Ethereum

Ethereum – Traders keep ETH’s price action in check as accumulation continues

Credit : ambcrypto.com

- One analyst highlighted ETH’s stance, suggesting a breakout may very well be imminent if demand rises

- Additional evaluation hinted that the buildup section might take longer to resolve itself

Ethereums [ETH] progress has moderated after a sturdy rally in latest months, throughout which belongings rose 46.65%. Nevertheless, over the previous 24 hours, ETH has fallen 0.13% – an indication of a short lived slowdown.

Based on AMBCrypto, this slowdown could also be in step with the continued accumulation section: a promising signal for long-term progress. Nonetheless, uncertainty stays about how lengthy the market will stay on this sample.

Is ETH on the verge of a breakout? Analysts weigh in

Based on crypto analyst Crypto Jelle, ETH seemed to be buying and selling inside a bullish pattern generally known as a symmetrical triangle (an accumulation section) on the time of printing, the identical being indicated by white strains on the map.

Supply:

Traditionally, this sample suggests {that a} rally may ensue, with the buildup section consisting of consumers buying ETH at a reduction earlier than a surge in demand drives the value increased. If this transfer materializes, ETH may probably rise to $8,500 primarily based on the chart’s projections.

Nevertheless, AMBCrypto’s evaluation discovered that whereas the buildup section bodes properly for ETH’s long-term prospects, it’s unlikely to result in a rally but.

Market members are nonetheless bidding at cheaper price ranges, indicating {that a} breakout might take longer to develop.

The ETH market is actively bid in the course of the accumulation section

On the time of writing, the ETH market was seeing energetic bidding – indicators of an ongoing accumulation section. This has precipitated ETH to keep up its oscillatory movement: bouncing between the converging help and resistance ranges of the symmetrical triangle.

