Ethereum

Ethereum traders, watch out for THIS level to avoid the next sell-off!

Credit : ambcrypto.com

- ETH made modest features on the month-to-month charts, up simply 2.89%

- Analysts consider that ETH should stay above $2300 to keep away from large sell-offs

Whereas Bitcoin [BTC] has fallen over the previous week, Ethereum [ETH] has taken a unique path. By doing this, ETH made average features on its month-to-month value charts.

On the time of writing, Ethereum was buying and selling at $2,404. This meant a rise of 1.06% on the weekly charts, with the altcoin additionally gaining on the day by day charts.

Nevertheless, regardless of these features, ETH stays considerably under its latest excessive of $2,700 and up 50.7% from its ATH of $4,878. As anticipated, these market circumstances have gotten analysts speaking. One in every of them is the favored crypto analyst Ali Martinez, in keeping with who, $2,300 stays the important thing assist stage for ETH.

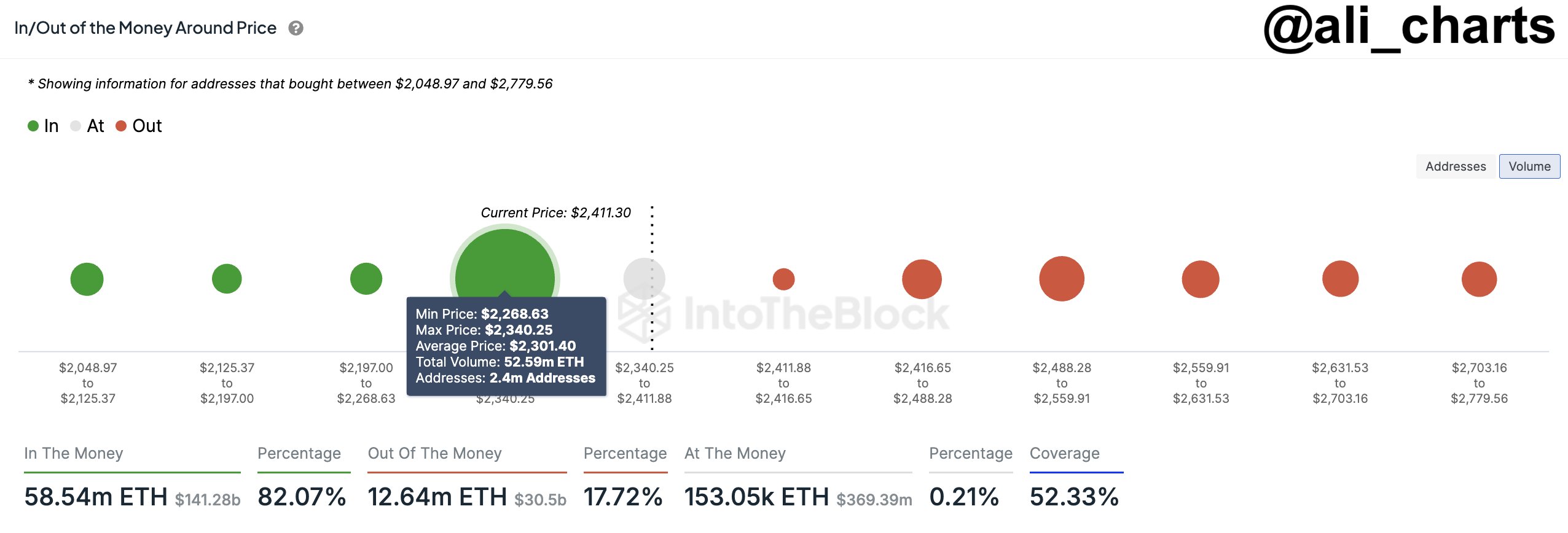

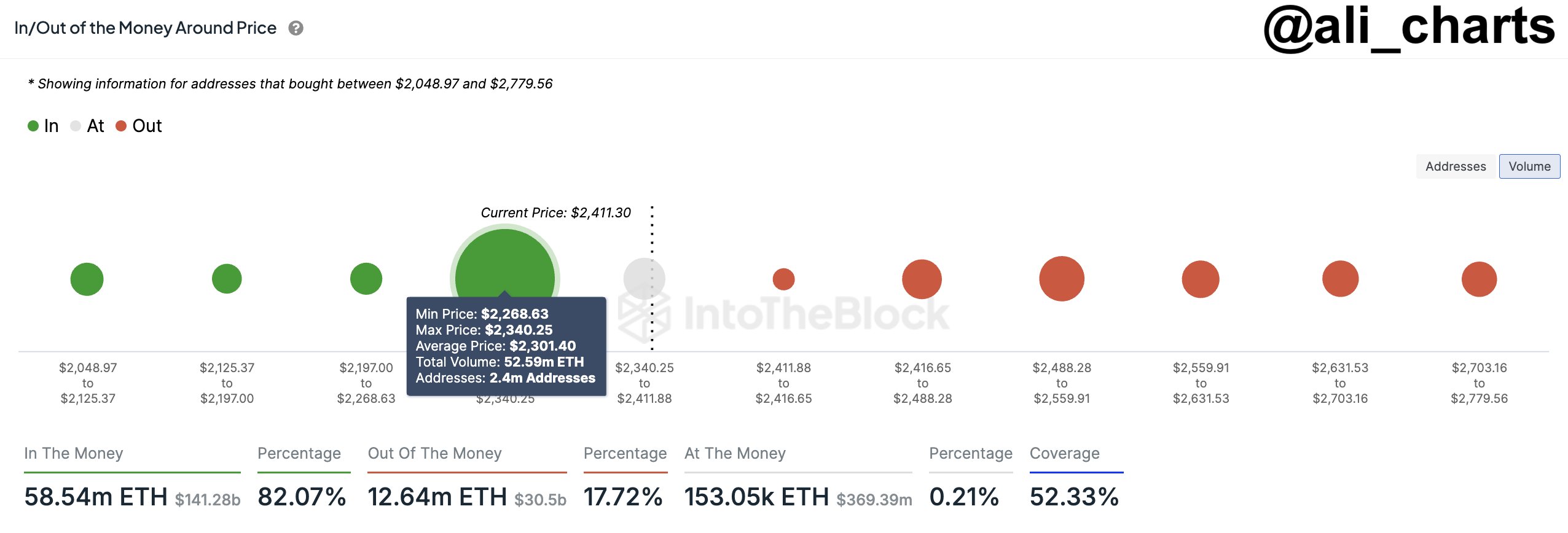

Why 2.4 million addresses are essential

In his evaluation, Martinez talked about 2.4 million addresses that bought 52.6 million ETH tokens for $2,300. In keeping with him, ETH ought to stay above this stage because it stays probably the most essential assist stage for the altcoin.

Supply:

Due to this fact, if the altcoin fails to carry this demand zone, ETH will register an enormous sell-off. A drop under this stage will immediate buyers to panic promote as they attempt to reduce losses.

In such a situation, Ethereum will expertise promoting stress, pushing costs additional up the charts.

What does the chart of ETH say?

Whereas Martinez’s aforementioned remark pointed to a doable market sell-off, it’s important to cross-check and decide what different market indicators recommend.

