Ethereum

Ethereum whale activity hits record highs: ETH’s 20% rally explained!

Credit : ambcrypto.com

- Ethereum sees a 20% value improve resulting from whale accumulation and foreign money outflows.

- Whale exercise signifies rising bullish sentiment and decreased provide on the inventory markets.

Ethereum [ETH] has risen 20% up to now week, fueled by important outflows from the inventory markets and the rising accumulation of whales, reflecting rising confidence in these property.

Regardless of the bullish momentum, current minor corrections have put ETH at a essential juncture, testing key assist and resistance ranges. Whereas the market waits for readability, these ranges will play an important position in figuring out the following course for Ethereum’s value.

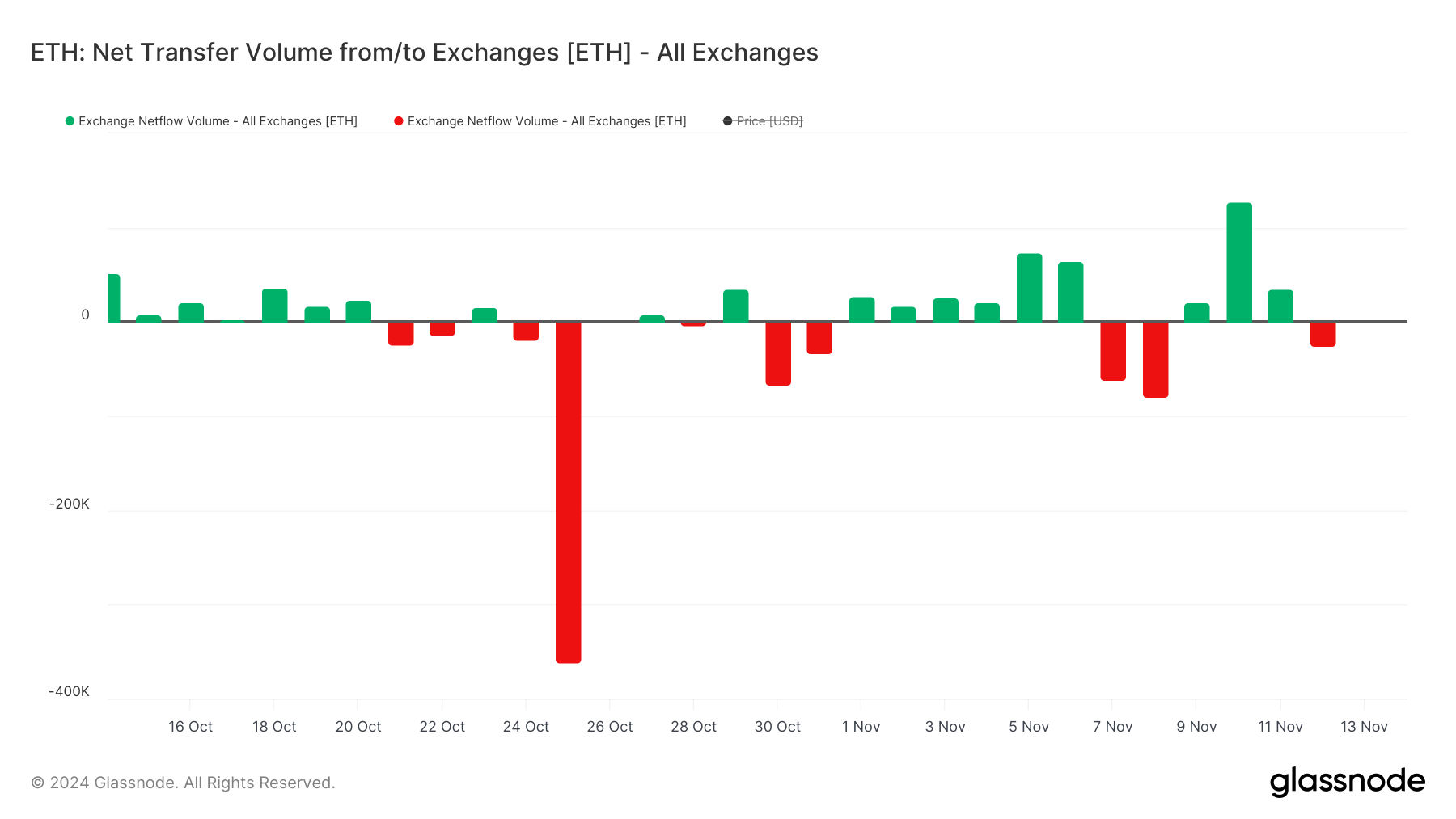

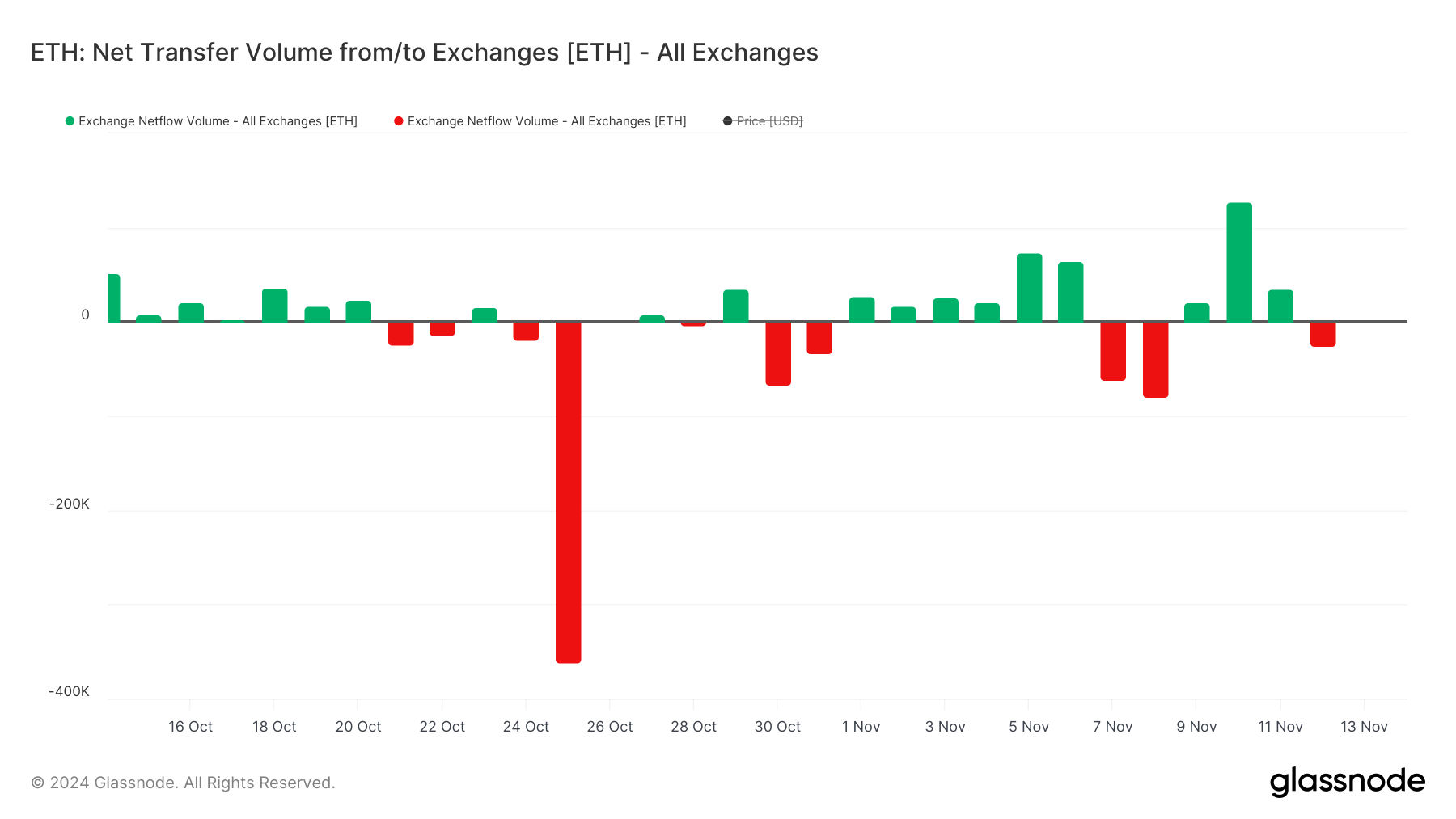

Ethereum trade flows

Ethereum noticed important outflows round October 26, with large-scale withdrawals from exchanges signaling elevated confidence amongst holders.

Supply: Glassnode

These outflows have dominated the pattern, particularly over the previous week, and have corresponded with the value improve of ETH because the whales piled in and provide on the exchanges decreased.

Whereas small inflows round November 7 and 10 counsel some revenue taking, total sentiment stays optimistic. Nevertheless, any sustained shift in the direction of inflows may jeopardize ETH’s assist ranges, creating potential volatility.

