Ethereum

Ethereum whales buy $19 million of ETH, Bullish signal for ETH?

Credit : ambcrypto.com

- Ethereum’s RSI was in oversold territory, signaling a attainable bullish reversal.

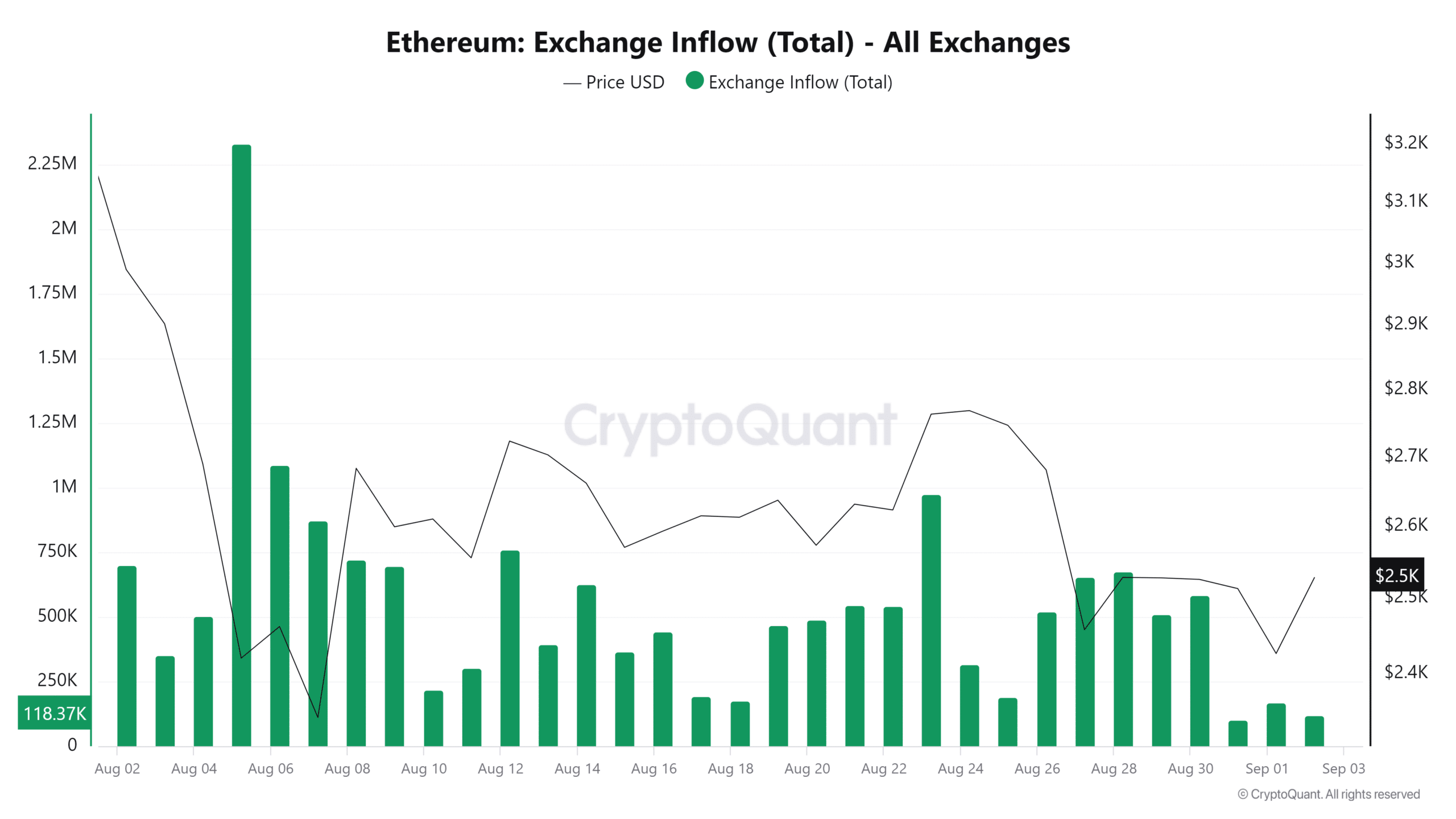

- Ethereum inflows on the CryptoQuant alternate have been on the lowest level prior to now 30 days – a purchase sign.