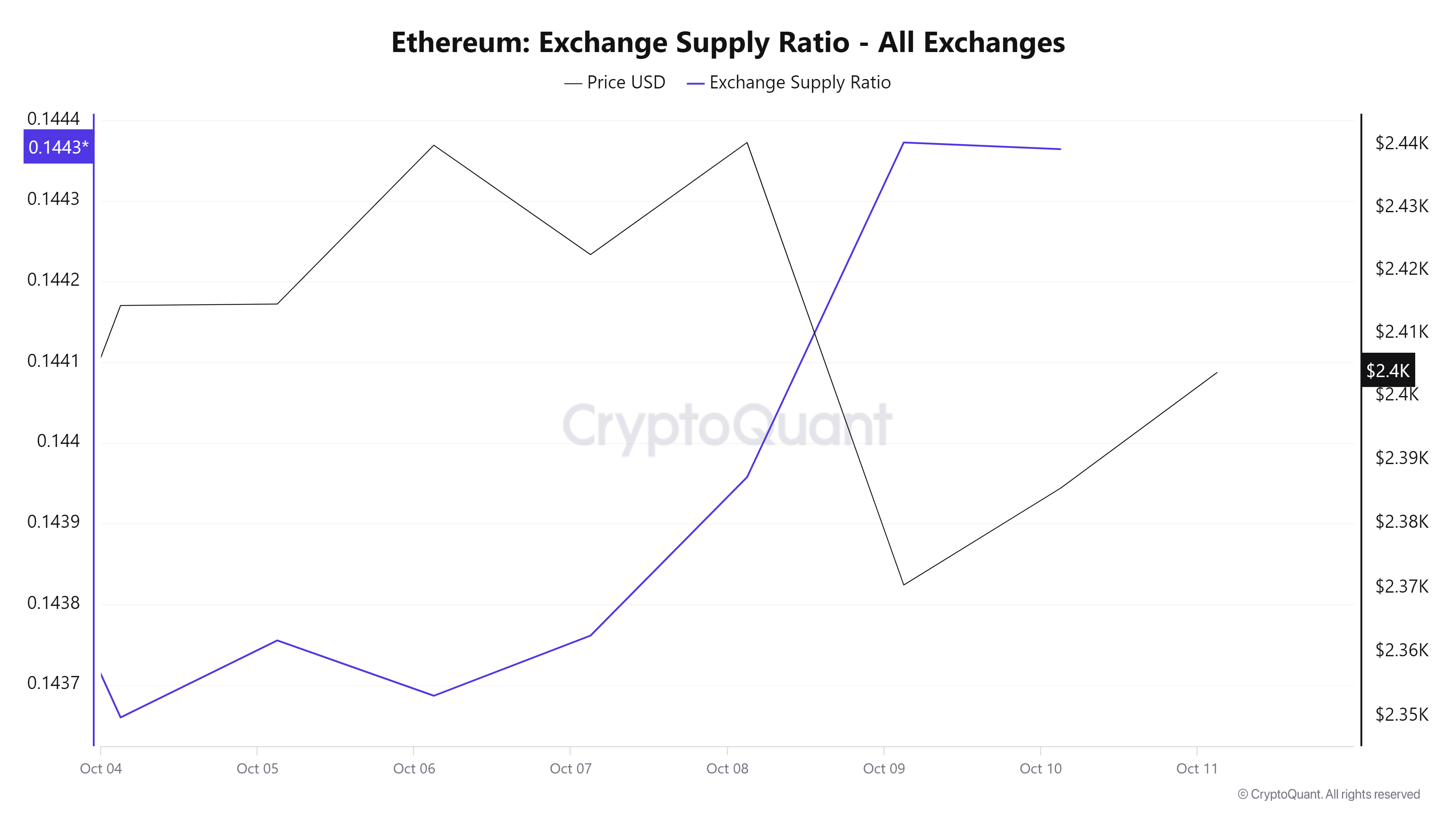

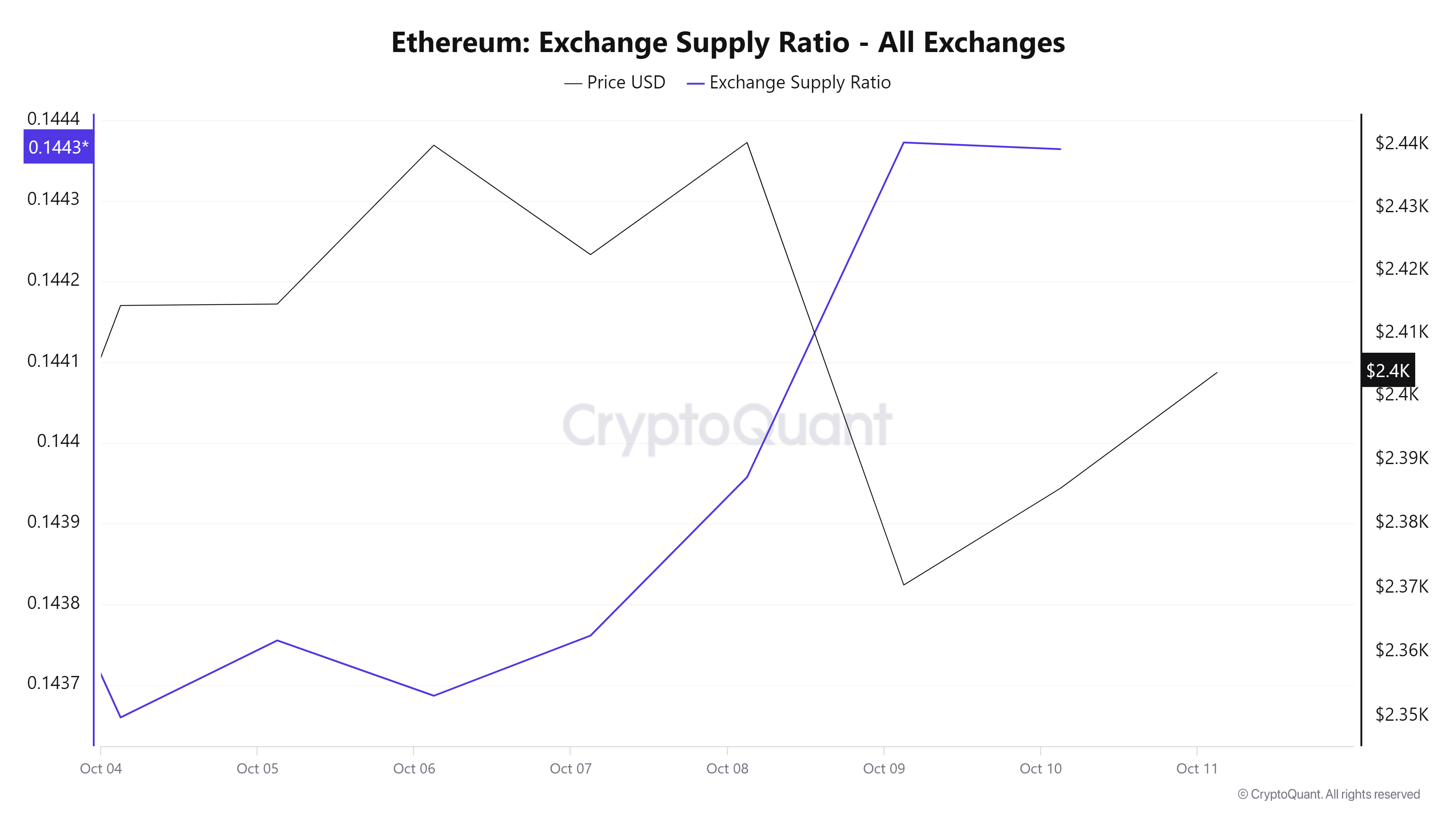

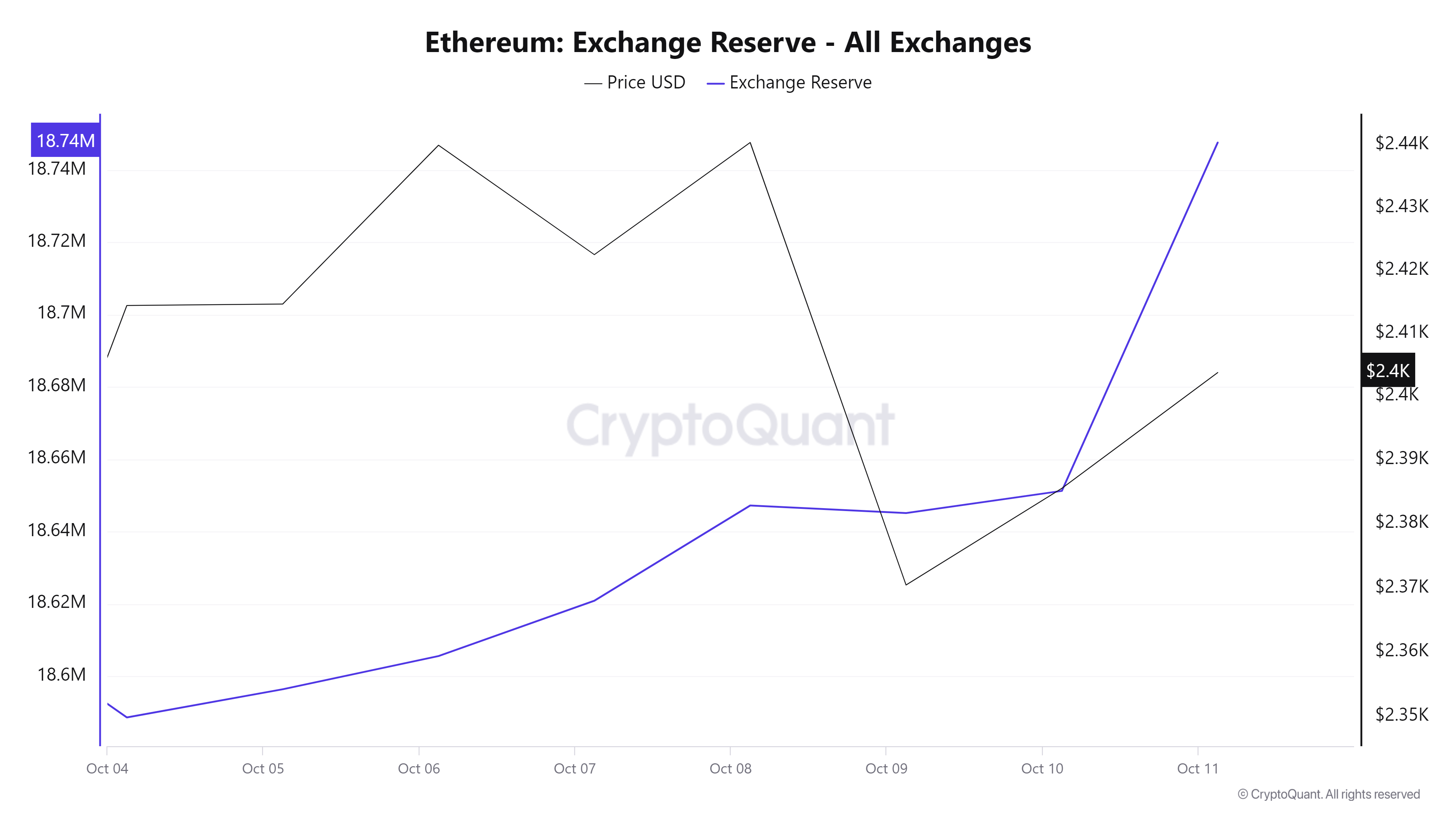

Supply: Cryptoquant

For instance, Ethereum’s Trade Provide ratio rose from 0.143 to 0.1443 final week. The rise within the provide ratio within the international alternate market recommended that holders could also be making ready to promote or take income.

That is often a bearish sign as buyers transfer their ETH from non-public wallets to exchanges.