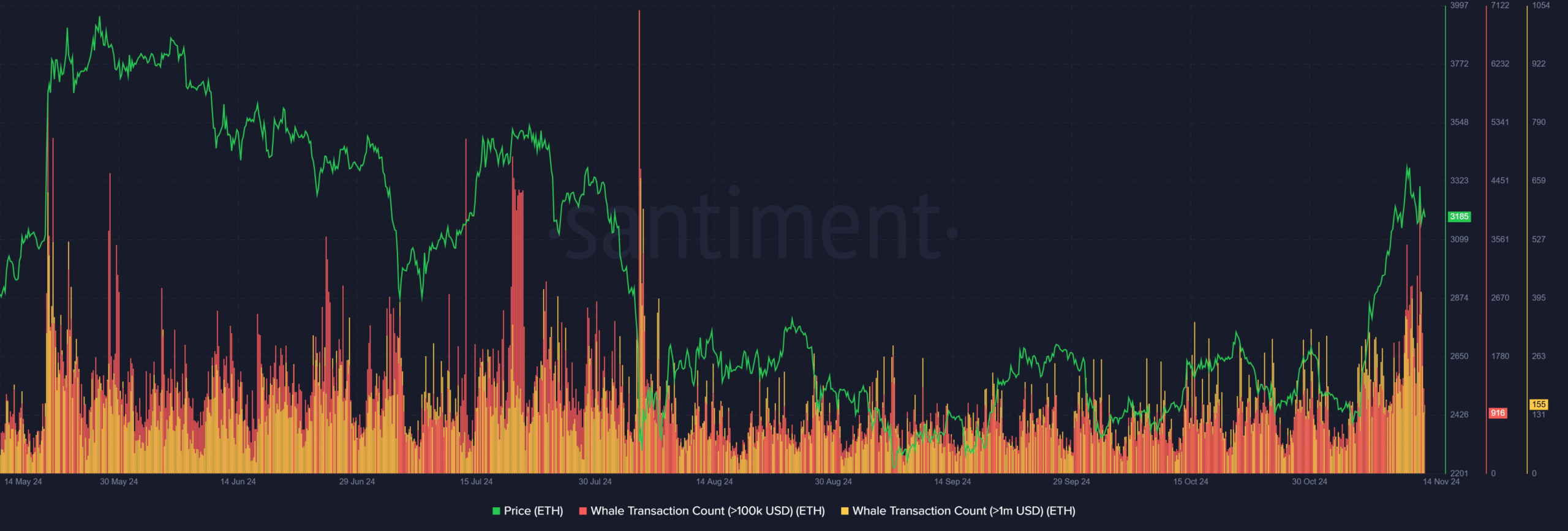

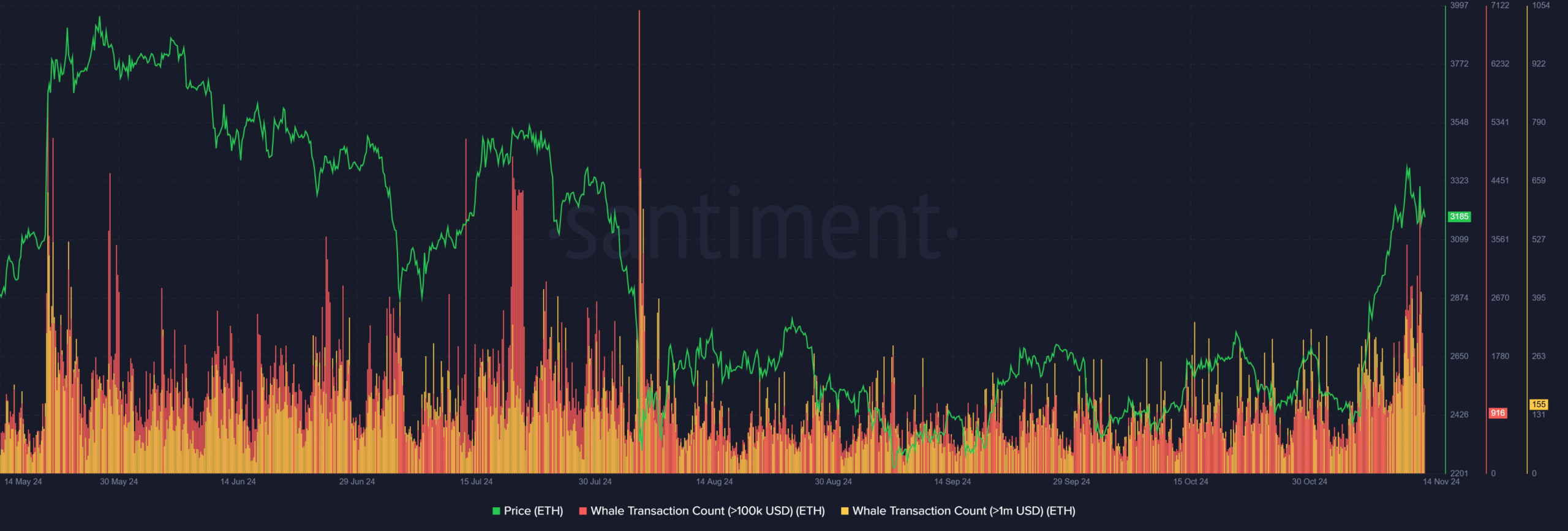

Whale exercise is driving ETH’s bullish momentum

Whale trades soared in late October and early November, correlating with the 20% value improve for ETH, indicating that enormous holders performed an important position in driving up costs.

Supply: Santiment

Traditionally, spikes in whale exercise typically precede main value actions, reinforcing the concept that whales are each an indicator and a catalyst for ETH’s value motion.

Nevertheless, with ETH reaching essential resistance ranges, whale trades have declined, probably indicating profit-taking or warning at greater costs.

Continued whale engagement might be essential to sustaining upward momentum. A continued decline in whale exercise may sign a doable correction or elevated volatility.

