Ethereum

Ethereum: THIS group reduces its positions: What it means for ETH

Credit : ambcrypto.com

- Ethereum liquidity suppliers have diminished their lengthy positions.

- ETH traders remained optimistic in 2025 regardless of excessive hypothesis.

For nearly two weeks Ethereum [ETH] has skilled main fluctuations. Throughout this era, ETH costs fell from $4109 to $3219. This worth volatility has brought on altcoin buying and selling to go sideways.

These market circumstances have analysts speaking about Ethereum’s efficiency in 2025. To this extent, Cryptoquant analyst Solar Moon has urged a strong efficiency for ETH within the first quarter of 2025, citing market stability.

Ethereum’s liquidity suppliers are lowering lengthy positions

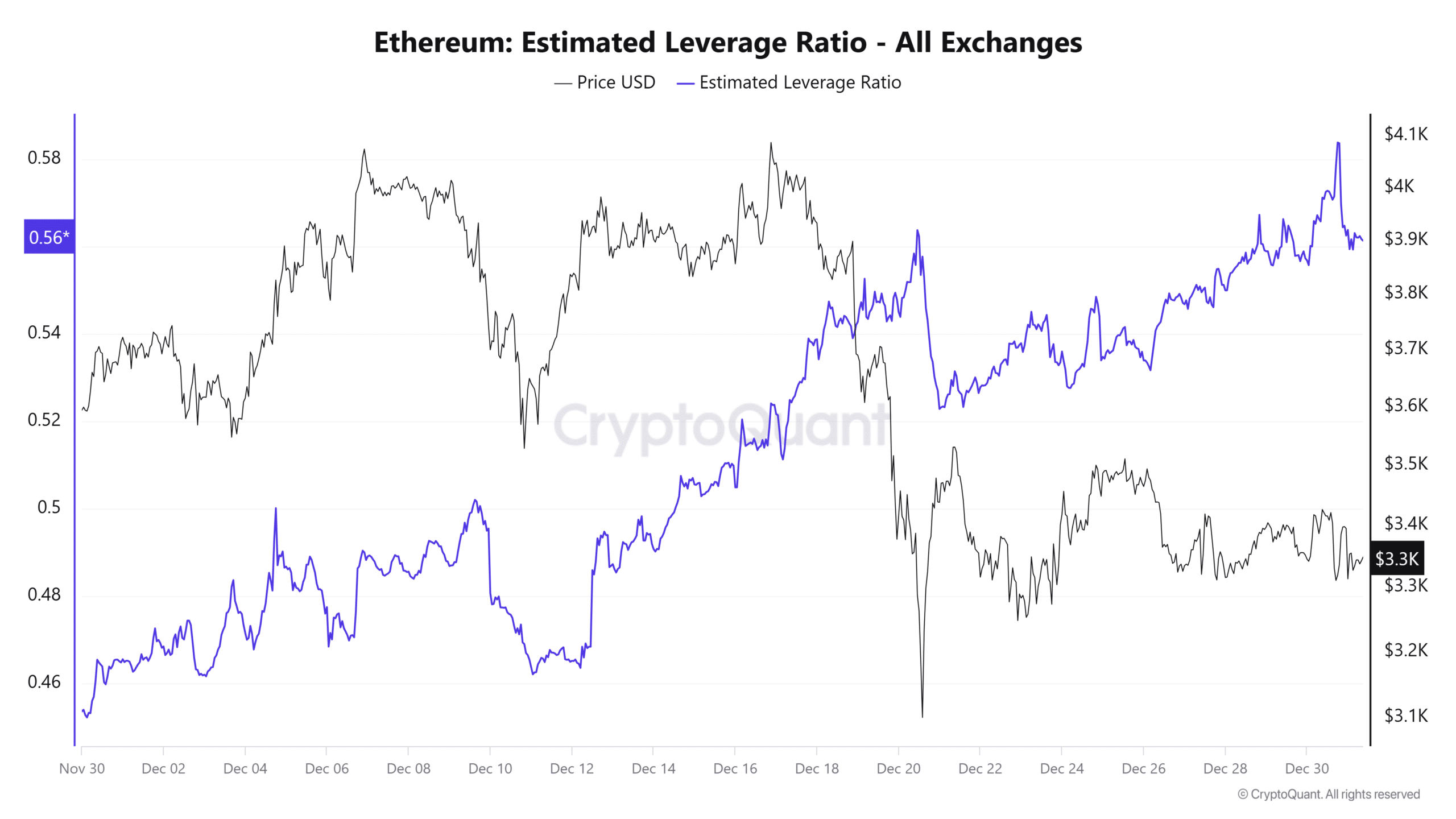

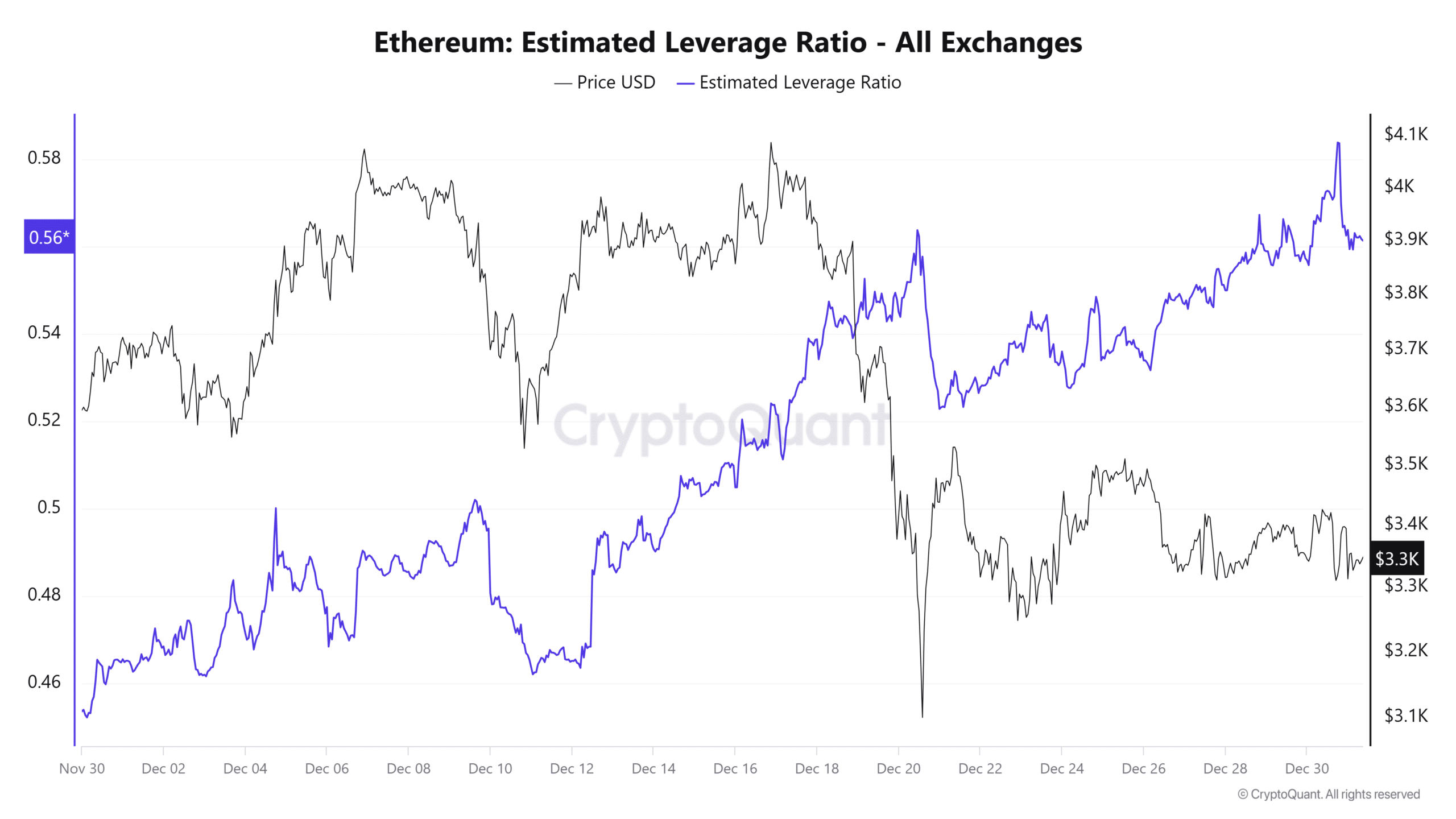

In accordance with CryptoQuantEthereum liquidity suppliers have diminished lengthy positions. When entities and merchants offering capital in ETH scale back their lengthy positions, it indicators a shift in sentiment.