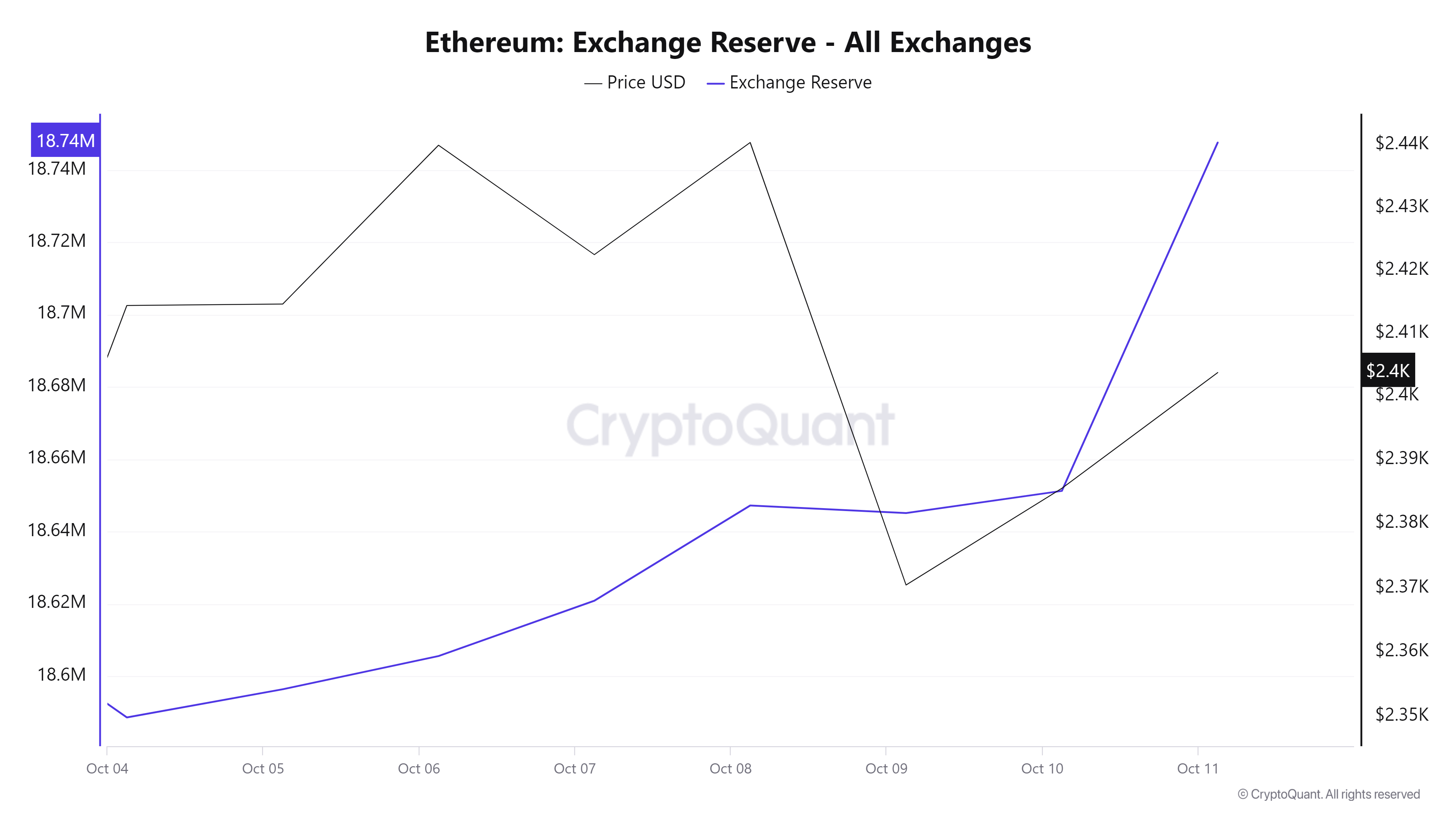

Supply: Cryptoquant

Moreover, Ethereum’s Trade Reserve has been rising all week, with the identical figures at $18.7 million on the time of writing. As beforehand noticed with a spike within the alternate provide ratio, this additional supported our remark that buyers are transferring their ETH to exchanges.

This sort of market habits may probably result in promoting stress, inflicting costs to fall.

