Altcoin

Ethereum’s funding rate signals a potential recovery for ETH

Credit : ambcrypto.com

- Ethereum’s funding price alerts a possible restoration for ETH.

- ETH is down 16.48% over the previous seven days.

Since reaching $4109, Ethereum [ETH] has skilled robust downward strain. As such, the altcoin has fallen to a low of $3095 over the previous week, down 16.48%.

Regardless of the current dip, Ethereum seems positioned for a comeback to $3,300. It’s because Ethereum’s funding price has cooled because the two $4k rejections.

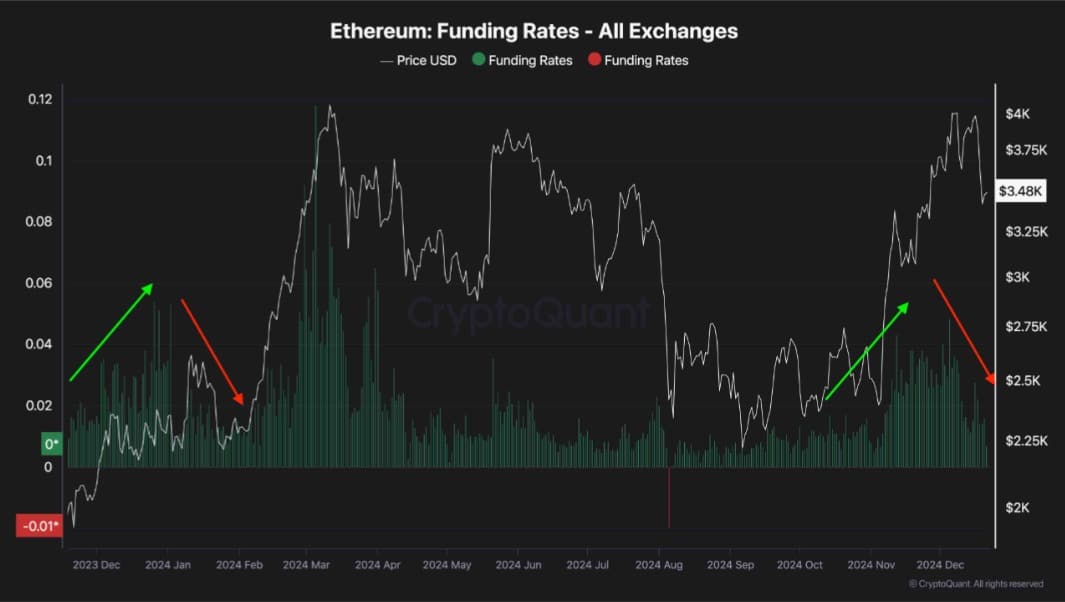

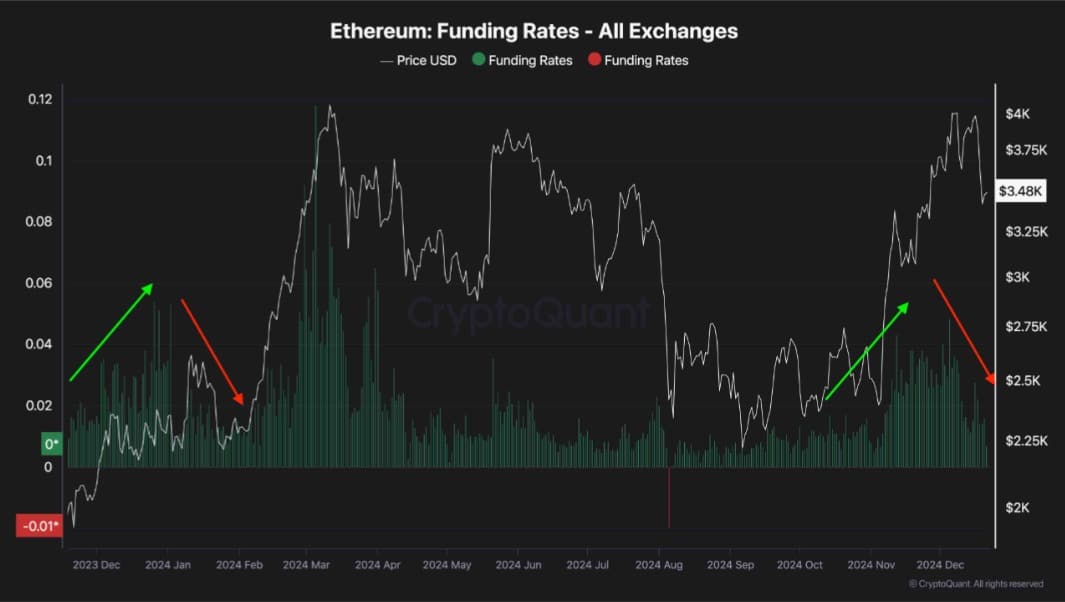

Ethereum futures market cools after $4k rejection

In keeping with CryptoquantumEthereum’s incapacity to reclaim the $4k resistance resulted in huge liquidations within the futures markets.

Supply: Cryptoquant

This resulted in an enormous market crash the place ETH hit all-time low. Whereas ETH’s funding price soared final week, the altcoin’s incapacity to carry above $4,000 introduced its funding price again to wholesome ranges. These ranges are very appropriate for a bullish pattern.

Due to this fact, the cooling impact of this might doubtlessly pave the way in which for a extra sustainable rally within the coming weeks.

Traditionally, such a sample occurred in January 2024, when the drop in funding charges cooled the futures market, inflicting ETH to have a significant uptrend.

Throughout this rally, Ethereum rose from $2169 to $4091. This historic precedent signifies that the present market reset may mark the start of a brand new bullish part.

What ETH charts counsel

Though Ethereum has skilled robust downward strain over the previous week, prevailing market situations level to a restoration.

