Ethereum

Ethereum whale sells 19K ETH : Is a deeper pullback on the way?

Credit : ambcrypto.com

- Ethereum whale has sparked worry amongst stakeholders after releasing roughly 19K ETH.

- Nevertheless, a deeper pullback might nonetheless be on the horizon.

Ethereum [ETH] skilled a fantastic shock when a distinguished ICO Ethereum whale offered 19,000 tokens – greater than $47.5 million – in simply two days, sending ripples throughout the market.

Though October began with consecutive pink candlesticks on the each day chart, stopping ETH from reaching $2.7K, the anticipated downward strain from whale exercise didn’t materialize.

As a substitute, ETH rose about 2% from the day past, which caught AMBCrypto’s consideration.

Ethereum whale exercise indicators a market high

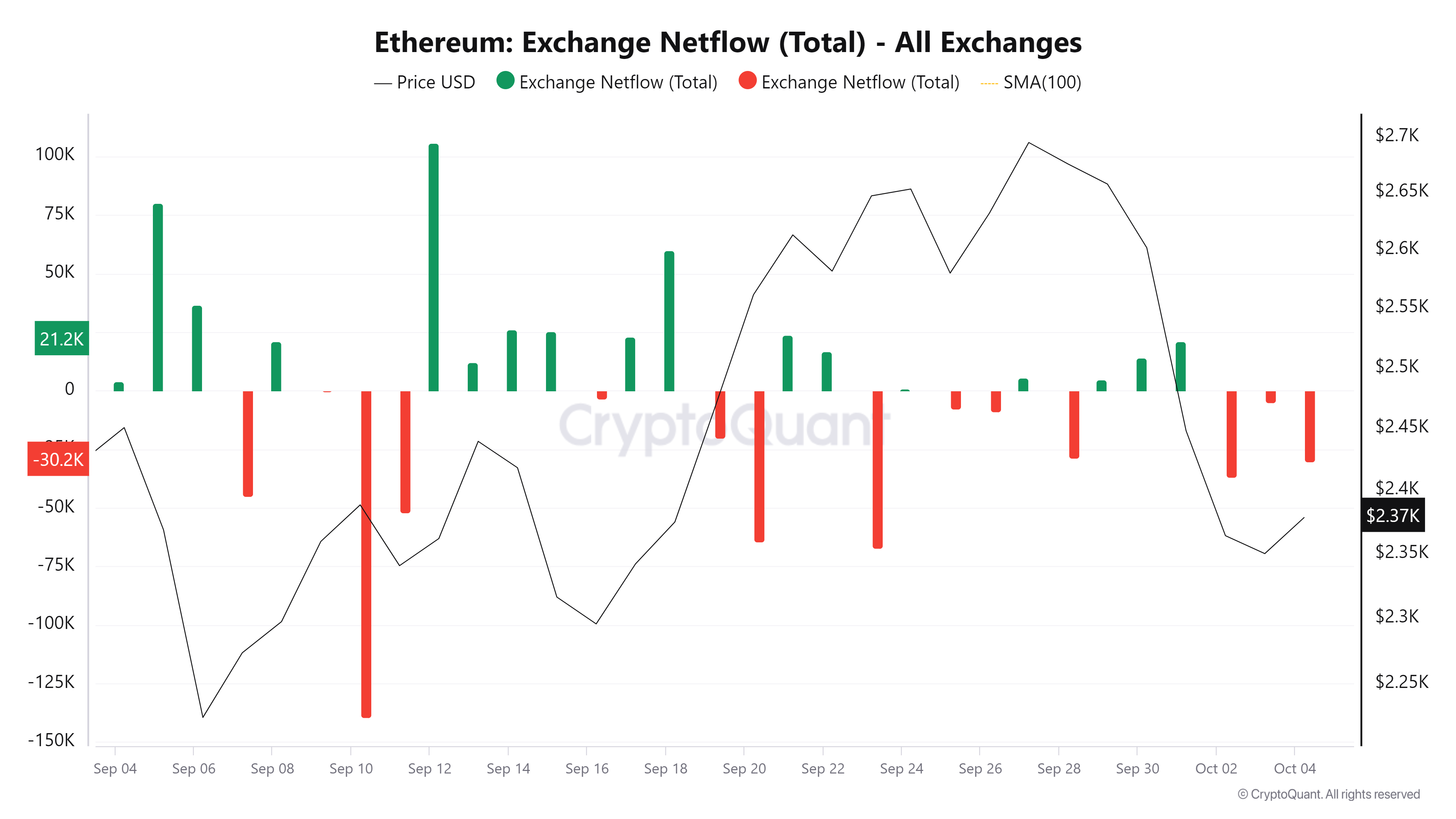

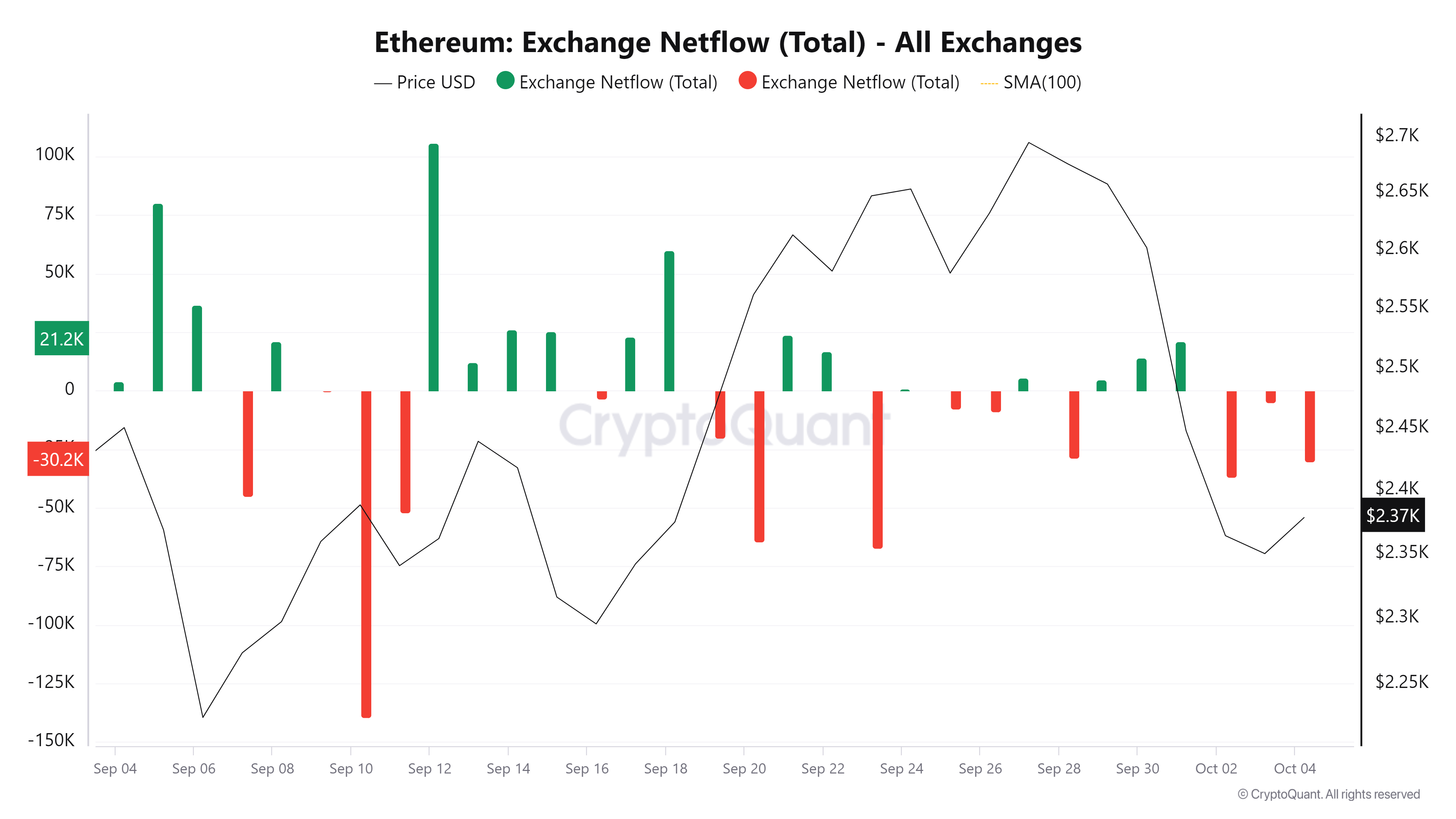

The graph beneath exhibits an intriguing improvement. Sometimes, a major spike in internet outflows signifies energetic shopping for, indicating that merchants are assured a few potential worth correction.

