Bitcoin

Ethereum takes the ‘lead’ against Bitcoin – All you need to know!

Credit : ambcrypto.com

- Crypto speculators stay cautious of issues about profit-taking and worth corrections

- There have been no consecutive ETH/BTC inexperienced weekly candles since April 2024

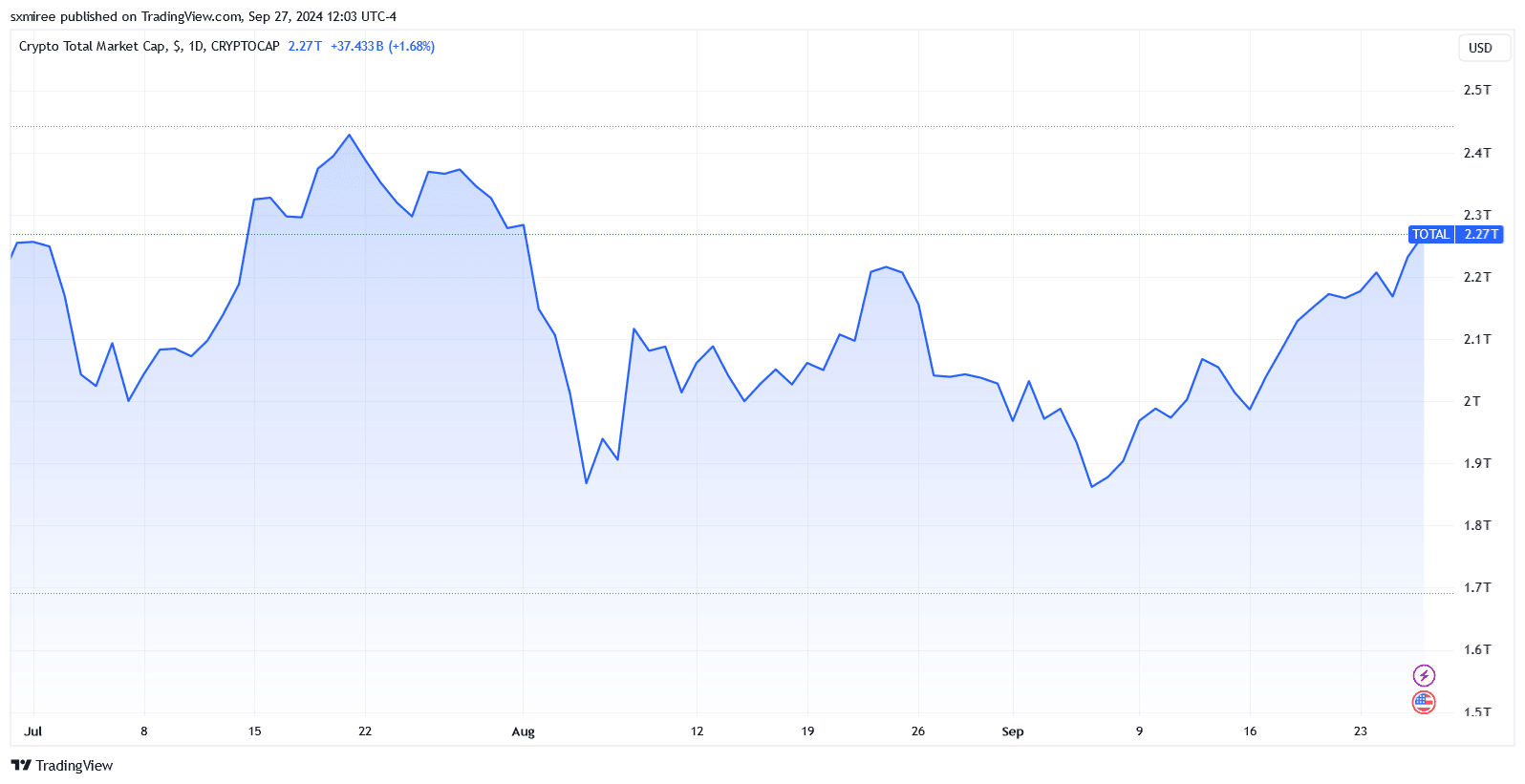

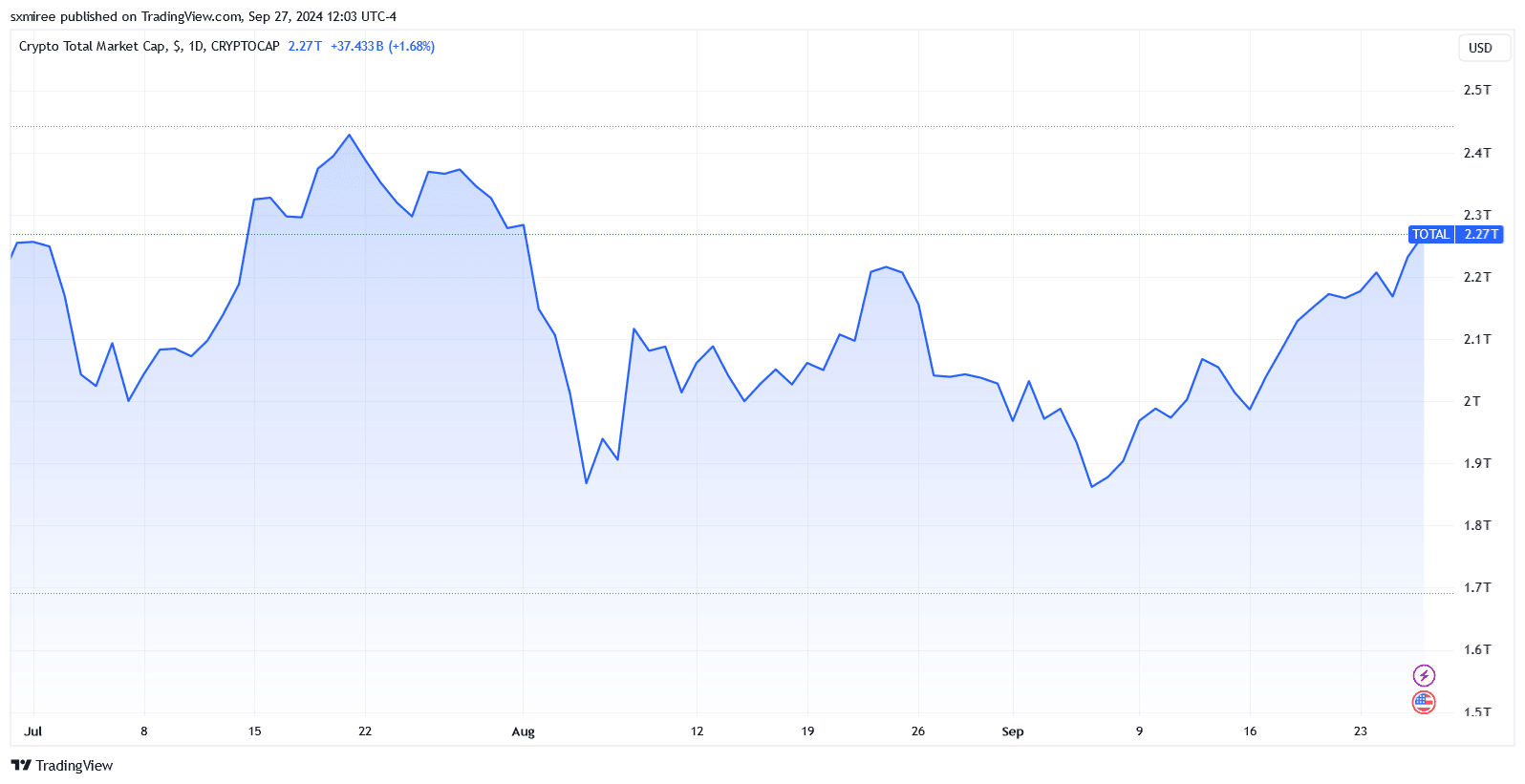

Most cryptocurrencies traded within the inexperienced on Friday, after making respectable progress between Wednesday and Thursday. Actually, the market-wide positive factors reversed an early midweek dip that adopted a gradual begin to the week.

Supply: TradingView

Ethereum (ETH), which has renewed its power in current weeks, was buying and selling at $2,689 on the time of writing, with bulls concentrating on a detailed above $2,770 for the primary time since August 24.

Right here it’s value declaring that ETH overtook Bitcoin within the second half of the month, posting a achieve of 16.34% since September 15.

Supply: TradingView

Nonetheless, that is not all. Mint glass facts revealed that the worth of ETH rose 11.26% final week, whereas BTC registered a 7.38% improve. Though each cryptocurrencies have slowed this week, they continue to be on monitor for third consecutive weekly positive factors.

Bitcoin bulls are aiming for double-digit month-to-month positive factors

Nonetheless, if we have a look at Ethereum’s not too long ago rejuvenated operation, it’s down 20.75% up to now three months. This decline is particularly pronounced given expectations of a rally following the July 23 launch of a US Ethereum Alternate Traded Fund (ETF). The institution-focused providing has did not dwell as much as the hype and has seen combined outcomes thus far.

