Ethereum

Ethereum’s market analysis – Whale actions, staking, and more…

Credit : ambcrypto.com

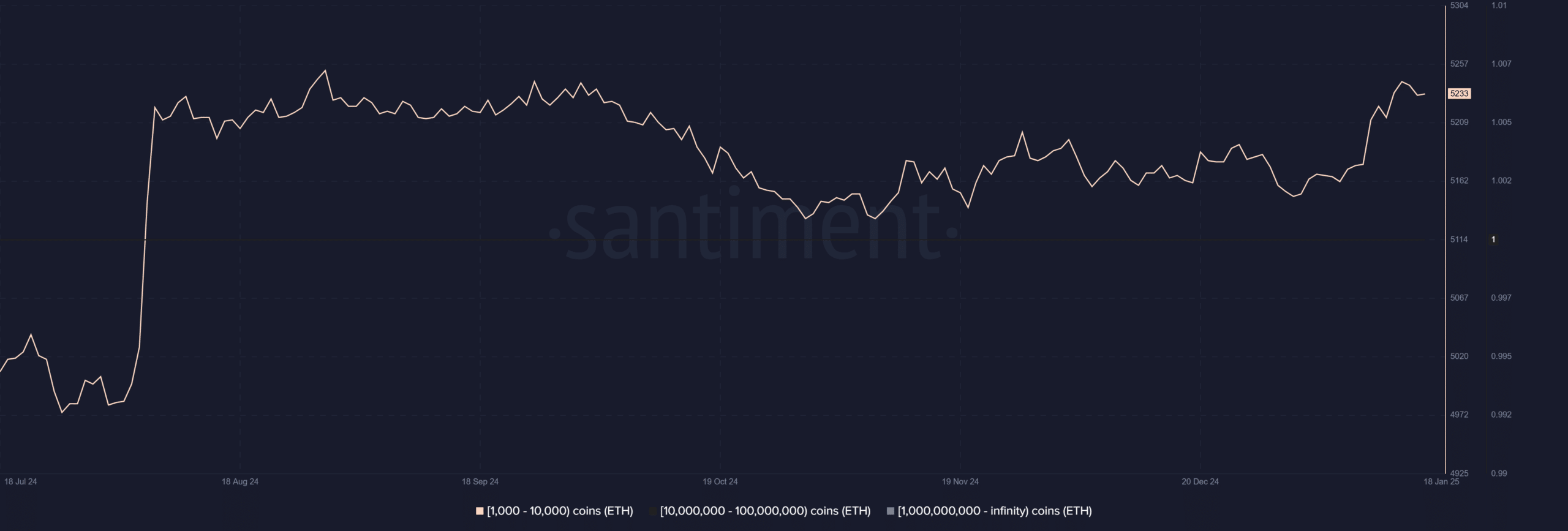

