Ethereum

Ethereum: Why this could be the right time to buy ETH

Credit : ambcrypto.com

- ETH traded inside a falling channel akin to energetic addresses and MVRV flashed accumulation alerts.

- Whales and OGs have been unloading, however Metrics urged a possible soil formation of the market.

Ethereum [ETH] Lengthy-term holders have formally entered ‘capitulation’ territory, with the LTH-NUPL metriek being purple in purple for the primary time in months. This shift displays the rising losses with seasoned holders and infrequently signifies the ultimate part of a bearish cycle.

On the time of the press, Ethereum traded at $ 1,591.63, with a rise of seven.32% within the final 24 hours.

In different phrases, even with lengthy -term downward strain, factors within the quick time period worth promotion now refers to a doable momentum shift.

ETH worth promotion, consumer exercise and mvrv -signal market stress

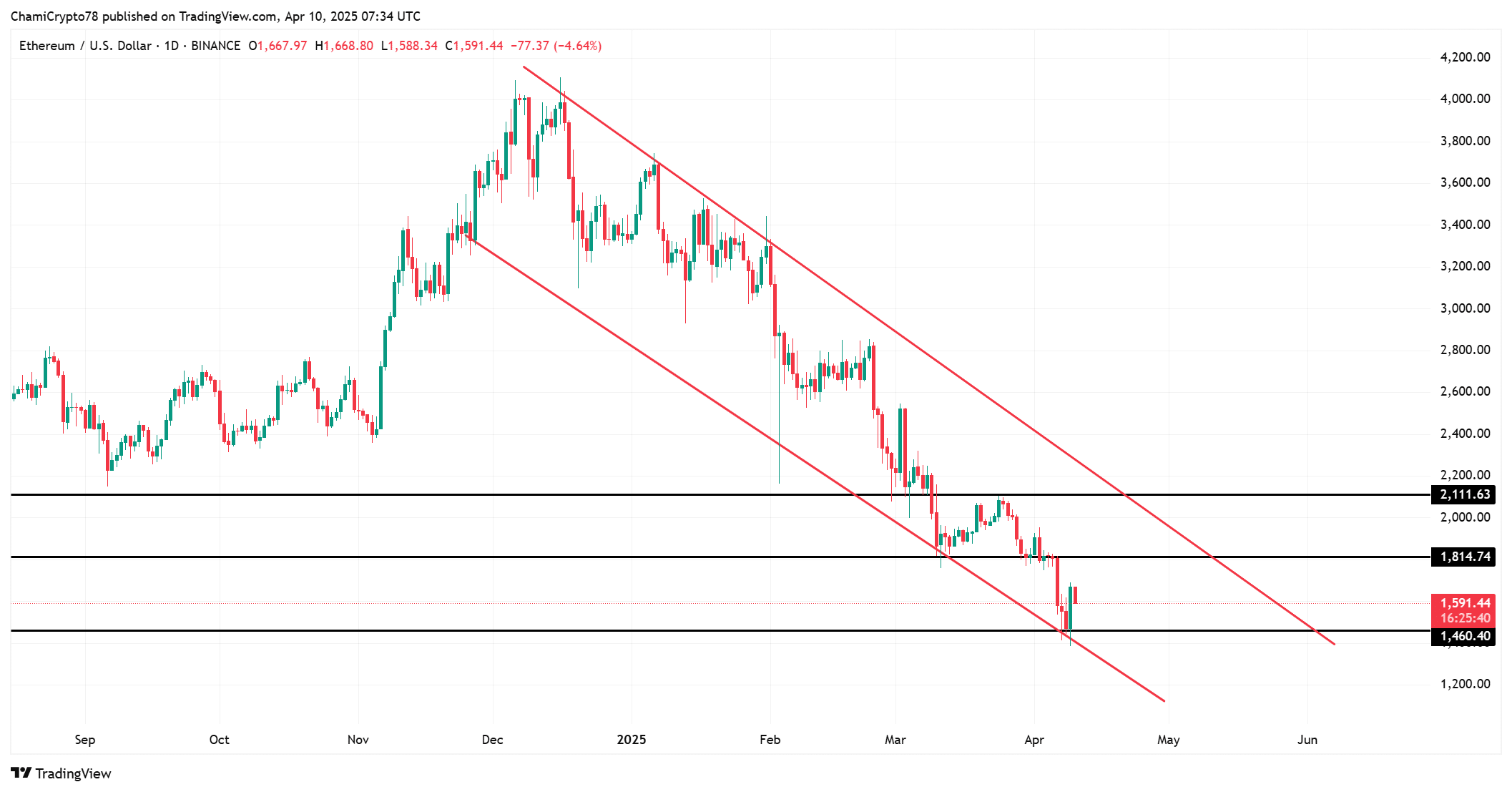

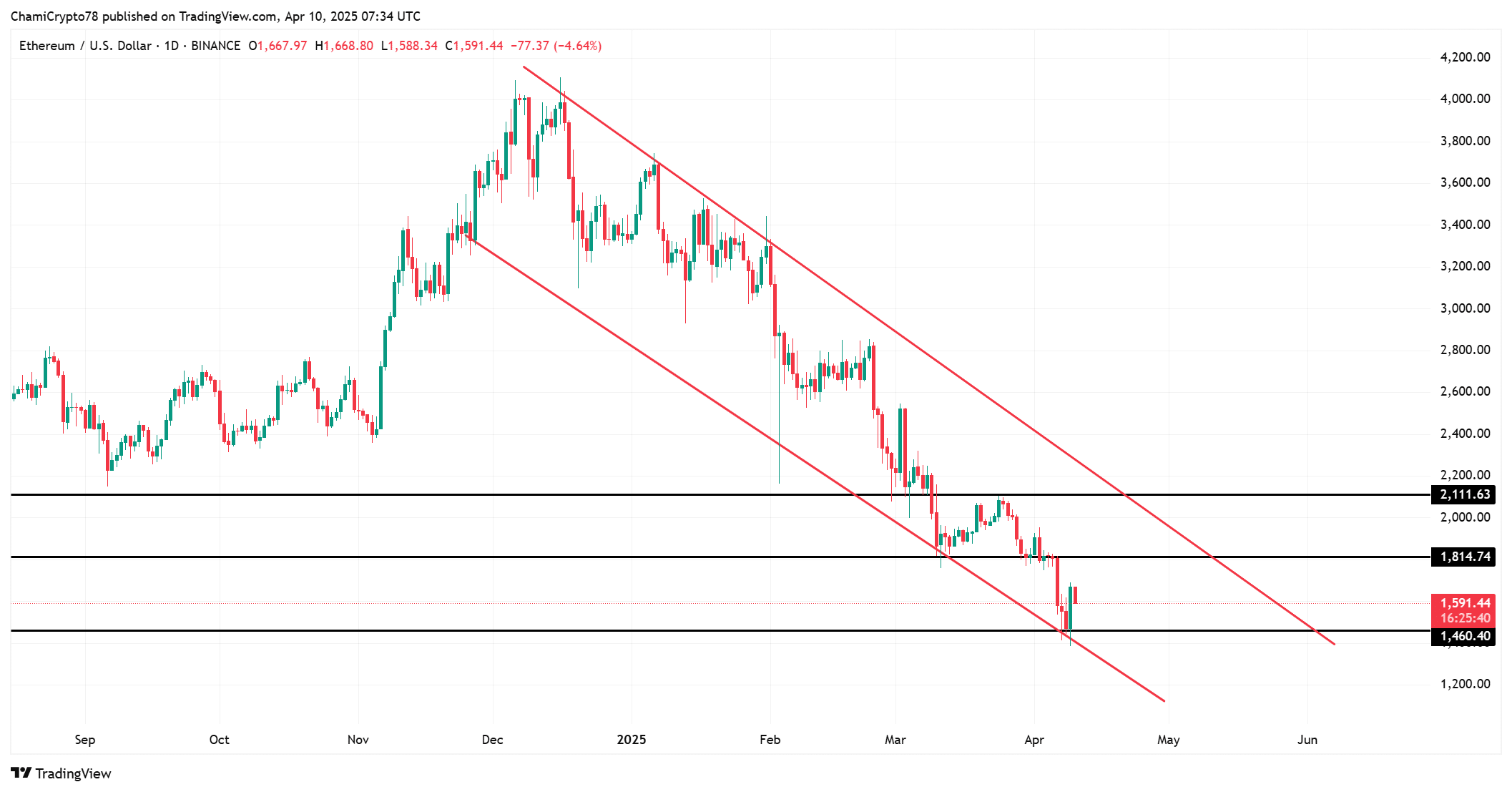

The Ethereum worth motion is restricted to a steep falling channel, characterised by constantly decrease highlights and lows since November 2024.

After strongly coming back from the $ 1,460 help zone, the worth is now confronted with resistance close to $ 1,815, a degree the place bears might attempt to assert management.

That mentioned, if the bulls achieve reclaiming the extent of $ 1,815, this might shift the market construction to Bullish and be the scene for a problem of the resistance of the higher channel.

Nonetheless, till this occurs, the shut strain will live on, with potential retests of essential help ranges when the momentum disappears.

