Ethereum

Ethereum: Whale buys 12k ETH- Should you buy the dip now?

Credit : ambcrypto.com

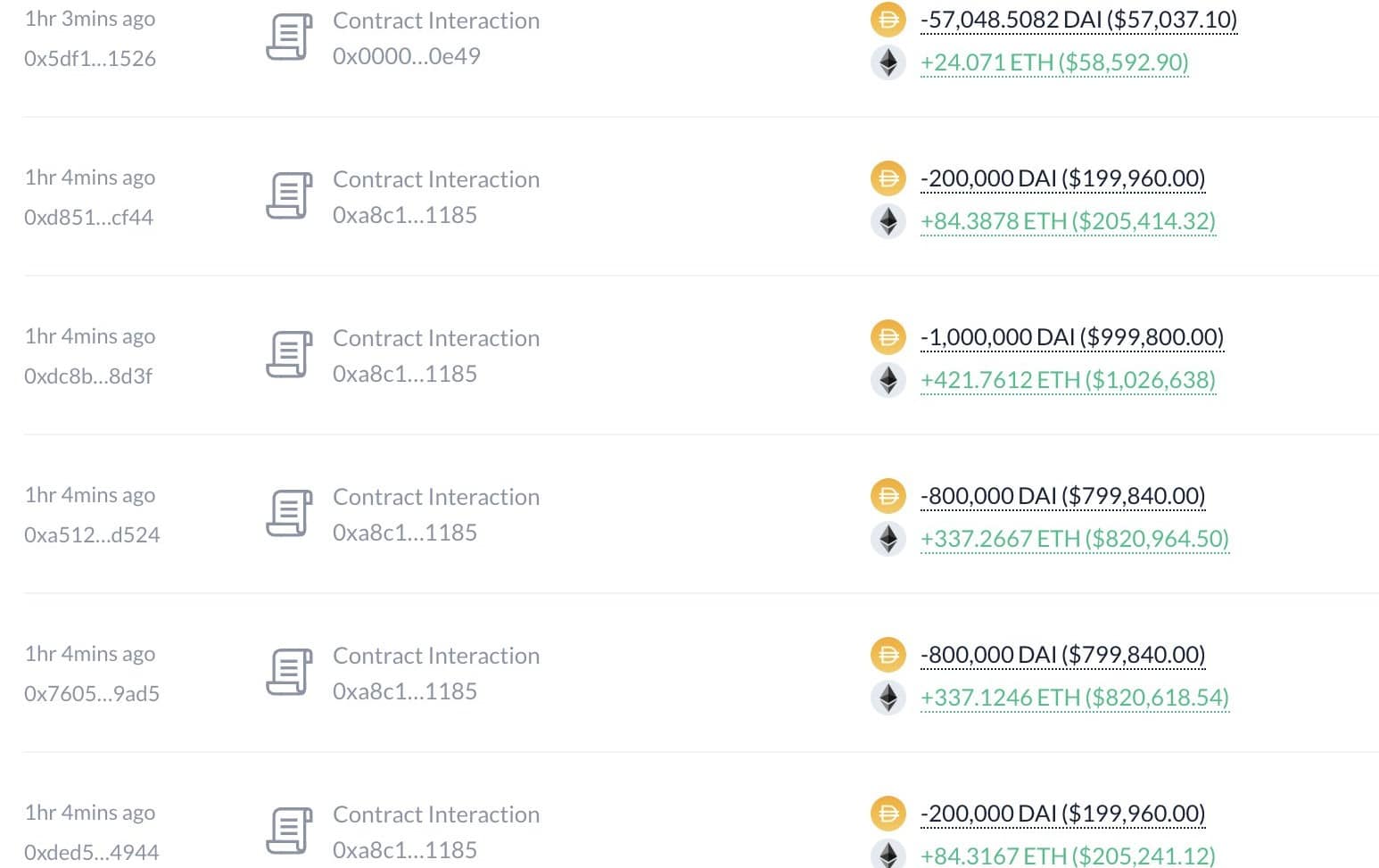

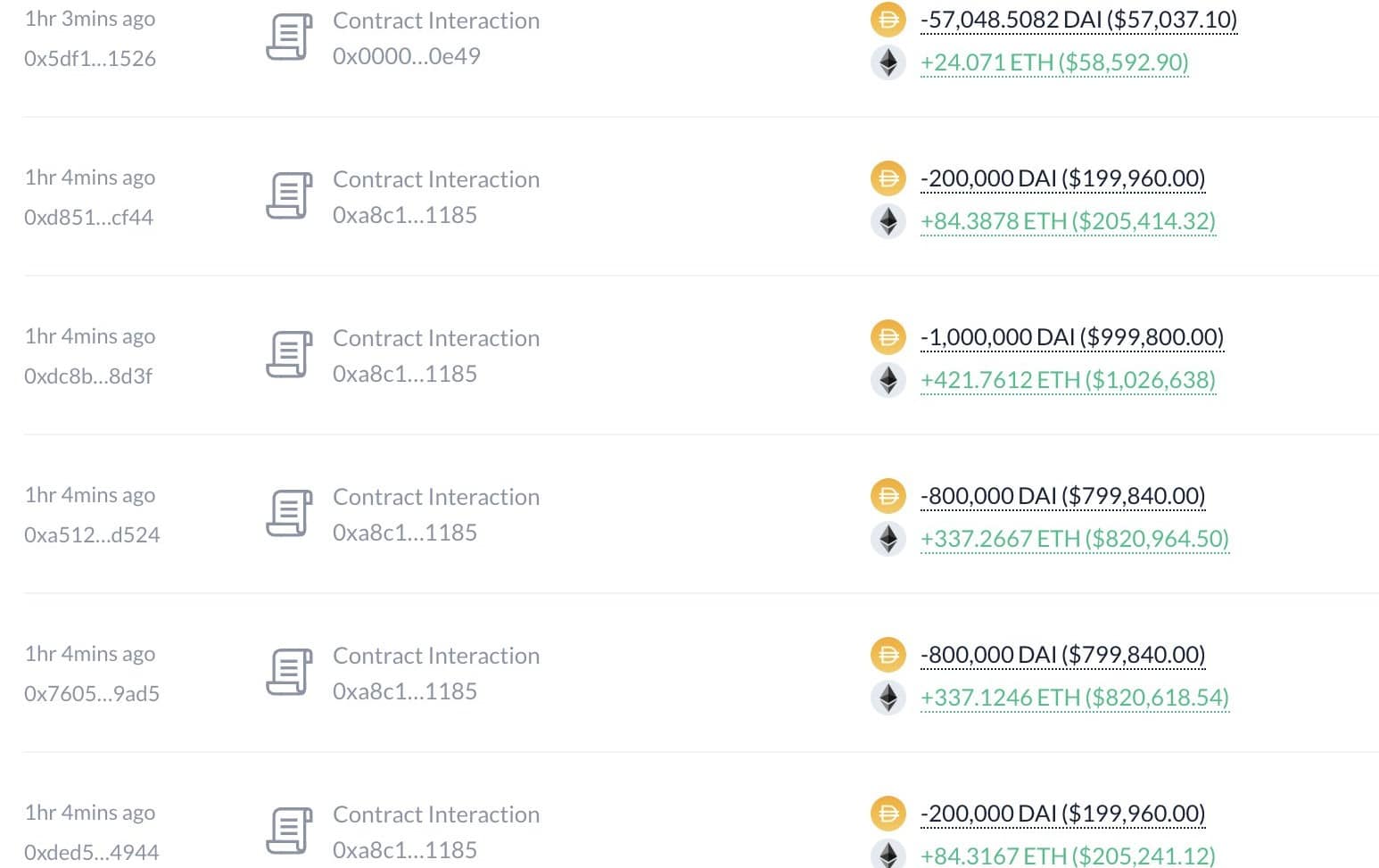

- After the market had fallen, 7 brothers and sisters issued 28.75 million DAI to purchase 12,070 ETH for $ 2,382 once more.

- Eric Trump tweeted “purchase the dips”, which means it’s now the best time to purchase ETH?

Whereas the cryptomarkt was confronted with decline, the pockets continued to speculate ‘7 brothers and sisters’ strategically closely in Ethereum [ETH] who confirmed their exceptional market optimism.

Latest transaction knowledge confirmed that ‘7 brothers and sisters’ exchanged a shocking DAI of 28.75 million inside a brief window to amass 12,070 ETH, with every unit at round $ 2,382 costs.

This repeated their final buy when ETH fell at related ranges.

This buy was a part of a broader technique that was clear by their firm of 1.15 million ETH, with a price of round $ 2.8 billion, in simply two portfolios.

By observing their funding sample, it could possibly affirm that the ‘7 brothers and sisters’ have purchased any essential dip on Ethereum.

Supply: Lookonchain

This aggressive acquisition passed off within the midst of wider market discomfort, which suggests a powerful perception within the lengthy -term worth of Ethereum.

Their actions had been tailor-made to public sentiments repeated the son of President Donald Trump, Eric Trump, whose latest tweet mirrored the timing of the purchases of seven brothers and sisters. Trump wrote on X;

“₿uy the dips !!!”

Such notes usually catalyze broader investor’s pursuits. If the pattern persists and extra massive holders enhance their participations throughout dips, ETH might strengthen the market place.