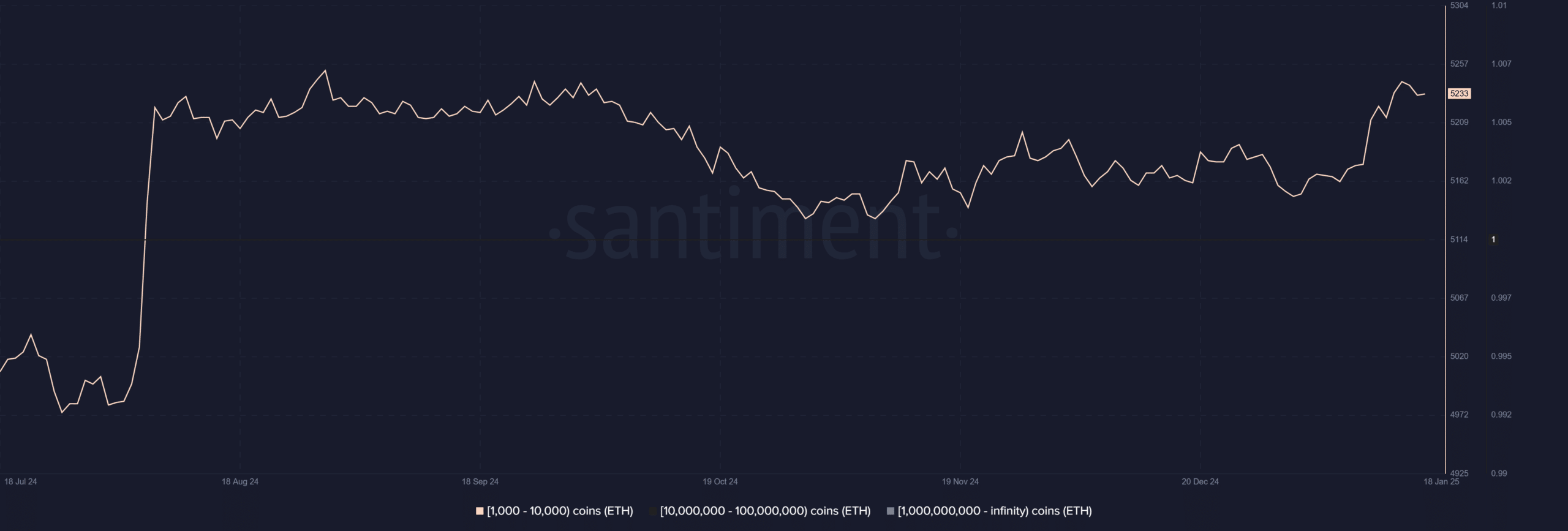

- Whale sentiment hit a six-month excessive as addresses holding 1,000-10,000 ETH elevated their positions

