Ethereum

Ethereum whale sells 6,900 ETH – Is it time to worry now?

Credit : ambcrypto.com

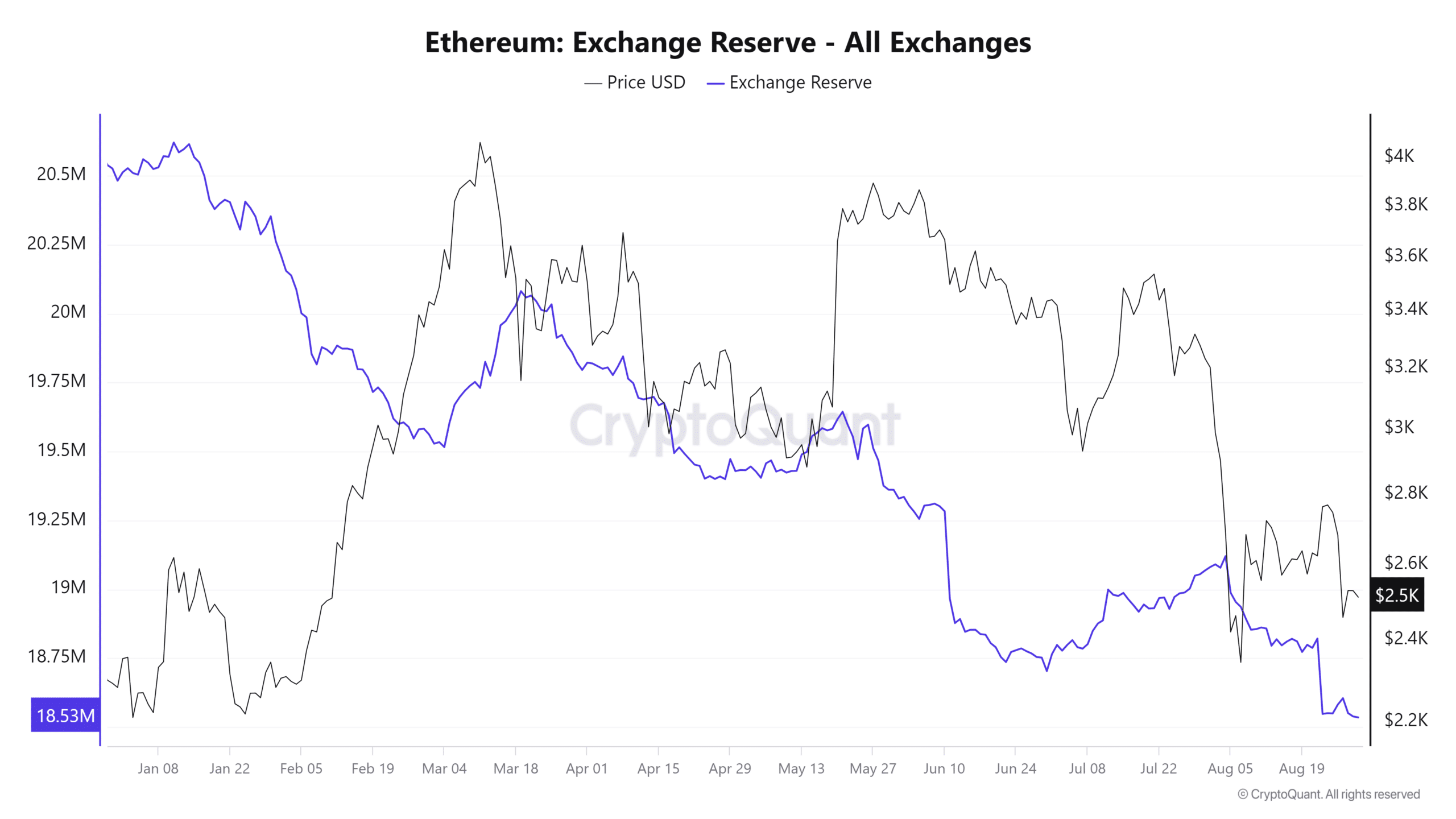

- The ETH alternate reserves dropped to roughly 18.5 million ETH

- ETH remained beneath key value ranges on the time of writing

Ethereum has confronted resistance at key value ranges in current weeks. This has possible contributed to the selections of some massive holders, or ‘whales’, to promote components of their holdings. Regardless of this promoting exercise, the continued decline in ETH alternate reserves has continued.

Ethereum is dealing with a sell-off

Latest information from Look at chain revealed that an Ethereum whale bought 6,900 ETH, price roughly $17.87 million.

This marks a notable change in conduct for the whale, which was beforehand in an accumulation part from January to Could. Throughout this time, the deal with acquired 65,000 ETH price over $196 million. Nonetheless, beginning in July, the whale began promoting off its belongings, draining greater than 21,000 ETH.

Regardless of this important sell-off, the online move worth for Ethereum remained unchanged CryptoQuant confirmed no clear dominance of inflows on the inventory exchanges. A dominant influx often signifies a possible enhance in promoting strain. As a substitute, the online move metric urged that inflows and outflows have been near steadiness – an indication that there was no important spike in inflows or outflows.

