Ethereum

Ethereum Whales Accumulate Over $4.1B In ETH In Two Weeks – Details

Credit : www.newsbtc.com

Ethereum reveals renewed energy after a pointy however quick withdrawal withdrawal. After its current excessive level of $ 3,860, ETH dropped to the $ 3,500 zone – an essential degree that shortly attracted the acquisition curiosity. Now the value motion factors up once more, with Ethereum pushing to reclaim the vary of $ 3,700, the signaling of bullish momentum may be in management once more.

Associated lecture

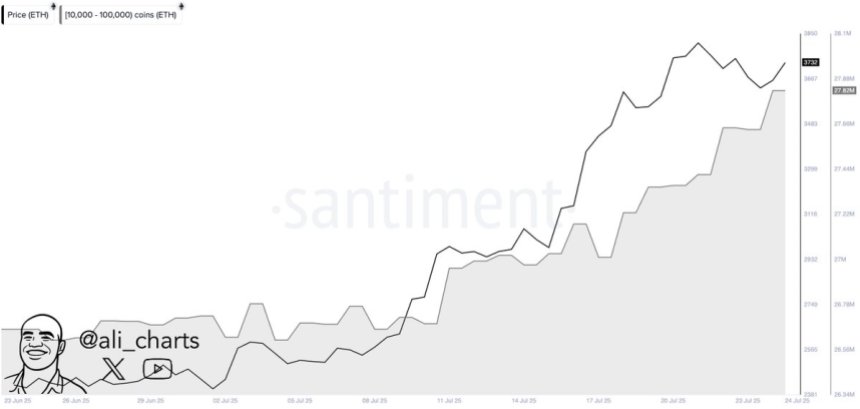

Regardless of the current volatility, knowledge on-chain helps the case for additional upwards. In line with santiment, whales have collected aggressive ETH in the course of the withdrawal. This improve in accumulation means that institutional gamers place themselves for the following a part of the rally, anticipating power within the coming months. These strategic flows have been traditionally preceded for lengthy -term upward developments.

The resilience across the $ 3,500 degree, mixed with the speedy restoration try, underlines the sturdy bullish construction of Ethereum. With a good macro setting, regulatory readability and growing institutional curiosity, Ethereum appears prepared for steady enlargement because the second half of the 12 months unfolds. All eyes are actually aimed toward whether or not this bouncer holds and results in a renewed outbreak over resistance.

Whales add Ethereum whereas the American authorized readability will increase Bullish -Outlook

The Bullish Momentum of Ethereum is bolstered by aggressive accumulation of huge traders. According to For Analyst Ali Martinez, whales have purchased greater than 1.13 million ETH – round $ 4.18 billion up to now two weeks. This improve in shopping for exercise marks one of the vital essential accumulative phases in current months and alerts that belief amongst institutional gamers.

The buildup comes at a vital second for Ethereum, which is consolidated close to the extent of $ 3,700 after a brief withdrawal of $ 3,860. This whale exercise not solely provides gasoline to the persistent worth restoration, but in addition reinforces the bullish construction of Ethereum on its solution to the second half of the 12 months.

Along with market habits, macro and regulatory shifts are additionally most well-liked by Ethereum and the broader Altcoin market. The current passage of the Genius Act and Readability Act by the American congress marks a vital second for crypto laws. These new legal guidelines provide a protracted -sought authorized readability for decentralized finance (Defi) platforms and digital belongings, which inspires American innovation and capital flows in house.

This evolving authorized framework removes one of many greatest boundaries for institutional acceptance of Ethereum and Defi. With clearer guidelines and a rising urge for food for ETH below whales, the stage is ready for a doubtlessly explosive rally if the current momentum applies.

Associated lecture

ETH applies sturdy after withdrawal

Ethereum (ETH) reveals renewed power after a brief correction of his native summit at $ 3,860. As may be seen within the 4-hour graph, ETH fell to $ 3,500 however bounced shortly, reclaiming the $ 3,700 zone and shutting the important thing resistance to $ 3,776 and $ 3,860. This rebound signifies a robust curiosity and resilience of consumers within the rebellion.

The value is now traded above all essential superior averages (50, 100 and 200), that are stacked bullishs. The 50-SMA on $ 3,648 has supplied dynamic assist in current periods, whereas the 100-SMA and 200-SMA, respectively, stay $ 3,304 and $ 2,883 below the present worth actions and the power of this upward motion is subjected.

Associated lecture

The quantity absorbs one thing, as a result of ETH consolidates in a good attain close to resistance. An outbreak above $ 3,860 would in all probability open the door to a motion to new native highlights, whereas not breaking this degree can result in a distinct take a look at of the $ 3,648 assist space.

Featured picture of Dall-E, graph of TradingView

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now