Ethereum [ETH]the world’s second largest cryptocurrency, has seen a major value drop following the launch of the spot ETH Trade Traded Fund (ETF) in the USA.

Amid these market declines, on September 2, two whales noticed the present ETH value as a possibility. They borrowed stablecoins from Aave [AAVE] and purchased 7,767 ETH value $19.22 million.

Indicators of whale exercise are shopping for the dip sentiment

In a submit on X (previously Twitter), Look at chain famous that the whale pockets “0x761d” had bought 3,588 ETH value $8.8 million, whereas one other deal with had bought 4,180 ETH value $10.42 million within the final 24 hours.

This vital ETH accumulation through the market decline alerts potential shopping for alternatives.

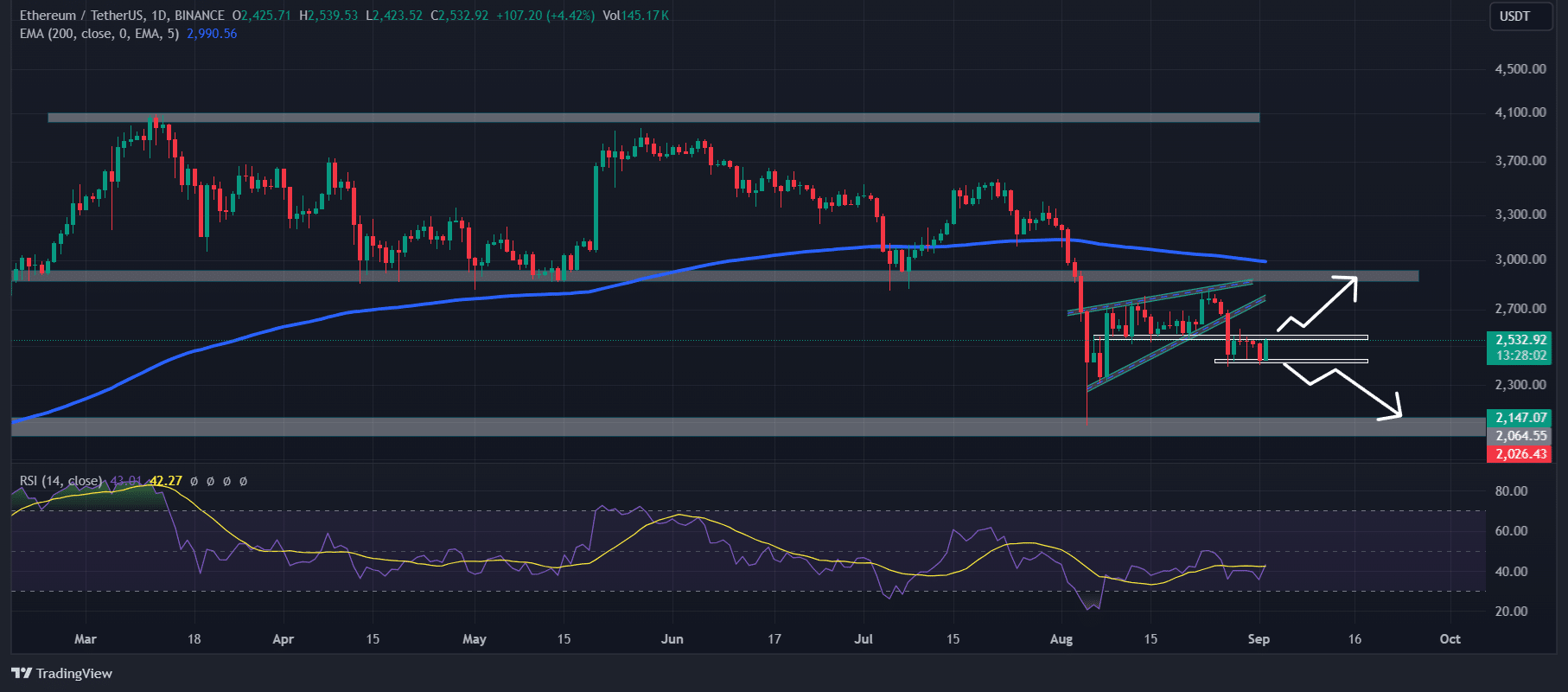

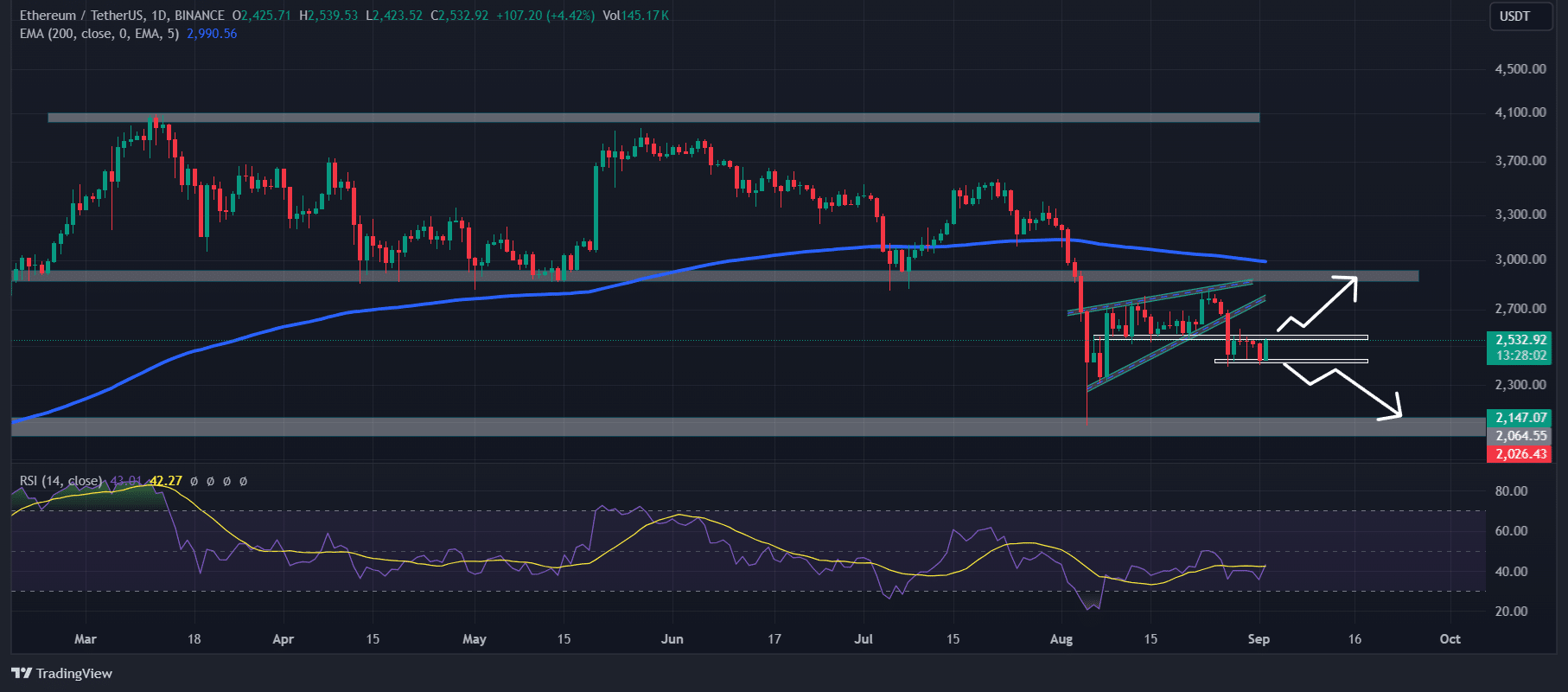

Technical evaluation of Ethereum and upcoming ranges

In response to professional technical evaluation, ETH was in a downtrend as it’s buying and selling beneath the 200 Exponential Transferring Common (EMA) on a day by day timeframe.

