Altcoin

Ethereum whales now control 57% of the supply – Impact on ETH?

Credit : ambcrypto.com

- The whale dominance in Ethereum indicated sturdy bullish sentiment and potential worth development

- Concentrated investments raised considerations about liquidity dangers and potential market corrections

Ethereum [ETH] Whales are more and more dominating the community, with 104 wallets now holding over 100,000 ETH, accounting for over 57% of the overall provide.

This important shift in Ethereum’s distribution raises necessary questions on its future, particularly relating to market management and worth actions. As these whales proceed to build up, their rising dominance signifies sturdy bullish sentiment.

However with such concentrated holdings, how might this have an effect on Ethereum’s future worth trajectory?

Accumulation of Whales and Lengthy Time period Holders: Bullish Signal or a Bear Entice?

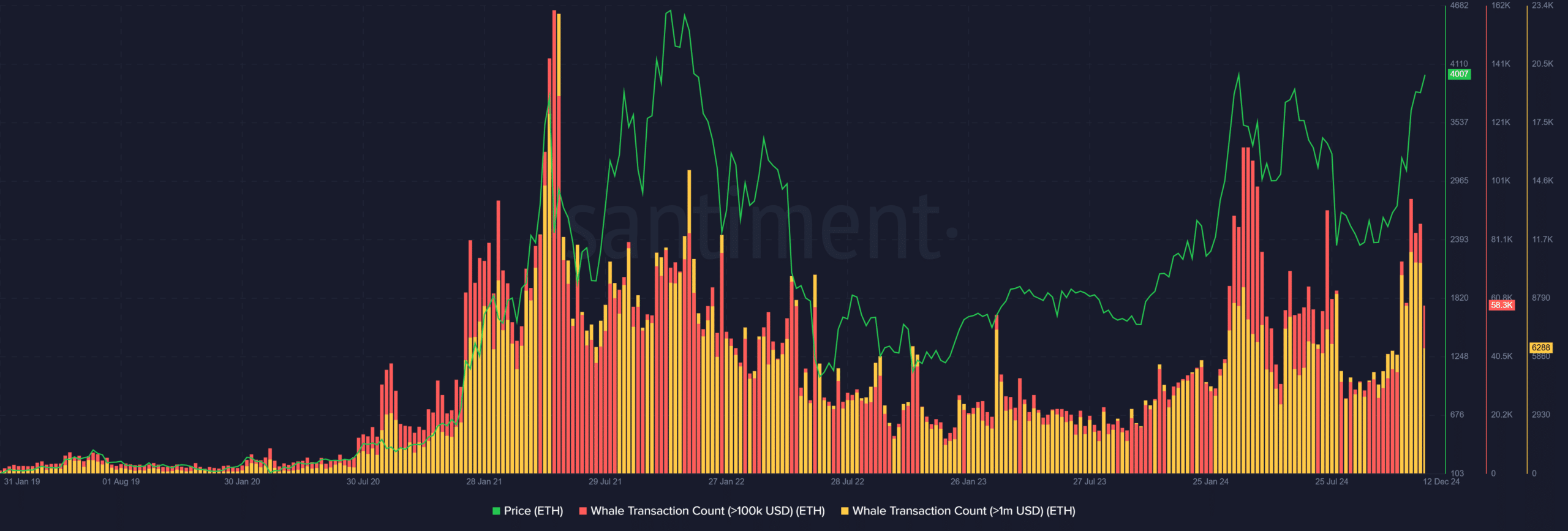

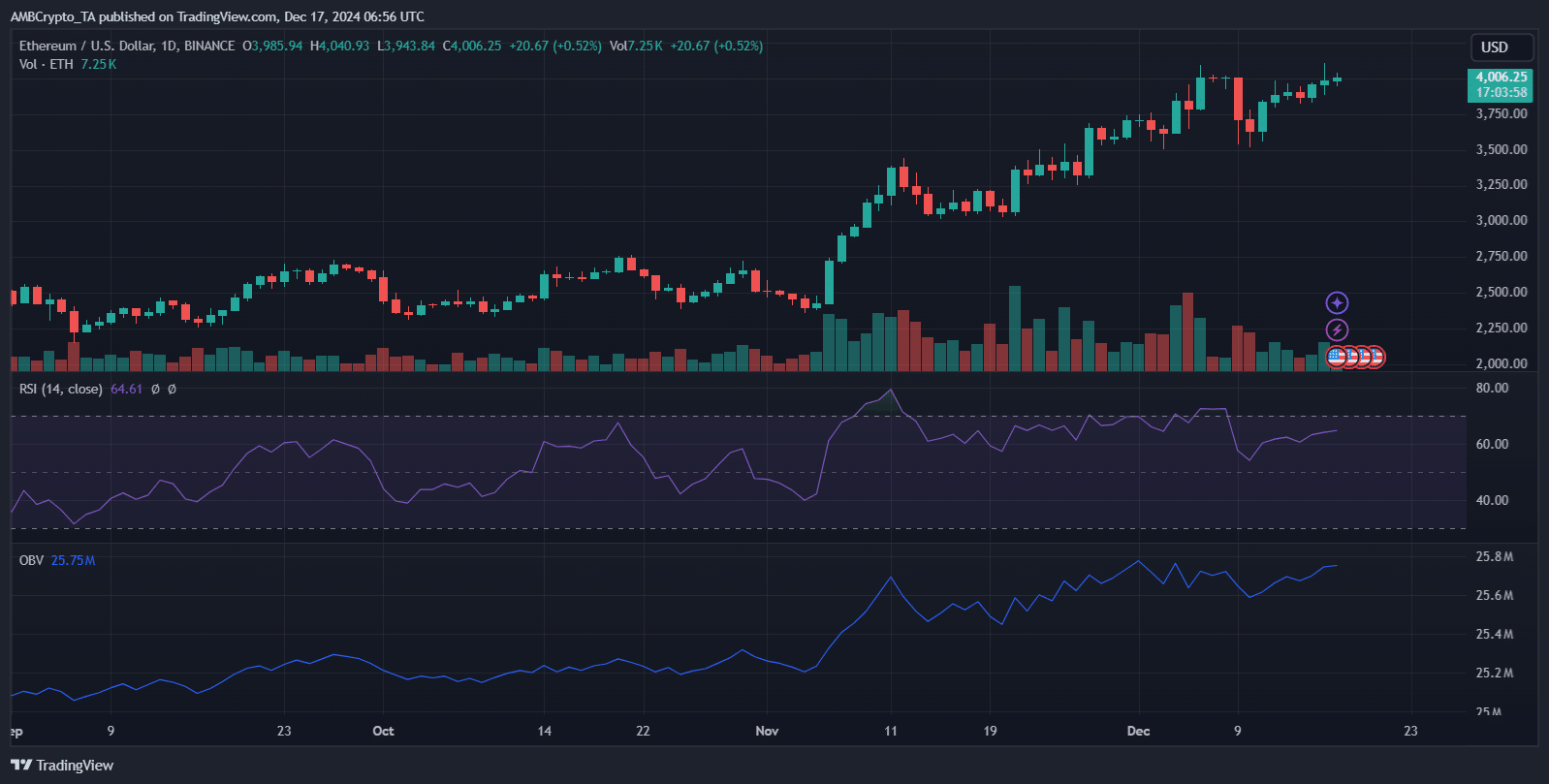

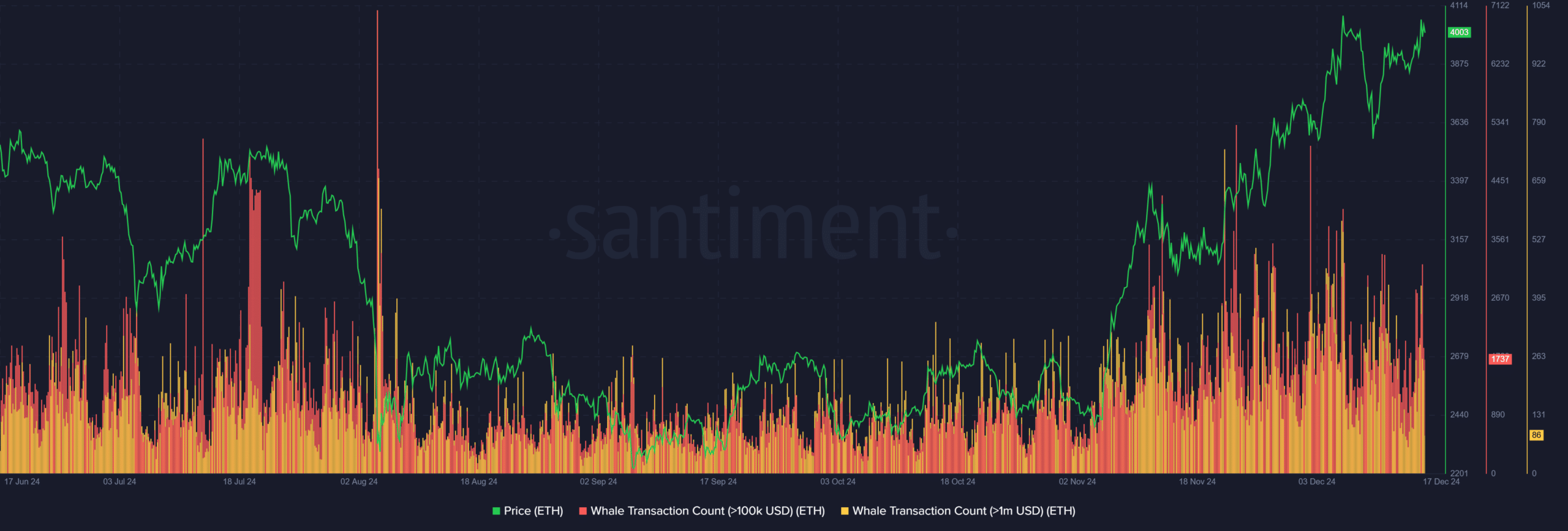

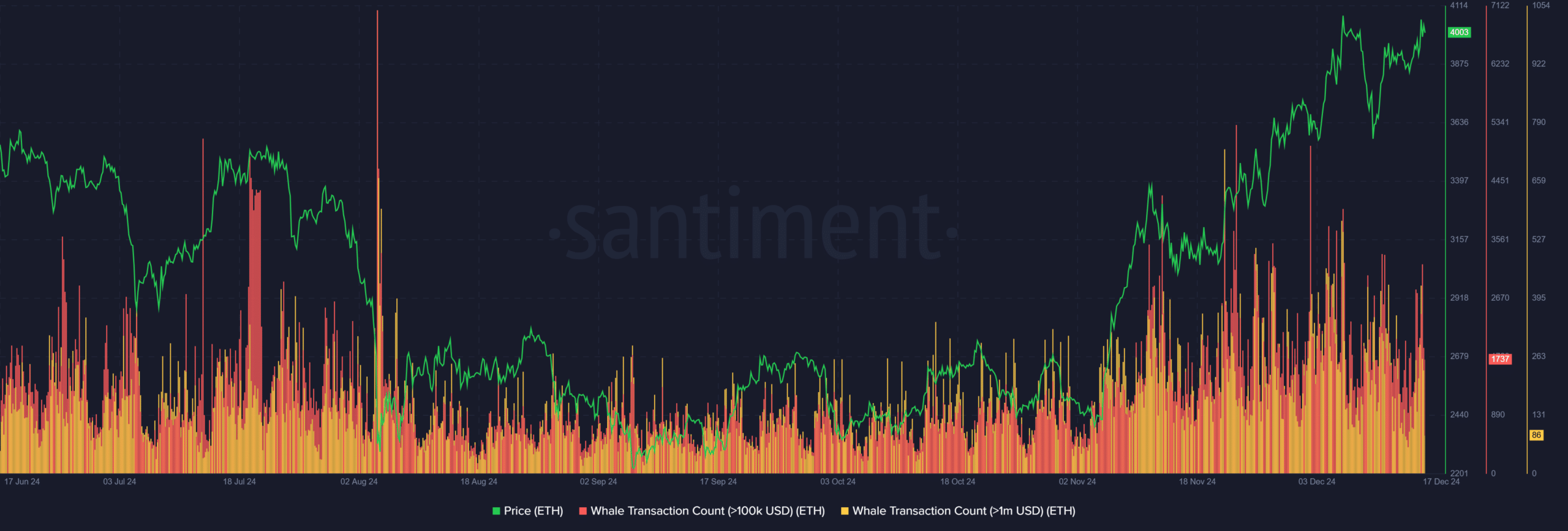

Whale accumulation in Ethereum has intensified alongside notable worth rebounds, mirrored in rising whale transaction volumes from over $100,000 to $1 million.

These giant traders, typically categorized as long-term holders (LTHs), act as stabilizing forces throughout unstable cycles, lowering provide shocks when sentiment turns bearish.

Their technique of accumulating on dips and holding on to uncertainty aligns with Ethereum’s upward worth trajectory in late 2024.

Supply: Santiment

Nevertheless, this focus raises a essential query: is that this a bullish signal or a bear lure? Whereas rising whale dominance alerts continued confidence and bullish momentum, it additionally will increase draw back danger.

A coordinated sell-off or exhaustion of shopping for stress might set off sharp reversals, highlighting the delicate stability between accumulation-driven optimism and a possible liquidity-driven correction.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now