, which can point out a provide -driven worth improve.

- The lengthy -term low reserves can result in upward worth stress within the brief time period.

Ethereum [ETH] Appears to be left behind regardless of the broader Bullish sentiment from Crypto market.

Whereas Bitcoin [BTC] Once more made once more, one other all time, final week, ETH continues to be struggling to interrupt past the nice resistance.

On the time of writing, nonetheless, the energetic prior to now day has risen by 4% with a press worth of the $ 3,195 press.

Within the midst of all these are an vital issue that influences the value actions of Ethereum, the reserves on spot festivals.

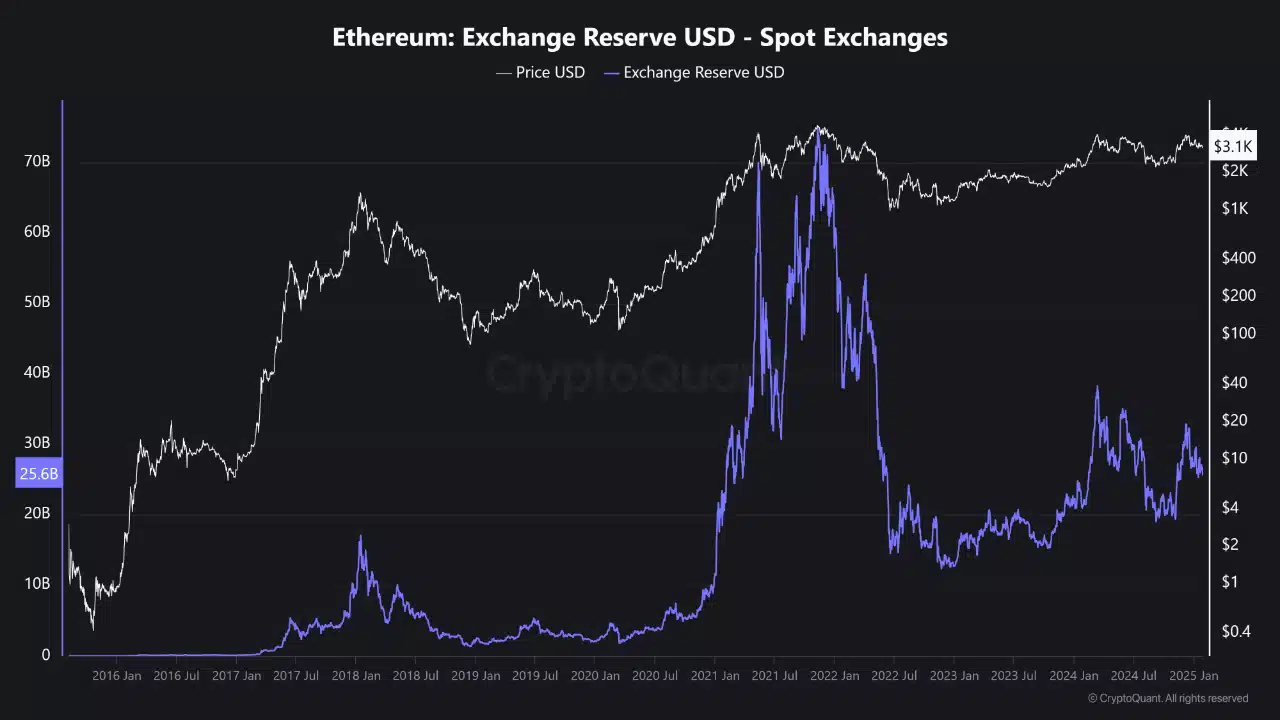

In keeping with an evaluation printed on the cryptoquant Quicktake platform, Ethereum has reserves exhibit Outstanding historic developments.

Following Ethereum -Reserves over time

The analyst sketched how the reserves of Ethereum have shifted through the years, which emphasizes their potential impression on the prize.

Throughout the Bull Market 2017-2018, the reserves elevated steadily and reached a peak at the start of 2018. This wave coincided with the elevated curiosity in Ethereum and associated tasks.

With the rise of decentralized funds (Defi) in 2020 and 2021, Ethereum -reserves noticed one other vital increase whereas customers belongings in protocols and platforms on the Ethereum community Guten.

Supply: Cryptuquant

Because the market grew up, nonetheless, the top of 2021 marked the beginning of a outstanding lower in reserves. Massive -scale recordings of inventory markets kind the stage for constantly low reservations in 2023 after which.

