Ethereum

Ethereum’s fake breakdown spotted, ETH price bounce imminent?

Credit : ambcrypto.com

- Excessive transaction quantity for ETH has elevated by 58.63%, indicating a bullish outlook.

- ETH may rise 15% to succeed in the $2,855 stage if it closes a each day candle above the $2,465 stage.

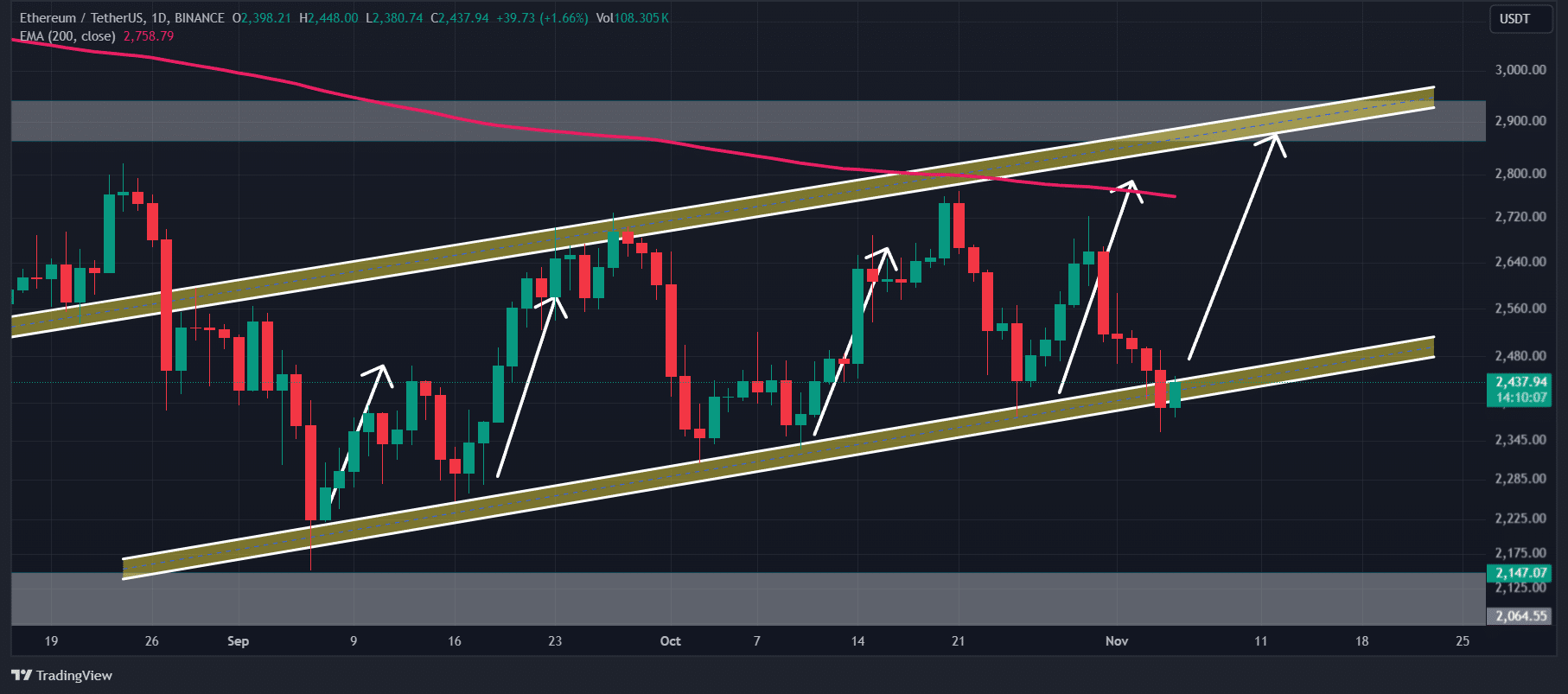

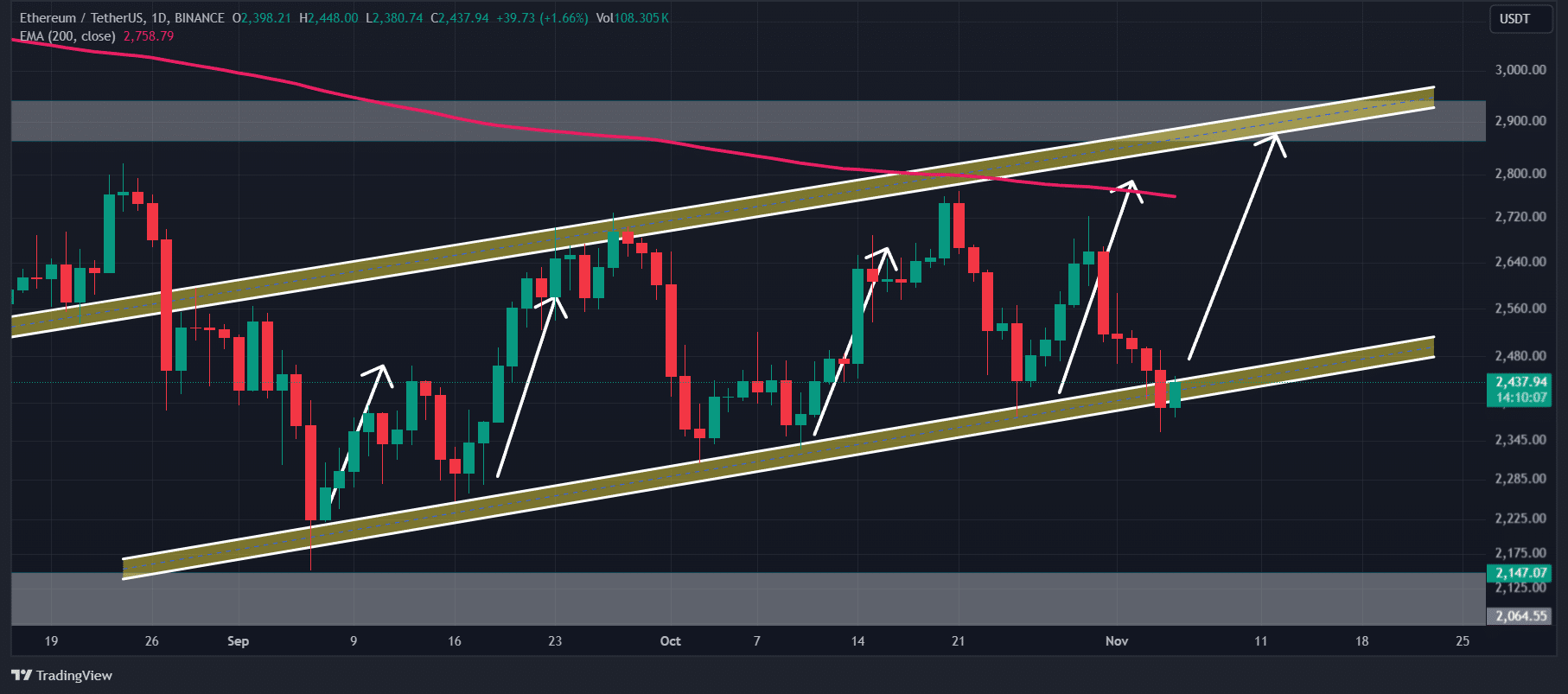

Amid the continued battle within the cryptocurrency market, Ethereum [ETH] skilled a breakout of a bullish channel sample, though this seems to be a fakeout as worth has moved again inside the sample.

Together with ETH, the general cryptocurrency market has struggled considerably to achieve momentum. Nevertheless, potential causes for this wrestle embody the US presidential election, geopolitical tensions and different elements.

Ethereum technical evaluation and key stage

AMBCrypto means that ETH is bullish and will publish vital positive aspects within the coming days. At present, the asset is at a vital help stage, or let’s imagine the decrease restrict of a bullish parallel channel sample.

Traditionally, when the worth reaches this stage, it experiences shopping for stress and an upward rally.

Supply: TradingView

This time, nevertheless, buyers and merchants count on an identical worth enhance within the coming days. Primarily based on current worth motion, if ETH closes a each day candle above the $2,465 stage, there’s a sturdy risk that the asset may rise 15% to succeed in the $2,855 stage within the coming days.

ETH’s bullish thesis will solely maintain so long as ETH trades above $2,400, in any other case it may fail.

Bullish statistics within the chain

On-chain metrics additional help ETH’s optimistic outlook, pointing to the asset’s potential power.

Nevertheless, it has additionally been noticed that regardless of market uncertainty and notable volatility, whale and investor participation has elevated dramatically.

In keeping with the on-chain analytics firm InHetBlokexcessive transaction quantity for ETH has elevated by 58.63%, indicating a bullish outlook.

