Ethereum

Ethereum: Why this weekend could set the stage for a $3K breakthrough

Credit : ambcrypto.com

- Ethereum has all the best causes to take a $3K gamble this weekend

- However first some pace bumps must be addressed

Amid post-election liquidity, altcoins are surging to new highs. Ethereum [ETH] is up greater than 15% to cross $2.9,000 for the primary time in 90 days. In the meantime, Bitcoin’s historic decline in reserves is fueling FOMO, paving the way in which for alts to observe go well with.

Nevertheless, ETH is dealing with headwinds: a sleeping whale holding $1.14 billion value of ETH has been reactivated, elevating fears of a sell-off. Regardless of the sturdy inflows, ETH continues to lag Solana, which is closing in on $200.

With Bitcoin focusing on $78,000, ETH’s path to regaining dominance might be an uphill climb.

The approaching weekend can be essential for Ethereum

Bitcoin dominance dropped from nearly 61% after reaching the ATH to about 58% on the time of writing. In the meantime, Ethereum’s market share has elevated over the identical interval and is now approaching 14%, signaling a capital shift in the direction of altcoins.

As anticipated, the mid-November cycle is essential for the altcoin market. Now that the election buzz has subsided and the market is getting into a section of utmost euphoria, altcoins are primed for a possible surge.

Nevertheless, this situation can solely happen if Bitcoin holds its floor between $74,000 and $78,000. A BTC consolidation would create the perfect situations for traders to give attention to high-cap alts, in keeping with the present market sentiment.

The FOMC charge minimize additional helps short-term holders to carry their BTC. Whereas there could also be some dumping this weekend, a significant downward spiral is unlikely.

Ethereum bulls are able to benefit from this case. As weaker arms shake out, concern may drive traders to Ethereum, probably setting the stage for a push in the direction of $3K.

But there are nonetheless loads of hurdles forward

After a shaky begin to November, Ethereum’s revival is outstanding. In October, ETH struggled, struggling three rejections and failing to interrupt above $2.7K, with pullbacks hampering momentum within the bull market.

In the meantime, Solana has turn into the highest altcoin, breaking the $160 ceiling with minimal setbacks. The truth is, SOL lately flipped BNB to safe the fourth spot and is now approaching a market cap of $100 billion.

So it is not onerous to think about Solana stealing the highlight once more. Moreover, the 8-year whale cashing in on good points may gasoline unfavourable sentiment, probably holding Ethereum again from testing $3K.

