Bitcoin

Ethereum’s epic comeback? Top reasons why ETH can beat Bitcoin

Credit : ambcrypto.com

- Ethereum is establishing itself as a singular asset and growing its personal identification.

- A number of components contribute to this growth.

Two years in the past, the crypto market was rocked by the collapse of FTX, sparking widespread concern and intense regulatory issues. Quick ahead to immediately and the panorama has been reworked.

The market is again with a vengeance, and Ethereum [ETH] is main the best way. ETH not too long ago broke out of a four-month hunch in lower than 5 buying and selling days, posting each day good points of practically 10%.

In early bullish cycles, capital typically shifts from Bitcoin to altcoins as traders chase new revenue alternatives.

As election uncertainty diminishes – an occasion that briefly pushed Bitcoin dominance above 60% – Ethereum is now rising as an asset class in its personal proper, and never simply one other extremely capitalized altcoin.

Might this pave the best way for ETH to outperform Bitcoin? [BTC]Now that traders are beginning to take a look at it with new conviction?

Ethereum is on a journey of self-discovery

Trump’s pro-crypto manifesto has clearly resonated with traders, pushing Bitcoin to nearly $80,000.

Bitcoin was buying and selling at $79,500 on the time of writing and has gained over 15%, and it’s nonetheless lower than every week because the election outcomes have been introduced.

Nevertheless, this fast progress in such a short while may result in warning amongst traders, particularly the ‘weak palms’ – those that are fast to exit when Bitcoin enters the chance zone.

This might create a wonderful alternative for Ethereum, a possible shift that AMBCrypto suggests it may gain advantage from, very like it did in the course of the mid-Could cycle.

