Ethereum

Ethereum’s demand rises positioning the ETH for sustained gains

Credit : ambcrypto.com

- ETH has gained 2.39% within the final 24 hours.

- The demand facet of Ethereum strengthens and positions the Altcoin for persistent income.

Because the market recovered from the charges Crash, Ethereum [ETH] has traded an ascending sample. In the meanwhile, Ethereum really acted at $ 1610.

This meant a rise of two.36% in comparison with the every day graphs.

Earlier than this revenue, the Altcoin had had a downward route and fell on weekly and month-to-month graphs by 10.99% and 14.79% respectively.

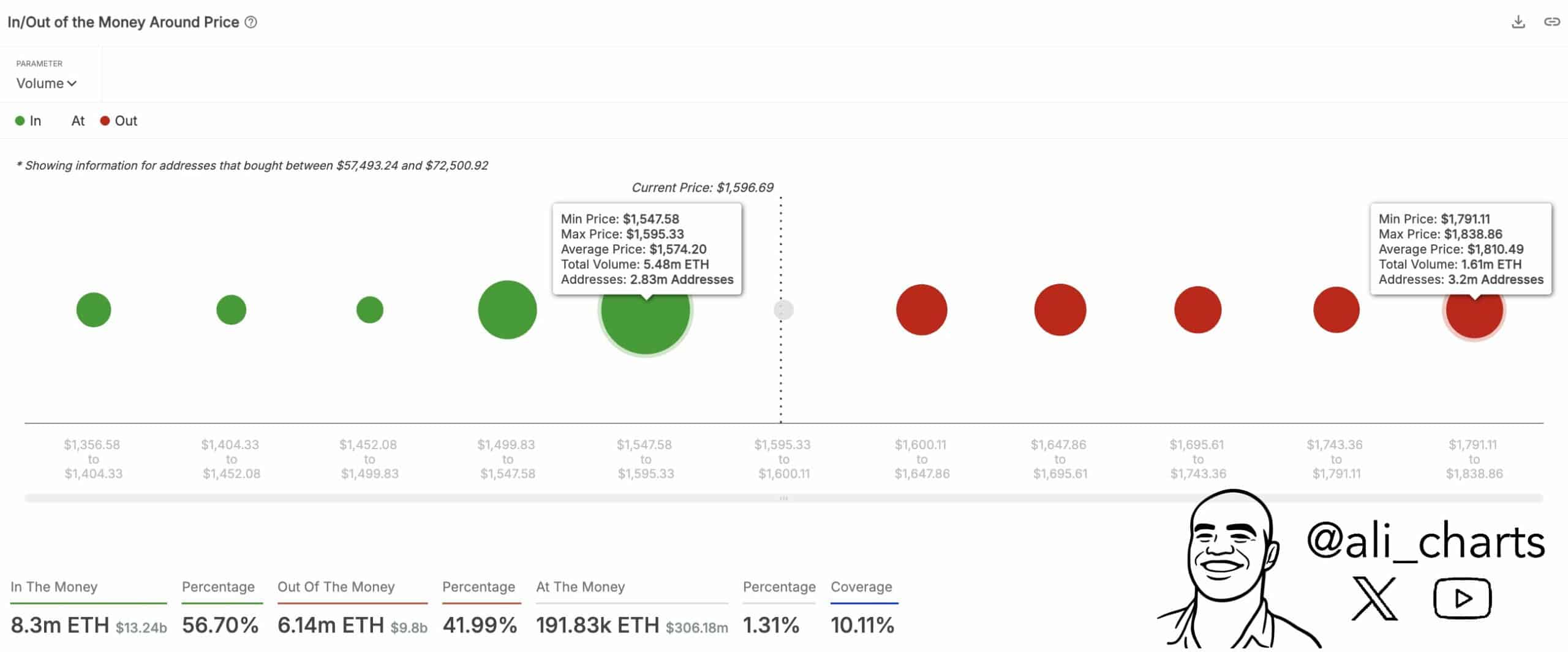

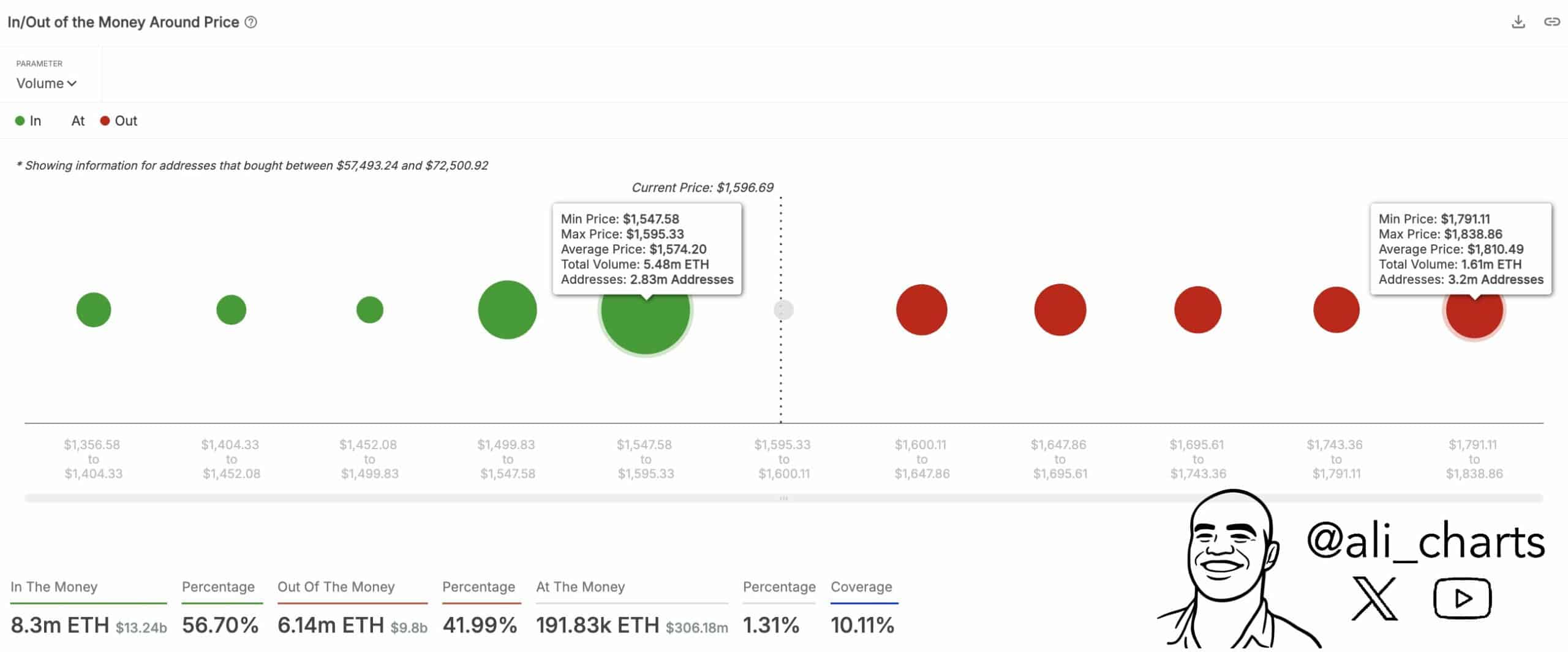

With the latest income, stakeholders have a look at a extra lengthy -term upward development. Common crypto analyst, Ali Martinezhas proposed a possible rally as much as $ 1,810.