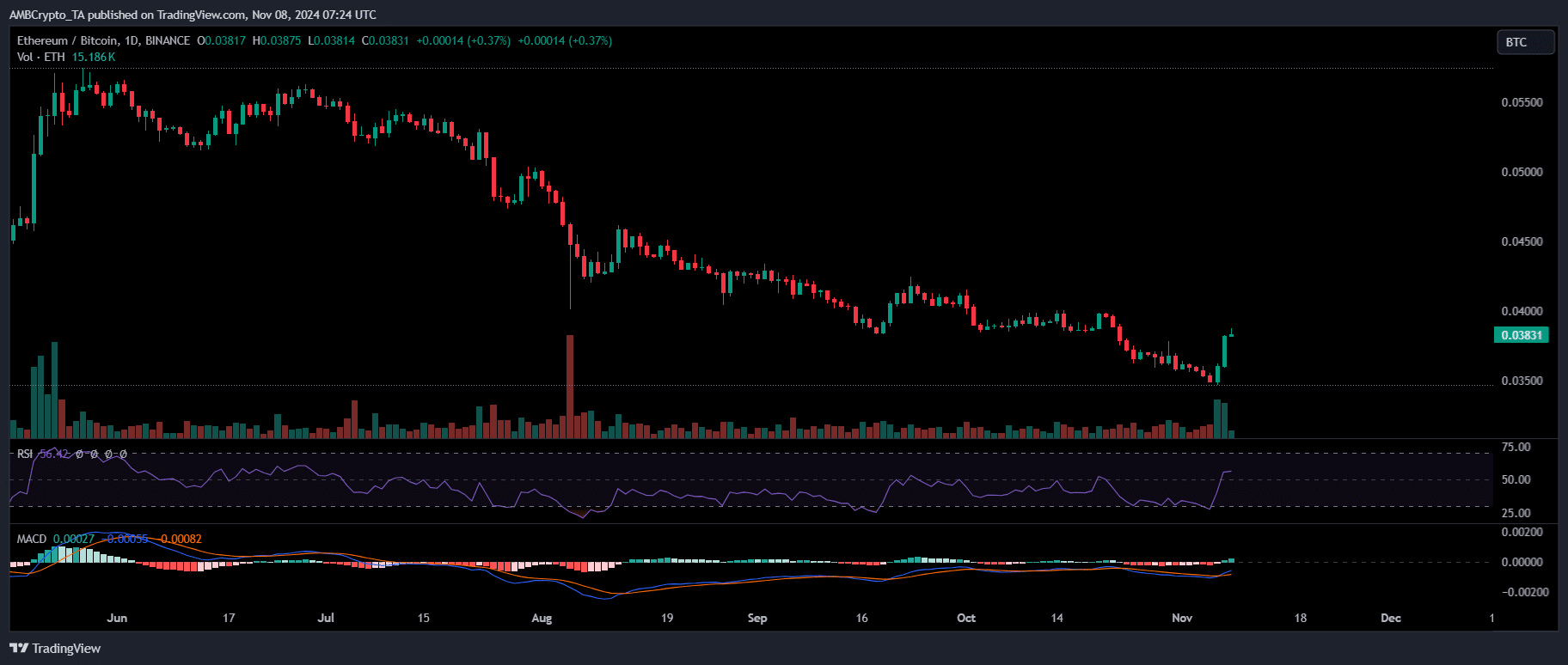

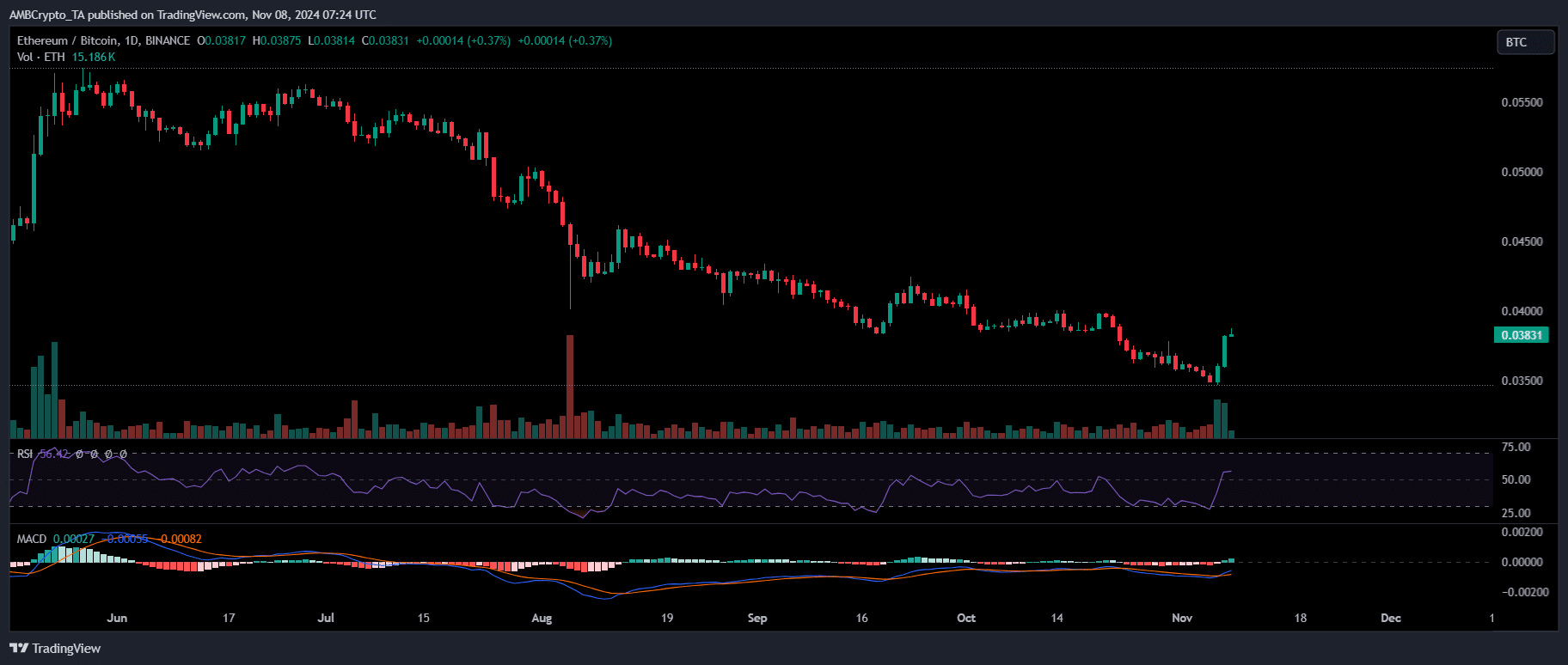

Supply: TradingView

Regardless of these challenges, Ethereum’s rising dominance over Bitcoin has caught the eye of AMBCrypto. After greater than 5 months, ETH has lastly outperformed BTC.

In consequence, the revenue is 80% cohorts will probably maintain their ETH, making a weekend pullback much less probably. That is supported by a number of components: BTC stays steady within the $74K-$78K vary, ETH attracts liquidity, and short-term holders stay in place.

Nevertheless, the affect of whales and long-term homeowners shouldn’t be neglected. If dormant whales reawaken, this might put ETH in a troublesome place. A robust catalyst could also be wanted to assist Ethereum overcome these potential challenges.