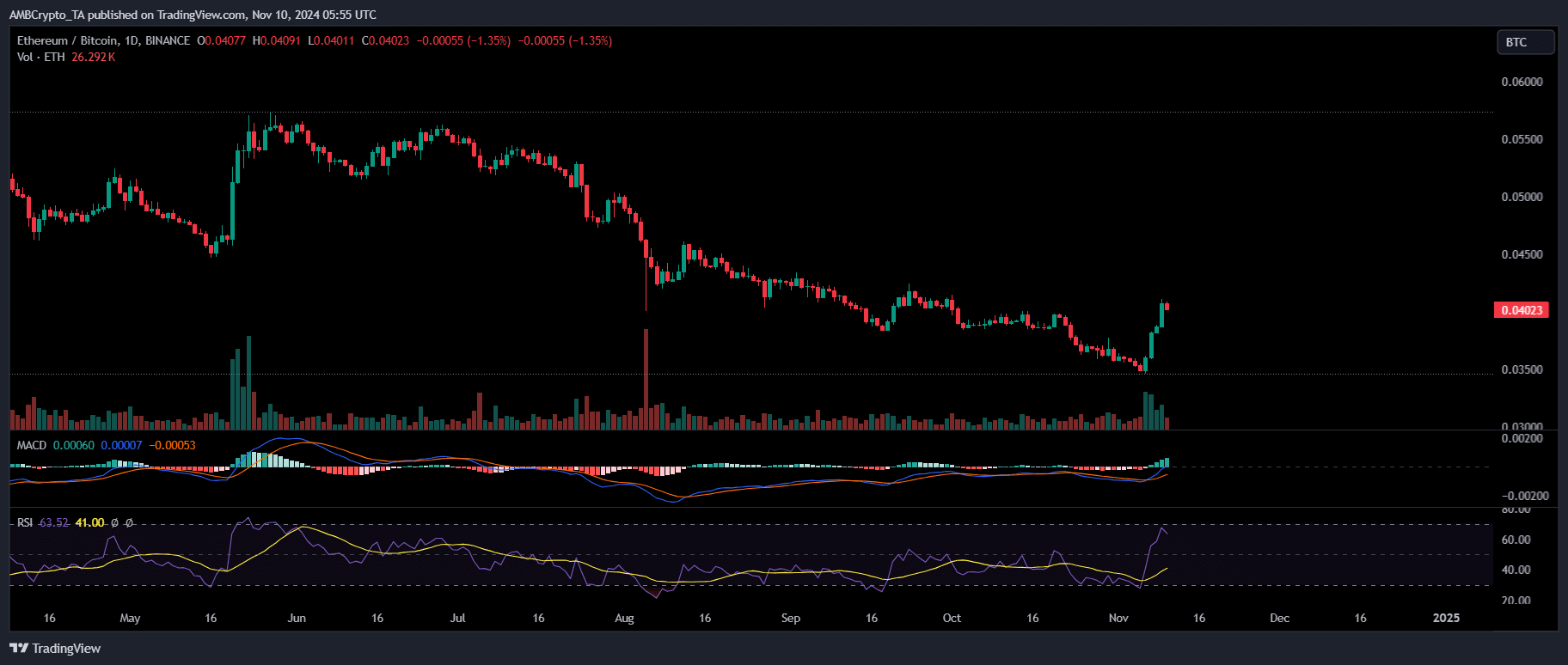

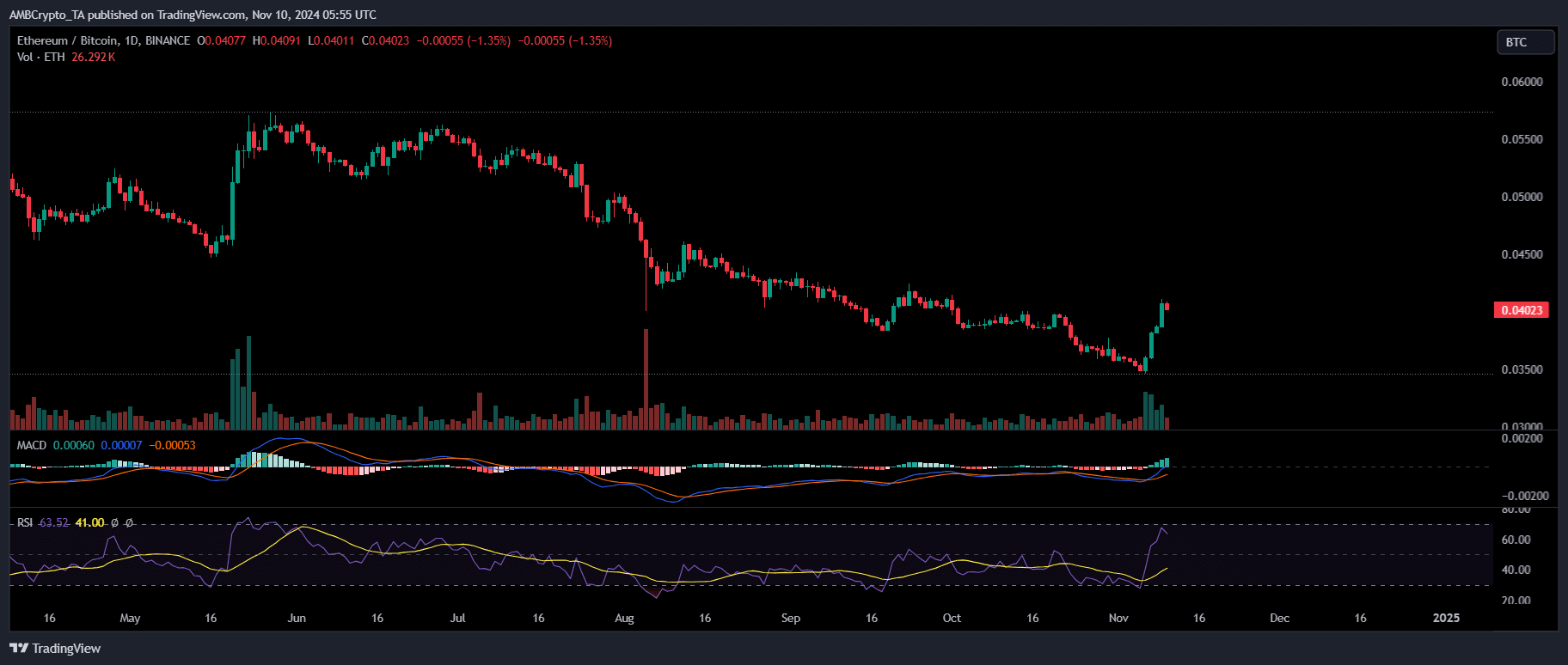

Supply: TradingView

After six months of constant downtrend, Ethereum confirmed vital dominance over Bitcoin. The final time this occurred, ETH posted an enormous each day candle, highlighting a 20% enhance in in the future.

Likewise, this time round, a considerable capital movement from Bitcoin to Ethereum has performed a key position in serving to ETH break the $3K benchmark.

Nevertheless, there may be extra to this shift, which may point out Ethereum’s rising independence from Bitcoin, positioning the 2 as several types of property available in the market.

There may be loads of proof to help this concept

For starters, Ethereum’s weekly good points have doubled in comparison with Bitcoin, reaching a exceptional 30%. The driving pressure behind this enhance is double-digit capital inflow in ETH ETFs.

It is a sport changer as it’s the first time ETH ETFs have seen an enormous inflow of capital since their launch 4 months in the past. Regardless of the launch, the affect on ETH’s worth was initially minimal.

