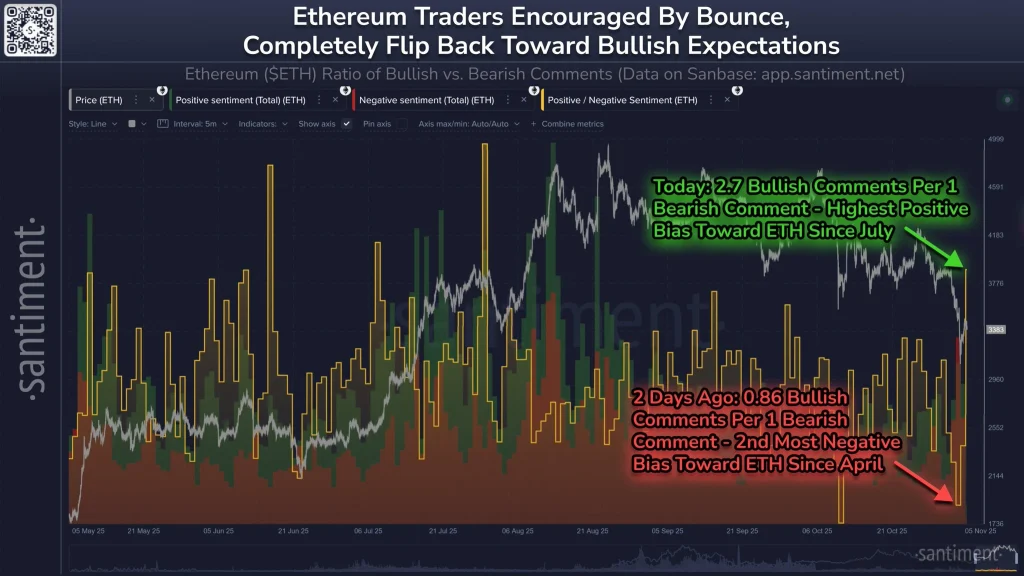

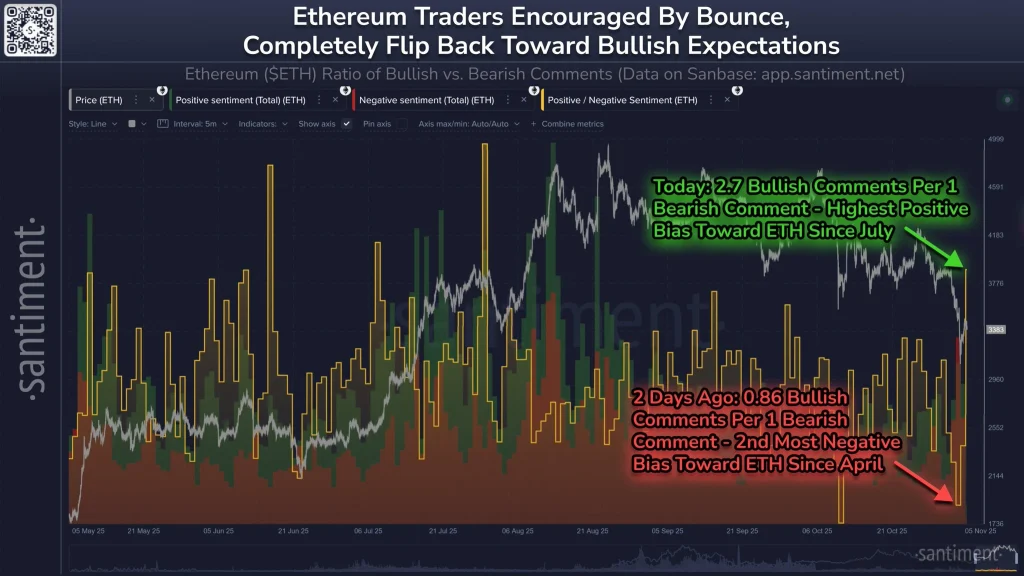

Ethereum (ETH) merchants have rapidly entered excessive bullishness following the current crypto market crash. In keeping with market information evaluation from Santiment, Ethereum merchants anticipate a robust restoration within the coming days after a collection of deleveraging.

Supply: Santiment

Nonetheless, Santiment warned Ethereum merchants that they have been changing into extraordinarily bullish as historical past has confirmed that the market usually strikes in the wrong way of the general public’s expectations.

Why Are Ethereum Merchants Turning Extraordinarily Bullish?

Renewed demand from whale buyers in a supportive macro atmosphere

Ethereum merchants have turned extraordinarily bullish within the current previous attributable to notable deleveraging and renewed demand from whale buyers. For instance on the chain data analysis shows Tom Lee-led BitMine has purchased into the current market dip, withdrawing ETH value about $70 million on Thursday.

Ethereum merchants had anticipated a bullish restoration as Wall Avenue progressively turns to altcoins. Forward of the Fed’s anticipated quantitative easing (QE), institutional buyers have constructed on Ethereum by way of Digital Belongings Treasuries (DATs), spot Change-Traded Funds (ETF), and tokenization of real-world property (RWA).

Technical tailwind forward of the anticipated 2025 altseason

From a technical evaluation viewpoint, ETH worth has retested a vital assist stage, which beforehand acted as a resistance stage for a very long time.

Supply: X

With ETH’s every day Relative Energy Index (RSI) hovering across the oversold stage, a possible restoration to a brand new all-time excessive is very probably. Nonetheless, if the Ether worth constantly falls under the assist stage above $3000, an outright bear market will likely be inevitable within the following months.