The catalyst ETH wants is right here

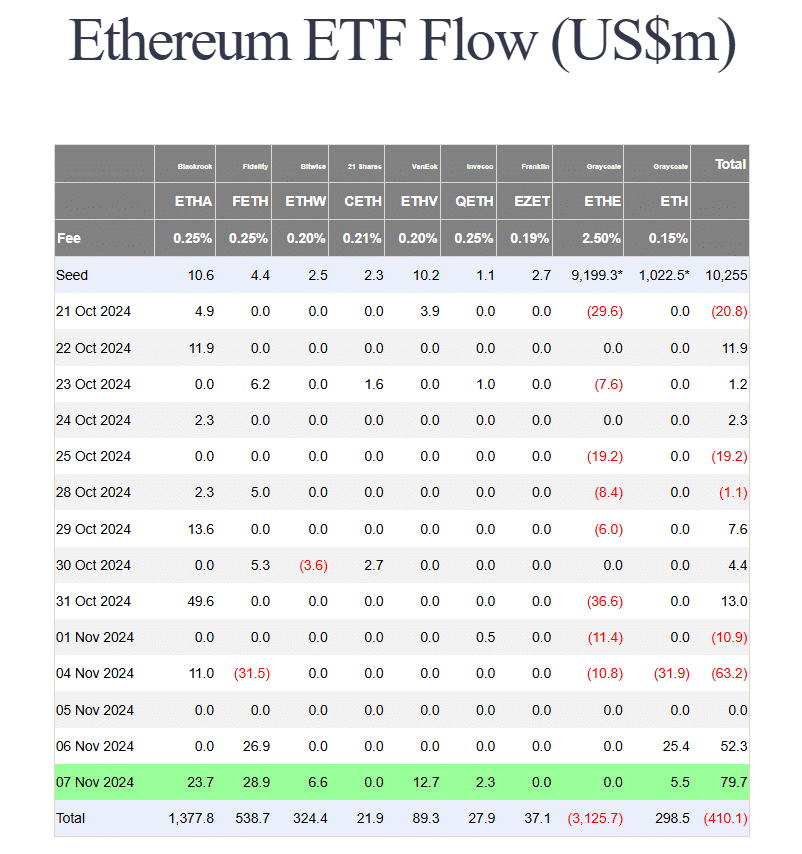

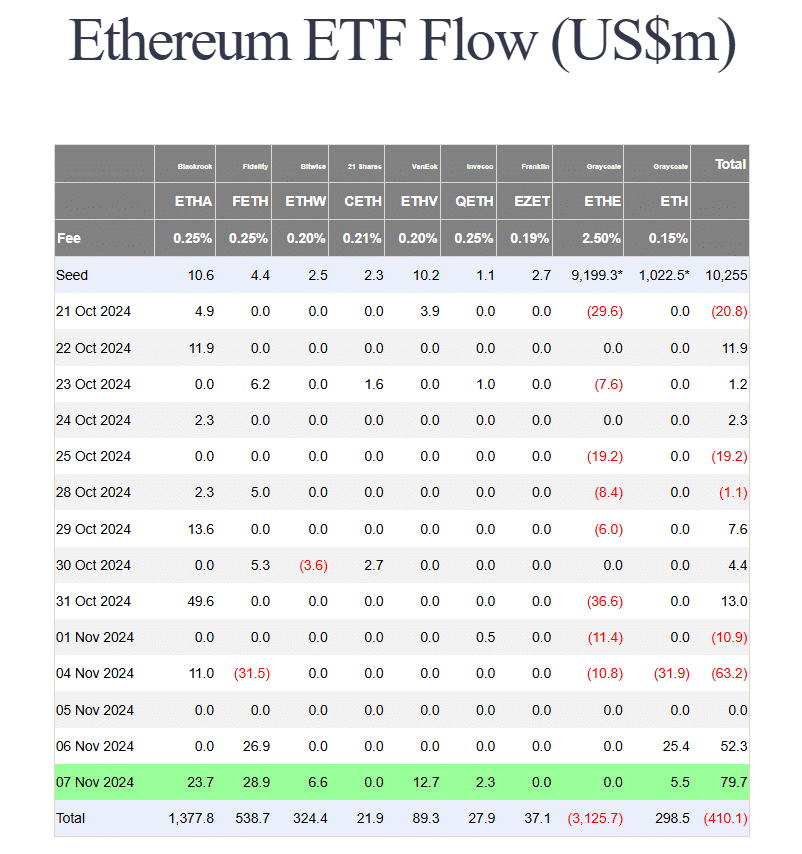

Over the previous two weeks, cumulative flows have been -$75 million, largely on account of components that stalled ETH’s rally in October. But, the primary components that held ETH again this yr – poor ETH ETF efficiency and low seasonality – are actually prone to reverse.

Even modest, regular flows might help ETH rise, particularly as Ethereum stays the one altcoin apart from Bitcoin with a visual and obtainable ETF product.

Supply: Farside Traders

In brief, Ethereum’s rising publicity to the institutional panorama may act as a significant catalyst, easing the aspect stress that would push ETH down.

Learn Ethereum’s [ETH] Value forecast 2024–2025

Regardless of issues that ETH will fail to draw liquidity from its ETFs, a reversal on this development would create the best momentum, permitting Ethereum to proceed taking part in the long run and probably regain its dominance.

With spot ETFs seeing the very best inflows of virtually $80 million, breaking a two-month droop, there’s a good probability that ETH will attain $3K by the top of this month.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now