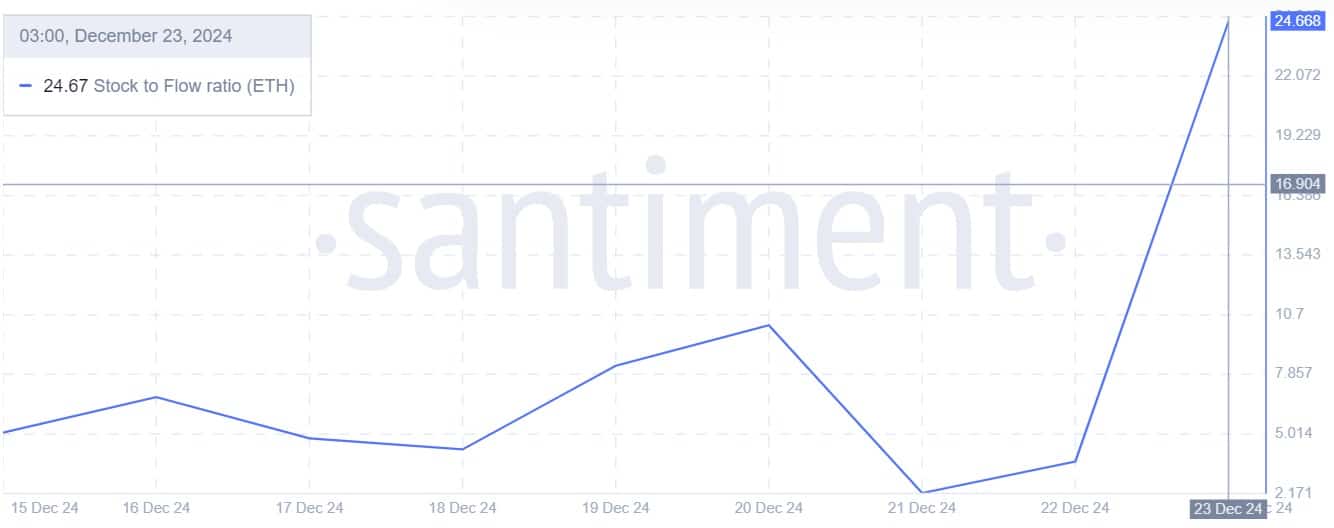

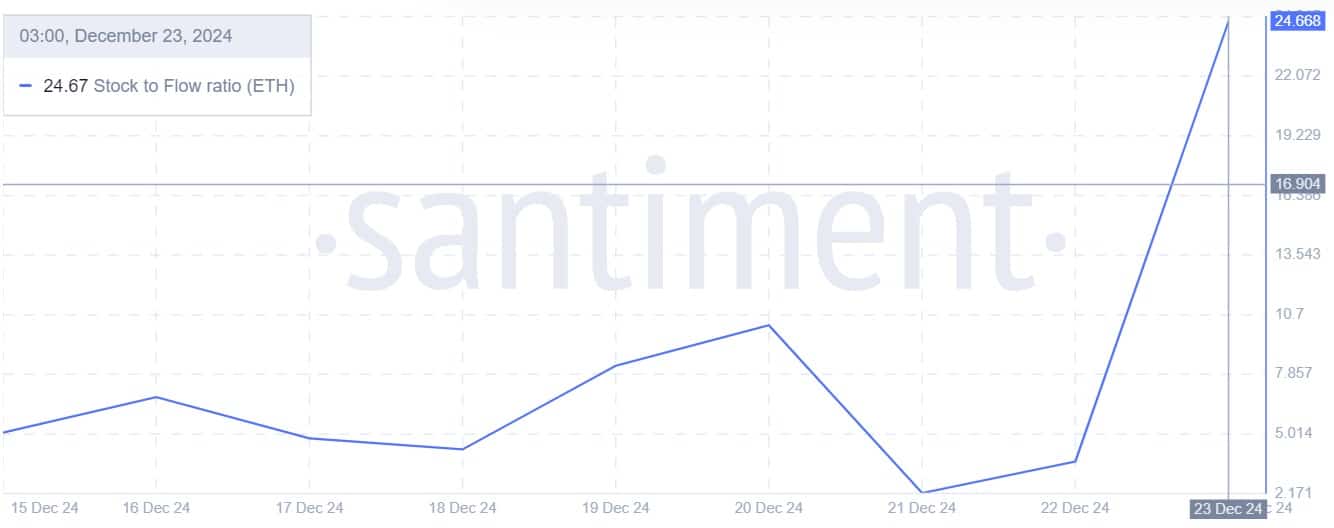

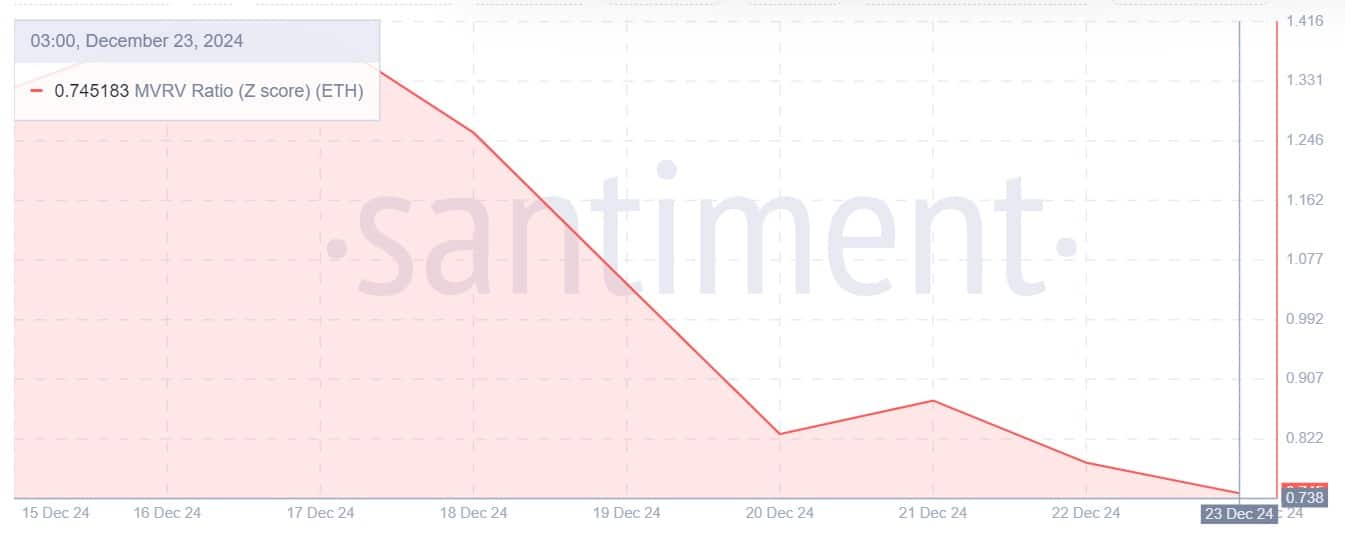

Supply: Santiment

For starters, Ethereum’s stock-to-flow ratio has elevated from 2.19 to 24.67 over the previous week. When the SFR rises, it implies that ETH has develop into scarcer amid elevated accumulation by giant holders.

