Ethereum

Ethereum turns deflationary: What it means for ETH prices in 2025

Credit : ambcrypto.com

- Ethereum might grow to be deflationary once more subsequent 12 months.

- ETH/BTC has skilled some fluctuations.

The provision of ether [ETH] has been rising steadily over the previous six months by roughly 60,000 ETH per 30 days. Nevertheless, after the latest 50 foundation level fee lower, this development has slowed considerably to between 30,000 and 40,000 ETH per 30 days.

If this development continues, Ethereum’s provide may grow to be deflationary once more in early 2025, earlier than it even reaches pre-merger ranges. If additional fee cuts are anticipated, inflation may fall additional, paving the way in which for future value development.

Ethereum’s provide performs a vital function in market dynamics. For the reason that fee lower, ETH inflation has fallen, suggesting that offer may attain pre-merger ranges by 2025.

Supply:

This transition to deflation may enhance demand for ETH, particularly as financial coverage continues to evolve.

As rates of interest drop, extra customers and buyers might flip to Ethereum’s community, growing total demand and probably driving up the worth.

The lowered provide mixed with secure or rising demand may help a bullish outlook for Ethereum in the long run.

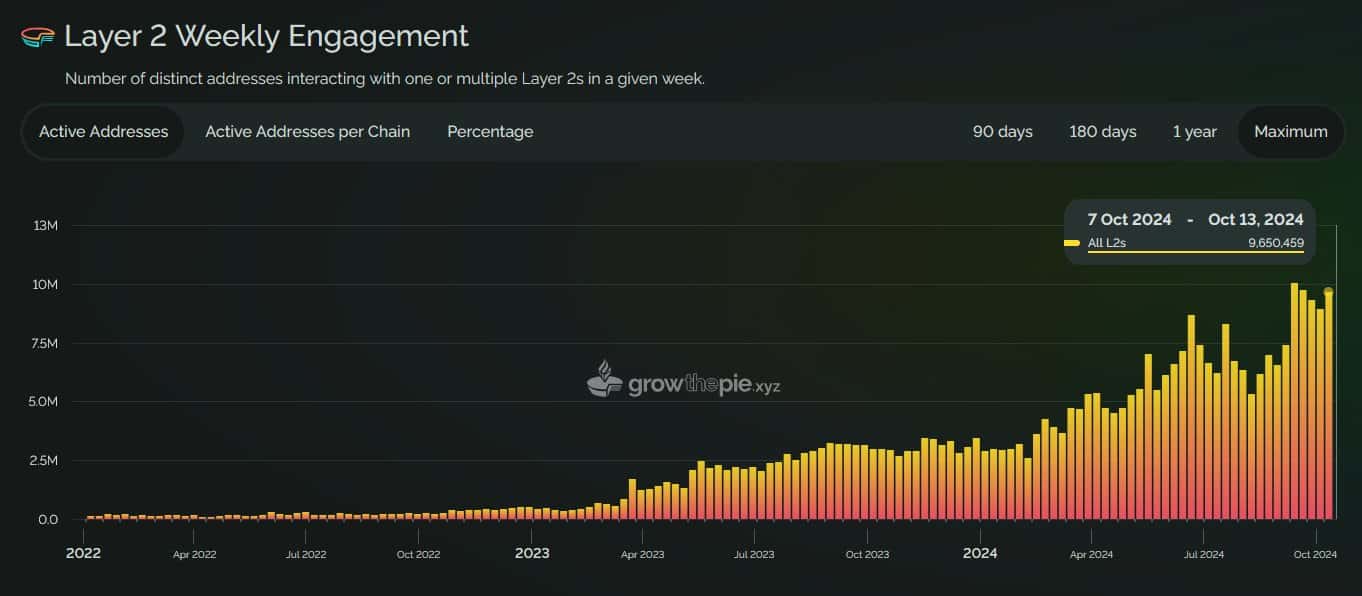

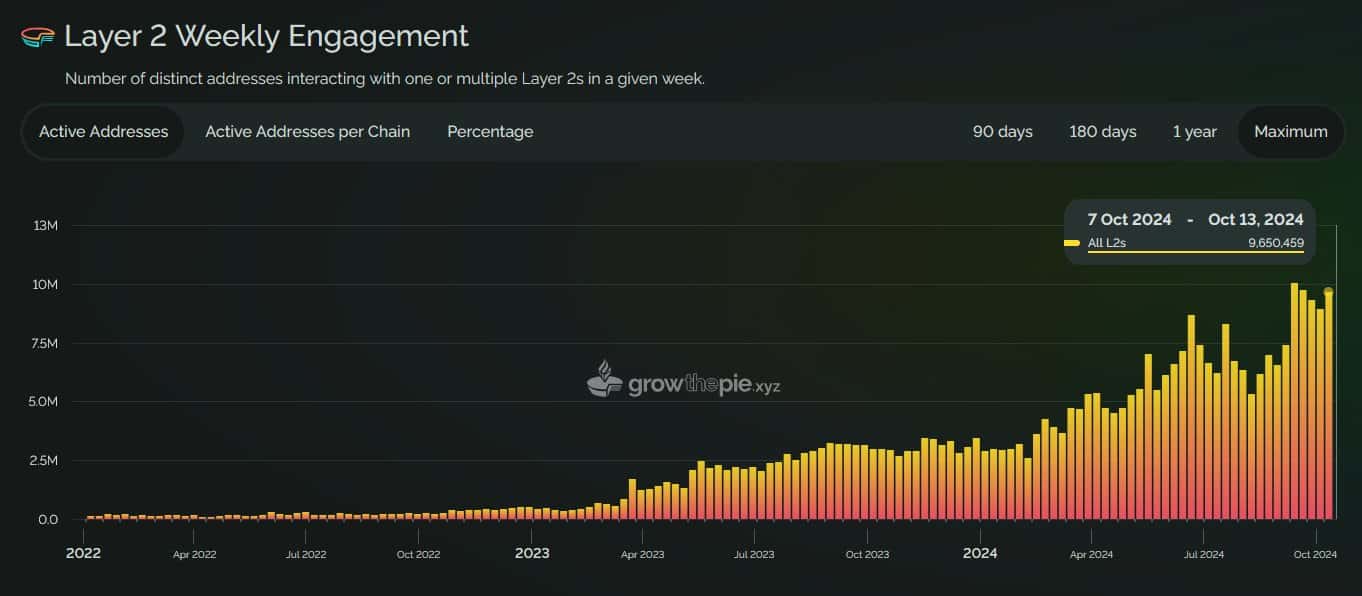

Along with provide adjustments, weekly energetic addresses on Ethereum’s Layer 2 networks are skyrocketing.

At the moment, these energetic addresses have reached roughly 9.65 million, with forecasts suggesting this quantity may multiply by 10 within the coming years as Web3 adoption grows.

Supply: growthepie.xyz

