Altcoin

Ethereum’s Buterin has confidence in Aave, but should you share it too?

Credit : ambcrypto.com

- Vitalik Buterin’s deposit of two.27 million USDC and a pair of,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish giant transactions, community progress, and impartial momentum for the token

Ethereum co-founder Vitalik Buterin has made waves within the DeFi house with a latest deposit of two.27 million USDC and a pair of,851 ETH (roughly $6.73 million) into the Aave [AAVE] protocol. This important transaction has raised questions on its impression on Aave’s liquidity and the token’s value efficiency.

Ergo, the query: is that this a bullish sign for Aave’s future?

How did Buterin’s deposit have an effect on Aave’s liquidity?

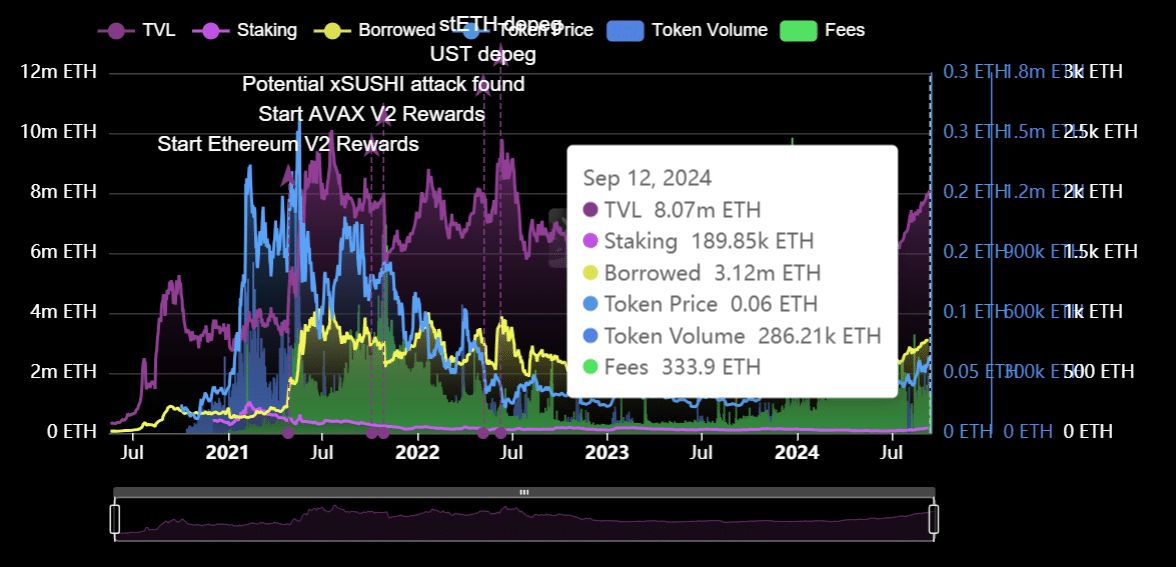

Buterin’s deposit contributed considerably to Aave’s complete Complete Worth Locked (TVL), which stood at 8.07 million ETH on the time of writing. Of this, 3.12 million ETH was lent, reflecting the robust demand for loans on the platform. Aave’s TVL in USD was $11.08 billion, placing it in a powerful place 25.4% market share within the DeFi ecosystem, second solely to Uniswap.

This liquidity enhance strengthens Aave’s means to challenge giant loans and makes the platform much more enticing to each lenders and debtors. AAVE’s token was buying and selling at $147.86 on the time of writing, having gained 1.48% over the previous 24 hours.

Supply: DeFiLlama

What do the alerts from Aave say on the chain?

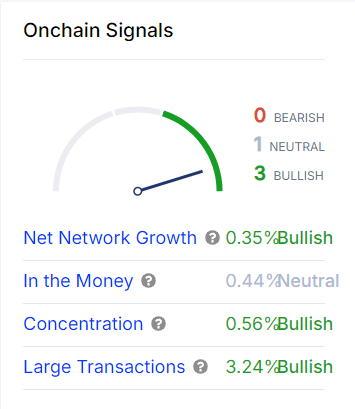

Current on-chain alerts have pointed to a largely bullish outlook for Aave. The Internet Community Development underlined a bullish sign of 0.35%, reflecting the regular progress of the platform’s consumer exercise.

Massive trades particularly appeared worthwhile and confirmed a bullish sign of three.24%. This urged that whales and huge traders are transferring important quantities of cash on Aave; Buterin’s deposit is a transparent instance of this.