Moreover, the current collapse of the bearish rising wedge value motion sample signifies that ETH may fall in direction of the $2,200 degree within the coming days until it closes a day by day candle above the $2,600 degree.

Supply: TradingView

Nonetheless, ETH’s technical indicator, the Relative Energy Index (RSI), was in oversold territory, signaling a attainable value reversal within the coming days.

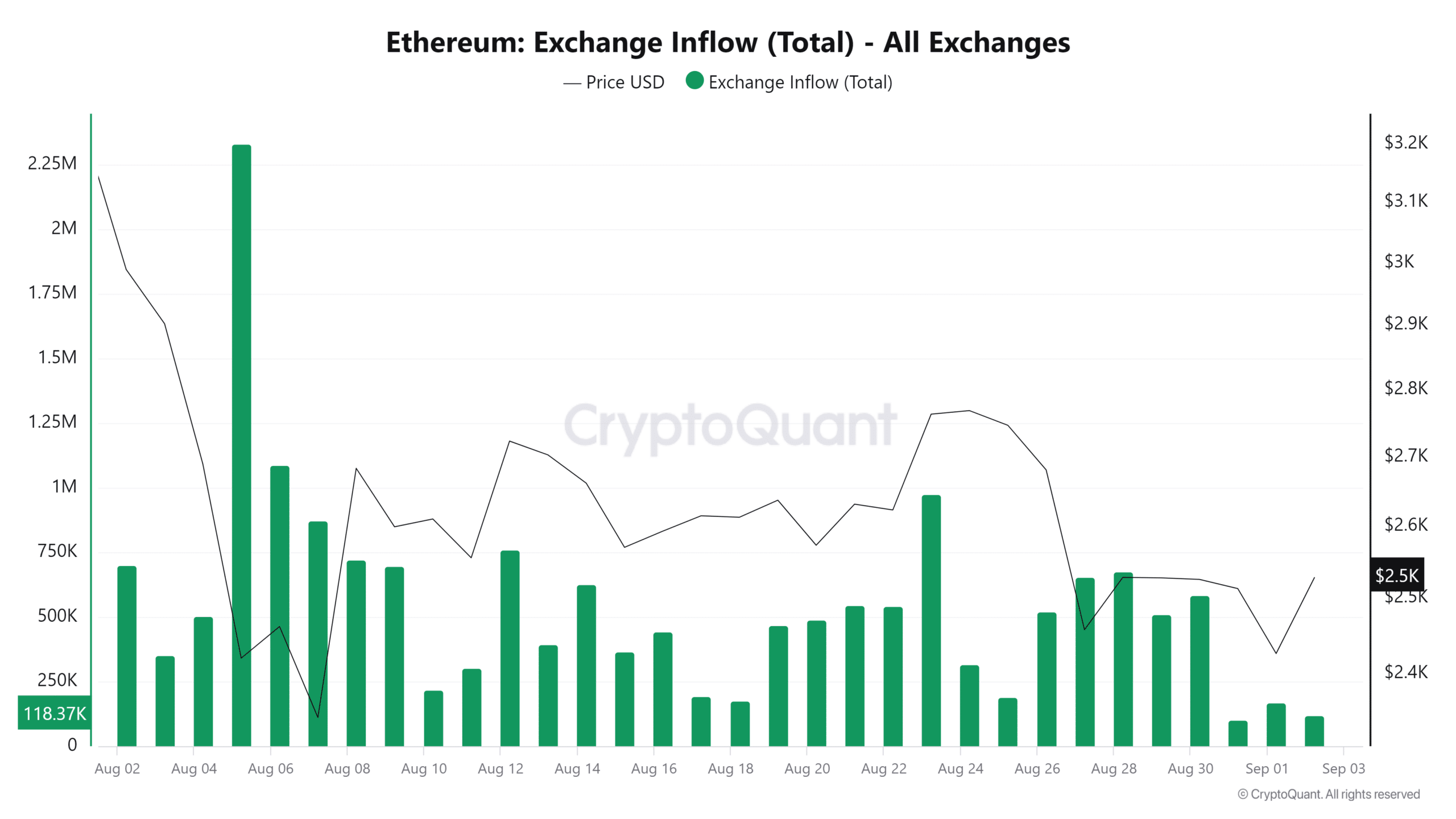

On-chain metrics assist bullish outlook

The on-chain metrics additionally supported ETH’s bullish outlook. Ethereum inflows on the CryptoQuant alternate have been at the moment on the lowest level prior to now 30 days – a purchase sign.

A excessive influx signifies increased promoting strain on the spot alternate or vice versa.