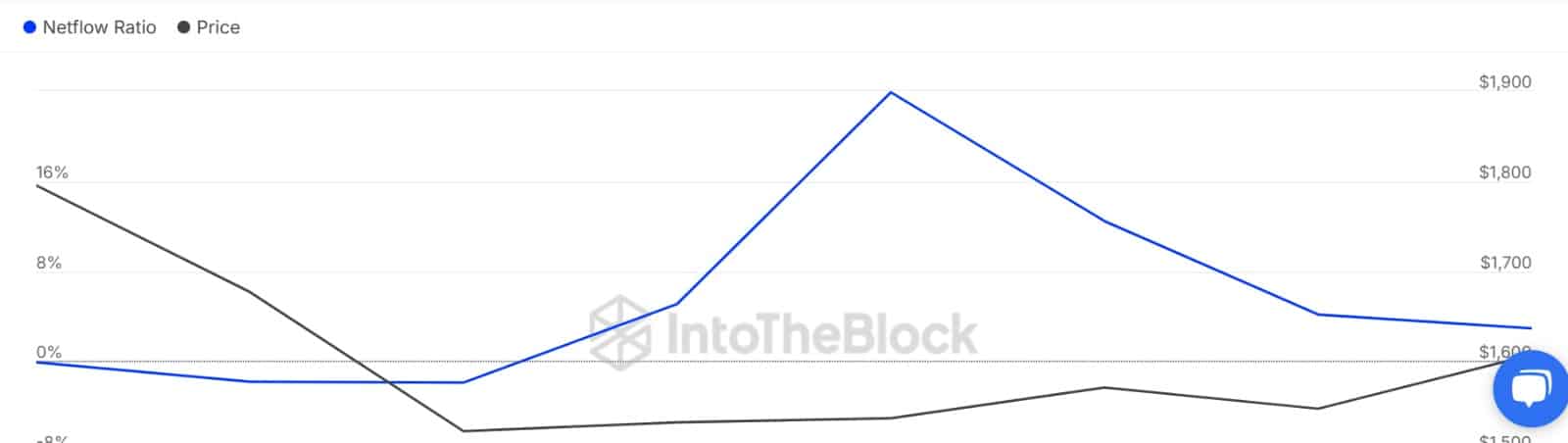

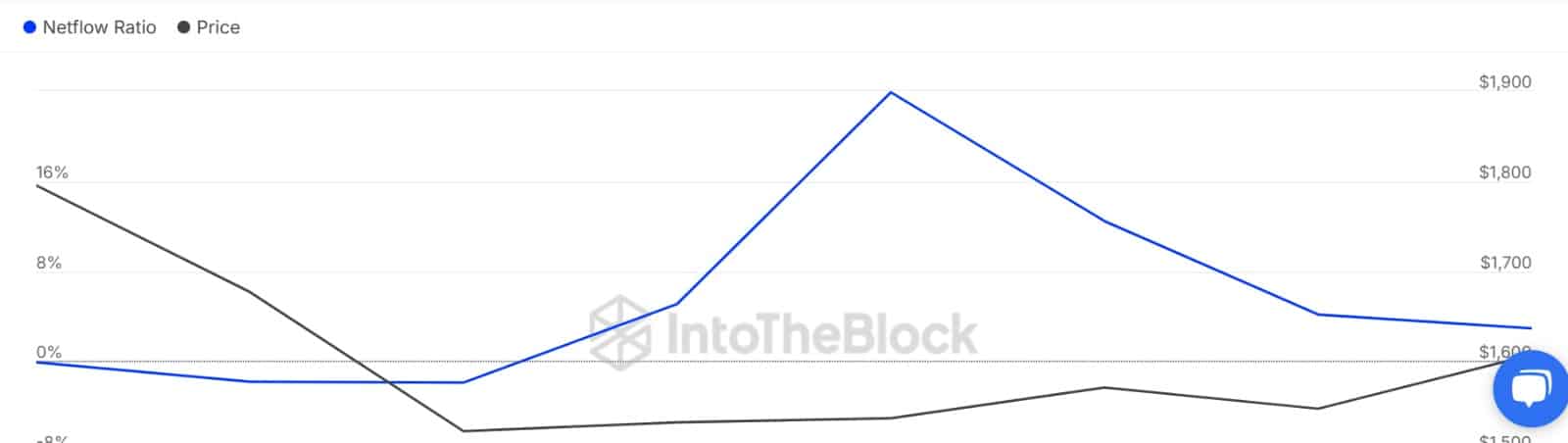

Supply: Intotheblock

In his evaluation, Martinez acknowledged that since ETH has reclaimed an important stage of help of $ 1574, the Altcoin may acquire if the demand zone applies. Thus a deal with over this rally will reclaim the Altcoin the resistance stage of $ 1,810.

The query is, can Ethereum make persistent revenue to reclaim a better stage of resistance?

Can Ethereum see a persistent rebellion?

In response to Ambcrypto evaluation, Ethereum sees a restoration from his demand facet.