If liquidity suppliers scale back publicity, it might be troublesome for the market to take care of bullish momentum with out new shopping for strain.

Supply: CryptoQuant

The analyst additional famous that regardless of the shift in sentiment, Ethereum lengthy liquidations have declined. This absence of widespread liquidations implies that the market is changing into extra steady.

So market corrections are much less prone to result in consecutive sell-offs.

Due to this fact, from 2025 onwards, ETH will observe the identical sample as final yr. In December 2023, ETH costs rose from $2045 to $2448 earlier than correcting to $2259 on the finish of the yr.

Beginning in January 2024, costs rose from $2281 to $2717, adopted by a two-week consolidation earlier than a pointy rise to $4090.

Due to this fact, if costs observe the identical sample, and historical past is one thing we are able to observe, ETH costs will see a pointy improve. Because the analyst famous, Ethereum’s worth will rise considerably within the first quarter of 2025.

What it means for ETH

Regardless of Ethereum liquidity suppliers scaling again lengthy positions, ETH continues to be experiencing important demand for lengthy positions amid sturdy speculative exercise.

As such, in keeping with AMBCrypto’s evaluation, Ethereum is presently seeing a leverage-driven market.

Supply: CryptoQuant

To start with, that is evident from the truth that the estimated leverage ratio has skilled a sustained improve. Over the previous month, the ELR has elevated from 0.4 to 0.56.

This uptick displays elevated hypothesis as traders turn into extra prepared to take dangers with borrowed cash to maximise potential beneficial properties and losses.