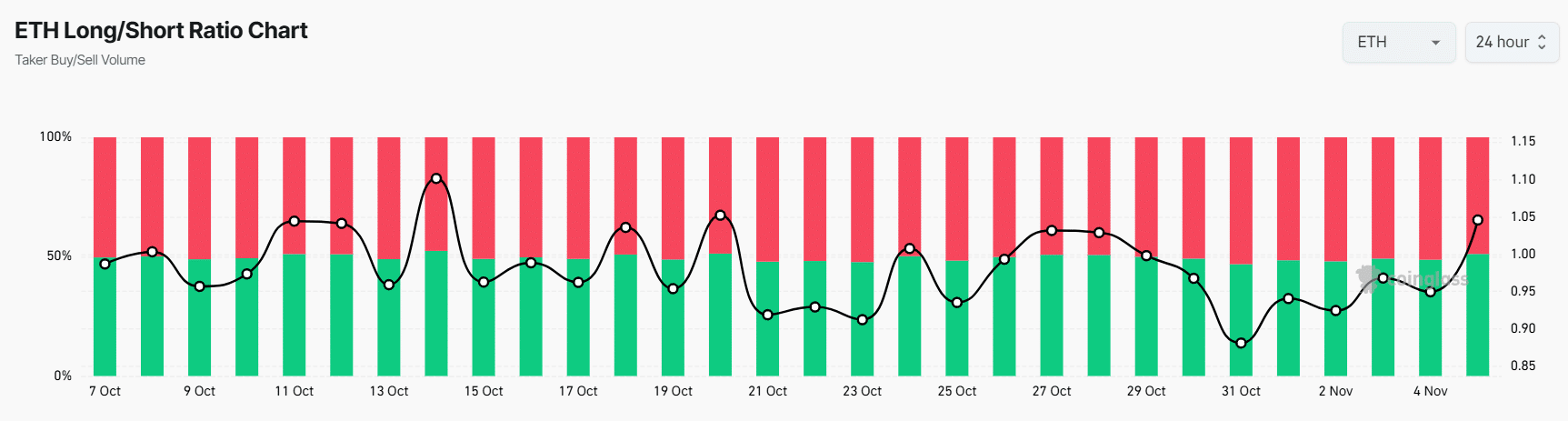

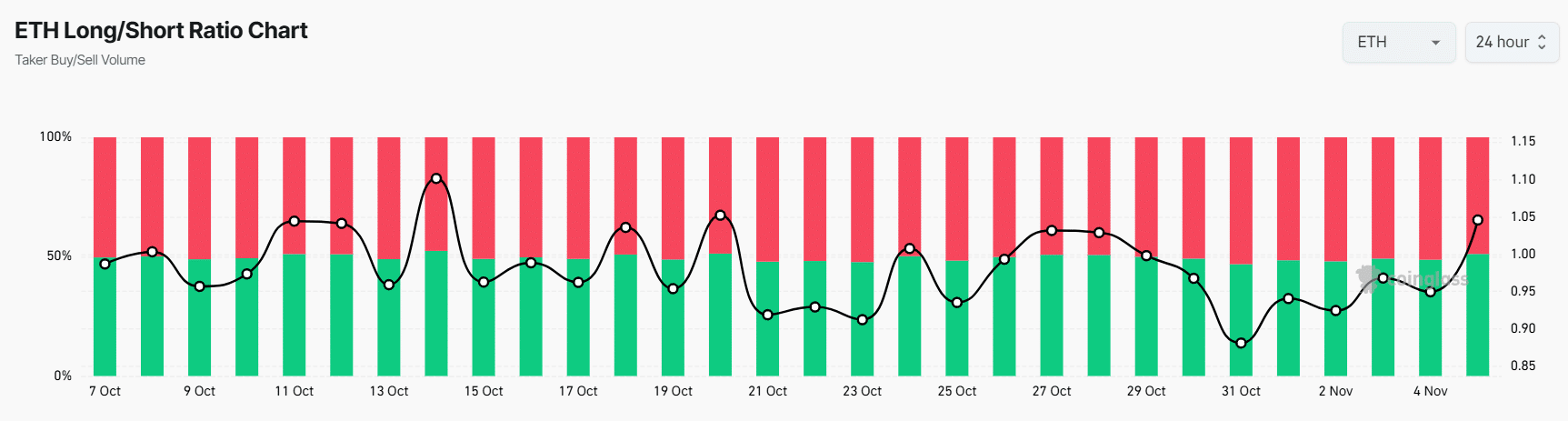

In the meantime, ETH’s Lengthy/Quick ratio presently stands at 1.055, the very best since October 21, 2024. A ratio above 1 signifies sturdy bullish sentiment amongst merchants. Moreover, open curiosity has remained unchanged over the previous 24 hours, indicating that merchants have secured their positions regardless of the current worth decline.

Supply: Coinglass

Learn Ethereum’s [ETH] Value forecast 2024–2025

Dealer sentiment

The mixture of on-chain metrics and technical evaluation means that bulls are presently dominating the asset and will help a big rise in ETH within the coming days.

On the time of writing, ETH was buying and selling round $2,440 and has skilled a modest worth decline of 0.75% over the previous 24 hours. Throughout the identical interval, buying and selling quantity elevated by 24%, indicating better participation from merchants and buyers amid the current worth decline.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024