Ethereum

Ethereum’s 3% bluff: Will ETH remain above $2.5K or fall to $2.3K?

Credit : ambcrypto.com

- Ethereum noticed a notable worth surge, testing the essential $2,500 resistance degree.

- Will the bulls preserve the momentum, or will the bears regain management?

Ethereum [ETH] suffered a big pullback in the beginning of the final week of August, wiping out many of the good points it made through the first week of the month when the altcoin examined the $2,700 ceiling.

Nonetheless, the bearish tone that began September modified as ETH rose greater than 3% prior to now 24 hours to commerce at $2,521 on the time of writing.

Curiously, the altcoin seasonal index fell regardless of the value improve, indicating weak investor confidence within the ongoing bullish development.

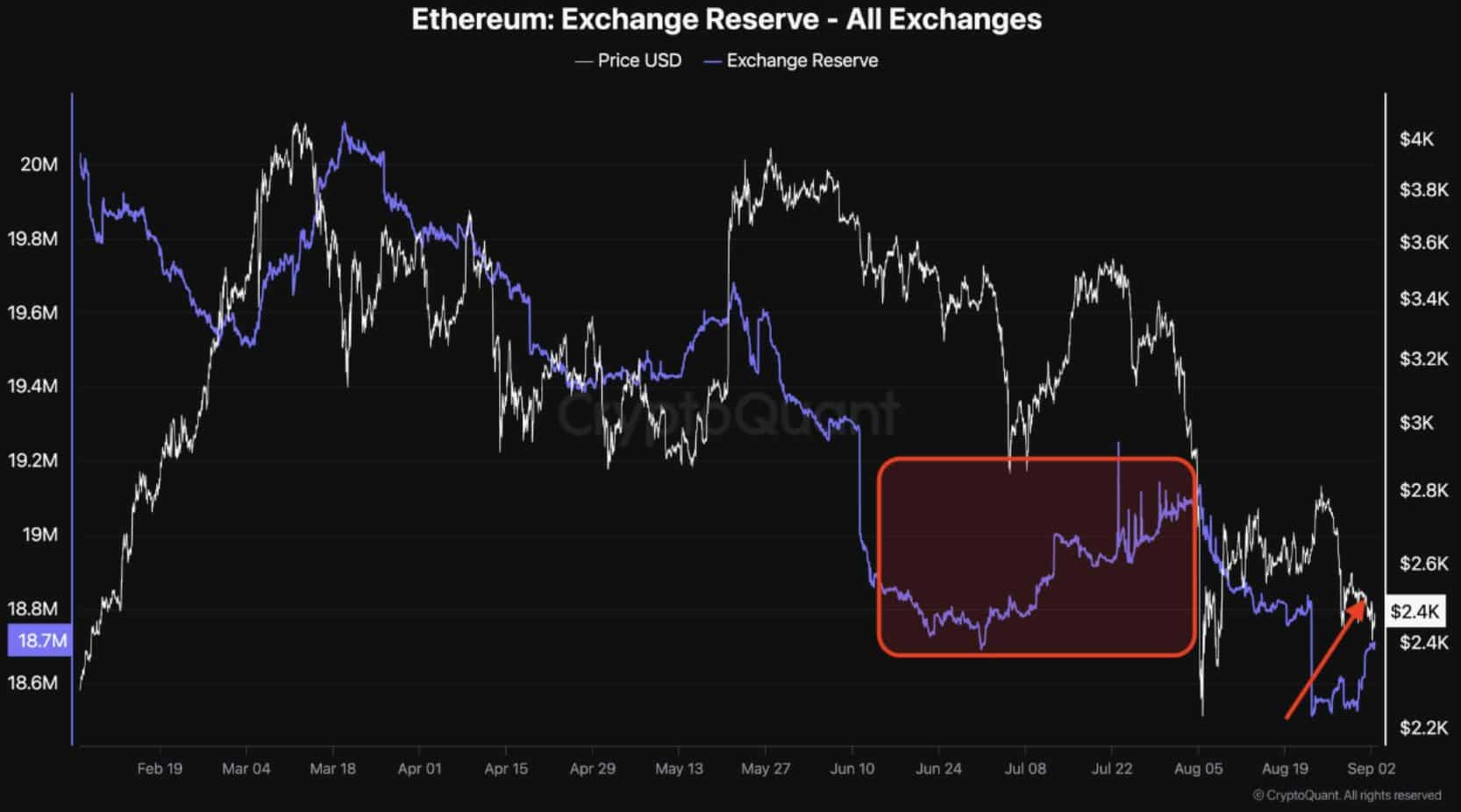

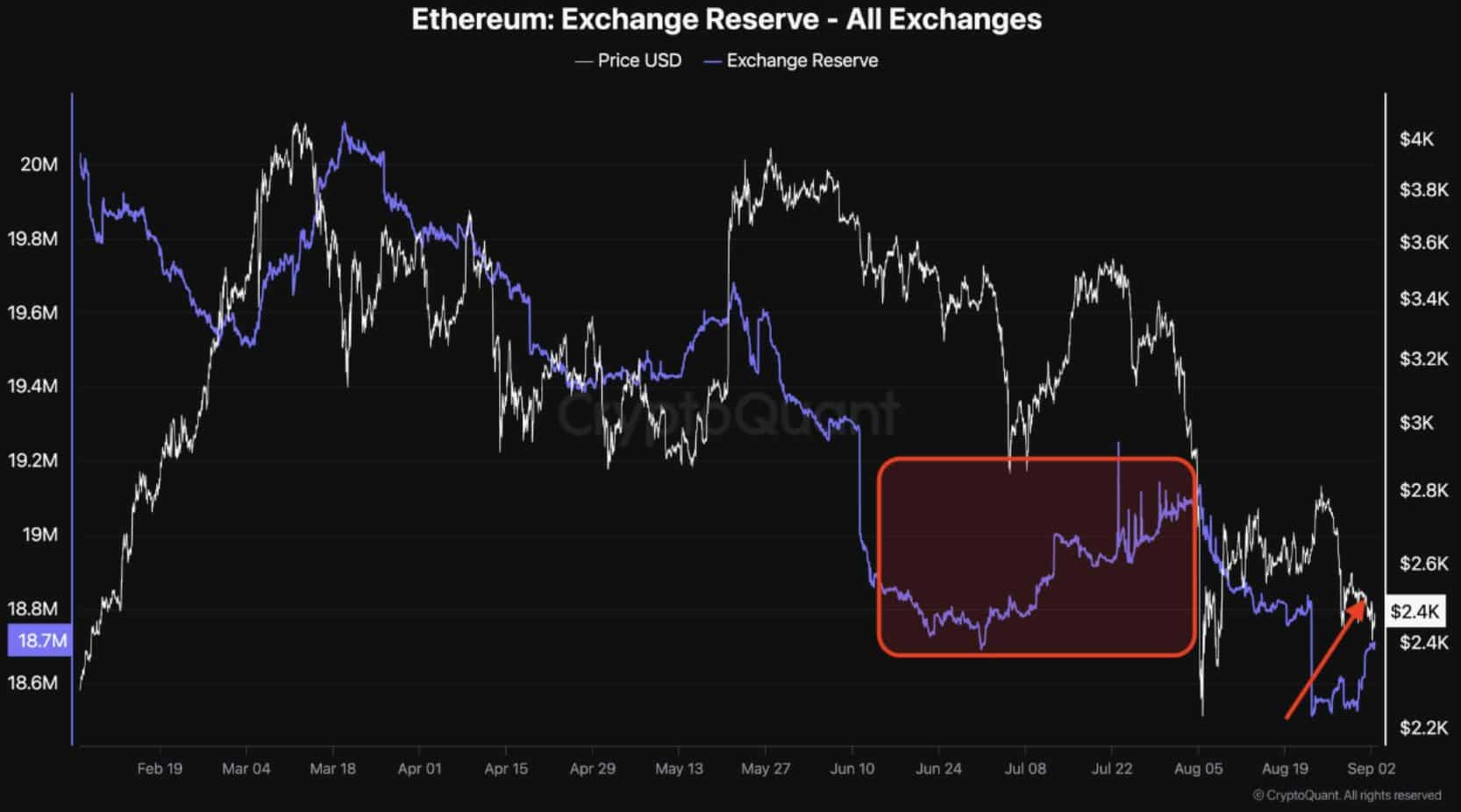

Backed by rising ETH trade reserves

In a single aftera outstanding crypto analyst highlighted an necessary improvement, indicating the start of a distribution part.