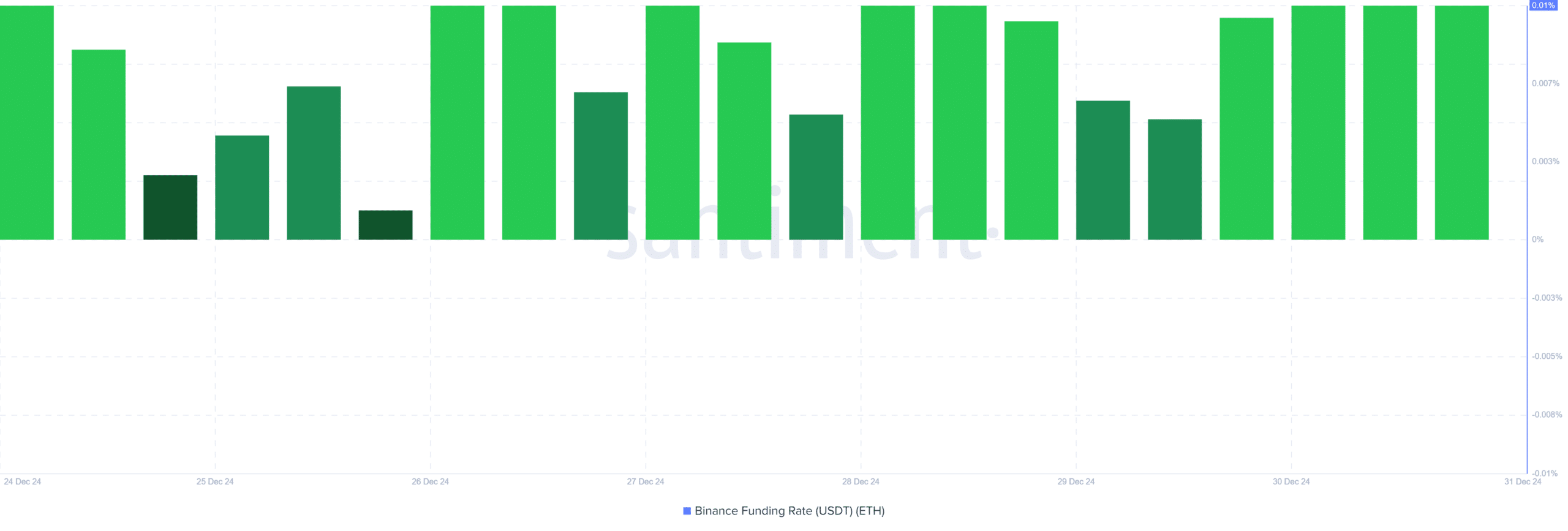

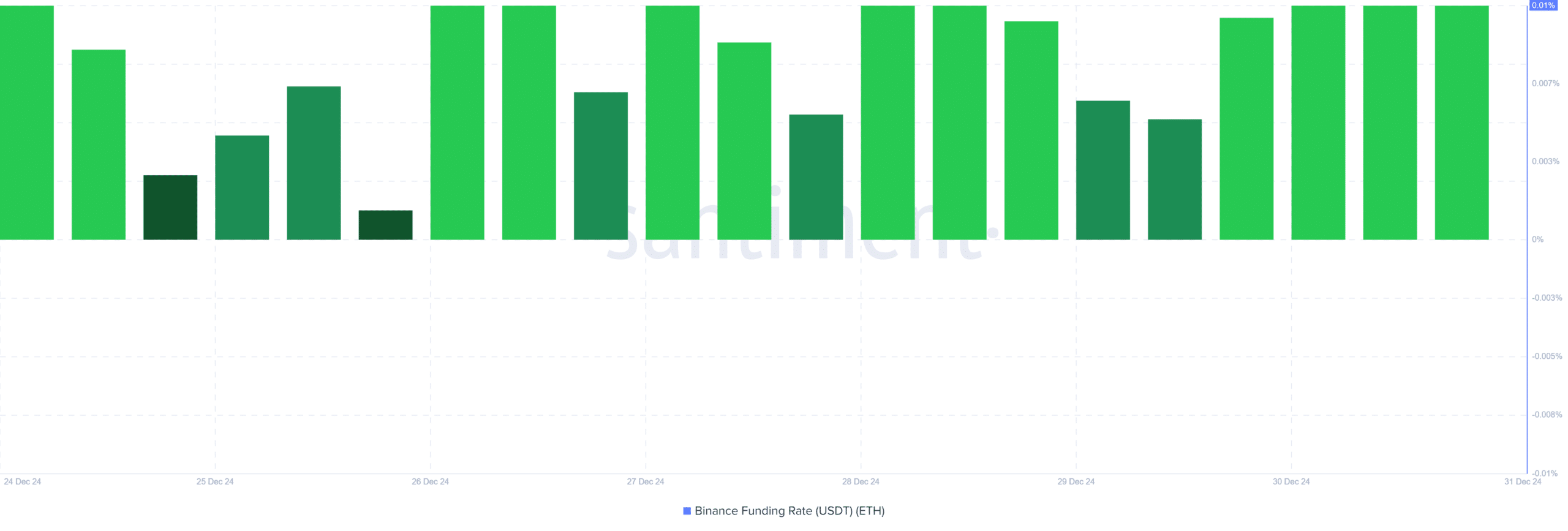

Supply: Santiment

Moreover, the Binance Funding Price has remained optimistic over the previous month.

This reveals that although liquidity suppliers are repeatedly lowering their capital inflows, merchants nonetheless count on costs to rise and demand for lengthy positions continues to be excessive.

ETH, enters 2025

Merely put, although liquidity suppliers are lowering their funds, demand for lengthy positions continues to be excessive, as famous above. Due to this fact, ETH continues to see sturdy hypothesis exercise.

Whereas speculative market exercise may cause costs to break down, it could additionally push costs up within the brief time period.

By 2025, the Ethereum market should strengthen its fundamentals and be much less depending on a speculatively pushed market, which is delicate to corrections.

Learn Ethereum’s [ETH] Value forecast 2025–2026

Since demand for longs continues to be excessive, this means that the market continues to be bullish and ETH is getting into 2025 with optimistic sentiment.

If bullish sentiment holds, ETH will get away of the USD 3500 consolidation vary and problem USD 4000, the place it confronted a number of rejections. Nonetheless, if the hypothesis bubble bursts, ETH may fall under $3000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024