Ethereum

Ethereum: Why THIS analytics firm expects ETH to hit $6K in 2025

Credit : ambcrypto.com

- ETH might gather larger per ambient information if the American spot ETF deployment has been authorized.

- The choice market was positioned in December 2025 for an upward objective of $ 6K upward ETH.

Ethereum’s [ETH] Current 70% run-up from April Lows might be the beginning of a bigger uptrend geared toward $ 3.5k $ 6K, based on crypto choices evaluation firm Amberdata.

In its weekly market reportAmbergates Greg Magadini wrote,

“There’s a good argument for ETH ‘catching up’, as a result of spot ETFs with strike rewards generally is a catalyst for institutional participation and sentiment is all about. No purpose to ‘name tops’ now.”

Eth -catalysts

The SEC has postponed its resolution on the preparation of requests for spot eth ETFs from Grayscale and Hashdex, which pushes the evaluation interval between June and October.

However most analysts, together with Magadini, imagine that this additional look (3% per yr) generally is a key catalyst To the demand for spot eth ETFs, finally collect ETH.

Actually, the manager energy pointed to latest sturdy bullish devices geared toward $ 3.5k and $ 6K on the finish of the yr, suggesting that merchants place such a state of affairs.

“Eth Block Trades Final week noticed a really bullish stream in Eoy December choices. $ 3,500 / $ 6,000 name spreads traded for 30,000x contracts by way of 10 totally different transactions. The full premium issued right here was simply over $ 7 million. ”

Bullish bets or safety for the profit are on name choices, which is a mirrored image of bullish sentiment for future worth promotion. Quite the opposite, quite the opposite, refers back to the reverse and downward safety, underlines a bearish bias.

Merely put, the merchants anticipated ETH to satisfy between $ 3.5k and $ 6K by December 2025.

