Ethereum

Ethereum whales offload 5,677.7 ETH tokens worth $14.03 million

Credit : ambcrypto.com

- ETH was confronted with robust gross sales stress when the costs return from current Excessive.

- Ethereumwalfissen discharge 5,677.7 ETH tokens value $ 14.03 million.

After Market Restoration, Ethereum [ETH] Costs rose from a low of $ 1.7k to an area spotlight of $ 2.6k. Nevertheless, since reaching these ranges, the Altcoin has withdrawn and registers three consecutive days of losses.

On the time of the press, Ethereum was in truth traded at $ 2457. This meant a lower of three.97% on each day graphs.

With ETH that begins to fall, is the query of what the costs are pushing?

The gross sales exercise of Ethereum is growing

The evaluation of Ambcrypto emphasizes robust revenue realization at Ethereum buyers. After they’ve been beneath water for 2 months, they now take aggressive revenue.

The pattern is particularly noticeable with Ethereum-Walvissen, the place onchainlens reviews appreciable sale.

One whale deducted 4.677.7 from an Aave V3 and offered it for 11.52 million USDC for $ 2,463 per ETH. This whale purchased the ETH tokens initially a month in the past for $ 6.8 million USDC and made a revenue of $ 4.717 million.

One other whale collapsed 1,000 ETH value $ 2.51 million in Kraken after he had stored it for 4 years.

Initially this whale was admitted and a pair of,693 ETH value $ 5.7 million from Binance US, Coinbase and a Twister -Contant Pockets. After the current transaction, the whale nonetheless has 1,693 ETH with a price of $ 4.13 million.

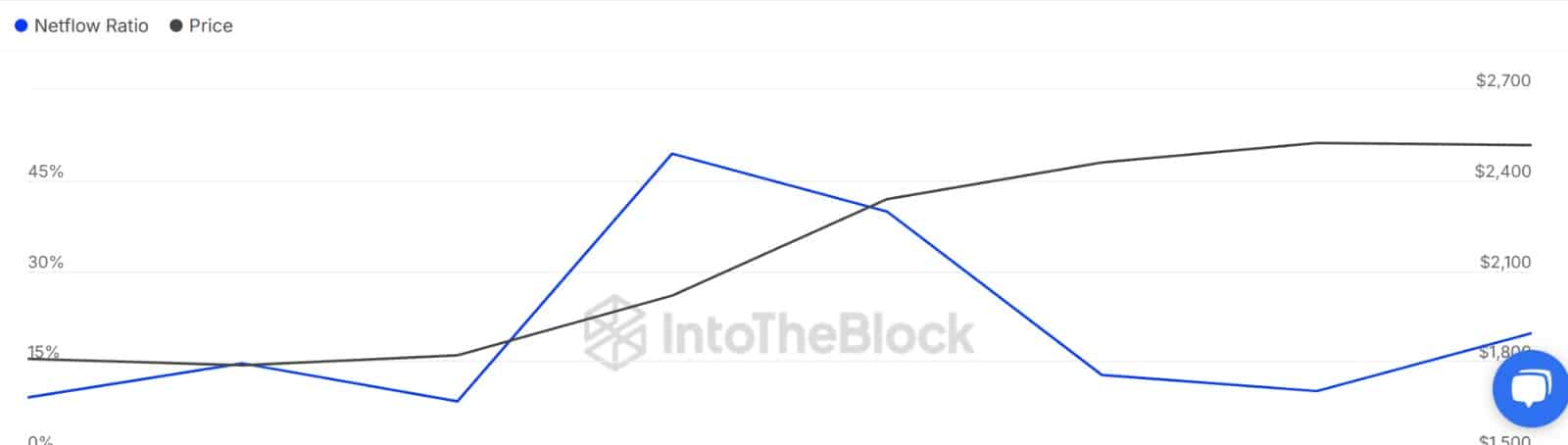

Supply: Intotheblock

Gross sales exercise appears widespread among the many massive holders of Ethereum. The large holders Netflow to vary the Netflow ratio fell to 10% when EHH $ 2.5k reached.

As the costs fell, massive holders resume gross sales, which pushed whale trade to 19%. This marks a rise of 9% within the exercise of whale-to-exchange exercise previously day, which intensifies the gross sales stress.

Supply: Cryptuquant

Now that promoting whales that flip to sale, most market members, even retailers and sharks appear to promote. Once we have a look at Ethereum Trade Netflow, it has develop into optimistic after 4 days of consecutive adverse Netflows.

A optimistic Netflow means that exchanges expertise extra deposits than recordings, which displays the next gross sales exercise.

Supply: Santiment

As such, the shortage of Ethereum has decreased as a result of there is a rise within the accessible ETH amount ETH.

The ETH shares-to-flow ratio has subsequently fallen from a weekly excessive level of 47 to 18, on the time of writing. This displays the rising provide at commerce festivals, which is normally a bearish sign, as a result of oversupply results in decrease costs.

What’s the subsequent step for ETH?

Growing whale gross sales have negatively influenced ETH markets, as may be seen in current tendencies. Often greater gross sales stress stimulates the costs decrease as buyers load the revenue to guard the revenue or forestall deeper losses.

If the present gross sales exercise continues, ETH may be additional fallen, making it attainable to help about $ 2,188. Nevertheless, if consumers seize the retrace as an entry possibility, ETH nonetheless has development potential.

In that case it might attempt a rise to $ 2,864.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International