Supply: TradingView

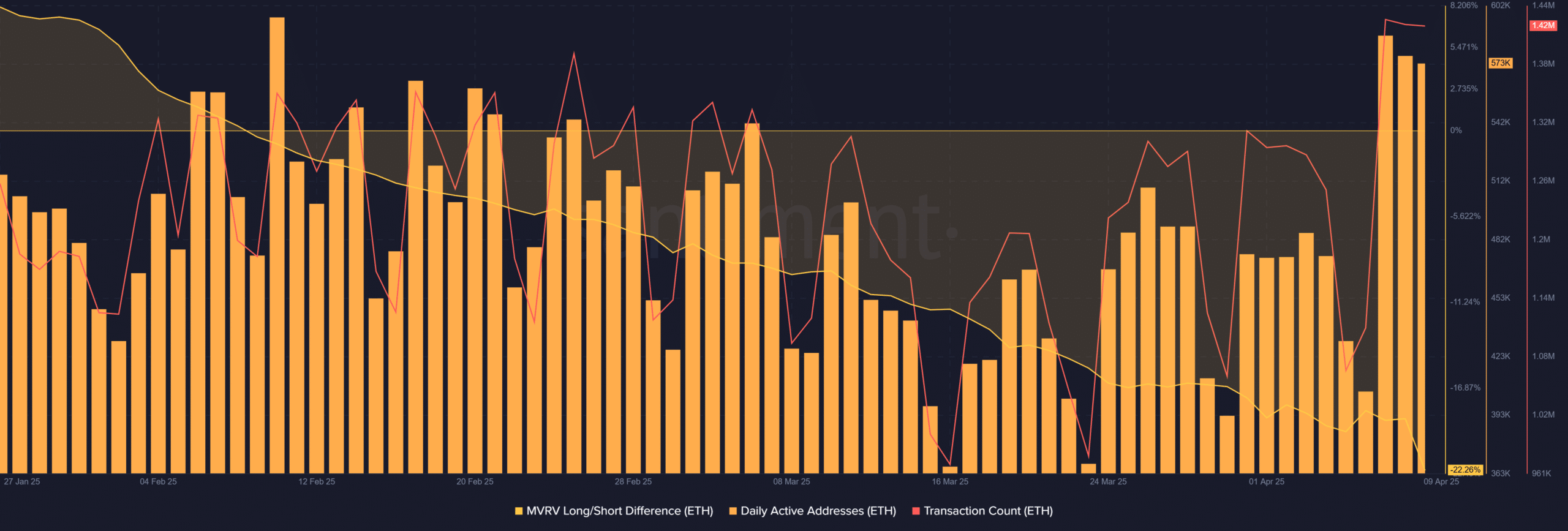

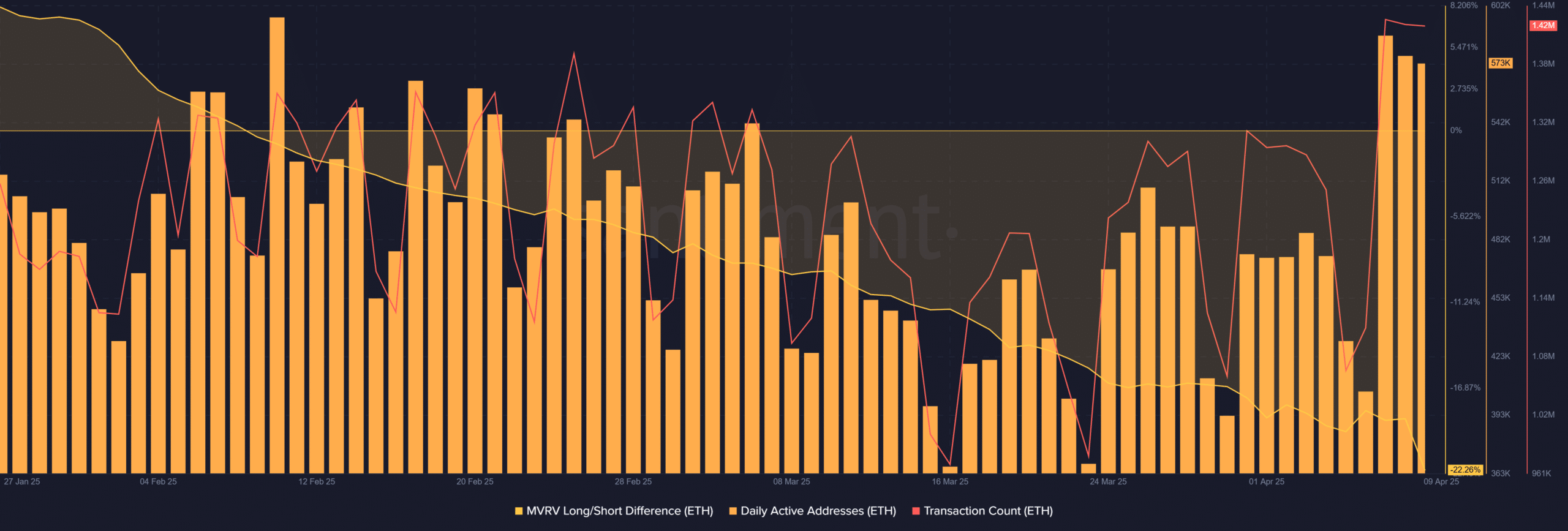

Within the meantime, exercise on the chain tells a distinct story.

Day by day energetic addresses have risen to 573,000 and the variety of transactions hit 1.42 million on April 9, which marks a substantial peak in consumer involvement.

This elevated participation – unclear worth weak point – suggests growing curiosity within the Ethereum ecosystem at lowered costs.

Furthermore, the MVRV -long/quick distinction has fallen to -22.26 %, a degree that’s typically related to most ache and splendid accumulation throughout historic soils.

Supply: Santiment

Whale actions and OG gross sales verify capitulation risk-off temper

Curiously sufficient, whale conduct is intensified.

Greater than 530,000 ETH has been moved over giant portfolios up to now week, which normally signifies strategic accumulation or once more in stability.

Much more telling is a sleeping Ethereum OG who acquired ETH in 2016 and discharged 10,702 ETH price $ 16.86 million at simply $ 1,576.

Fascinating is that tHis whale constantly solely offered during times of essential market corrections, in order that the turnover was even averted when Eth $ 4,000 exceeded.

Such actions could point out strategic outputs or makes an attempt to psychological manipulation which are designed to impress panic within the retail commerce, making the stage for closing market restoration.

Is one of the best time to purchase Ethereum now?

Ethereum’s long-term holder capitulation, excessive MVRV measurements and elevated whale exercise all level to a standard accumulation setup. The rising community use provides additional affirmation that the rate of interest stays sturdy beneath the floor.

That’s the reason all alerts, regardless of the quick -term volatility, point out that Ethereum is appearing in a turning zone with a excessive chance.

Sensible traders can see this as among the best entry factors for danger rewards earlier than the following bullish leg unfolds.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now