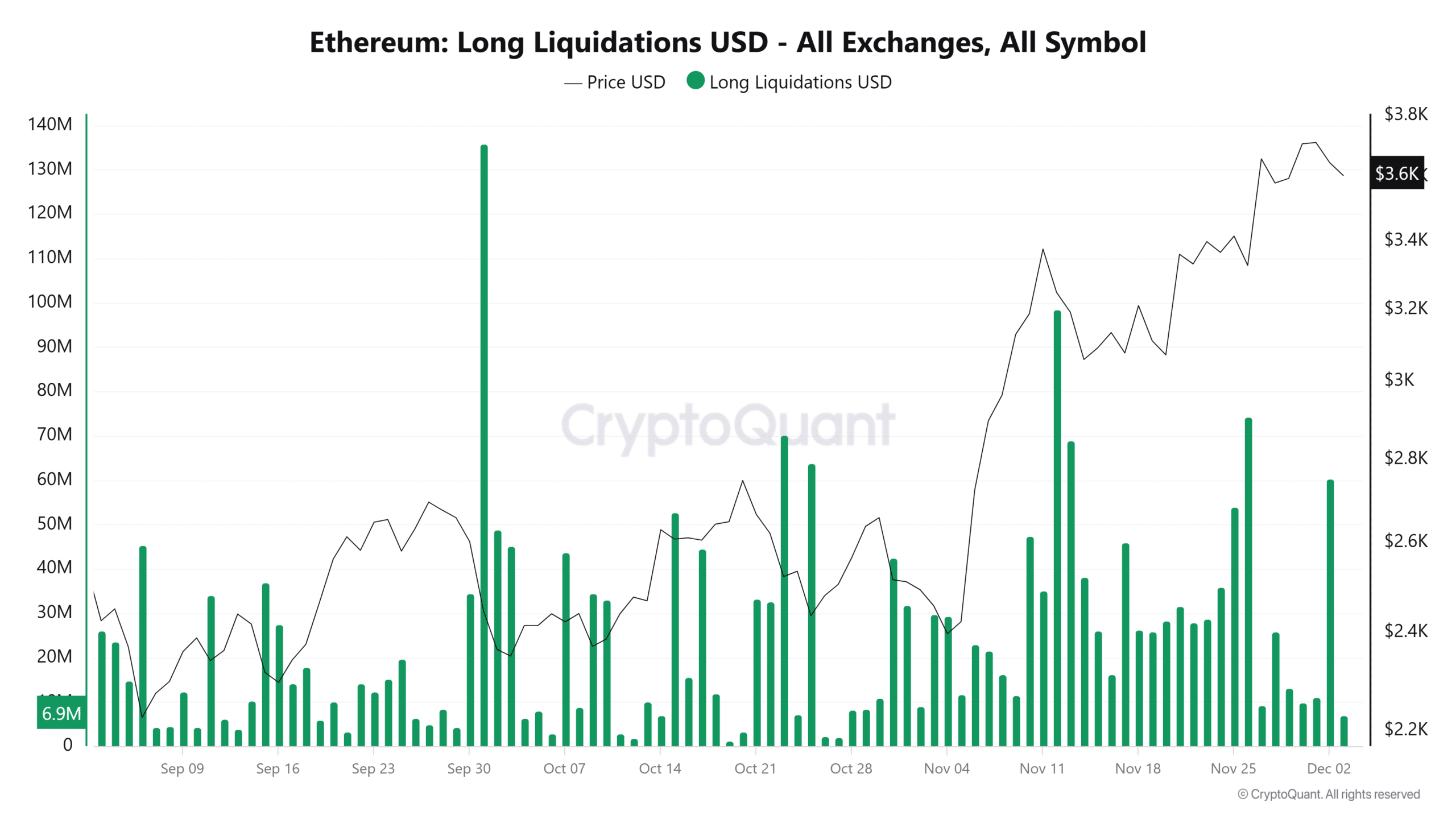

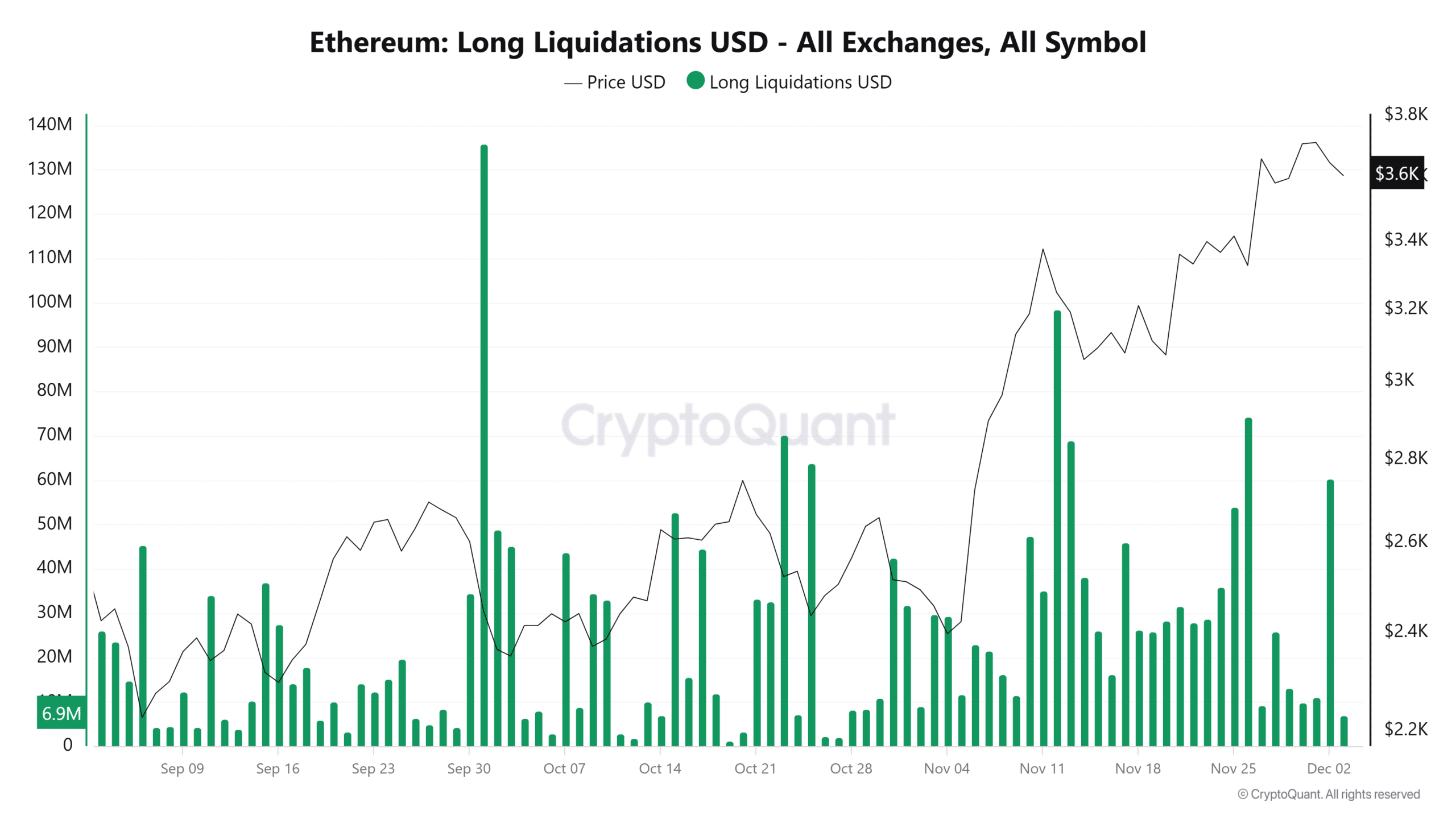

This pattern is mirrored within the spike within the variety of lengthy liquidations, which have greater than doubled in comparison with quick liquidations. With $31 million in long-term liquidations, the market appeared primed for a downturn.