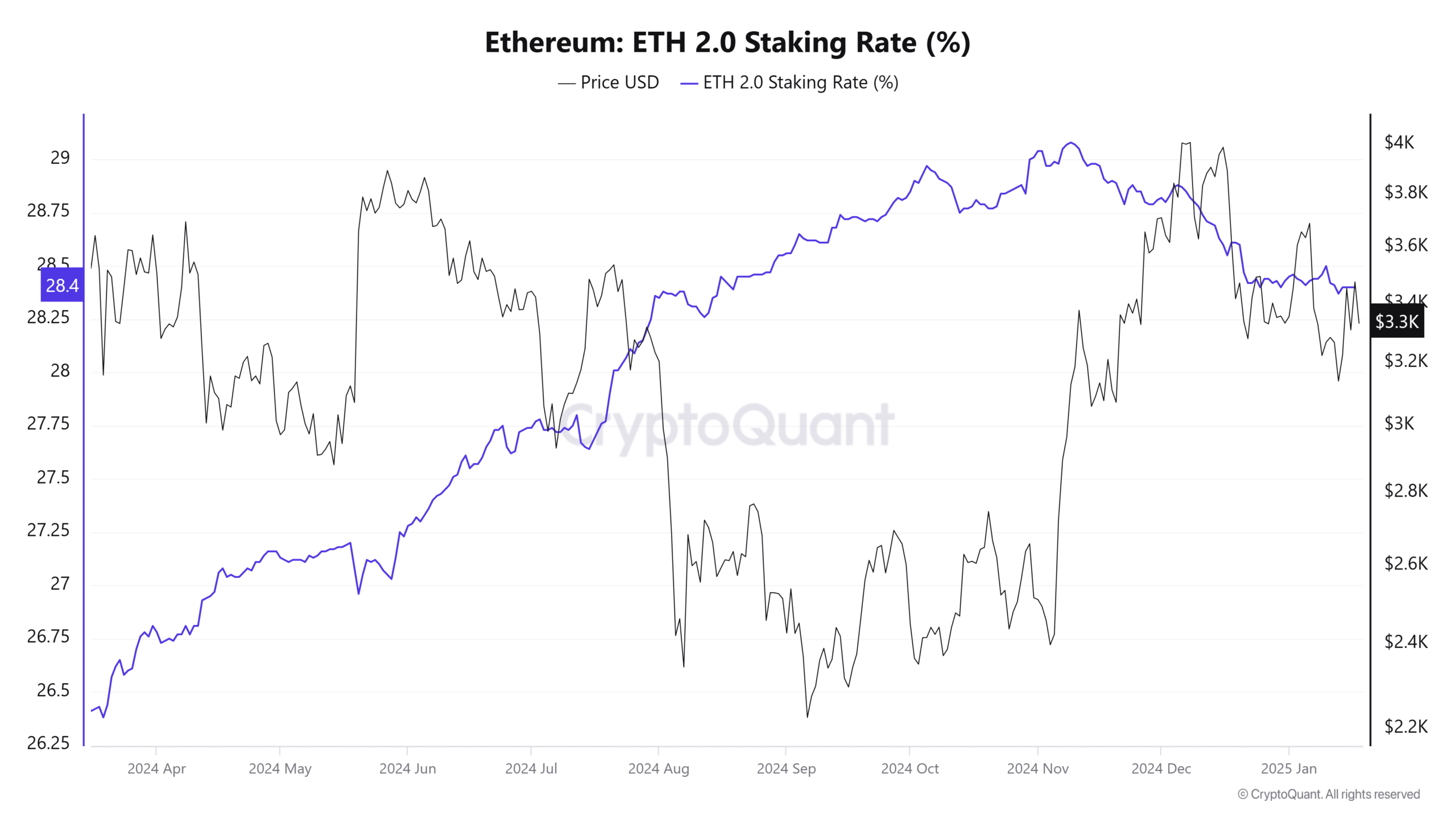

- ETH’s strike charge has steadily elevated from 26.25% to twenty-eight.4% since early 2024

In a significant shift that’s reshaping Ethereum’s possession panorama, whale addresses have expanded their management to roughly 43% of the whole ETH provide. This represents a dramatic enhance from a 22% share in early 2023 IntoTheBlocks details.

The truth is, giant holders have amassed over 330,000 ETH (valued at over $1 billion) previously week alone, with many now profiting from staking alternatives to strengthen their positions.

A dive into Ethereum’s whale conduct

Once we look at the Santiment index for addresses valued between 1,000 and 10,000 ETH, the focus sample turns into clearer.

The evaluation confirmed that it has reached the best degree since August 2024. On-chain knowledge additionally confirmed that these addresses have maintained constantly excessive sentiment regardless of market volatility – an indication of robust conviction of their accumulation technique.

Supply: Santiment

The most recent surge in whale addresses coincided with Ethereum’s value stability above $3,000, indicating strategic positioning forward of potential market strikes.

This enhance in confidence additionally corresponded with participation in institutional placing – an indication of a strategic method to accumulation.

