Ethereum

Ethereum transactions surge to $60B in a week, highest since July

Credit : ambcrypto.com

- Ethereum’s weekly transaction quantity reaches $60 billion as exercise inside the community will increase.

- 78% of Ethereum holders proceed to make earnings amid rising utilization and bullish on-chain indicators.

Ethereums [ETH] mainnet noticed a pointy enhance in exercise, with almost $60 billion price of ETH settled over the previous week. This marks the best weekly transaction quantity since July, indicating rising demand for the community.

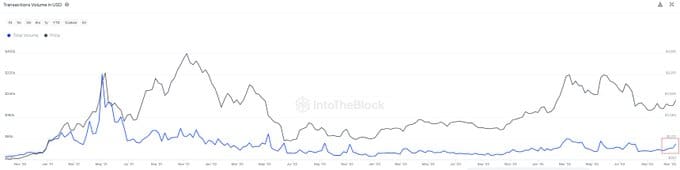

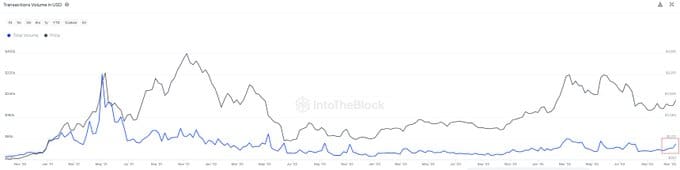

Knowledge from IntoTheBlock shows a gentle restoration in transaction quantity since mid-2022, when market exercise slowed. Regardless of Ethereum’s value being under its all-time excessive, the community continues to draw important exercise.

Value and quantity dynamics

Ethereum’s value and transaction quantity have traditionally moved in parallel. Each figures peaked in late 2021 and early 2022 as speculative exercise elevated. Nevertheless, each declined in mid-2022 because the market entered a bearish part.

Supply: IntoTheBlock

On the time of writing, Ethereum was buying and selling at $3,178.93with a 24-hour buying and selling quantity of $48.48 billion. Whereas the asset noticed a slight decline of 0.70% over the previous 24 hours, it has risen 28.92% over the previous week.

The latest enhance in transaction quantity signifies rising utilization regardless of value fluctuations.

Vital statistics within the chain

DefiLlama knowledge shows Ethereum’s Whole Worth Locked (TVL) is $59.327 billion. Stablecoins on the community have a mixed market capitalization of $89.517 billion.

Within the final 24 hours, Ethereum has processed a transaction quantity of $2.387 billion and recorded an influx of $72.74 million.

Prior to now day, there have been a complete of 391,248 lively addresses, whereas 64,793 new addresses have been created. The community additionally recorded 1.23 million transactions.

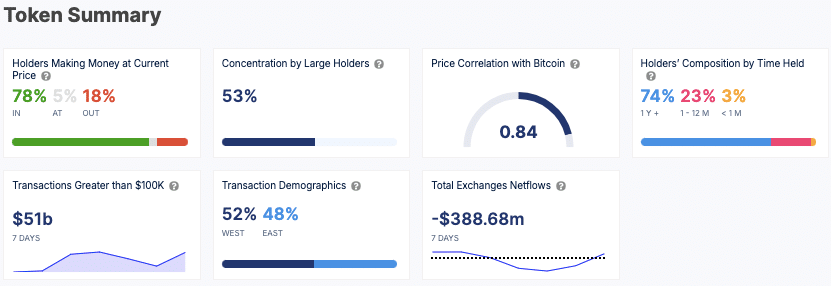

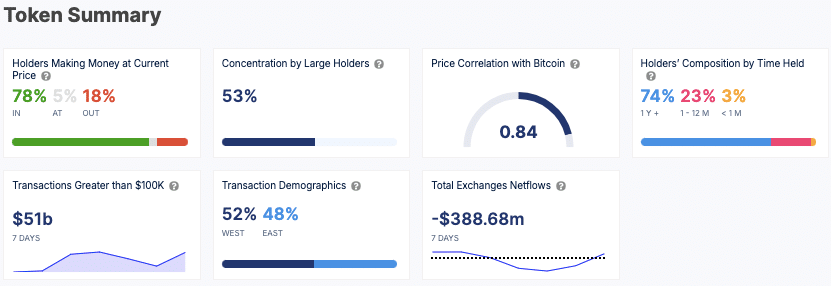

Excessive-value transactions above $100,000 accounted for $51 billion in exercise final week, indicating sturdy participation from main buyers.

Holder composition and market indicators

Ethereum’s profitability stays sturdy, with 78% of holders at present making a revenue. Giant holders management 53% of the token provide, indicating a excessive focus of wealth.

The token additionally has a powerful correlation of 0.84 with Bitcoin, displaying that its value actions intently observe the broader crypto market.

Supply: IntoTheBlock

Nearly all of Ethereum holders are long-term buyers, with 74% holding their tokens for greater than a 12 months. Web change flows point out that $388.68 million price of ETH was faraway from exchanges up to now week, indicating that promoting strain is easing as extra customers transfer property to non-public wallets.

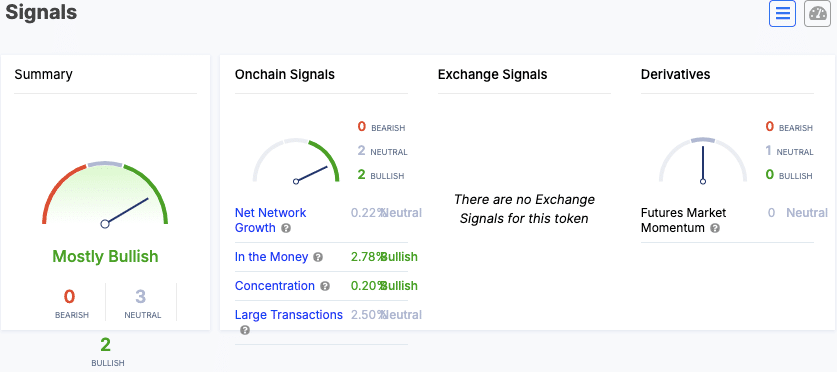

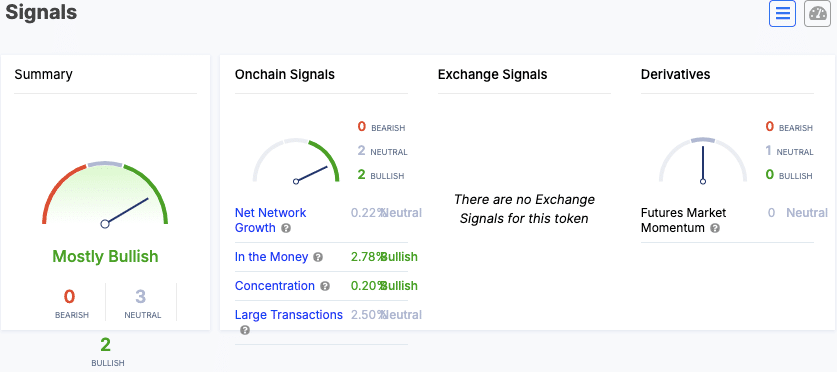

The market indicators are predominantly bullish, with indicators equivalent to ‘Within the Cash’ and ‘Focus’ displaying constructive developments.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Web community progress and enormous trades stay impartial, whereas momentum within the futures markets can also be at impartial ranges.

Supply: IntoTheBlock

Ethereum’s rising transaction exercise and favorable on-chain metrics point out an lively and engaged community.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now