Ethereum

Ethereum tracks 2016 pattern: Will Q4 bring a price decline for ETH?

Credit : ambcrypto.com

- Ethereum repeats 2016 sample.

- Geopolitical tensions are impacting the broader crypto market.

Ethereum [ETH] continues to ship combined alerts because the fourth quarter (This fall) of the 12 months begins. Traditionally, a bullish shut in September has typically led to constructive market strikes, however Ethereum seems to be on a special trajectory.

ETH closed in inexperienced in September, intently following the 2016 sample, which may point out a probably purple fourth quarter. If this sample continues, there may very well be a decline within the fourth quarter, adopted by a restoration within the first quarter (Q1) of 2025.

Ethereum’s value dynamics are intriguing, with its historic efficiency value monitoring to see if it deviates from earlier developments.

Supply:

Whales taking earnings and taking again their stakes

Ethereum’s present value habits mirrors the 2016 sample, indicating a potential bearish flip within the fourth quarter. This expectation is strengthened by massive traders, or “whales,” withdrawing their ETH and securing earnings.

Lately, a whale undid 29,480 ETH and transferred it to Coinbase for a revenue of over $2 million.

Supply: Onchainlens

The sort of habits typically alerts that main gamers expect a downturn, rising the chance of a purple fourth quarter for Ethereum. These actions enhance stress on ETH’s value, with traders paying shut consideration to potential declines.

ETH ETF circulate and market actions

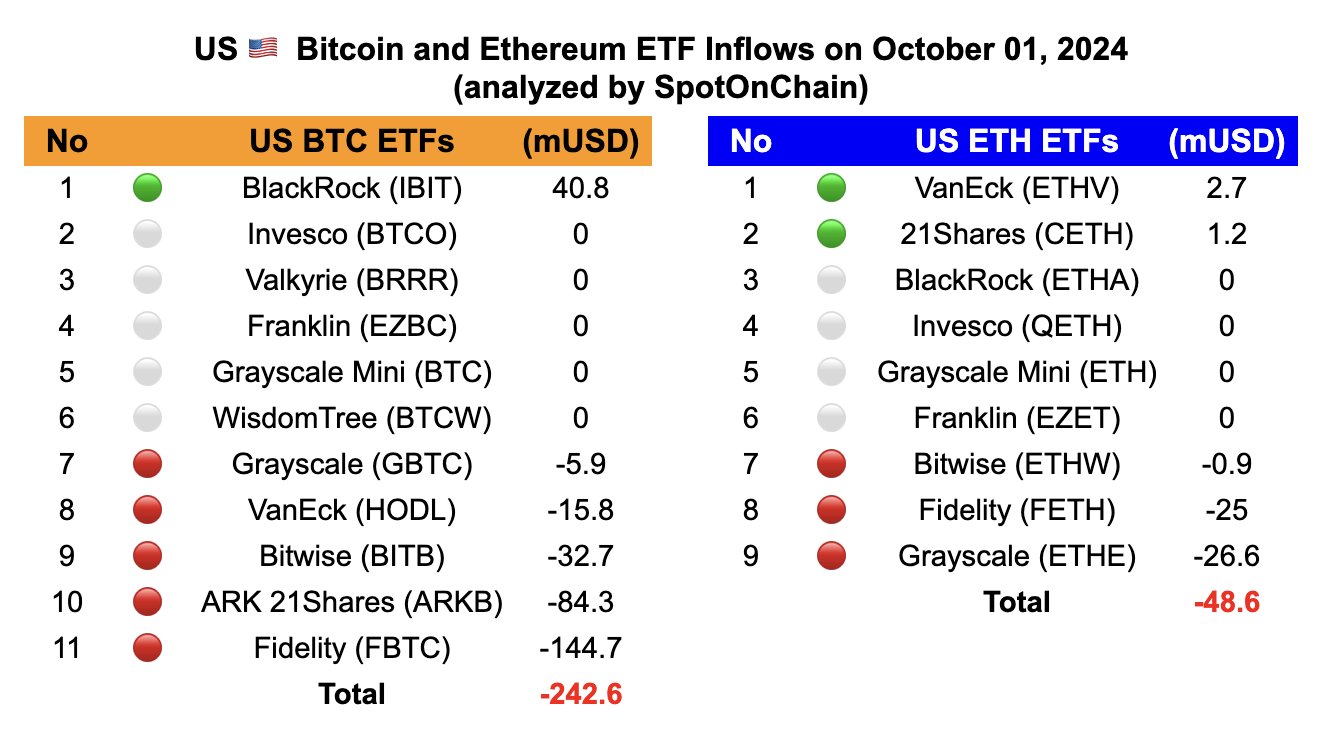

Ethereum has additionally skilled important outflows from its exchange-traded funds (ETFs), additional contributing to the cautious outlook. Since September 3, the market has seen the most important web outflows for each Bitcoin (BTC) and Ethereum ETFs.

ETH ETFs noticed outflows of $48.6 million, with main gamers like Grayscale and Constancy witnessing massive withdrawals. Whereas some smaller ETFs noticed inflows, these weren’t sufficient to offset the broader pattern.

Supply: SpotOnChain

This means that institutional traders could also be positioning themselves for a potential drop in Ethereum’s value within the fourth quarter, in step with broader market sentiment.

Geopolitical tensions have an effect on costs

The continued battle within the Center East has additionally impacted the broader crypto market, together with Ethereum. Each BTC and ETH noticed sharp declines, with ETH falling under $2,500.

Within the final 24 hours alone, 155,000 accounts had been liquidated, totaling $533 million, of which $451 million got here from long-standing orders.

These liquidations, particularly in ETH, add additional proof to the chance that Ethereum will comply with 2016’s sample of a purple fourth quarter.

Supply: Coinglass

The mix of whale habits, ETF outflows and geopolitical tensions means that Ethereum may face challenges within the fourth quarter.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Though the value of ETH has confirmed sturdy, historic patterns and present market circumstances point out that the value might fall earlier than probably recovering in early 2025.

Buyers ought to stay cautious and intently monitor these developments, as any deviation from the sample may carry each dangers and alternatives for ETH within the coming months.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024