This enhance in exercise on Layer 2 networks displays the growing demand for quicker and cheaper transactions on Ethereum, permitting the community to scale with out compromising decentralization.

Greater person exercise usually correlates with larger transaction charges, additional lowering the entire ETH provide by way of burning mechanisms reminiscent of EIP-1559.

Affect on ETH value

The affect of those developments on the worth of ETH is important. The present decrease inflation fee, mixed with elevated exercise on Layer 2s, strengthens the long-term value outlook for Ethereum.

If the deflationary development continues into 2025, it may result in larger ETH costs, particularly as provide decreases whereas demand stays excessive.

A run on the vary low within the FVG and doable demand, for longs. Conversely, a sweep at vary excessive results in shorts, however a detailed above the vary would imply no commerce.

In the meantime, ETH/BTC has skilled some fluctuations. Ethereum has lagged Bitcoin in latest months, and plenty of analysts imagine ETH/BTC may head decrease within the close to time period.

Supply: TradingView

The pair is at the moment buying and selling within the vary of 0.03-0.04, and a backside might kind at 0.038 and even 0.036. Some even contemplate 0.03 to be the worst-case situation, though it’s unlikely to get that low.

Learn Ethereum [ETH] Worth forecast 2024-2025

Whereas ETH/BTC might stay weak till late 2024, the long-term outlook for ETH/USD is stronger, with a restoration anticipated in 2025.

Regardless of the short-term weak spot of the ETH/BTC pair, ETH’s fundamentals recommend its value may surge larger in 2025, making it a stable long-term guess for buyers.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now