Merely put, the notable spike in ETH trade reserves indicated that extra merchants are making the most of the current surge by shifting their income to exchanges earlier than the hype dies down.

Supply: CryptoQuant

In accordance with AMBCrypto’s evaluation of the chart above, each time ETH closed close to its resistance degree, it was accompanied by a rise in ETH trade reserves.

For instance, when ETH examined the $4,050 resistance earlier in March, its foreign money reserves rose from $19.5 million to $20.8 million.

Equally, when ETH’s worth rose above the $2,800 ceiling final month, rising foreign money reserves led to sturdy resistance, stopping bulls from pushing the value larger.

Consequently, the value returned to the $2,390 assist degree.

Since then, nonetheless, bulls have been eagerly awaiting a worth correction. So is the current 3% acquire the important thing to a rally?

No assure of a bullish rebound

Unsurprisingly, the above chart confirmed a notable spike in overseas trade reserves from $18.5 million to $18.7 million, the day after ETH noticed a big improve on September 2.

This confirmed the standard day buying and selling technique of locking in income as soon as the value confirmed a slight upward development.

Nonetheless, to counter this algorithmic conduct, new merchants should enter the market whereas long-term holders keep away from promoting.

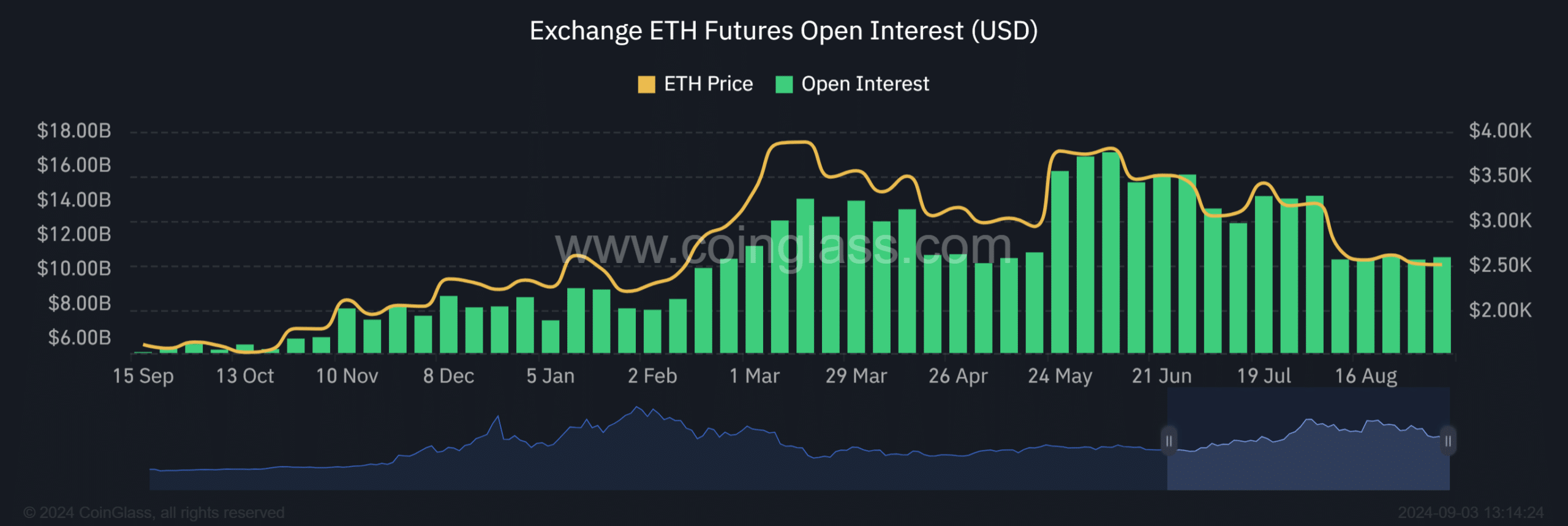

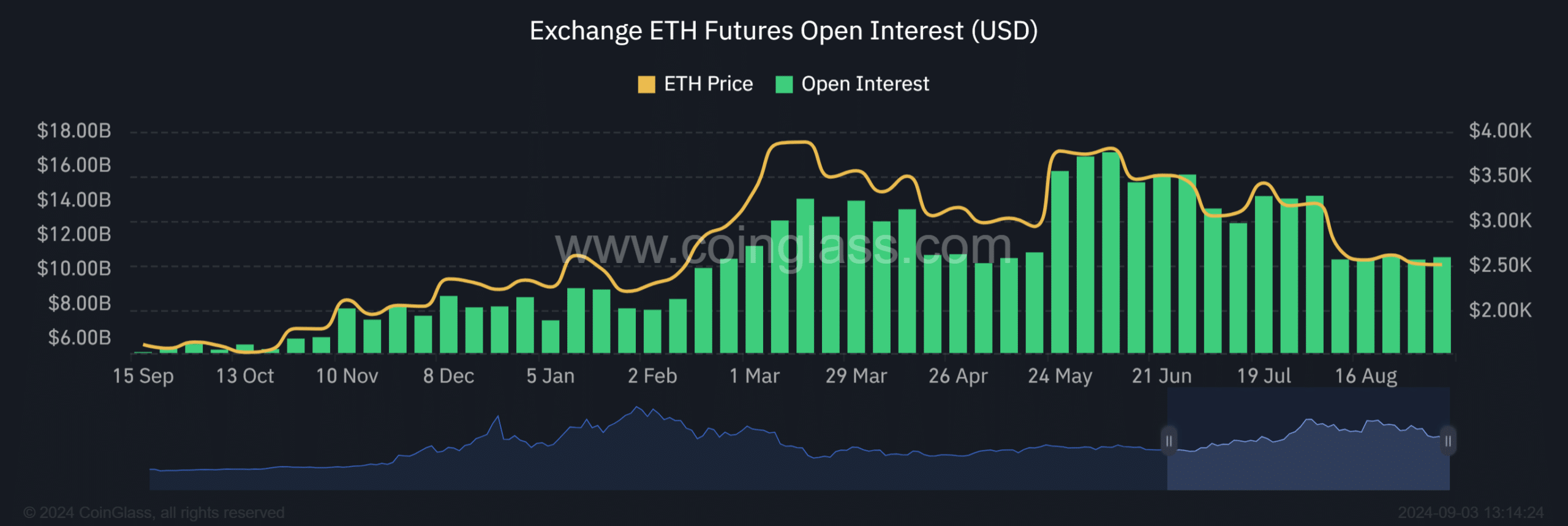

Supply: Coinglass

To the reduction of bulls, AMBCrypto famous a rise in open curiosity amongst futures merchants.

In accordance with the chart above, OI rose to $10.72 billion, up 0.37% from the day gone by’s $10.68 billion.

Regardless of this uptick, a a lot stronger rise in Open Curiosity could be wanted to make sure a sustained bullish swing.

