Ethereum

Ethereum’s $4K dreams face hurdle as whales take profit – What now?

Credit : ambcrypto.com

- Ethereum’s promoting stress from flows from giant holders outperformed inflows from the identical class.

- A abstract of the combined alerts, and why ETH might be on the verge of a retracement.

Holders clung to the hope that Ethereum [ETH] may rise above $4,000 earlier than the tip of 2024.

Whereas the cryptocurrency confirmed indicators of sustaining November’s bullish momentum, a big pullback may happen.

Whale exercise signifies that ETH promoting stress could also be rising. An unsurprising outcome provided that the beforehand sturdy momentum has seemingly cooled.

Moreover, exercise from giant ETH holders has grown, which can contribute to the bearish momentum.

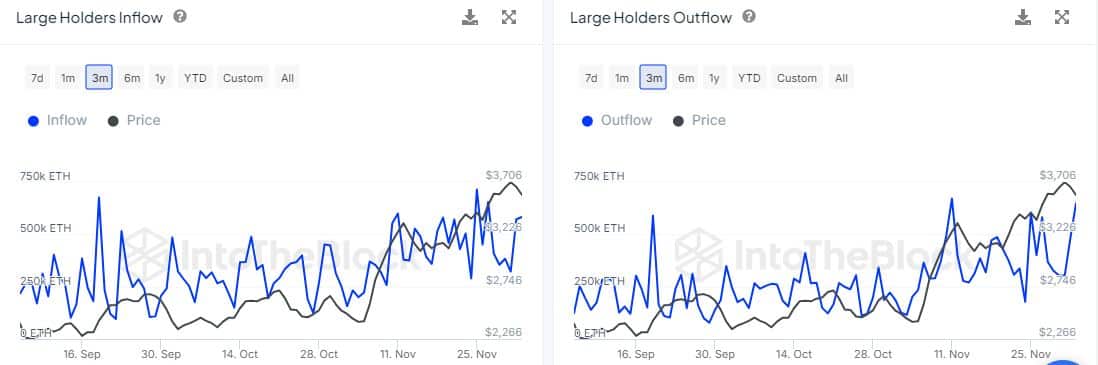

Information from IntoTheBlock confirmed that giant holder outflows peaked at 647,220 ETH on December 3. Inflows from giant holders have additionally grown over the previous three days, reaching a peak of 582,710 ETH in response to the most recent knowledge.

Supply: IntoTheBlock

The distinction between inflows and outflows recommended that there was extra promoting stress from whales than demand. This wasn’t the one signal exhibiting bullish weak spot.

Ethereum ETF inflows have remained bullish up to now this week. Nevertheless, they’re down considerably in comparison with every week in the past.

For context, Ethereum ETFs had constructive flows of $132.6 million on December 3, an enchancment from $24.2 million the day earlier than.

Supply: Farside.co.uk

Ethereum ETFs rose to $332.9 million final Friday. Because of this ETF inflows have decreased considerably.

Is bullish demand weakening?

Whereas one can view the disparity as an indication of shrinking demand, it’s price noting that demand can develop or decline in a single day.

Nevertheless, the above observations do spotlight the slowdown in bullish demand for ETH over the weekend.

Whereas flows from giant holders and Ethereum ETFs level to a attainable slowdown in demand, spot flows painted a distinct image.

Spot inflows peaked at $285 million within the final 24 hours and reached $252.69 million on November 3.

Supply: Coinglass

The constructive spot flows have been in keeping with ETH’s value motion. This bullish demand has contributed to the cryptocurrency’s restoration over the previous two days.

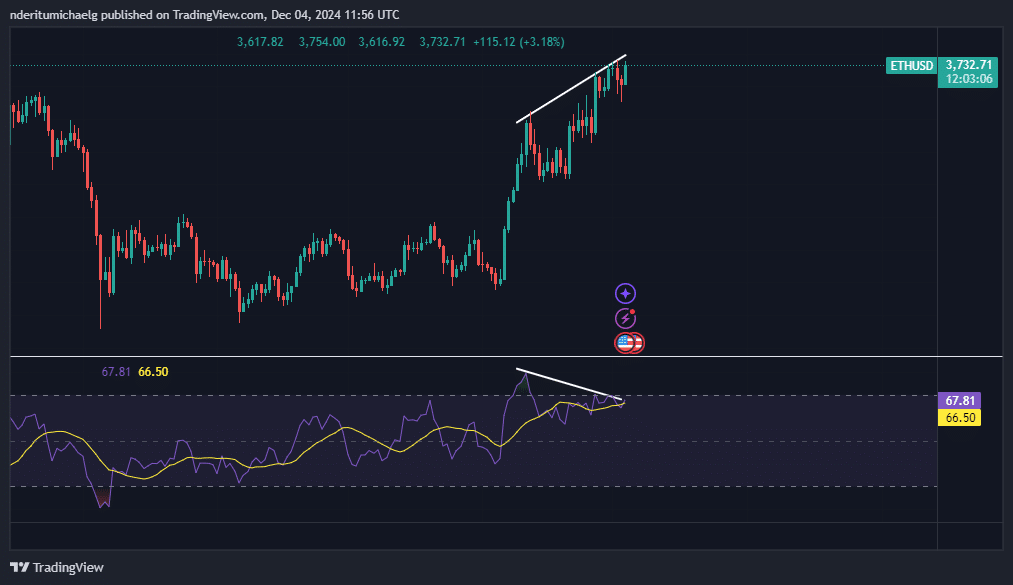

ETH was exchanging palms at $3,731 on the time of writing, recovering from the preliminary promoting stress seen firstly of the week. Nevertheless, there may be one main purpose for the rising expectations of a retracement.

Supply: TradingView

Learn Ethereum’s [ETH] Value forecast 2024–2025

ETH’s value motion types a bearish divergence with the RSI. This means {that a} vital pullback is within the offing.

A return from the present stage may trigger a value drop right down to the $3050 value stage. This is without doubt one of the cryptocurrency’s newer assist ranges.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September