Over the previous three days, ETH internet flows have remained destructive, indicating rising optimism.

Supply: CryptoQuant

Nevertheless, this optimism is in stark distinction to the current Ethereum whale exercise, which factors to $2.6K – the value at which the sell-off occurred – as a possible market high.

In that case, a retracement from $2.37K, ETH’s present worth, again to $2.23K, the earlier rejection stage, might observe.

Furthermore, the graph has one other facet. Merchants who purchased ETH within the final three days when it opened at $2.6K, anticipating a bull cycle, now discover themselves in a internet loss.

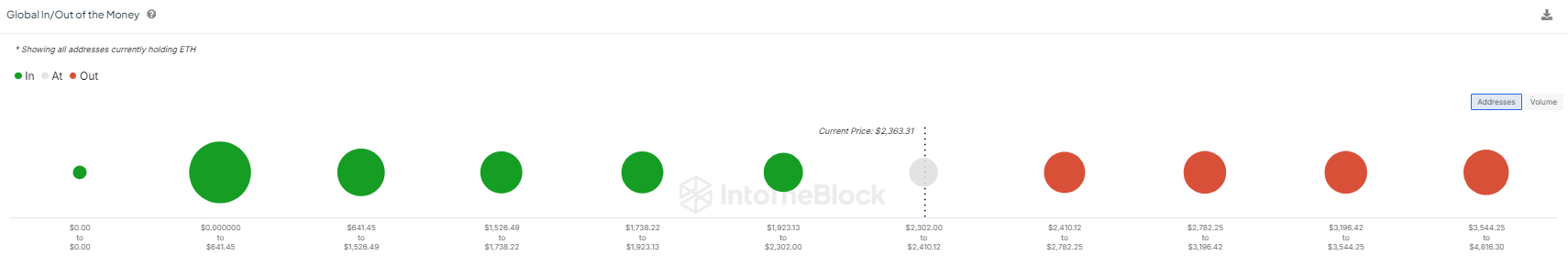

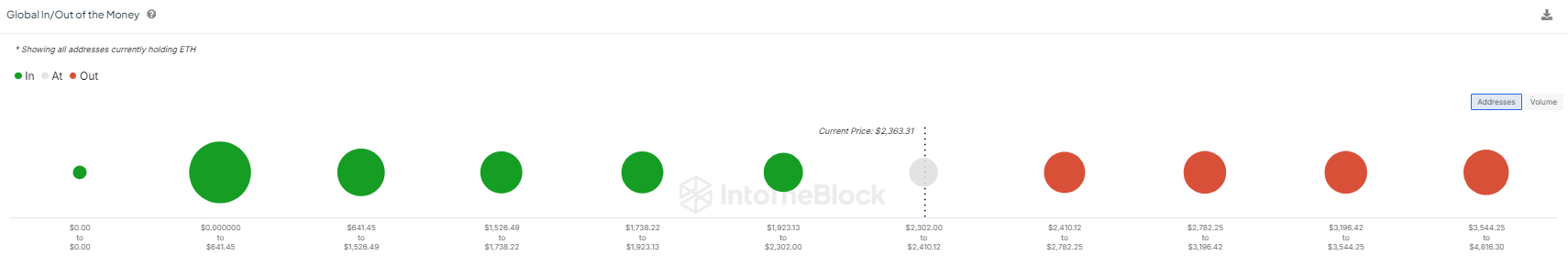

Supply: IntoTheBlock

This case highlights the affect of the current Ethereum whale exercise, which has pushed many buyers into unfavorable positions.

Consequently, this widespread loss amongst merchants might additional scale back the chance of a market reversal as confidence declines resulting from important promoting strain.

Worry can result in panic promoting

It’s clear that the Ethereum whale had a major impression on the ETH worth motion. This has additionally affected investor confidence in a future restoration, as proven within the chart beneath.