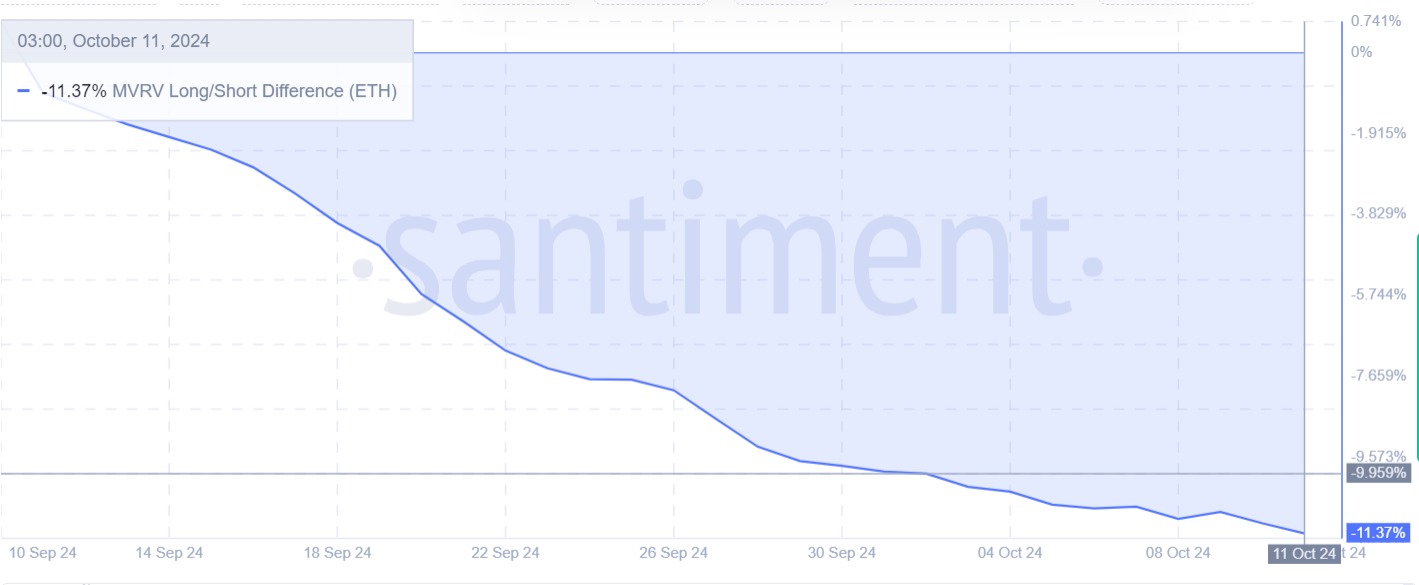

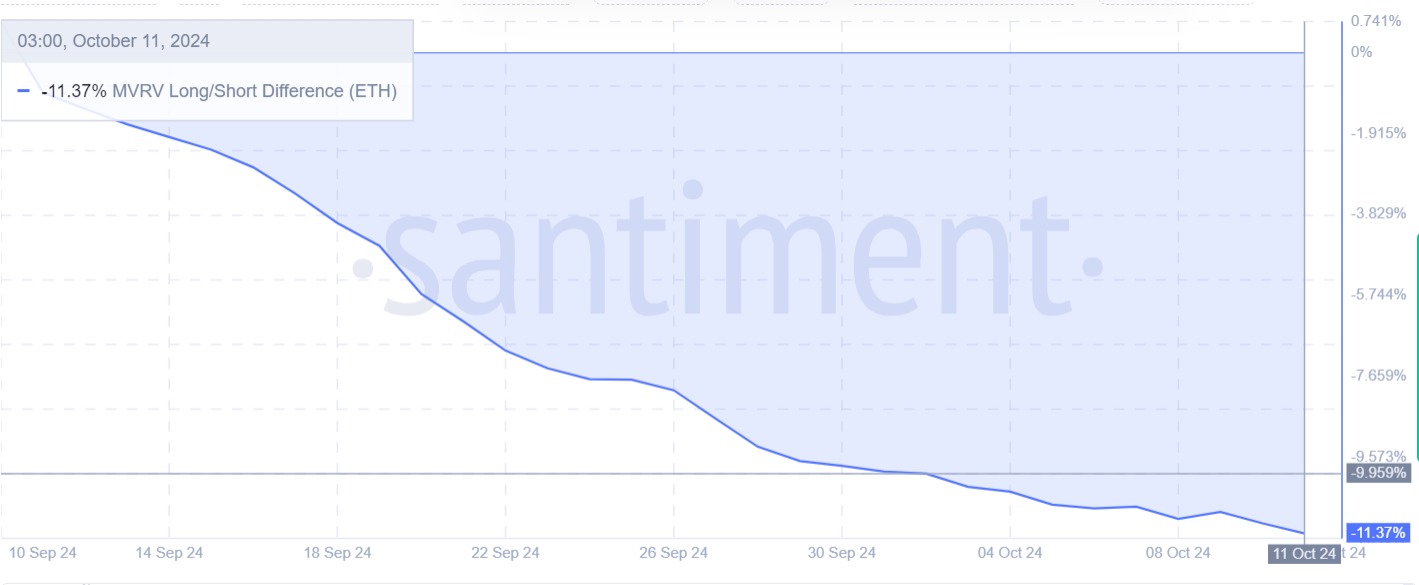

Supply: Santiment

Lastly, the lengthy/brief MVRV distinction in Ethereum has remained detrimental over the previous month. When long-term holders endure losses whereas short-term holders are worthwhile, this often results in capitulation of long-term holders. This ends in larger promoting stress as they attempt to reduce their losses.

As such, capitulation by long-term buyers ends in a brief backside after they shut their positions, creating the chance that costs will fall within the brief time period.

Merely put, in keeping with AMBCrypto’s evaluation, ETH is buying and selling inside a multi-month bearish channel. Mixed with detrimental market sentiment, Ethereum may fall earlier than this development breaks. If it sees a pullback, ETH will discover web assist at $2,325.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024