With three days to go, Bitcoin leads the flagship altcoin in month-to-month returns. BTC’s worth trajectory has put the corporate on monitor to document double-digit month-to-month positive factors if it maintains a worth above $65,000. Quite the opposite, Ether is positioned for a 5.70% achieve in September at press time worth.

BTC and ETH worth targets earlier than the fourth quarter

Heading into the weekend, speculators have their eyes on the month-to-month closes for the respective cryptocurrencies. On the time of writing, Bitcoin was buying and selling in no man’s land round $66,000, whereas help was round $62,800. In the meantime, Ethereum held regular above $2,600.

Analysts have set a near-term worth goal within the vary of $68,000 to $70,000 for BTC and within the vary of $2,760 to $2,820 for ETH. Nonetheless, a potential withdrawal, particularly as momentum diminishes, warning needs to be exercised in lengthy positions. Momentum depletion would pave the way in which for bears to grab the weekend and drag costs down, as was the case in July.

Supply: TradingView

Bitcoin retracement draw back targets embrace a return beneath $62,000, with the potential for a downturn as excessive as $57,400. Ether, in flip, was rejected at $2,770 on August 24, earlier than retreating to $2,430 three days later.

The upside potential of ETH worth was additionally pressured by elevated ether issuance, which might weigh on spot motion. Actually, information from Ultrasound Cash confirmed {that a} complete of 54,098.4 ETH was added to the provision over the previous 30 days, translating into an annualized inflation price of 0.547%.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024