Ethereum

Ethereum’s crisis: How leadership’s mixed messages affect ETH

Credit : ambcrypto.com

- Members of the Ethereum group had various views on ETH’s worth and roadmap.

- The combined alerts from Ethereum management might damage ETH’s sentiment.

The Ethereum [ETH] management has made headlines because of ETH’s long-term roadmap and imaginative and prescient for worth constructing. One of many members of the Ethereum group, Justin Drake, recommended that ETH was like Nvidia and Apple and will appeal to billion-dollar valuations based mostly on the charges.

Drake declared,

“Ethereum is sort of a very massive firm like Nvidia, Apple. We will generate valuations within the billions purely based mostly on the flows [fees]. After which you realize there’s a complete different matter on prime of this primary trillion-dollar valuation for ETH as cash, collateral… for decentralized stablecoins.”

Combined opinions on the worth of ETH

Nevertheless, some builders and founders within the Ethereum ecosystem disagreed with these perceived management views. Sam Kazemian, founding father of DeFi protocol Frax Finance, was among the many critics.

Kazemian believed that evaluating ETH to Nvidia or Apple would restrict the altcoin’s development potential in comparison with Bitcoin. He claimed that this valuation wouldn’t be a victory for the altcoin property.

‘ETH at the moment has an annual turnover of $1 billion. If we double these revenues 385x to match Apple’s, which means ETH would match Apple’s valuation at 11x. Does this look like a profitable roadmap for ETH?”

He believed that this was a flawed means for the management to measure the worth of ETH and that it may not compete with BTC.

“Ethereum as a big firm whose ‘base valuation’ is measured as a result of its money flows from charges give it an opportunity to overhaul BTC or ever overtake it?”

He added:

“Apple has annual gross sales of $385 billion, which is price $3.3 billion. BTC has no annual income and can by no means have even one greenback in income. It’s already price $1.1 trillion.”

Kazemian, like a lot of the protocol’s founders, advocated that ETH’s major worth ought to be based mostly on the shop of worth (SoV) and the DeFi ecosystem.

ETH management says…

Opposite to BTC’s ‘digital gold’ slogan, ETH has struggled to have an impactful and unified pitch deck for potential buyers. Leaders’ push for ‘programmable cash’ and ‘digital oil” has not gained the anticipated traction.

Ethereum’s DeFi imaginative and prescient has additionally seen divergent visions from leaders. Vitalik Buterin, for instance, has been that skeptical of pure DeFi as the only crypto development catalyst.

This was in distinction to different group members, reminiscent of Hayden Adams of Kazemian and Uniswap, who believed that DeFi was essential to the expansion of ETH’s worth.

Based on Coinbase analysts, that is the case deviant imaginative and prescient for Ethereum’s DeFi has made it troublesome for brand new buyers to grasp the asset and dented market sentiment.