Supply: CryptoQuant

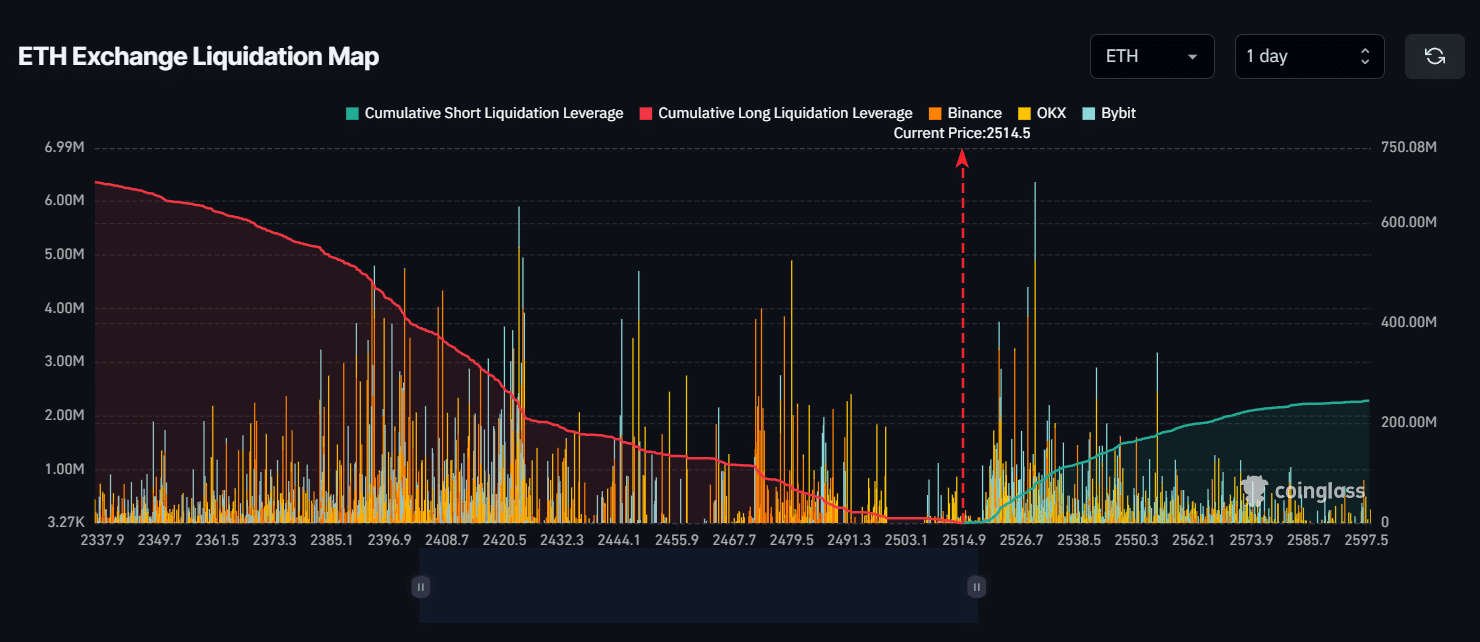

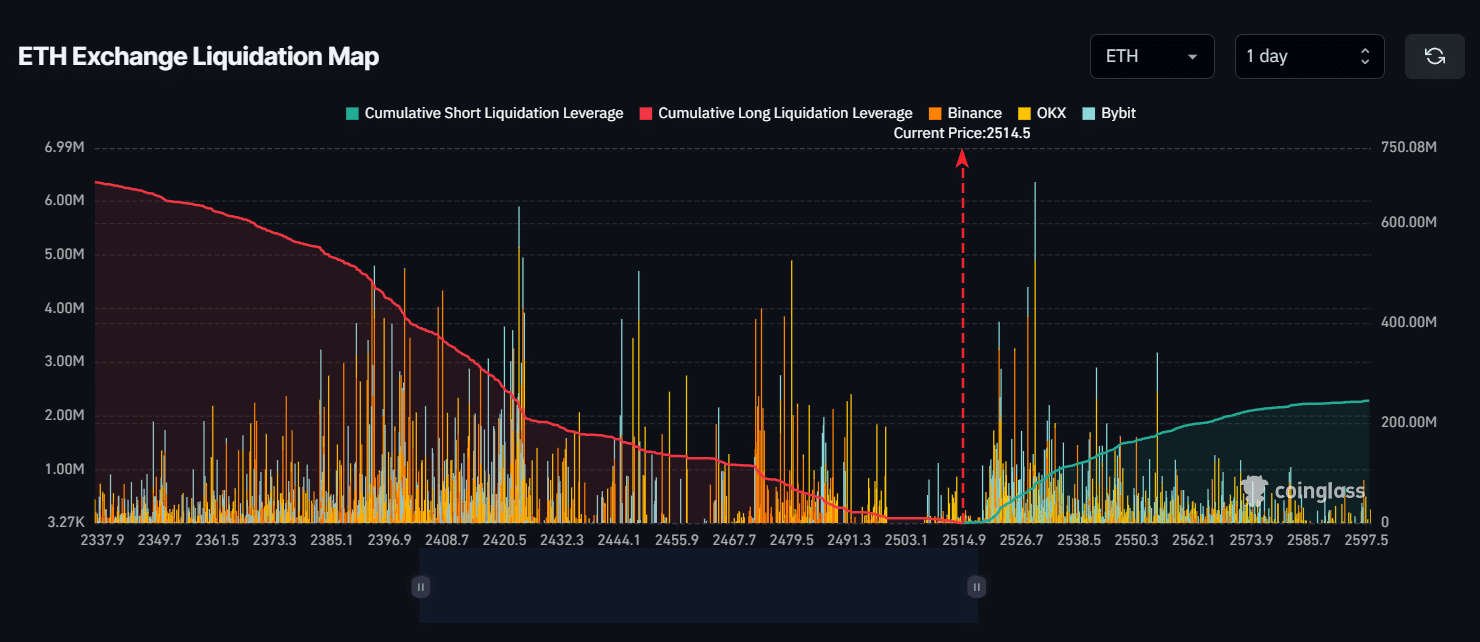

In the meantime, CoinGlass’s ETH inventory liquidation map indicated that bulls have been dominating belongings and presumably liquidating quick positions.

Key liquidation ranges have been round $2,420 on the draw back and $2,530 on the draw back, as merchants are over-indebted at these ranges.

Supply: CoinGlass

If sentiment stays bearish and ETH value falls to the $2,420 degree, almost $230 million in lengthy positions will probably be liquidated.

Conversely, if sentiment modifications and the value rises to the $2,430 degree, quick positions value roughly $70 million will probably be liquidated.

Learn Ethereum’s [ETH] Value forecast 2024–2025

On the time of writing, ETH was buying and selling across the $2,510 degree, having risen greater than 1.3% prior to now 24 hours. In the meantime, Open Curiosity grew, after rising 1% within the final hour and 1.5% within the final 4 hours.

This rising Open Curiosity signifies rising curiosity from traders and merchants amid the current value declines.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now