Supply: Cryptoquant

AMBCrypto additionally discovered that this transfer was fueled by an increase within the variety of energetic addresses, with the identical improve to over 406,000 as many holders offered ETH to safe income. This marked a notable improve from the 365,000 energetic addresses recorded only a day earlier.

If the variety of long-term liquidations continues to rise and energetic addresses stay excessive, ETH will seemingly pattern downward within the ongoing accumulation section.

Revenue-taking exercise limits ETH’s rally

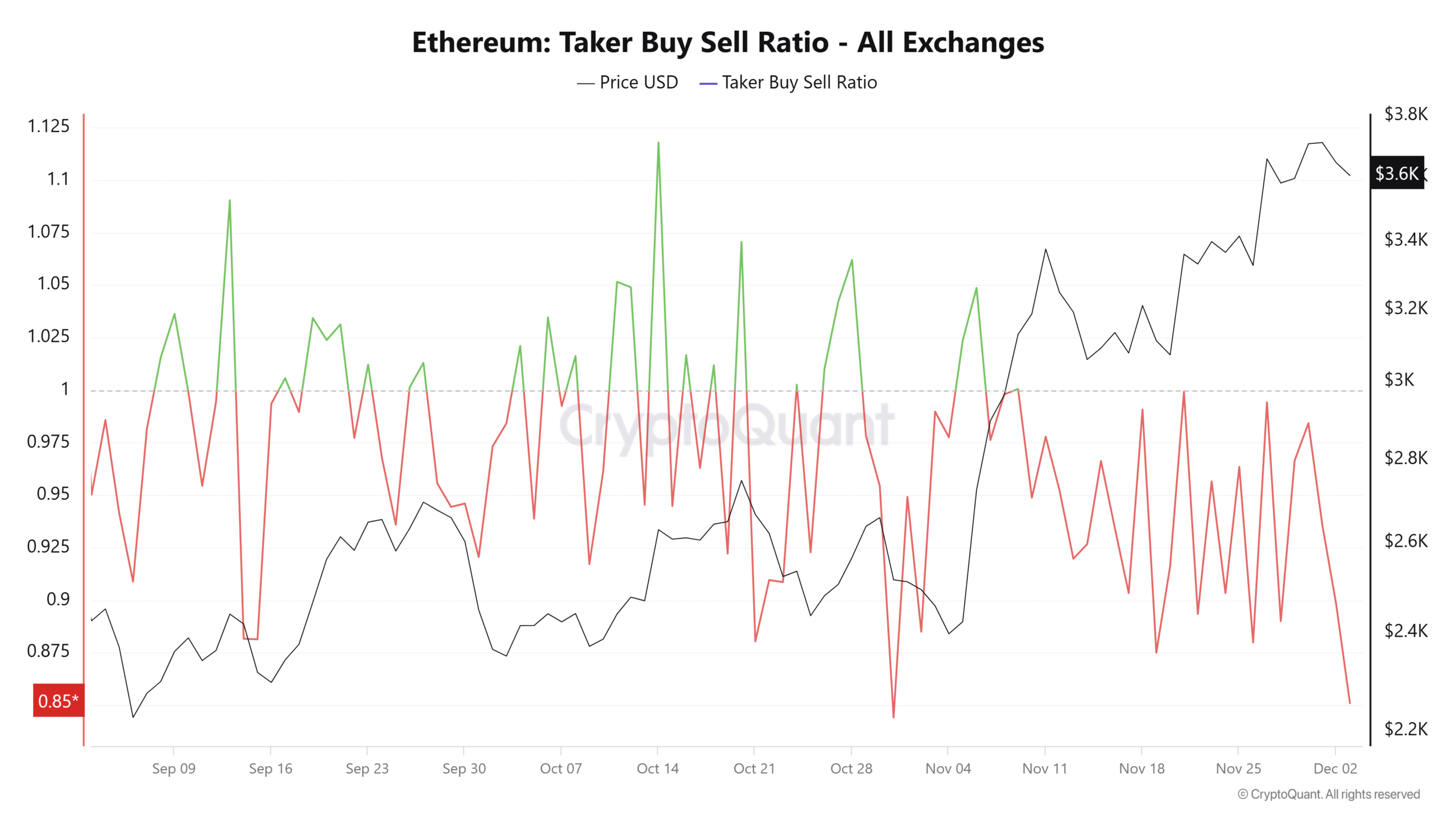