Ethereum’s path to an ATH

Supply: Santiment

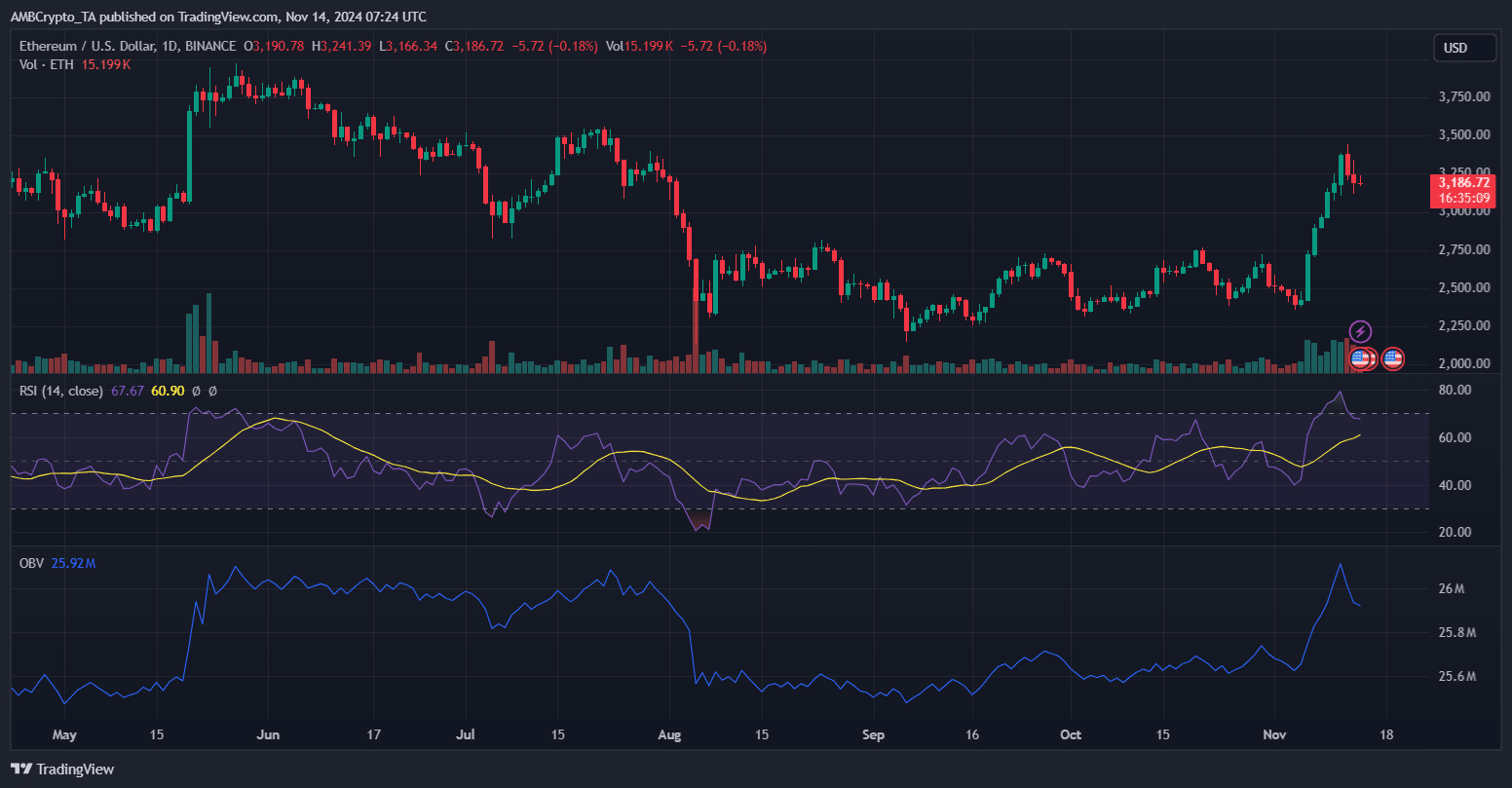

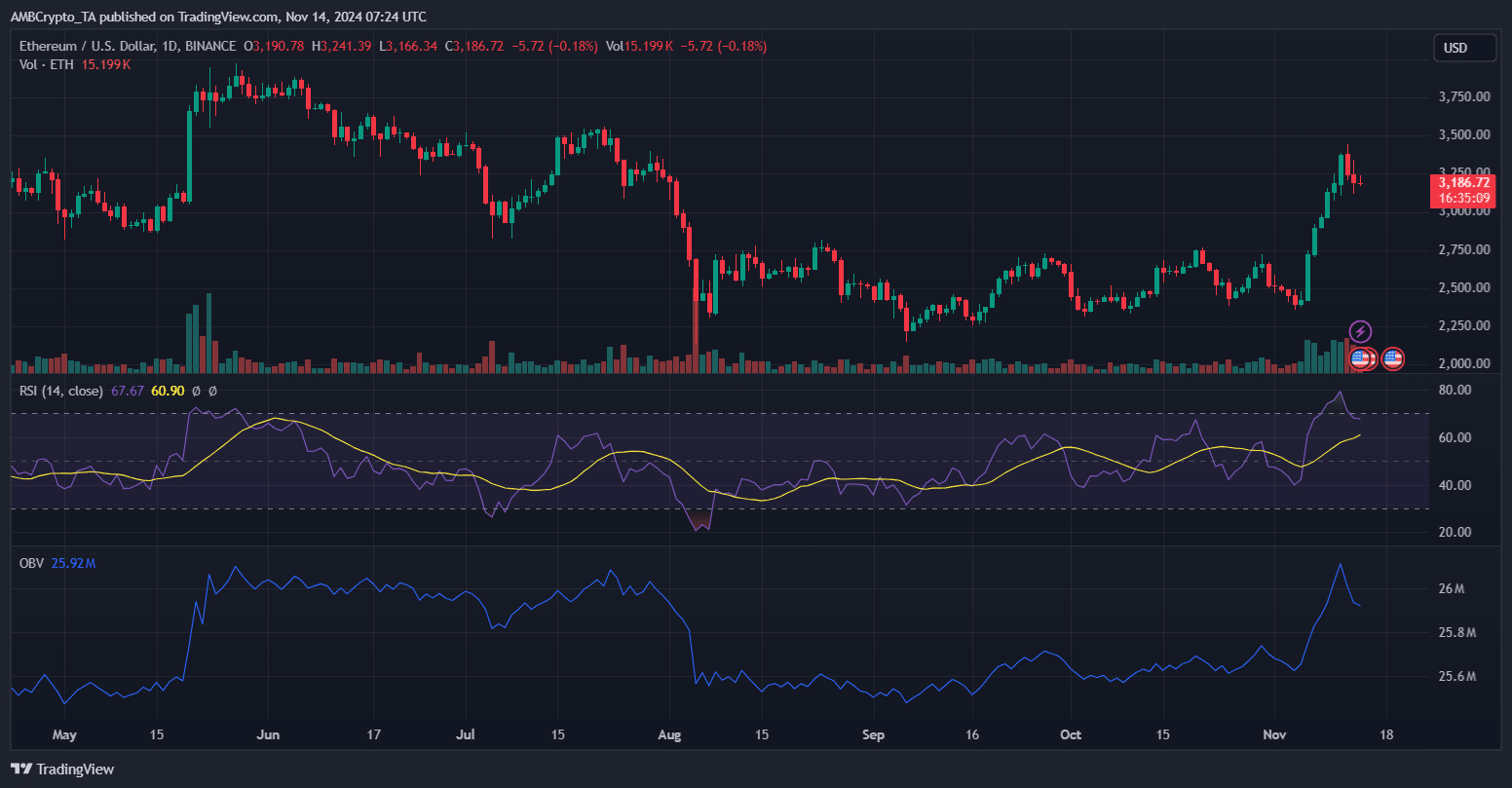

Ethereum’s current rally and powerful whale accumulation increase the potential of revising or surpassing its ATH. The RSI at 67 signifies bullish momentum with out being overbought, indicating room for additional progress.

In the meantime, the OBV is exhibiting sturdy shopping for strain, indicating continued demand.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

ETH stays above the important thing EMA boundaries, with $3,500 because the fast resistance stage. Breaking it may result in a transfer in the direction of $3,700, with $4,000 as the following goal.

Small corrections mirror profit-taking, however ETH’s resilience and whale exercise point out potential momentum for a brand new ATH, offered assist breaks above $3,000.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024