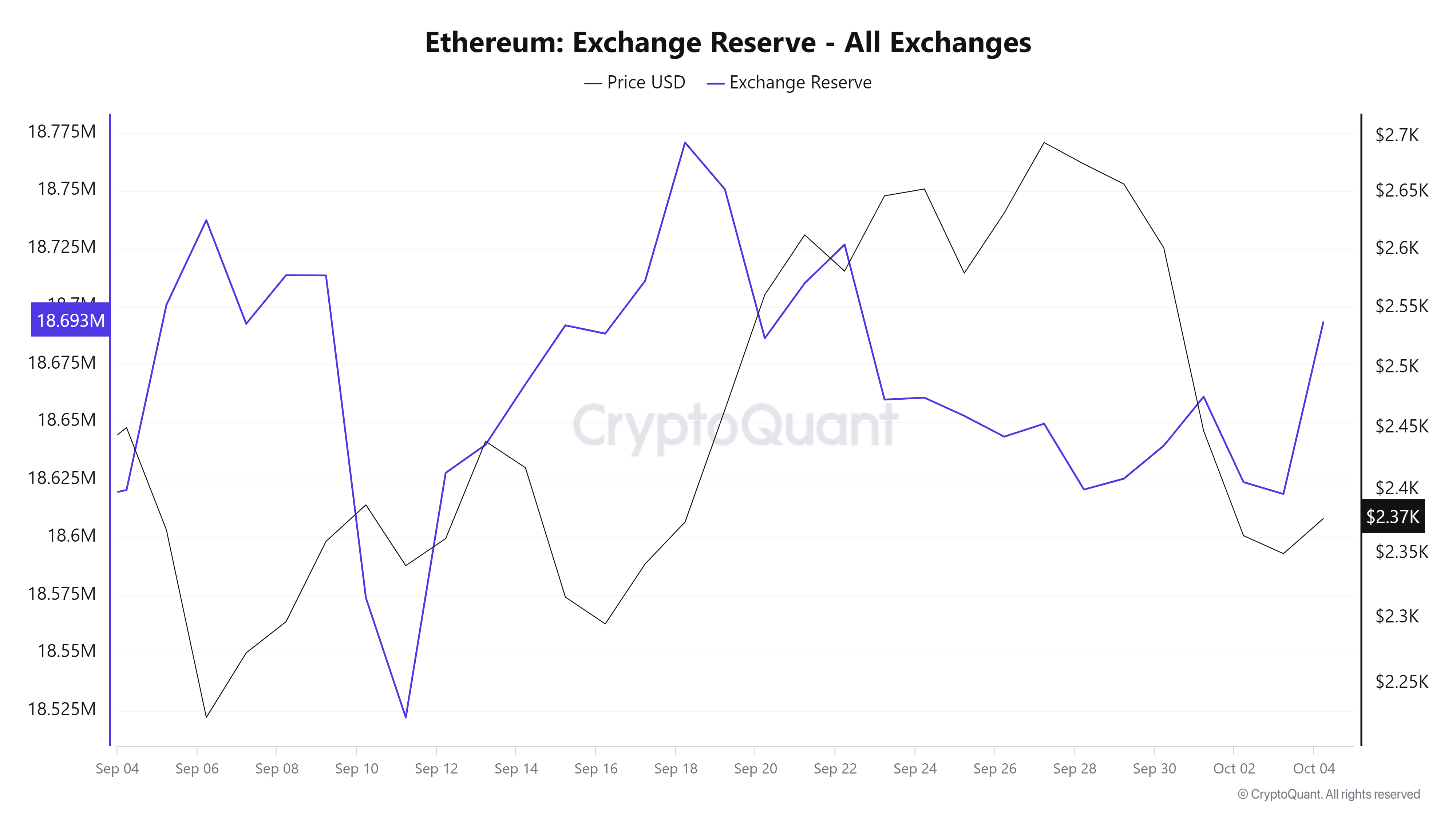

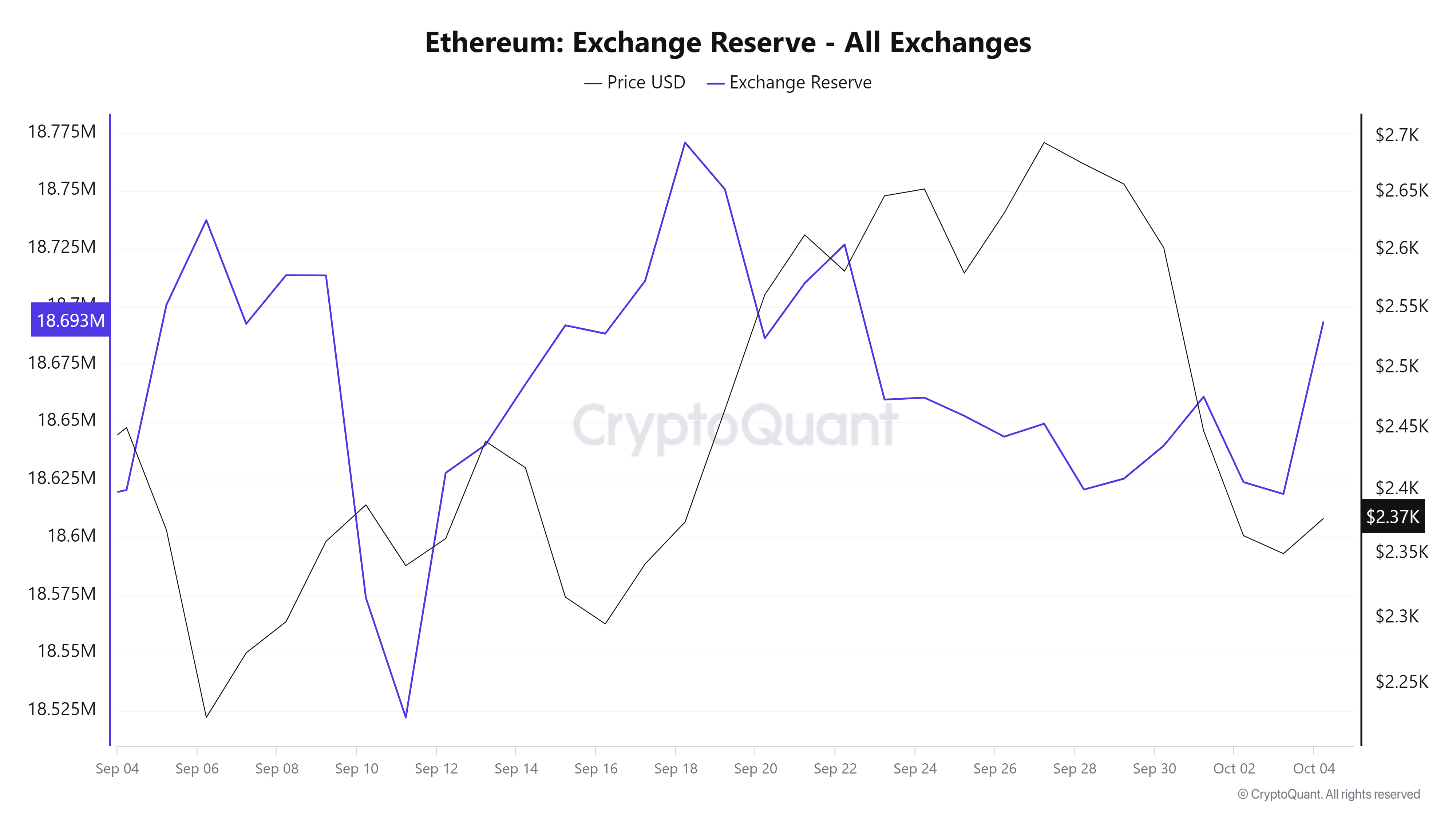

Ethereum trade reserves have seen a sudden spike, with roughly 18.7 million ETH deposited on exchanges.

Supply: CryptoQuant

This improve is a direct reflection of the worry gripping stakeholders following the sell-off of 19,000 ETH in Ethereum whales.

Basically, excessive worry is important for an optimum dip shopping for alternative. The small 2% improve talked about earlier, regardless of the numerous sell-off, might point out precisely that.

In accordance with AMBCrypto, a extra aggressive buyout might reverse the present development by absorbing the promoting strain brought on by the Ethereum whale. If this occurs, it might set the stage for a market backside, attracting patrons on the lookout for decrease costs.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Nevertheless, for this turnaround to work, there have to be excessive worry amongst buyers. With out that worry, the possibilities of a sustainable restoration turn out to be smaller.

Due to this fact, along with the affect of the Ethereum whale, ETH could face a deeper pullback earlier than a major rally happens.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now