Web 3

Ethereum’s network revenue plunges by 99%, sparking ‘death spiral’ concerns

Credit : cryptoslate.com

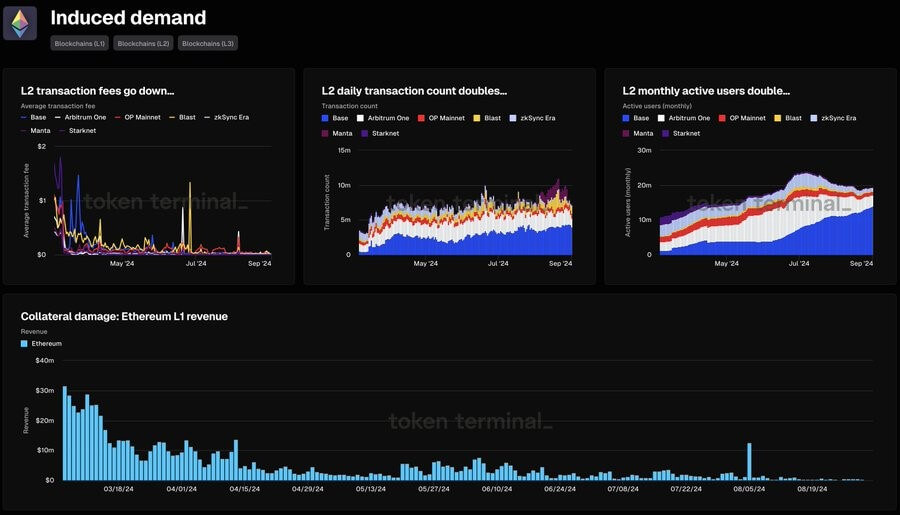

Ethereum’s Layer-1 community has witnessed a drastic drop in income, falling 99% since March 2024.

Facts from Token Terminal reveals that community revenues peaked at greater than $35 million on March 5. By September 2, nevertheless, every day revenues had fallen to an annual low of about $200,000.

Market observers attribute this decline to the expansion of Layer-2 (L2) networks and March’s Dencun improve, which lowered charges for L2 transactions and reshaped Ethereum’s income construction. Token Terminal acknowledged:

“Key metrics displaying how decrease transaction charges on L2s have elevated utilization but additionally lowered income on the L1.”

Put up-upgrade transaction exercise has shifted from Ethereum’s mainnet to L2 networks, resulting in extra every day transactions and energetic customers on these platforms.

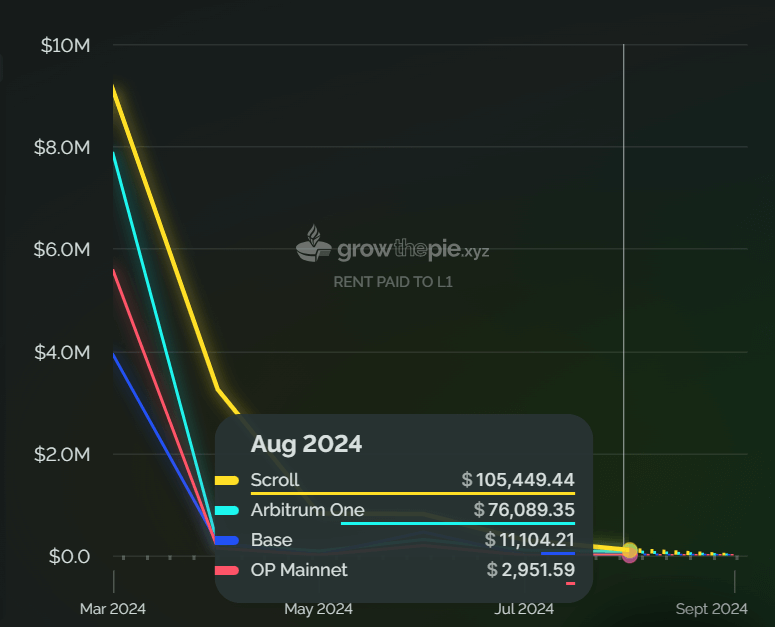

Nonetheless, this migration has had a big impression on Ethereum’s charge income. For instance, Coinbase’s L2 community, Base, generated $2.5 million in income in August however paid solely $11,000 to ascertain itself on the mainnet, underscoring the shift in worth from Ethereum’s base layer.

Crypto analyst Kun warned that if this pattern continues, L2 networks may dominate and presumably exit Ethereum’s mainnet, particularly for shopper functions. He emphasised the necessity for Ethereum to develop beneficial use instances on its mainnet or threat a critical valuation downside.

He added:

“ETH L1 wants beneficial use instances on the mainnet that may’t be besieged, or you must hope that the L2 utilization is so excessive that you simply basically want 100,000 instances the utilization on L2 to get the identical worth as on the mainnet, with a small fraction that then creates a valley of valuation issues.”

‘Loss of life Spiral’

Bitcoin investor Fred Krueger has echoed these issues, suggesting that Ethereum may face a “loss of life spiral” if the low income state of affairs continues.

He identified that Ethereum’s present charges of $200,000 per day equate to $73 million per yr, removed from sufficient to keep up its $300 billion market cap.

Krueger argues {that a} extra sensible valuation may very well be nearer to $3 billion, underscoring the discrepancy between Ethereum’s charge income mannequin and its market valuation. He mentioned:

“[Ethereum is] not equal to an organization that makes $73 million a yr in income, or perhaps a firm that generates $73 million a yr in revenues. That is $73 million not even sufficient to purchase again all of the inflation that naturally involves ETH validators.”

Talked about on this article

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now