Ethereum

Ethereum whales play their part as ETH repeats 2019 pattern: What’s next?

Credit : ambcrypto.com

- Ethereum displays the 2019 sample.

- The biggest holders of ETH have been steadily accumulating extra since 2019.

Ethereum [ETH] remained the second-largest cryptocurrency, with market sentiment shifting from bearish to bullish as 2024 nears its finish.

Ethereum’s worth motion mirrored the 2019 sample on the ETH/USD pair, the place a rising wedge fashioned.

This cycle’s increased wedge lows have been ten instances larger than 2019’s.

In 2019, Ethereum’s worth fell under the rising wedge earlier than the Federal Reserve’s first price reduce, a scenario much like what occurs in 2024.

Supply: TradingView

After the 2019 price reduce, each ETH/USD and ETH/BTC bottomed out, forming a robust confluence.

The present sample is predicted to repeat this success, with the value prone to break under the wedge, draining liquidity earlier than turning upside once more in late This autumn 2024 or early Q1 2025.

Nonetheless, if the value stays under the rising wedge for an prolonged time period, additional evaluation could also be vital to regulate methods or decrease potential losses.

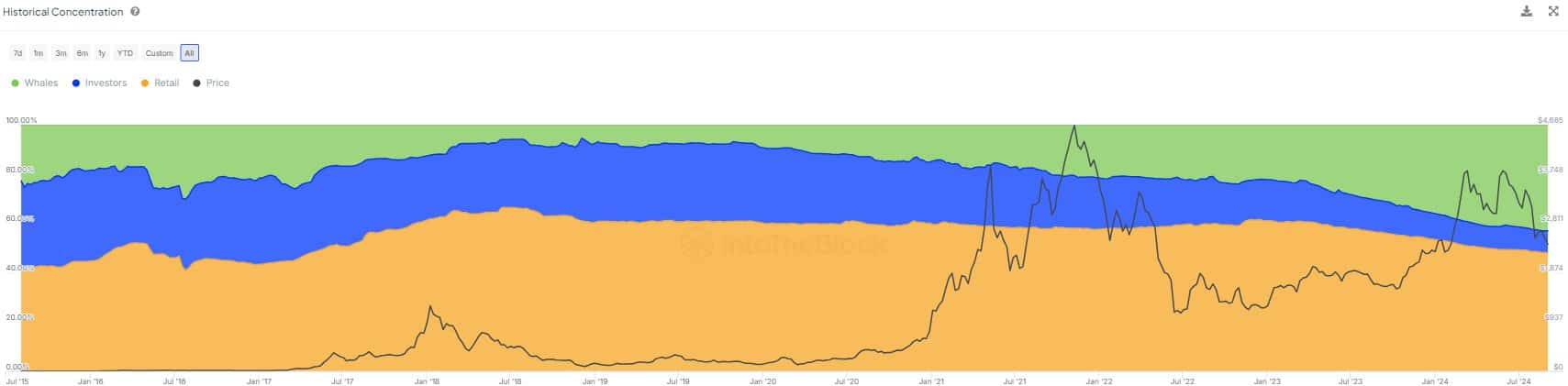

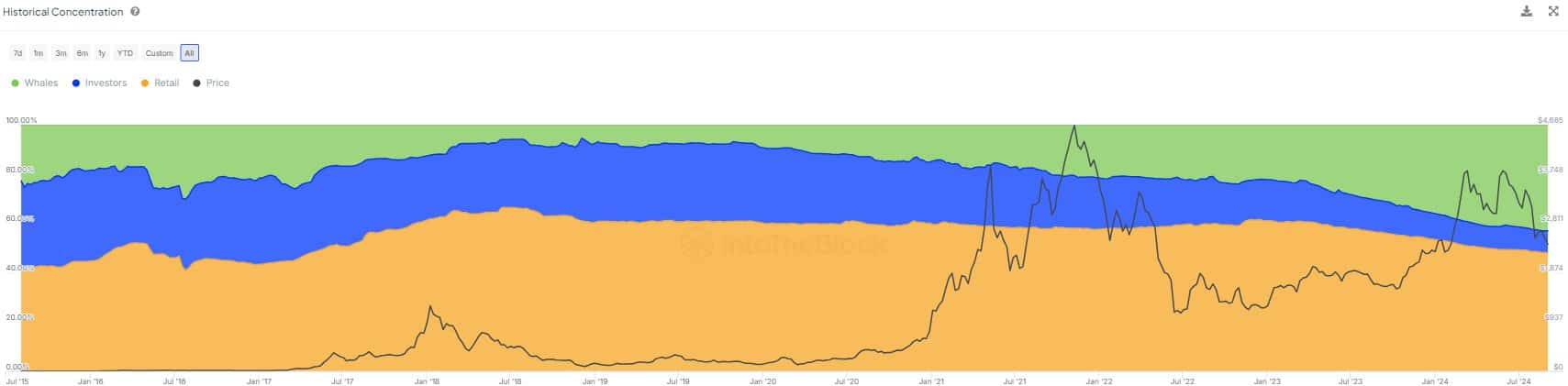

Whales proceed to build up

Whales play an essential function in supporting this anticipated upward motion. Ethereum’s largest holders have steadily gathered extra ETH since 2019, and this pattern intensified after the Shanghai improve in early 2023.

On the time of writing, whales managed over 43% of Ethereum’s circulating provide, bringing them nearer to retail buyers’ 48%.

This accumulation signifies that these main gamers anticipate Ethereum’s worth to maneuver increased over time.

