Ethereum

Ethereum Whale Dominance Hits Record High, but Here’s the Risk

Credit : coinpedia.org

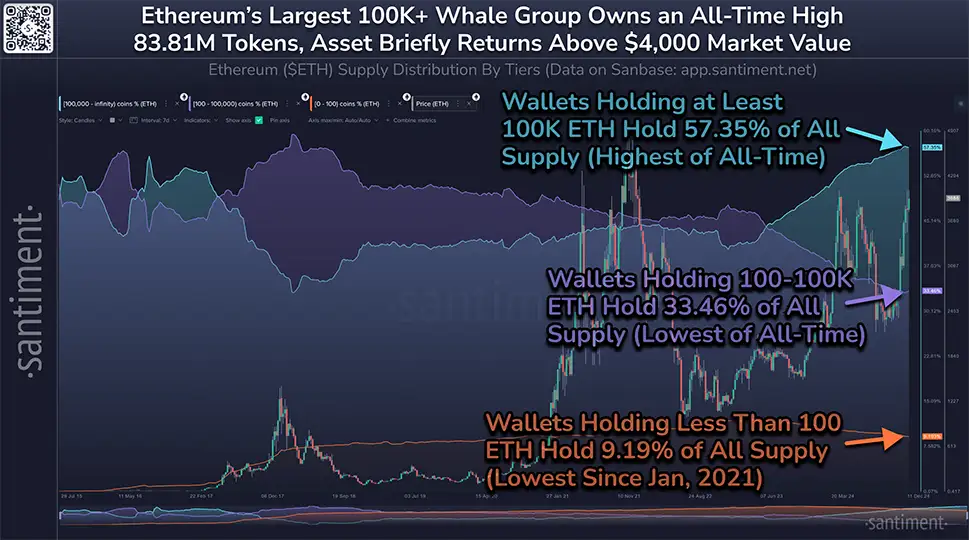

Ethereum’s whale dominance has reached an all-time excessive, and this might have vital implications for the way forward for the community. Whereas smaller buyers personal lower than ever, whales – main ETH holders – are quietly rising their positions.

This raises an necessary query: is that this the beginning of a brand new bull run, or is one thing else at play?

Whales are in management

At present, 104 wallets every maintain greater than 100,000 ETH, representing 57.35% of Ethereum’s whole provide – the best share ever recorded. In distinction, mid-market buyers (who personal between 100 and 100,000 ETH) now personal simply 33.46%, the smallest share in historical past.

Smaller buyers are additionally seeing their affect diminish.

Portfolios holding lower than 100 ETH now account for simply 9.19% of the entire provide, the smallest share since January 2021. This shift has been accelerating since late 2022, when massive buyers started accumulating extra ETH. It’s clear that the Whales are positioning themselves for the long run and could also be anticipating a serious market shift.

A well-known sample: will historical past repeat itself?

This is not the primary time whale exercise has affected Ethereum’s value. In late 2020 and early 2021, an identical accumulation of whales led to a bull run that pushed ETH to new heights. Nonetheless, there’s additionally a cautionary story. When whale dominance peaked in 2022, it was adopted by a pointy value correction, reminding us that whale-driven markets could be risky.

A have a look at the technical points

Ethereum is presently priced at $4,015, with rapid resistance at $4,109. The 4-hour chart reveals the 20-day transferring common (MA) at $3,931, whereas robust assist lies at $3,575, supported by the MA 200.

The technical indicators level to cautious optimism. The Relative Energy Index (RSI) is at 58.42, which means ETH shouldn’t be but in overbought territory. Nonetheless, the On-Steadiness Quantity (OBV) of -44.94 signifies some hesitation amongst buyers.

Cash in, cash out: the distribution of buyers

investor conduct, knowledge from IntoTheBlock reveals that 74% of Ethereum holders have held their ETH for greater than a yr, indicating robust confidence within the asset. The short-term holders are distributed as follows:

- 22% purchased ETH between 1 month and 12 months in the past.

- 4% are newer buyers, who purchased up to now month.

When it comes to profitability, the outlook is constructive:

- 94% of Ethereum holders make a revenue.

- 3% is break even.

- 3% undergo losses, primarily those that bought in November 2021 throughout Ethereum’s all-time excessive (ATH) of $4,891.

Nonetheless, roughly 4.27 million addresses maintain 1.21 million ETH at a loss, with most of those purchases being made between $4,093 and $4,891, which is near the present value.

Bullish or dangerous? What does this imply for the common investor?

What does all this imply for the common investor? There are two doable eventualities. On the bullish facet, the whales’ continued accumulation factors to long-term optimism. If this pattern continues, ETH might rise to the $4,500 – $5,000 vary.

Nonetheless, there’s additionally a threat. Now that a big a part of the availability is within the fingers of some wallets, the market is turning into extra weak. A coordinated sell-off by these whales might result in a sudden drop in costs. It is one thing to maintain an in depth eye on as Ethereum’s future unfolds.

Finally, Ethereum’s whale dominance is a reminder that the largest gamers nonetheless have probably the most management on this market. Whether or not this dominance results in a brand new bull run or a market correction stays to be seen.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024