Furthermore, the focus metric indicated a bullish sign of 0.56% – an indication of the arrogance of huge traders in sustaining or rising their positions.

Supply: IntoTheBlock

What does Technical Evaluation say about AAVE?

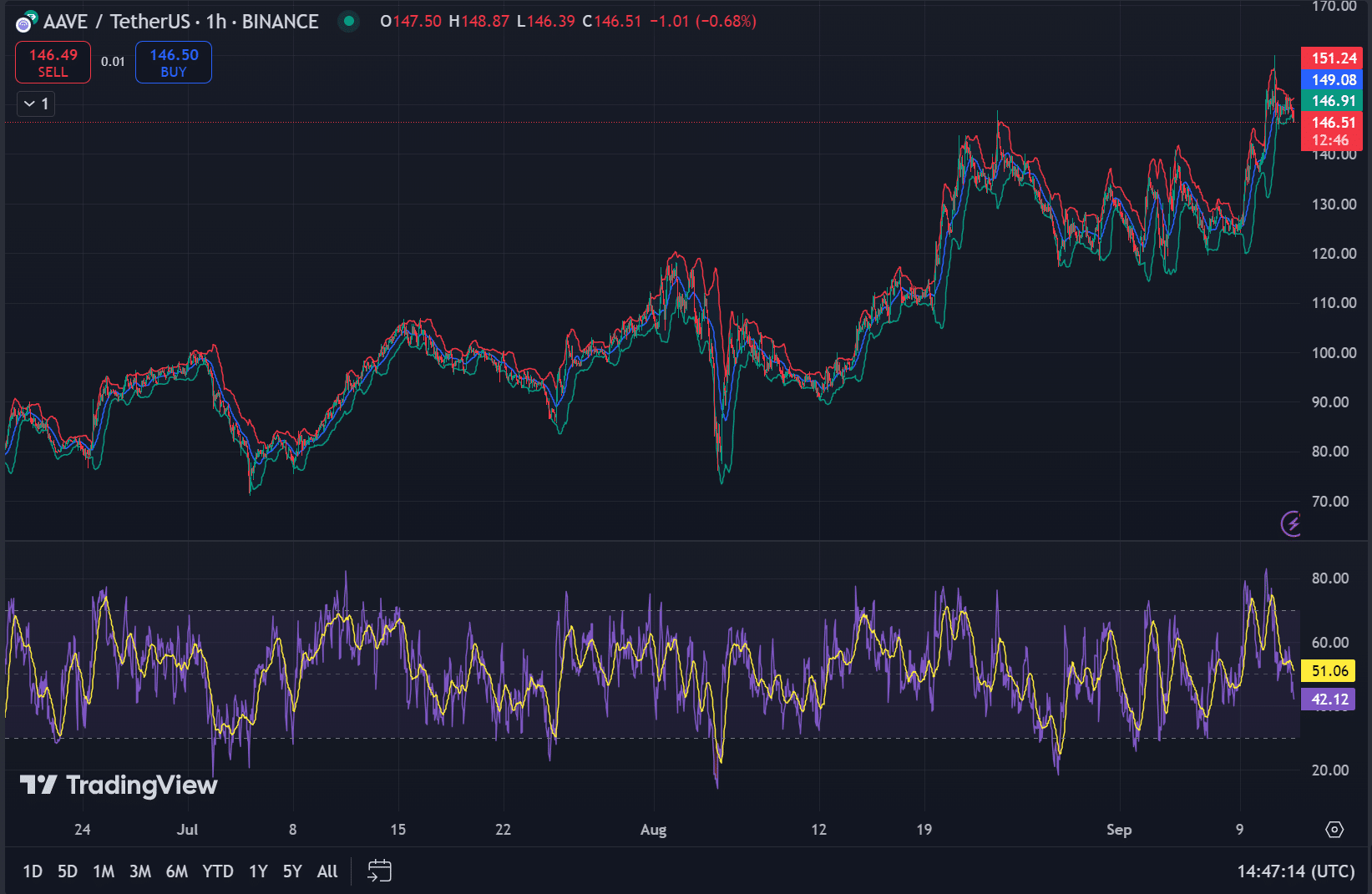

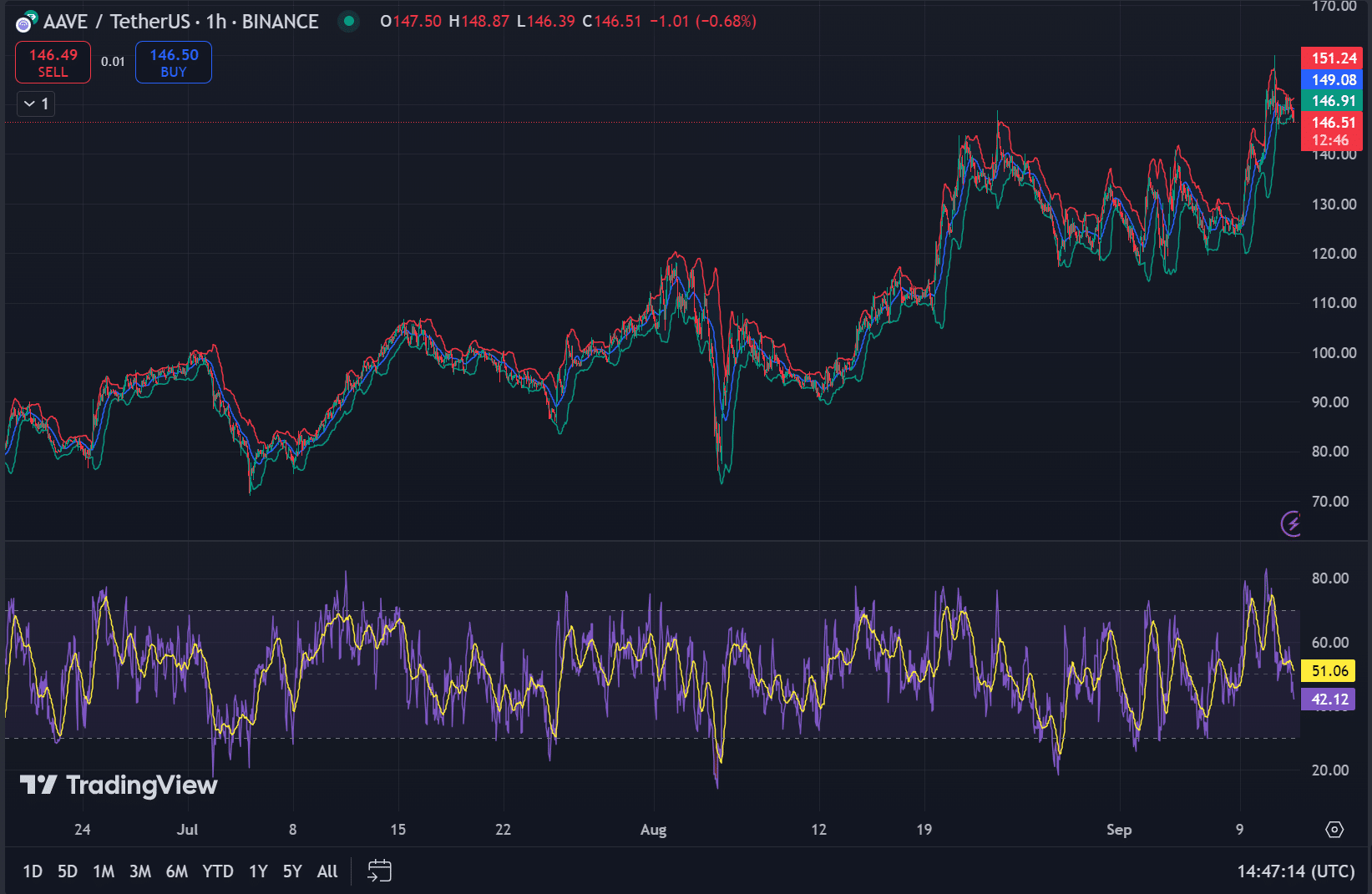

From a technical perspective, AAVE’s token was buying and selling at $147.86, with a 24-hour acquire of 1.48% on the time of writing. The Relative Energy Index (RSI) stood at 51.06, indicating impartial momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealed that AAVE gave the impression to be buying and selling close to the higher band, with a value of $147.86 and the higher band round $151.24.

Each metrics indicated that the token could have room for upside. Particularly when buying stress will increase.

Supply: TradingView

Is Buterin’s deposit a bullish sign for Aave?

Sure, Vitalik Buterin’s deposit in Aave is certainly a bullish sign. The addition of $6.73 million in property to the protocol will increase liquidity and market confidence.

Mixed with constructive alerts alongside the chain, akin to robust whale exercise and internet community progress, and technical evaluation, Aave could possibly be effectively positioned for future progress.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now