Supply: IntoTheBlock

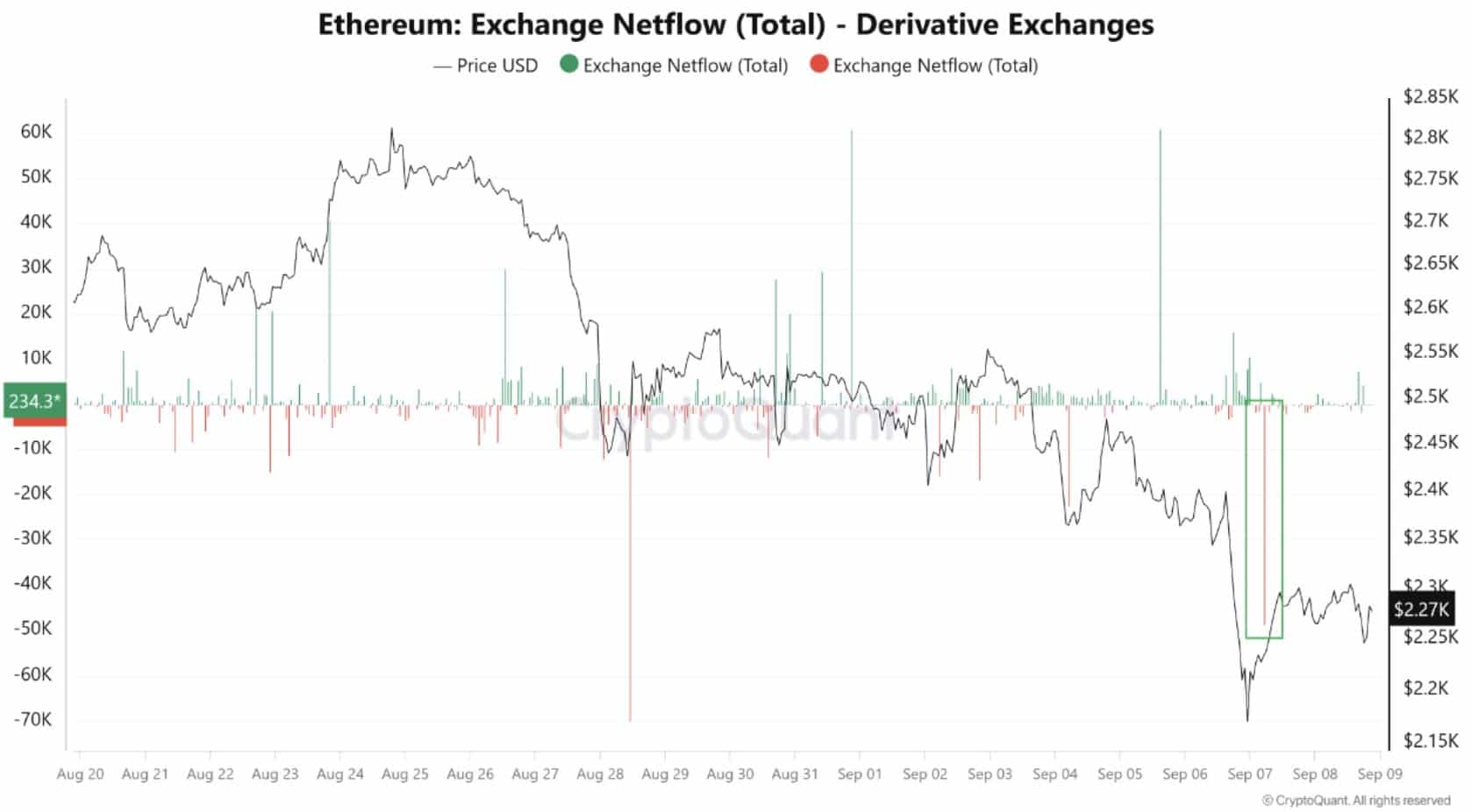

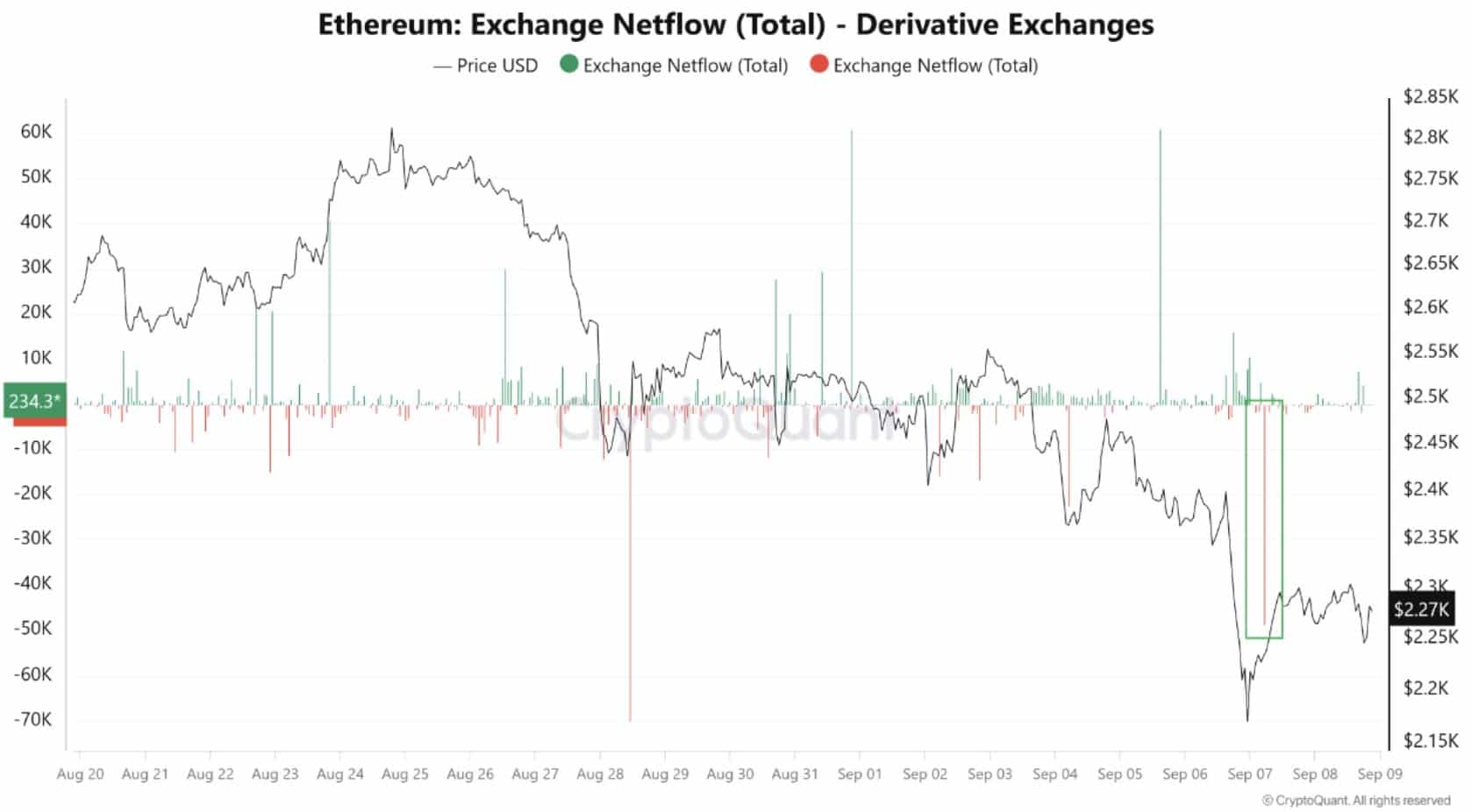

ETH trade internet flows

Taking a look at Ethereum’s internet stream, knowledge confirmed that unfavourable internet stream on derivatives exchanges has exceeded 40,000 ETH.