This steadiness in internet flows implies that whereas some massive holders, like this whale, are promoting, there have additionally been important withdrawals from the exchanges. The dearth of a dominant move path signifies a comparatively secure market setting. One during which the short-term promoting of some members is countered by accumulation or possession by others.

Ethereum reserves proceed to say no

An evaluation of Ethereum’s international alternate reserves indicated that the current sell-off had minimal influence on halting the general decline. In response to information, after a short enhance to round 18.6 million ETH on August 27, this quantity fell once more – to 18.5 million ETH.

Supply: CryptoQuant

This continued decline in international alternate reserves suggests {that a} important quantity of Ethereum continues to be withdrawn from exchanges.

Sustaining declining international alternate reserves is extensively seen as a bullish signal. Primarily as a result of it means that the provision of ETH out there for quick buying and selling is reducing. If demand stays secure or will increase, this decreased provide might assist greater costs or at the very least stabilize the market.

ETH stays bearish

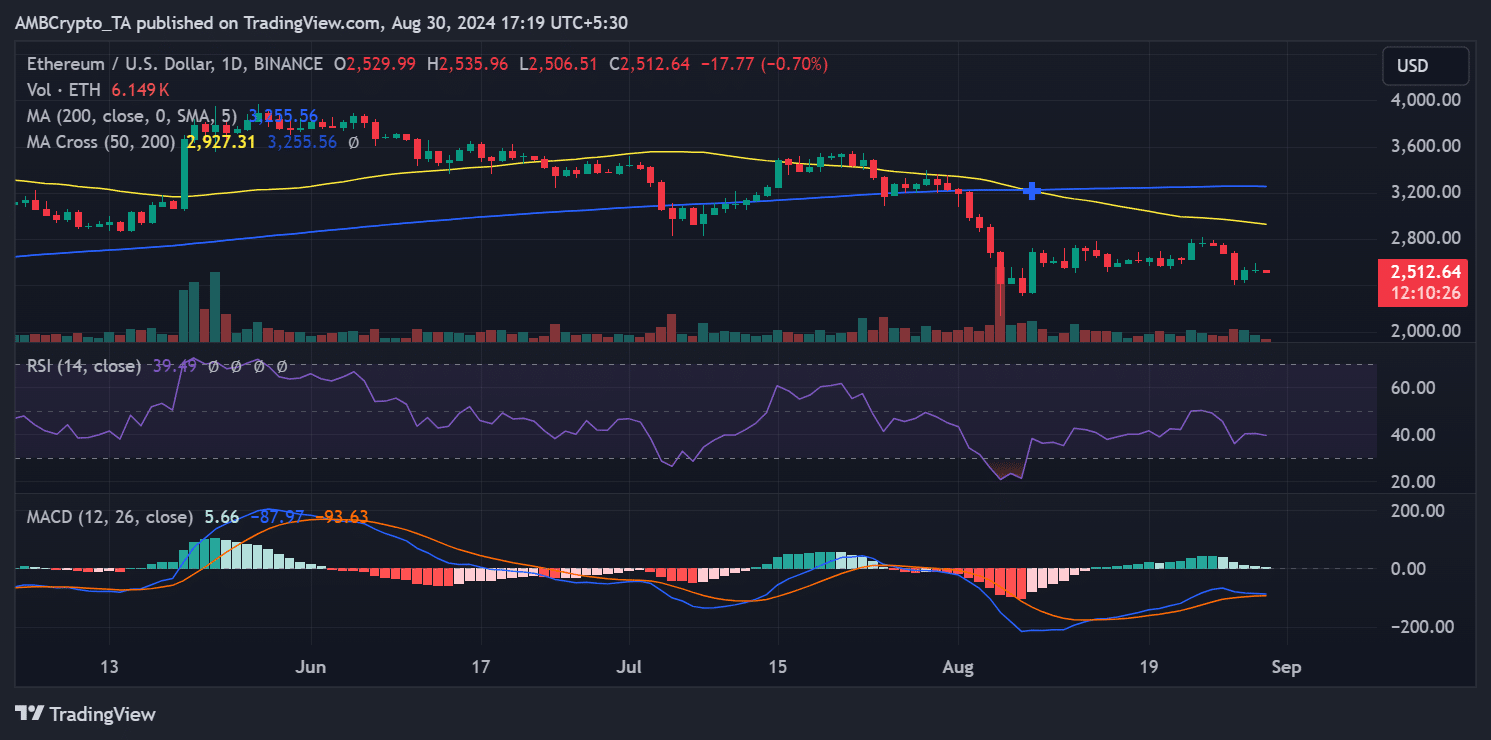

On the time of writing, Ethereum was buying and selling at round $2,512, after falling virtually 1% on the charts. Moreover, an evaluation of the Shifting Common Convergence Divergence (MACD) and the Relative Power Index (RSI) revealed that Ethereum was in a bearish development on the time of writing.

Supply: TradingView

– Learn Ethereum (ETH) value forecast 2024-25

The RSI was beneath 40 – an indication that the asset was in a robust bearish part.

The MACD sign strains had been beneath zero, though the MACD histogram was above zero. This could generally point out a attainable shift in momentum. Nonetheless, the general place of the sign strains urged that the bears maintained a point of management.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now