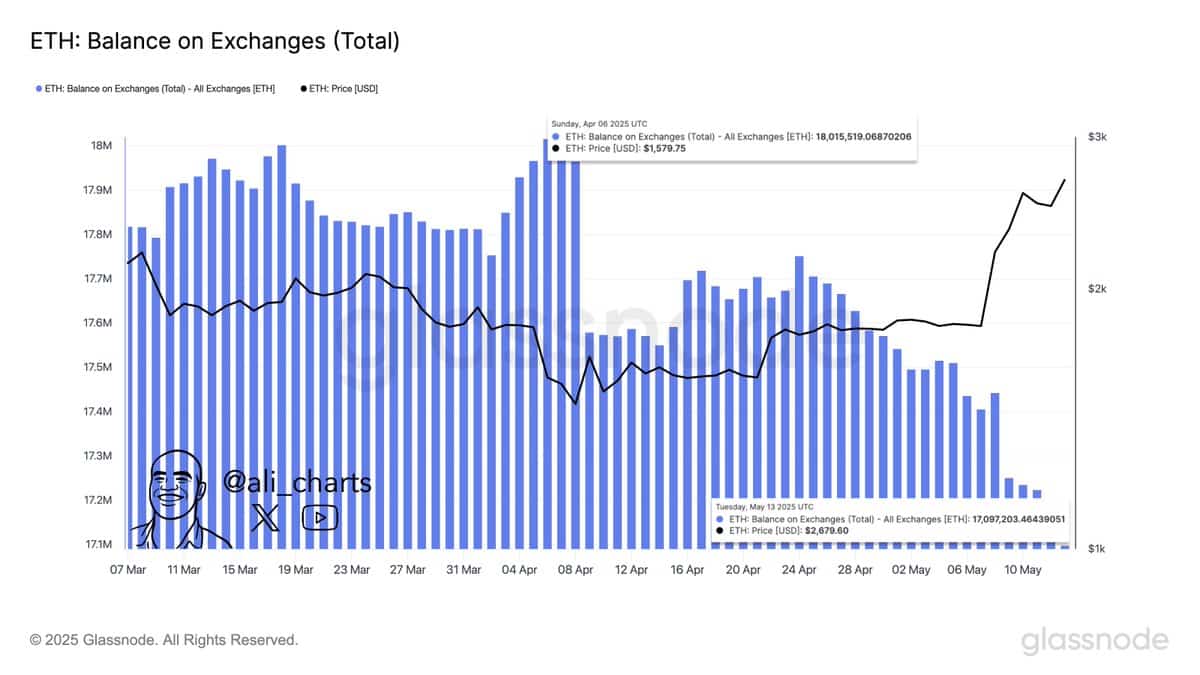

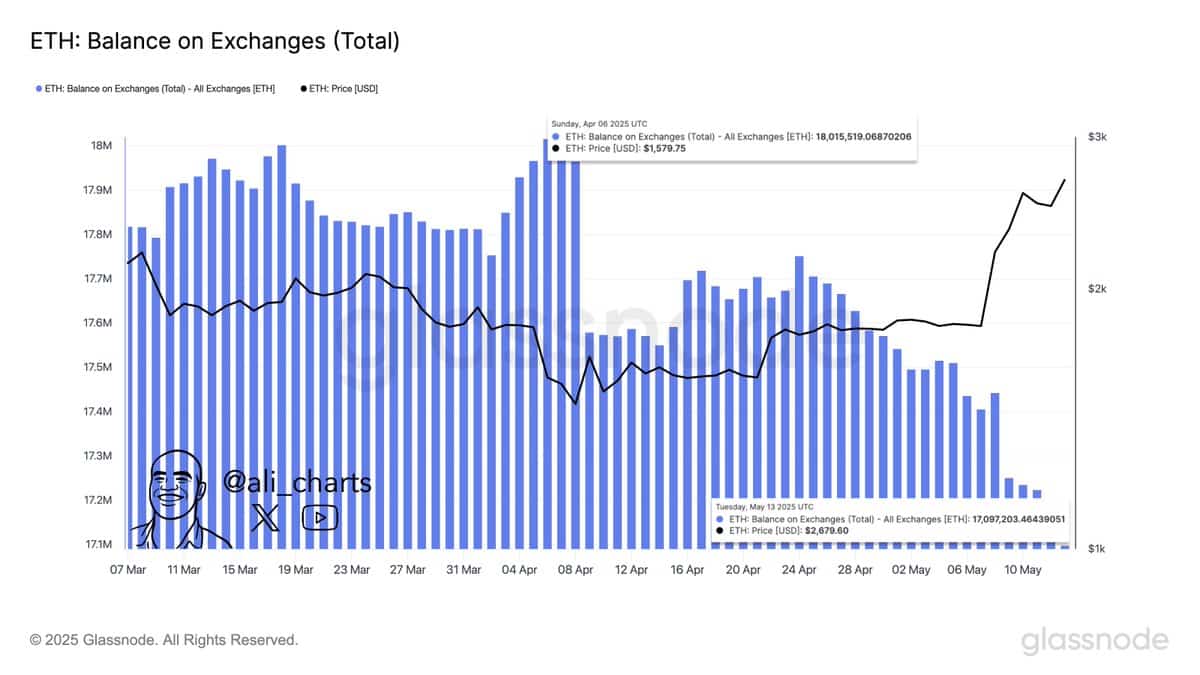

Information on the chain additionally supported the continual Uptrend thesis. Since April, greater than 1 million ETH (round $ 2.38 billion) have been moved from commerce gala’s between April and mid -Could.

This mirrored wider accumulation within the midst of the renewed Altcoin over voltage.

Supply: Glassnode

That could be a important discount in gross sales strain that would additional stimulate the rally. Regardless of the medium bullish-outlook, the momentum of ETH weakened considerably on the time of the press within the quick time period.

In accordance with Crypto Dealer and Analyst, Income menETHs on stability quantity (OBV) withdrew, which suggests {that a} lowered quantity might drag the rally.

Supply: Earnings sharks/x

By the way in which, he added That the formation of a bearish major and shoulder sample ETH can drag decrease whether it is validated.

On the day by day worth chart, nevertheless, ETH flashed a Golden Cross, a formation that typically precedes strong rallies.

Supply: Eth/USDT, TradingView

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024