This prompt that extra ETH was being withdrawn from these exchanges and transferred to chilly wallets, indicating diminished promoting stress.

Merchants could also be getting ready for long-term good points, suggesting that the present drop in Ethereum’s worth is a short lived correction, doubtlessly paving the way in which for a major upward transfer.

Supply: CryptoQuant

Learn Ethereum’s [ETH] Value forecast 2024–2025

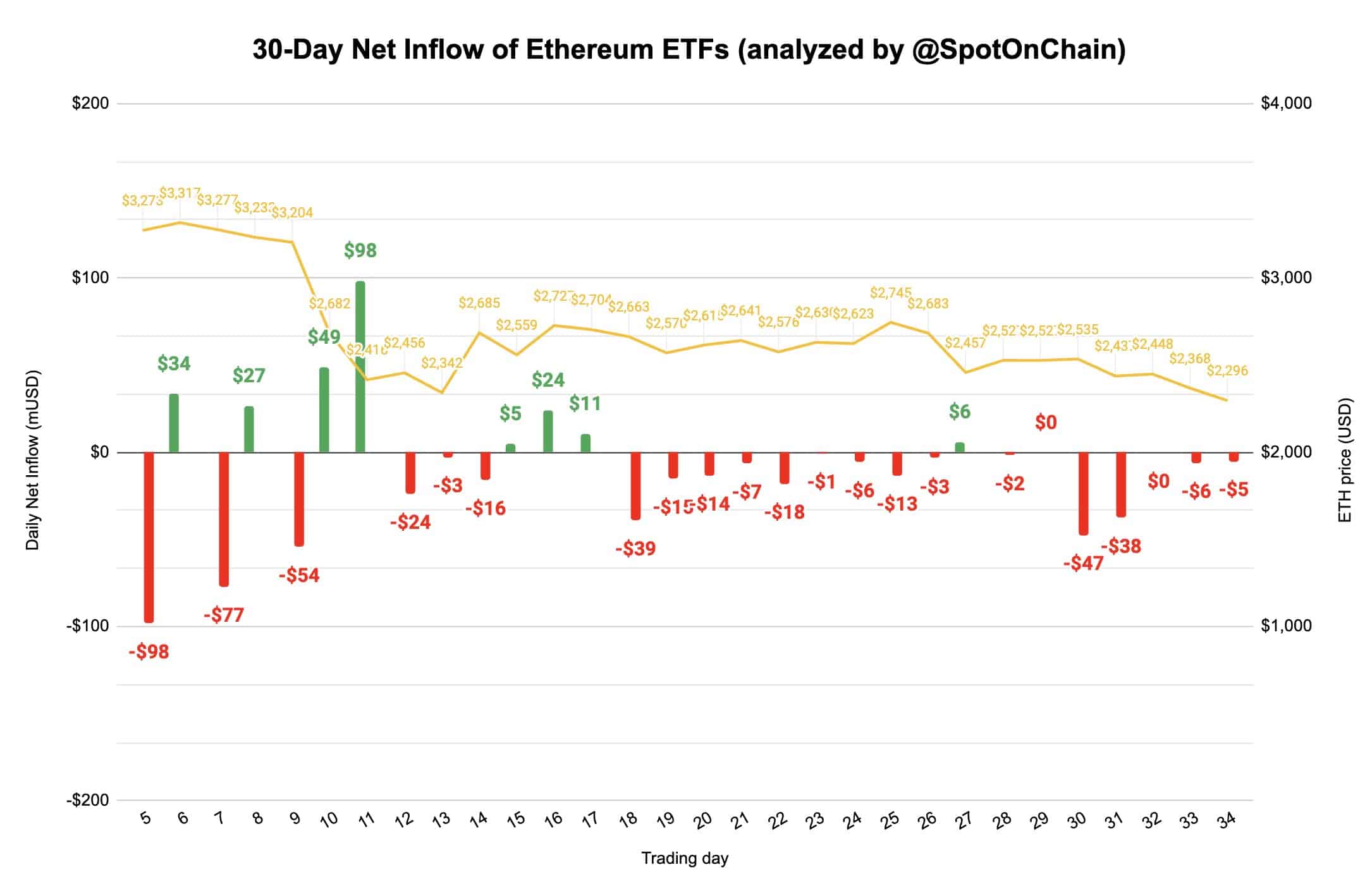