As such, the altcoin has develop into scarcer. Mixed with rising demand, this drives up costs resulting from provide shortages.

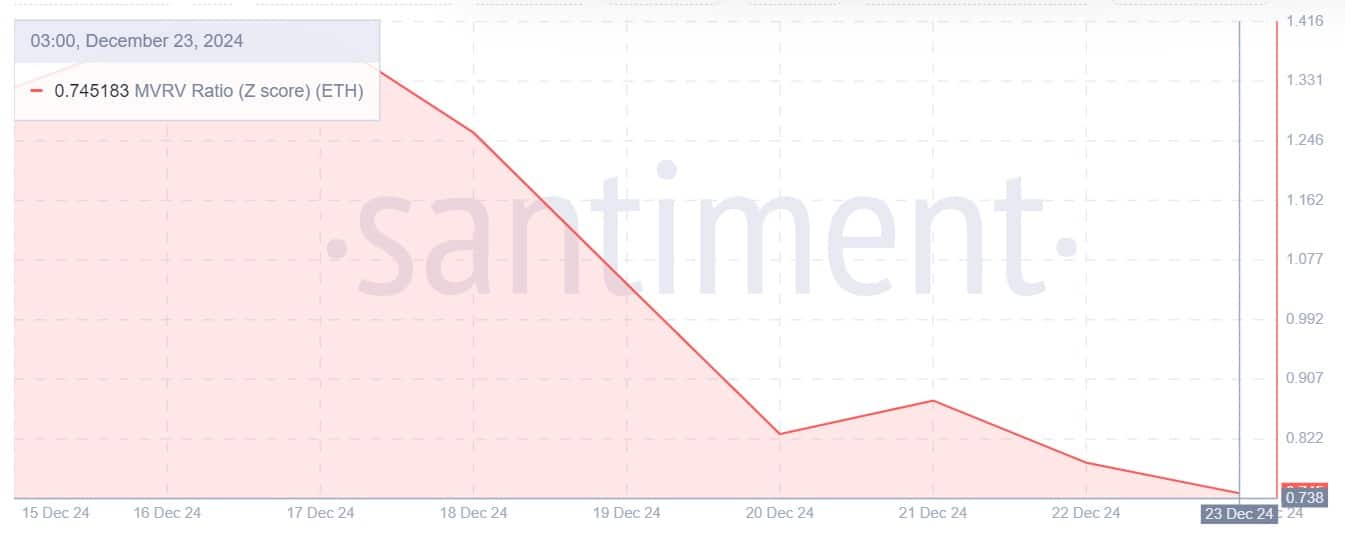

Supply: Santiment

Moreover, the Ethereum MVRV Z-score ratio has dropped to 0.745 over the previous week. When the MVRV rating reaches such low ranges, it signifies that ETH is at the moment undervalued, which is an effective sign for accumulation amongst long-term holders.

This pattern has been seen over the previous week as whales turned to purchase the dip. Higher accumulation typically creates larger buying strain, which places upward strain on costs resulting from excessive demand.

Supply: Santiment

Lastly, Ethereum’s Bitmex foundation ratio has elevated from -0.22 to 0.07 in current days. When this ratio turns optimistic, it displays optimism within the futures market as merchants anticipate costs to rise after the dip.

Is a comeback doubtless?

As famous above, the futures market is bullish and expects ETH costs to get well. Likewise, spot demand for Ethereum is continually rising, creating wholesome situations for value beneficial properties.

Learn Ethereum’s [ETH] Worth forecast 2024-25

Now that the market is bullish, ETH may get well from the $3300 dip and regain larger resistance. If these situations maintain, ETH will reclaim the $3700 resistance.

A transfer from right here may strengthen Ethereum to move in the direction of $3900. Nevertheless, with the bears nonetheless robust, ETH will fall to $3160 if the bulls fail to recapture the market.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now