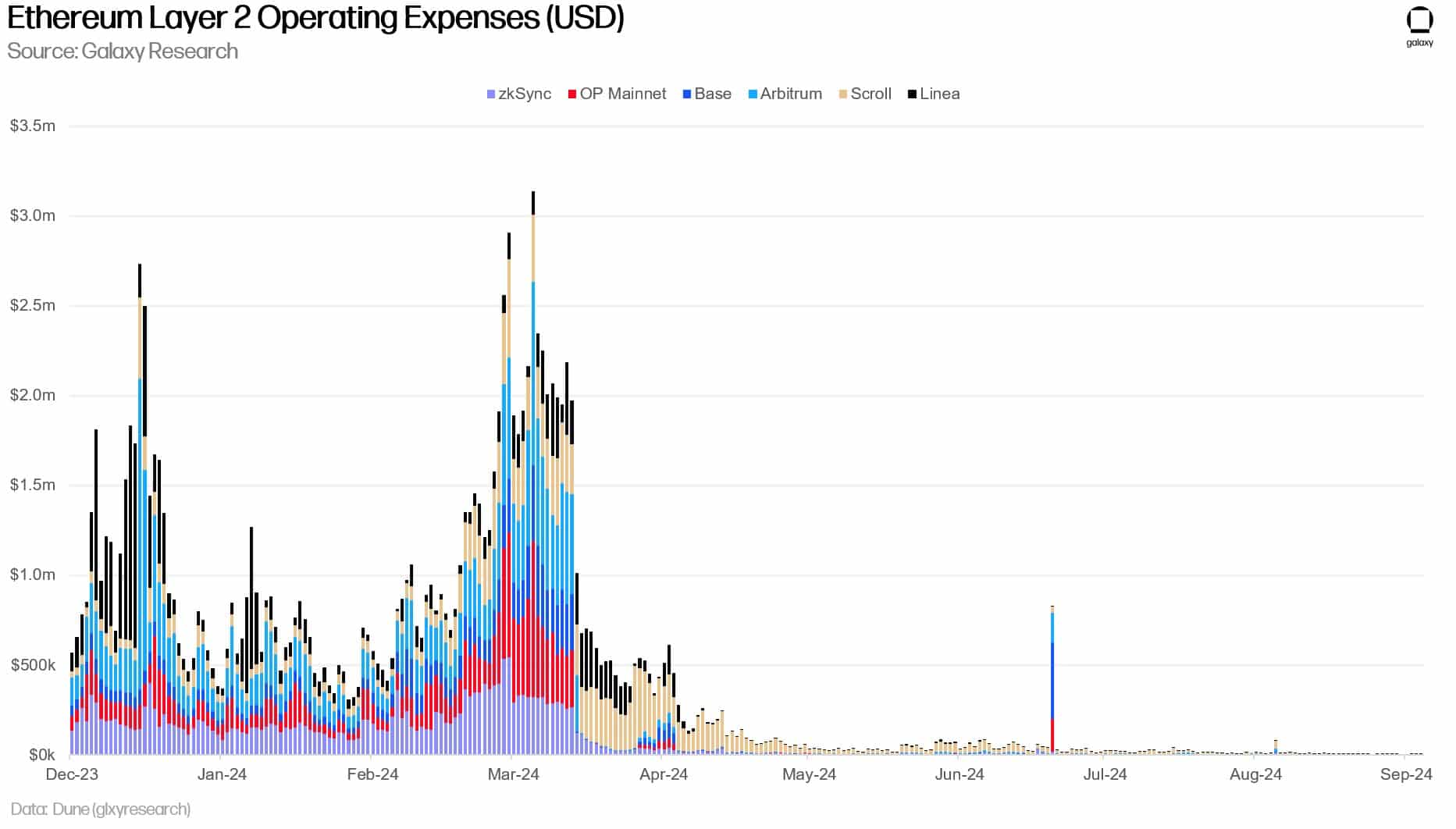

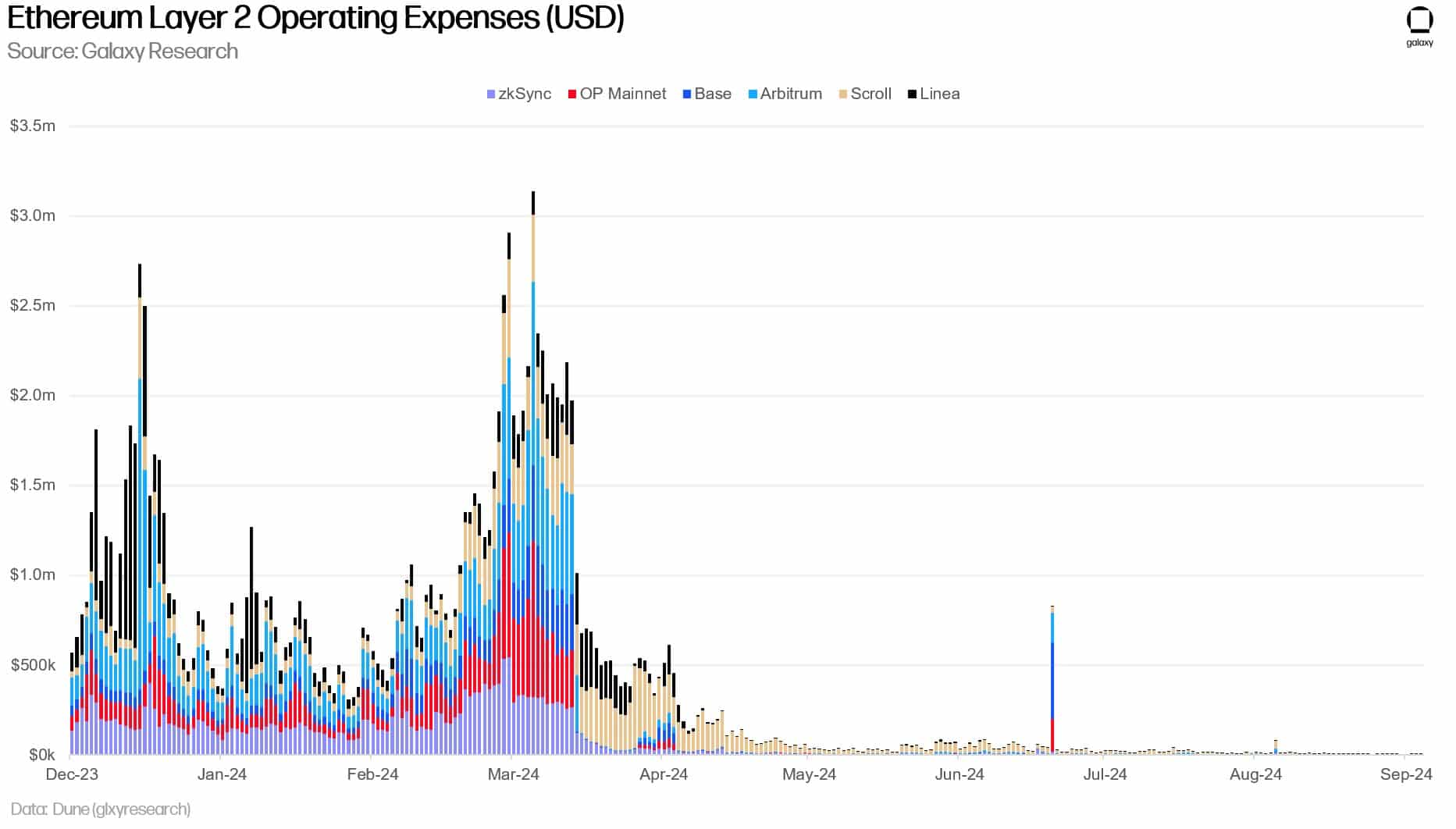

By the best way, so is the price of ETH rejected considerably for the reason that Dencun improve in March, as low-cost blobs drive customers emigrate to L2s.

Supply: Galaxy Analysis

This additionally has divided the group on whether or not blob charges ought to be adjusted to assist ETH L1 acquire worth from L2s, as ETH’s inflation drawback turns into even worse after the Dencun improve.

The aforementioned group points have additional disrupted investor sentiment round ETH.

That stated, ETH has misplaced floor to BTC. The underperformance was illustrated by a yearly low within the ETH/BTC ratio, which tracks the altcoin’s value efficiency in opposition to BTC. The worth of ETH has decreased 44% in comparison with BTC within the final two years.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now