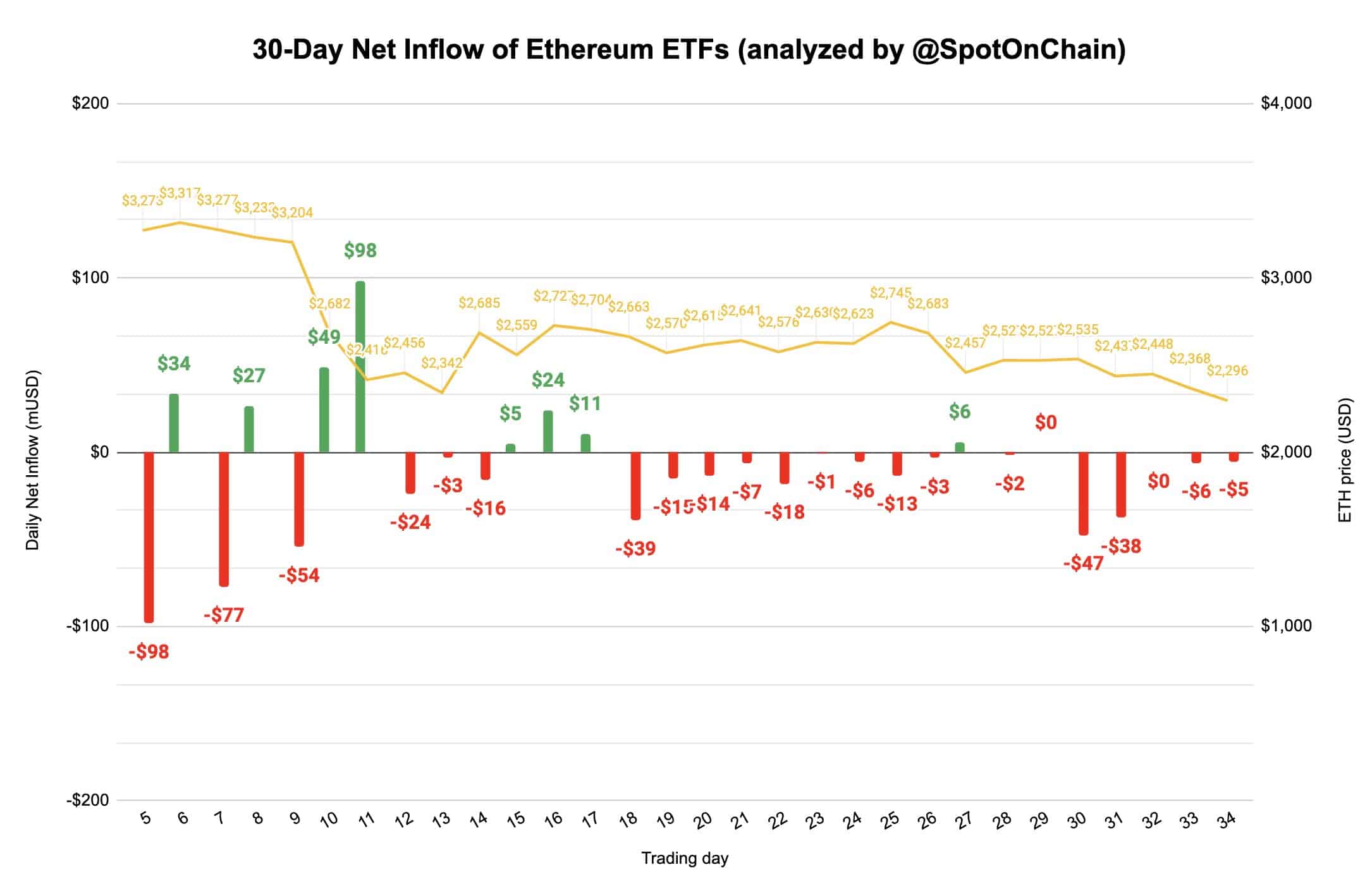

Ethereum ETF replace

Regardless of some unfavourable internet flows in Ethereum ETFs, there are constructive indicators. ETH ETFs, together with Constancy’s, noticed inflows over the previous 24 hours. Grayscale’s ETHE had the most important and solely outflow.

Nonetheless, the general constructive sentiment surrounding ETFs might finally assist Ethereum’s future worth development.

Supply: Spot On Chain

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024