Ethereum staking panorama strengthens focus

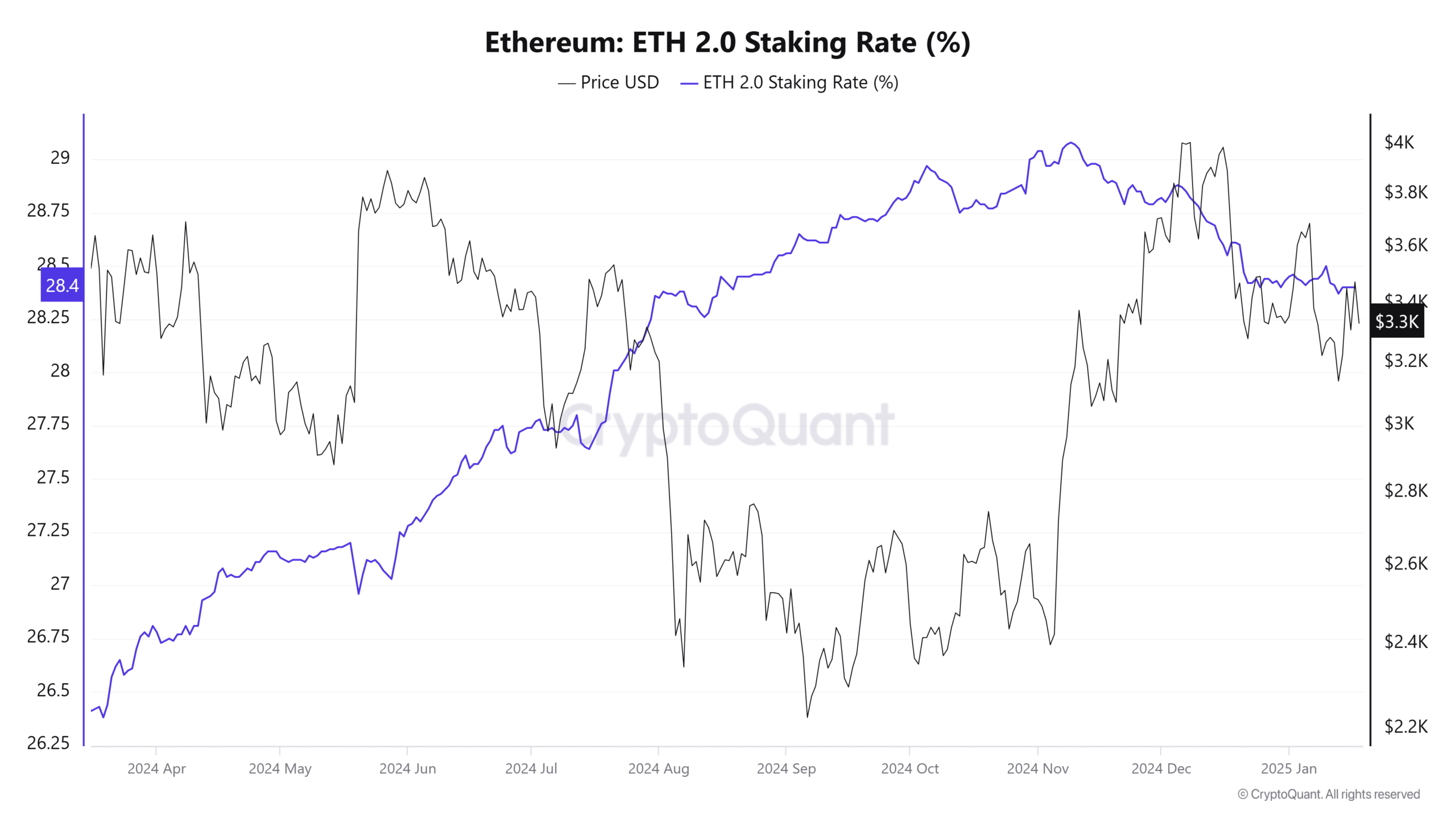

Ethereum’s stake charge has proven exceptional resilience, going from 26.25% in early 2024 to twenty-eight.4% on the time of writing.

This upward trajectory has continued regardless of vital value swings between $2,200 and $3,800, demonstrating the long-term holders’ conviction. On the time of writing, over 34 million ETH had been staked.

Supply: CryptoQuant

Help this development of whale accumulation by plotting knowledge Dune Analytics revealed a extremely concentrated ecosystem.

Coinbase leads centralized change staking with 3.27 million ETH (39.24% market share), adopted by Binance with 2.14 million ETH (25.73%) and Kraken with 886,625 ETH (10.61%). What this focus means is that simply three exchanges management greater than 75% of all ETH invested on the change.

The liquid staking sector is much more notable, the place Lido has emerged because the dominant power with 9.59 million ETH staked – with an awesome 89.49% market share.

Implications for the market

The convergence of whale accumulation and strike focus raises essential questions on market dynamics. With over $1 billion price of ETH collected in every week and main establishments holding vital positions, the market is displaying indicators of higher institutional entrenchment.

Whereas institutional involvement brings stability and legitimacy, the rising focus of energy raises considerations in regards to the dangers of market manipulation and the decentralization of networks. The current accumulation of $1 billion by whales and their vital presence might additionally impression market liquidity and value formation mechanisms.

– Reasonable or not, right here is the ETH market cap by way of BTC

Lastly, aggressive whale accumulation and concentrated strike positions indicated a maturing market construction. According to this, it turned out that institutional gamers have acquired strategic positions for the long run.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now