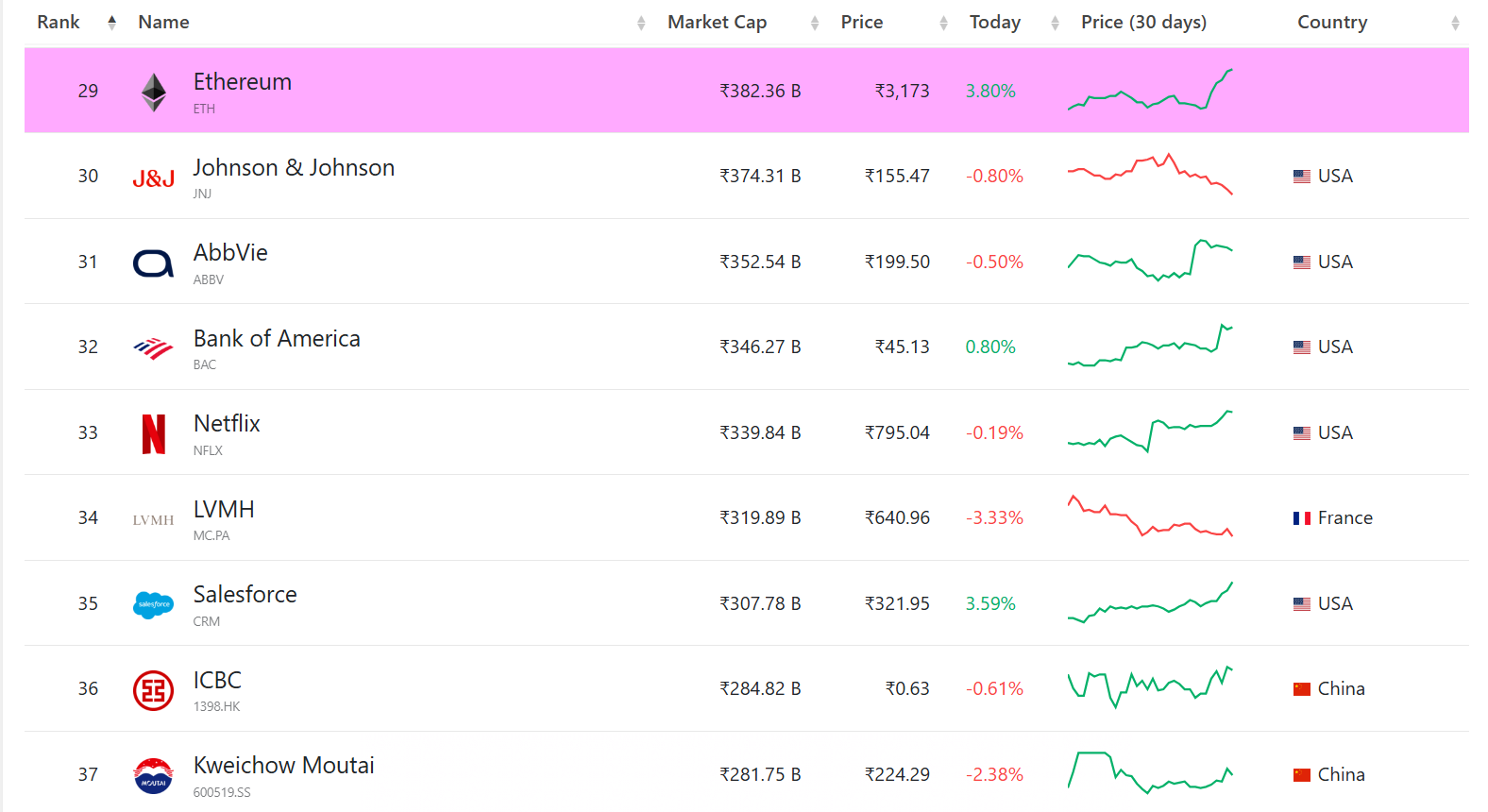

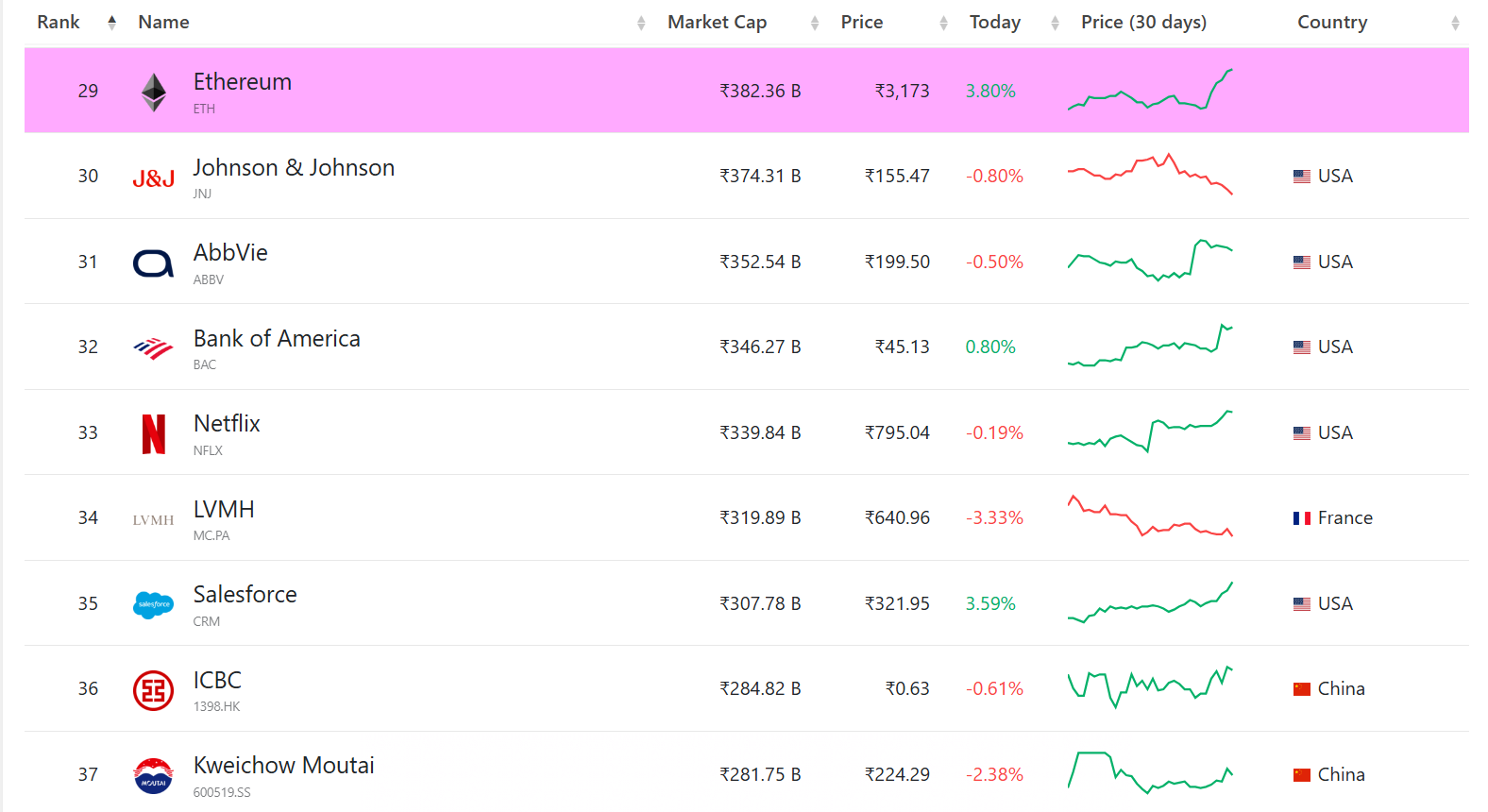

Nevertheless, this latest rise alerts a shift, placing Ethereum again into the highest 30 most precious property on the planet, with a market capitalization of $382.36 billion.

Supply: CompaniesMarketCap

These developments counsel a rising neighborhood of establishments supporting Ethereum’s long-term potential. This institutional help is essential to mitigate any short-term impacts Busy that would push ETH south.

Furthermore, Solana, what was as soon as referred to as the ‘Ethereum killer’, has lived as much as its identify. Since final cycle, Solana has attracted notable liquidity from Bitcoin, which is buying and selling above $200.

This triggered a stir available in the market, main analysts to marvel if a market shift is underway, with Ethereum doubtlessly dropping floor to its rival.

Whereas Ethereum nonetheless lags behind Solana on a number of fronts, its seven-day progress is vital on a number of counts statistics has been impressively robust.

With weekly gross sales up 250%, in comparison with Solana’s 67%, and each day transactions up 10%, nicely forward of Solana’s 3%, Ethereum reveals resilience.

Is your portfolio inexperienced? Take a look at ETH’s revenue calculator

So this bull cycle is a game-changer for Ethereum. Whereas the nation might face some sideways stress at key resistance ranges, this rise has actually improved its long-term prospects.

Ethereum is now primed for a possible breakout, with an actual probability of crossing the $3.5K mark within the close to future.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024