Conversely, if the broader market doesn’t stabilize, even substantial purchases may not forestall a possible decline.

What’s the subsequent step as an ETH worth marketing campaign on the offered -off territory?

The Ethereum’s worth factors for potential purchases when the offered -off territory arrived, in accordance with the newest RSI lecture. This marks a possible turning level for traders. ETH received greater than 6% on the time of a pointy drop within the final 24 hours after the sharp drop.

The RSI, which lately fallen beneath 30, started to range positively, which signifies the discount of downward momentum, even when costs proceed to fall. This implies that though sellers have been aggressive, gross sales strain can tire itself.

ETH costs have fallen constantly for the reason that starting of the yr, however are actually approaching a vital degree of round $ 2,480.

If this degree applies, this could point out a reversing level for the market, whereby a purchase order possibility is obtainable for many who view these technical indicators.

Supply: TradingView

Traditionally, such RSI abnormalities have usually preceded exceptional restoration within the worth of Ethereum.

If the sentiment shifts, strengthened by macro -economic components and the exercise of huge holders, ETH might get better larger resistance ranges which are seen in December 2024.

Conversely, if the assist fails below steady gross sales strain, costs can fall additional, which signifies that decrease thresholds are decrease than $ 2,000.

This situation would require better warning as a result of it might point out a extra intensive Bearish section earlier than a restoration holds.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024