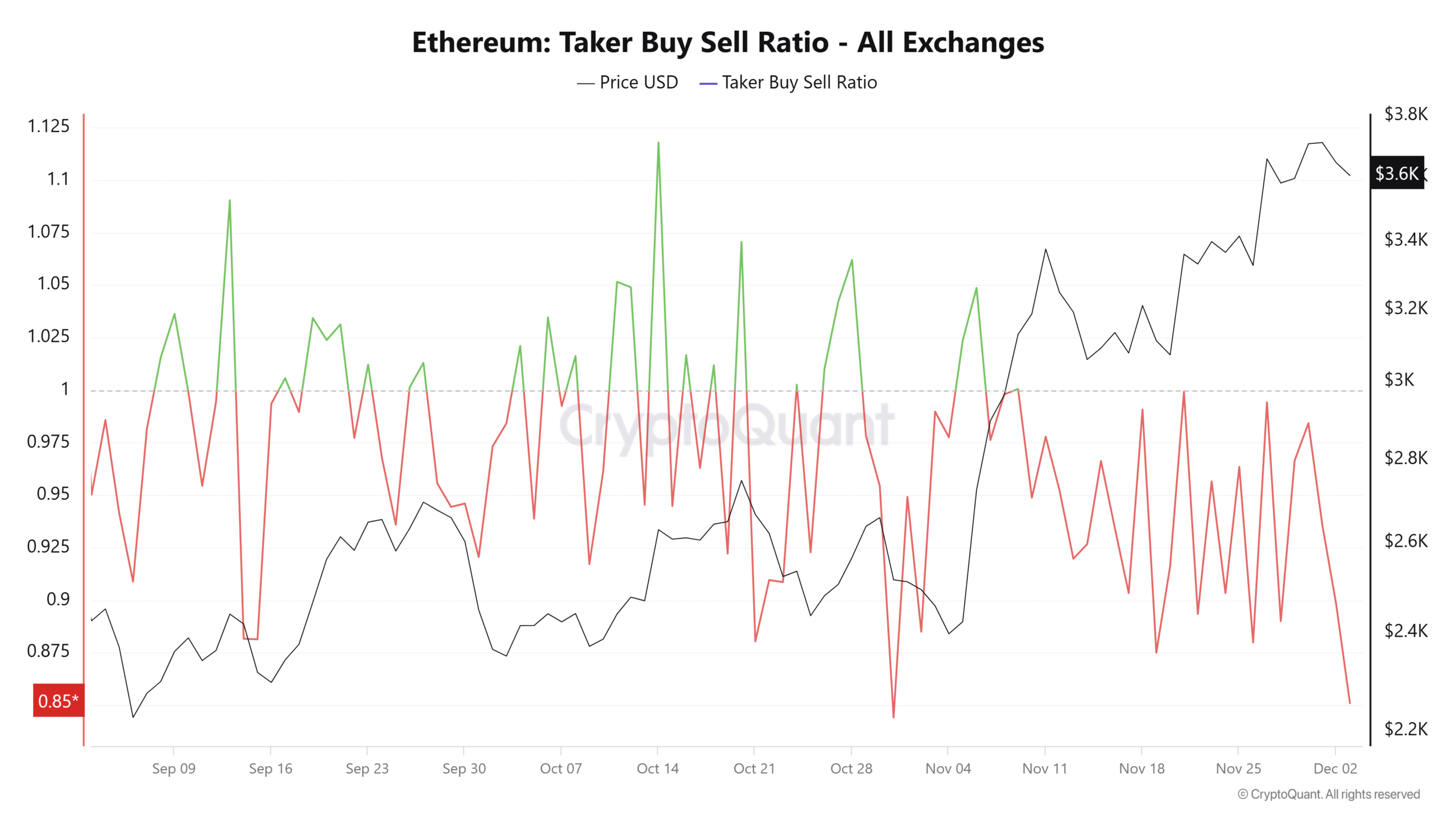

ETH’s rally has been restricted by continued profit-taking, as evidenced by the Taker Purchase Promote Ratio tracked by CryptoQuant.

On the time of writing, the ratio stood at 0.85, indicating that gross sales quantity exceeded buy quantity. This imbalance has pushed down the value of ETH, contributing to the asset’s downward trajectory.

Supply: Cryptoquant

If this pattern continues, ETH will seemingly stay confined to its buying and selling channel, delaying any important upward motion.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024