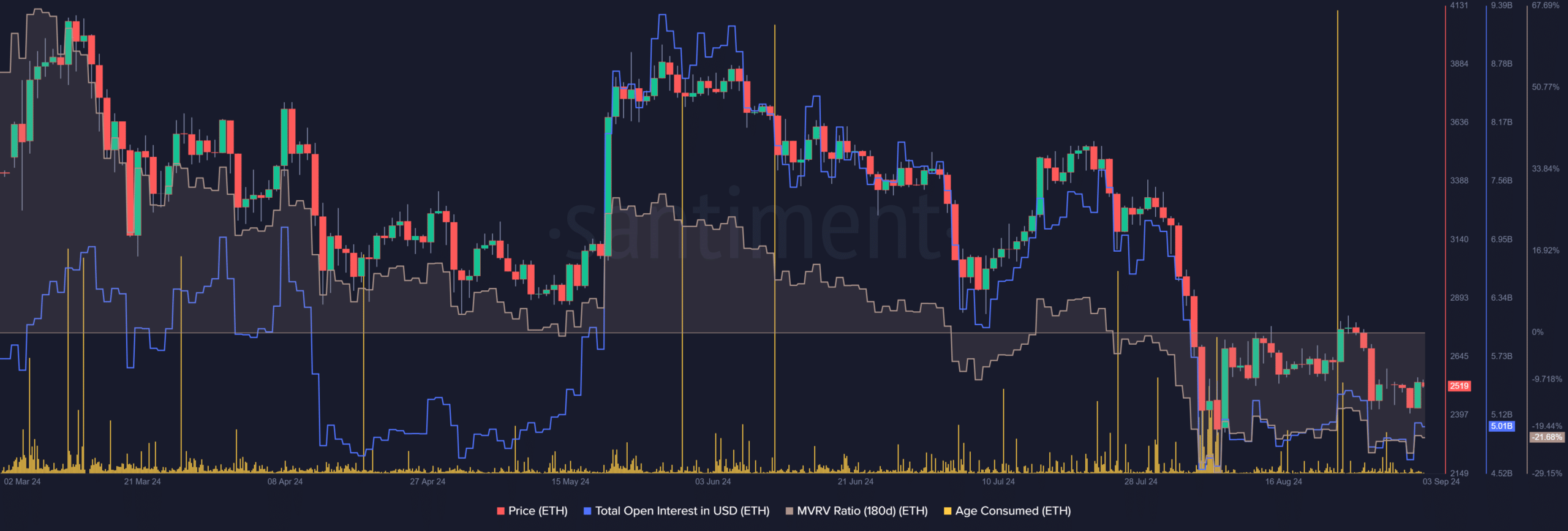

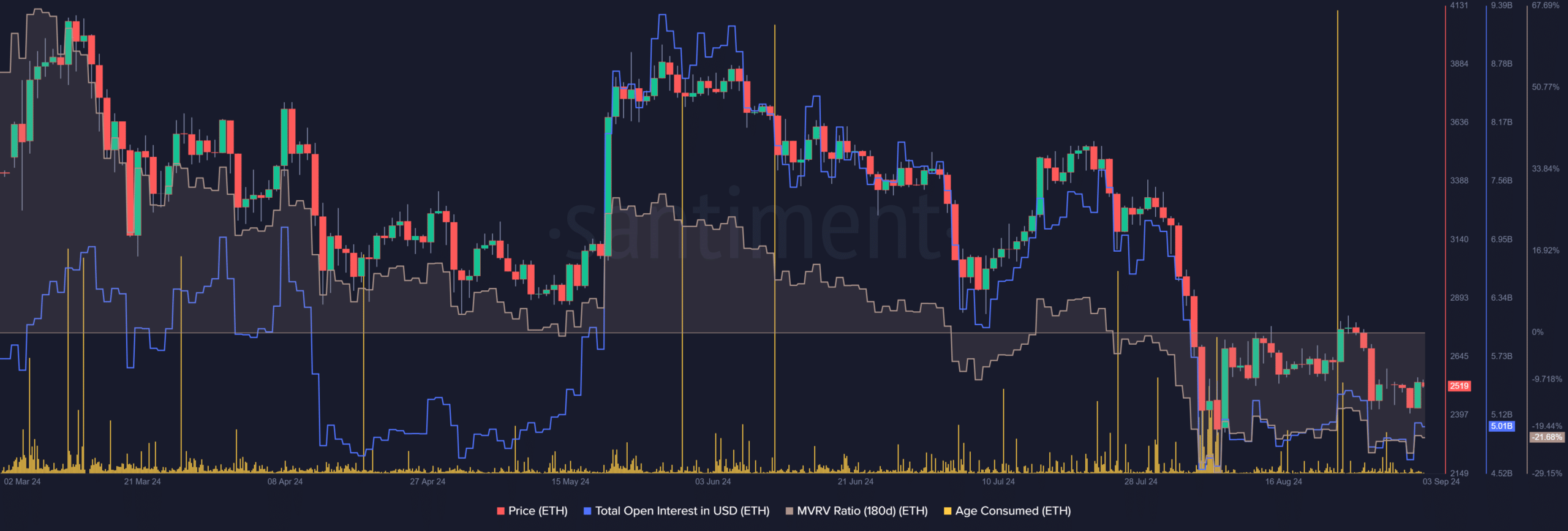

Supply: Santiment

Whereas futures merchants present restricted optimism a couple of assured ETH worth rise, long-term holders are routinely promoting off a few of their outdated cash, signaling a bearish development.

On August 23, old-age consumption rose to an astonishing $629 million, which subsequently led to a worth drop.

Moreover, a detrimental MVRV ratio indicated that ETH’s present market worth is beneath its realized worth, indicating that the asset could also be undervalued. It will possibly sign a possible shopping for alternative.

Nonetheless, the dearth of a big improve in Open Curiosity may point out that the true worth of ETH has not but been realized.

