Ethereum

Ethereum Whales Buy the Dip, Withdraw 1M ETH from Exchanges

Credit : coinpedia.org

The overall cryptocurrency market causes confusion as a result of heavy volatility. Within the midst of this, whales and buyers appear so as to add priceless tokens whereas performing at low cost ranges.

Right this moment, 11 February 2025, a distinguished crypto skilled on X (previously Twitter) posted that Walvissen Ethereum (ETH) have chosen as the very best funding alternative, which added tens of millions of {dollars} to ETH final week.

1 million Ethereum (ETH) withdrawn from inventory exchanges

In a publish on X, the skilled famous that greater than 1 million Ethereum (ETH) have been withdrawn from festivals final week. Such a exceptional outflow or token -back -back from inventory exchanges appears to point a possible accumulation that may trigger buying strain and generate additional upwards momentum.

Furthermore, this outflow suggests a super shopping for possibility. The present market sentiment, nonetheless, appears toareah, with a robust chance that this substantial accumulation may cut back gross sales strain.

The Bearish Tackling ETH Merchants

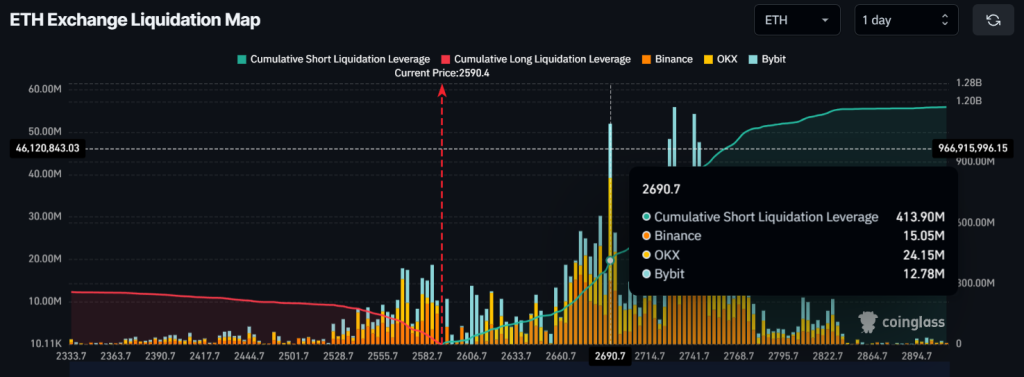

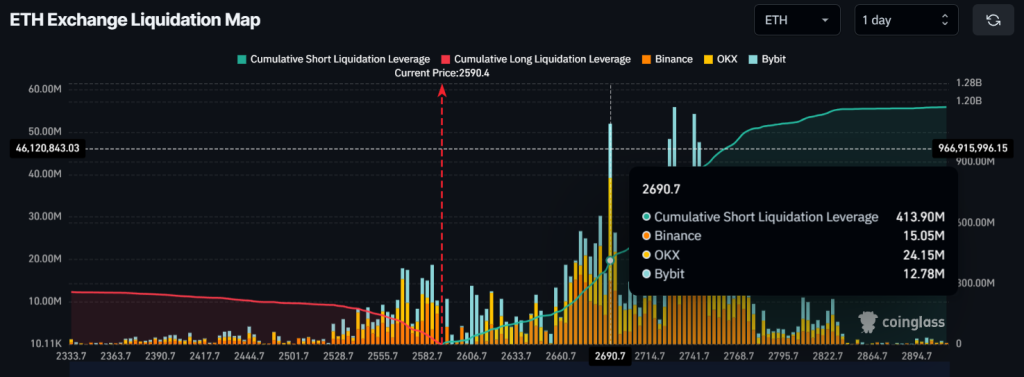

Regardless of the bullish perspective of buyers and long-term holders, intraday merchants appear to comply with the alternative strategy, as reported by the uncleaning evaluation firm Coinglass.

On the time of the press, merchants who gamble on the lengthy facet appear to be exhausted, whereas those that take brief positions are at the moment actively dominating.

Based on the info, merchants who’re held lengthy positions, overlap on the degree of $ 2,568, with $ 108 million in lengthy positions are over. Conversely, merchants who guess on brief positions are an excessive amount of livered on the degree of $ 2,690, the place they’ve $ 415 million in brief positions.

These liquidation knowledge clearly outline the present market sentiment, the place brief positions are 4 instances stronger than lengthy positions. Furthermore, brief merchants have the potential to simply liquidate lengthy positions.

Present worth momentum

Ethereum is at the moment buying and selling close to $ 2,588 and has skilled a worth fall of greater than 4.10% within the final 24 hours. Nonetheless, throughout the identical interval, on account of large volatility and substantial worth fluctuations, the commerce quantity fell by 17%, which signifies a decrease participation of merchants and buyers in comparison with the day gone by.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024