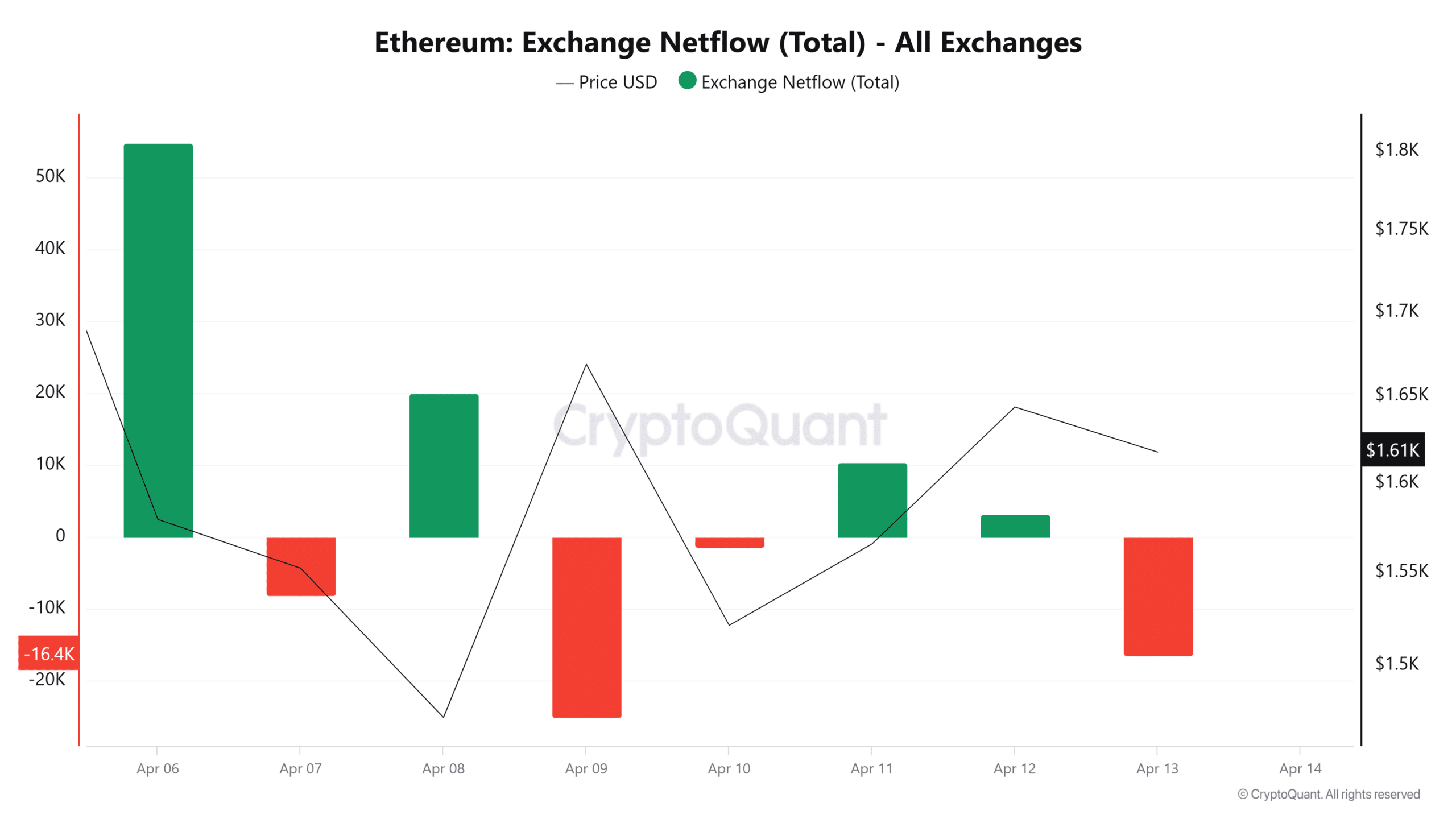

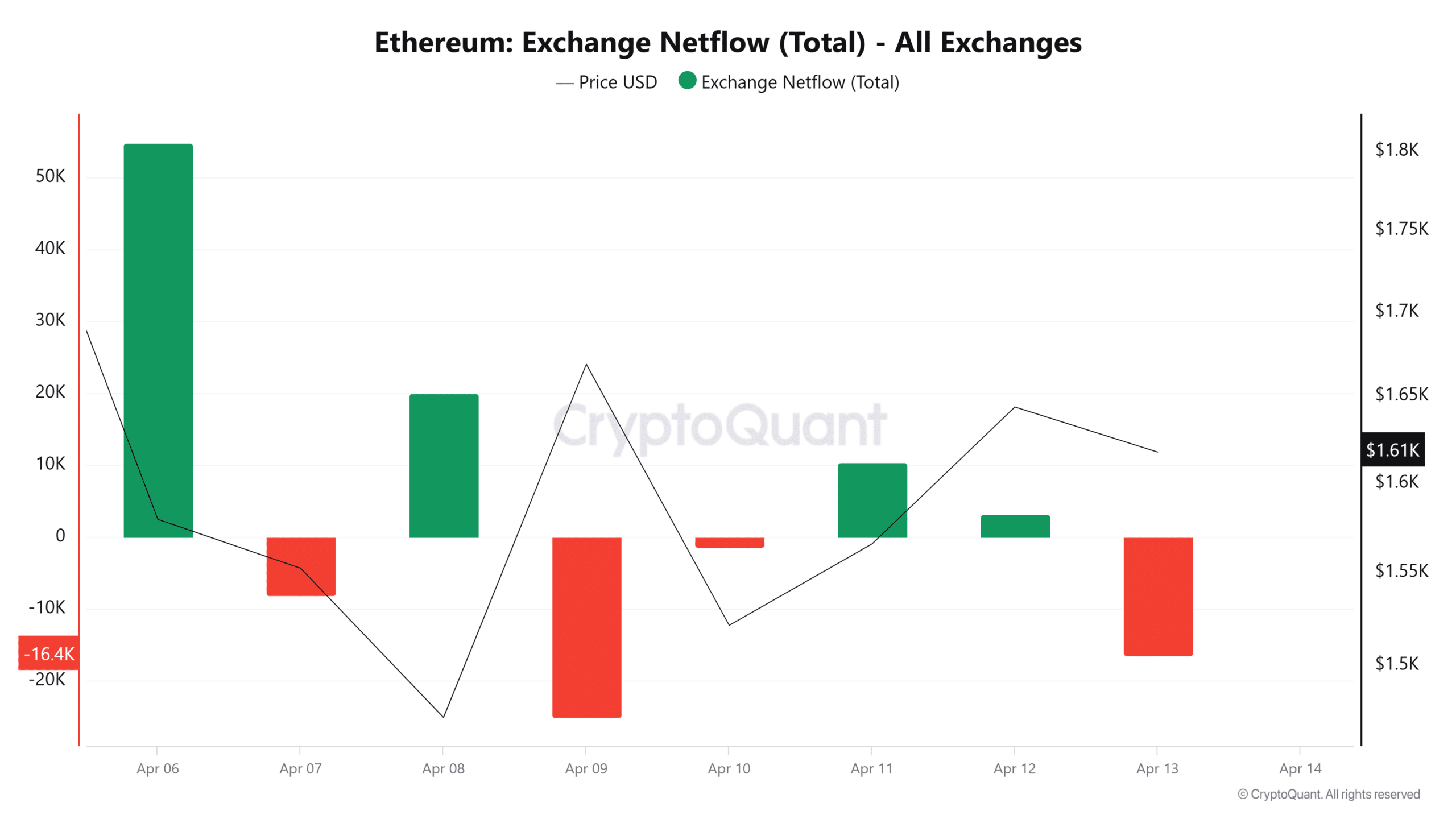

To start with, the Trade Netflow of Ethereum has turn into adverse after two consecutive days of constructive streams. A shift to adverse means that buyers have turned to gathering Ethereum.

As such, there are extra change outflows than the influx, which mirror an growing demand.

Supply: Cryptuquant

Constructive Order Insalans additional validates this side. With a constructive order of imbalance, it exhibits that extra shopping for orders are being carried out than promoting.

This means that consumers are lively available in the market, leading to extra change outings.

Supply: Mobchat

The rising demand is extra widespread in whales. As such, Ethereum makes giant holders fewer transfers in commerce festivals.

Trying on the Netflow from giant holders to change the Netflow ratio, the electrical energy to change ratio of whales has fallen from 23.9% to 2.92%.

This drop means that whales purchase greater than they promote.

Supply: Intotheblock

By shopping for whales and retailers, evidently they purchase the Altcoin and take lengthy positions. We will see this as a result of the aggregated financing proportion of Ethereum has turn into constructive, which displays a better demand for lengthy positions.

Most buyers due to this fact count on costs to rise even additional.

Supply: Coinalyze

Merely put, Ethereum sees a rise in query. Traditionally, greater demand leads to greater costs. With ETH that will get extra consumers than sellers, we may see the Altcoin $ 1758 reclaim.

If it rises to this stage, we may see a motion to $ 1800. Conversely, if Bulls’s try fails, we may see a correction with ETH that withdrew to $ 1465.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024