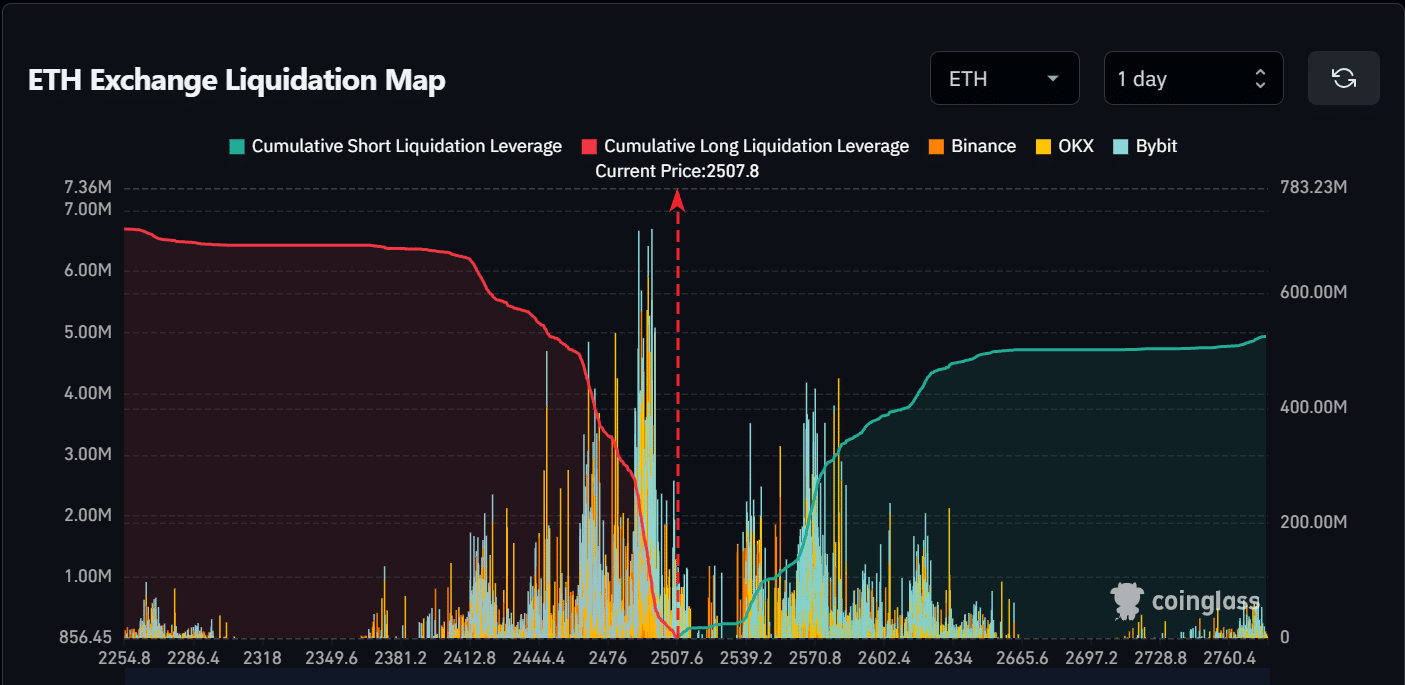

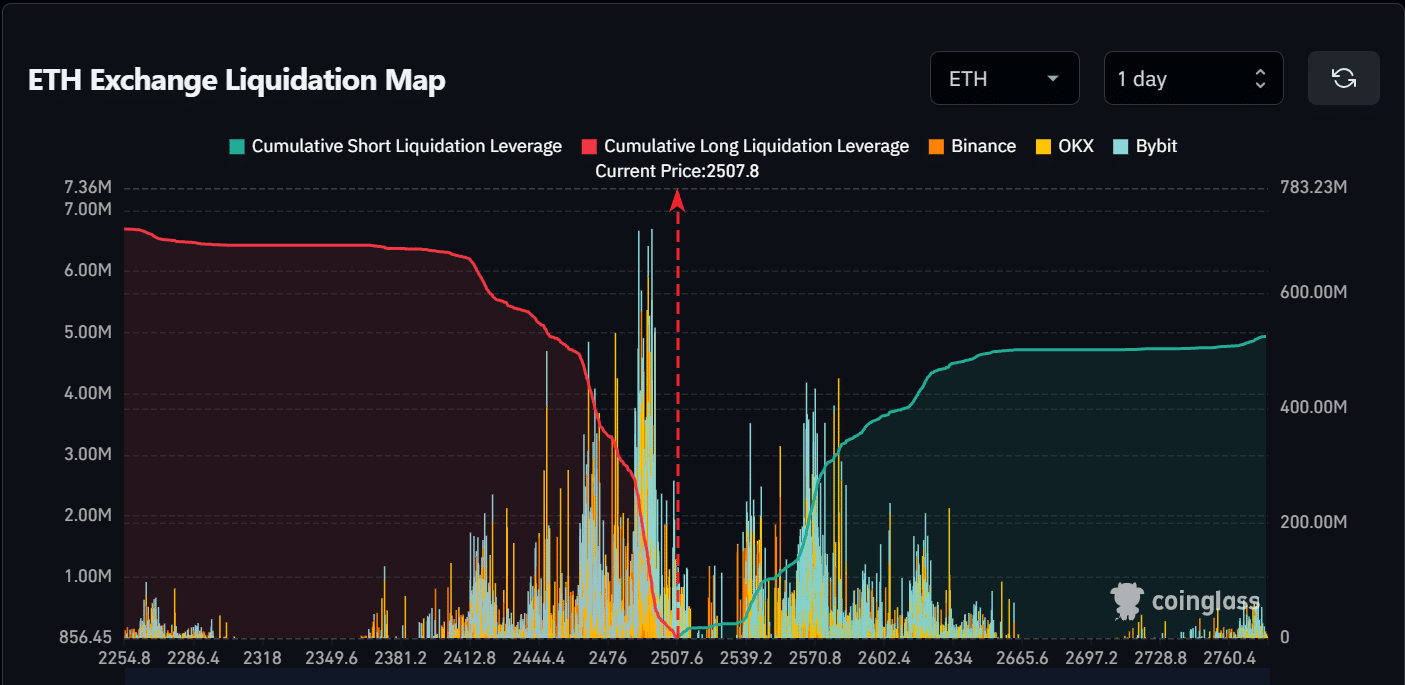

Supply: Coinglass

Moreover, AMBCrypto famous that the current 3% surge could have been a bluff, resulting in $34 million briefly liquidations and pushing ETH to check the essential $2,500 degree.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Nonetheless, as analyzed by AMBCrypto, the probability of a breakout had decreased attributable to an absence of sturdy shopping for exercise.

Briefly, if shopping for exercise doesn’t improve, ETH may face prolonged liquidations of round $40 million if the value falls beneath the $2,500 assist, taking the value again to $2,300.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now