These traditionally low reservations have vital implications for the value of Ethereum.

The fixed lower means that many market contributors choose to maneuver their Ethereum pursuits of commerce festivals, probably for long-term storage.

This habits usually signifies belief within the worth of Ethereum as a Lengthy -term belongings.

Present developments and market implications

From 2024, Ethereum -Reserves will stay on spot festivals close to historic lows. This restricted supply at festivals can contribute to upward worth stress, as a result of fewer cash are instantly accessible for commerce.

Over time, such circumstances can result in stronger worth actions if demand will increase.

Though the present worth of Ethereum stays below crucial resistance ranges, the present low reserve setting might be the scene for a brand new bullish pattern.

For now it’s price monitoring different statistics within the chain to achieve perception into the potential short-term trajectory of Ethereum.

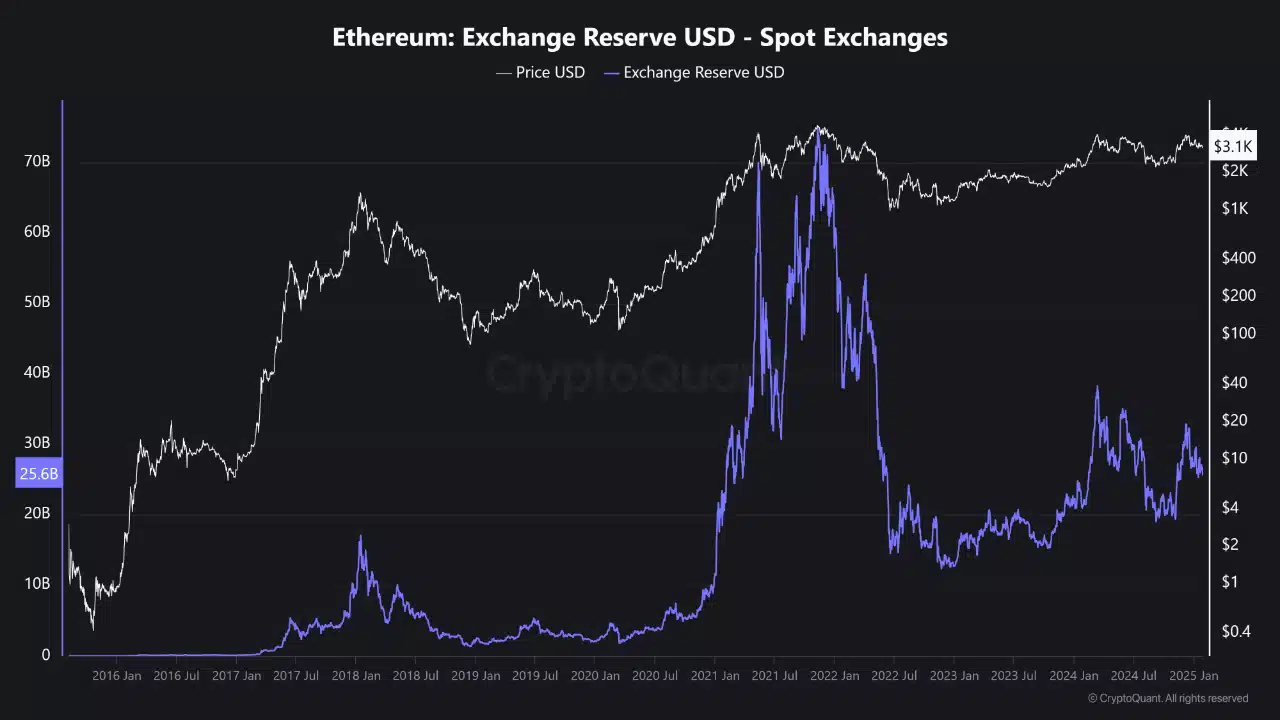

For instance, facts Van Cryptoquant indicated a latest improve in a sure metric from 0.58 to January 15 to 0.63 on January 18, adopted by a slight lower to 0.61 on January 27.

Supply: Cryptuquant

Learn Ethereum’s [ETH] Worth forecast 2025–2026

This fluctuation suggests a interval of consolidation, by which market contributors alter their positions in response to altering circumstances.

If the metric continues to carry on to sure thresholds, this could point out a rising confidence amongst traders and probably launch the highway for upward worth actions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September