Ethereum

Ethereum’s new roadmap: Will Vitalik’s latest plan boost scalability?

Credit : ambcrypto.com

Buterin has proposed A brand new route map was aimed toward bettering the scalability, finality and security of the Layer 2 options from Ethereum.

The brand new route map of Vitalik Buterin for Ethereum introduces a “2-of-3” mannequin, which mixes optimistic proof, zero information (ZK) and combines trusted implementing atmosphere (TEE).

Transactions are accomplished when two of those proof agrees, lowering dependence on one methodology and tackling safety and fraud issues.

The proposal is aimed toward lengthy -term layer 2 scale issues whereas retaining the decentralization of Ethereum.

An necessary characteristic is the event of “Stage 2 rollups”, which promise sooner confirmations, higher finality and elevated resilience in semi-affected environments.

The liquidation of Ethereum

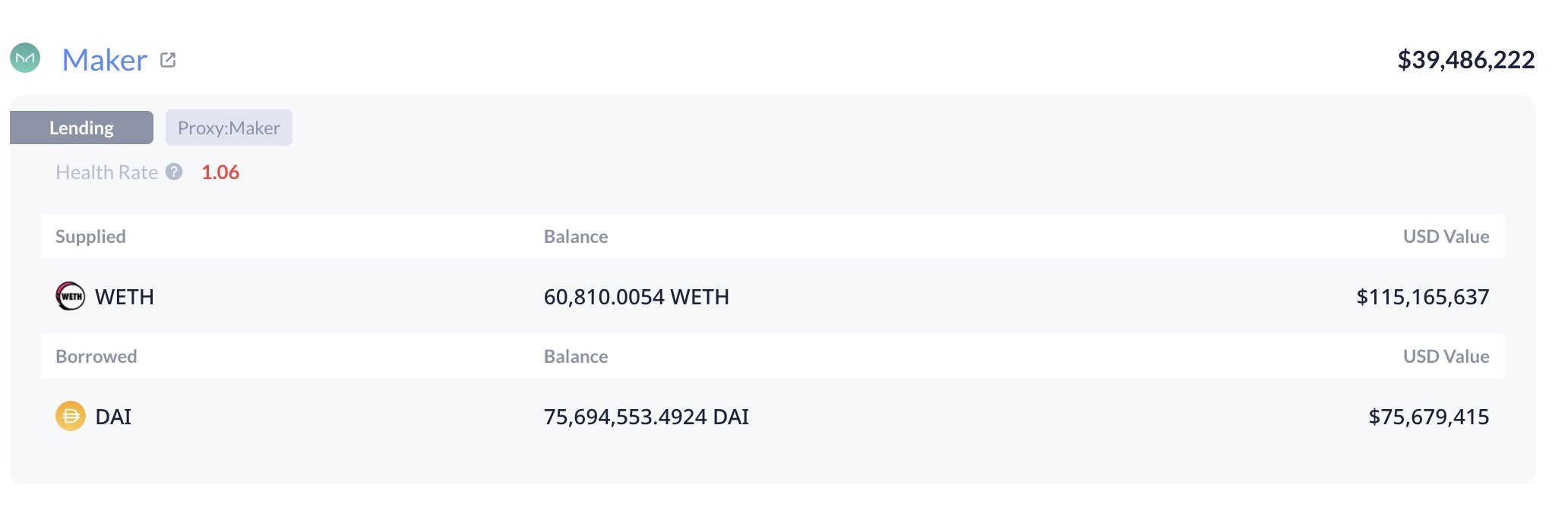

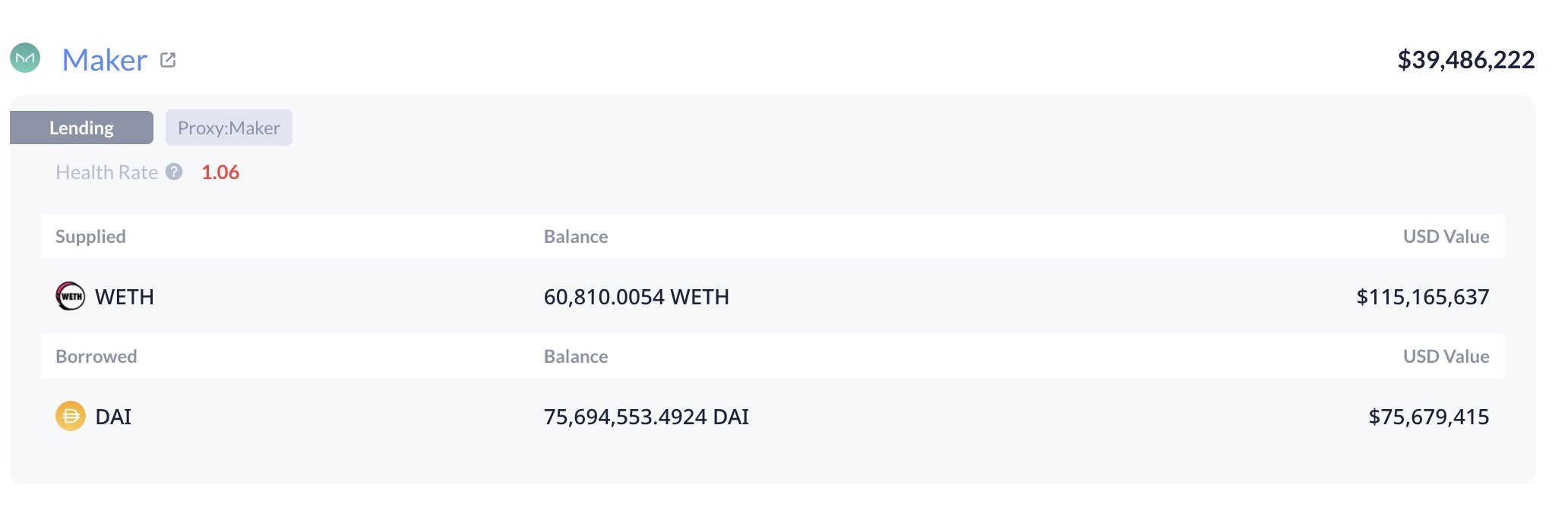

Though the Layer 2 improvements of Ethereum concentrate on bettering scalability and security, the broader ecosystem continues to be confronted with appreciable monetary dangers. Such a priority is the liquidation danger that’s related Large ETH companies On Makerdao.

Supply: X

Because the ETH worth fluctuates, the 125,603 ETH (roughly $ 238 million) runs into the fingers of two massive whales on the maker the danger of liquidation.

With the well being proportion of as much as 1.07 and significant liquidation costs for $ 1,805 and $ 1,787, an additional lower within the worth of ETH might trigger liquidations, which makes it potential to affect market stability.

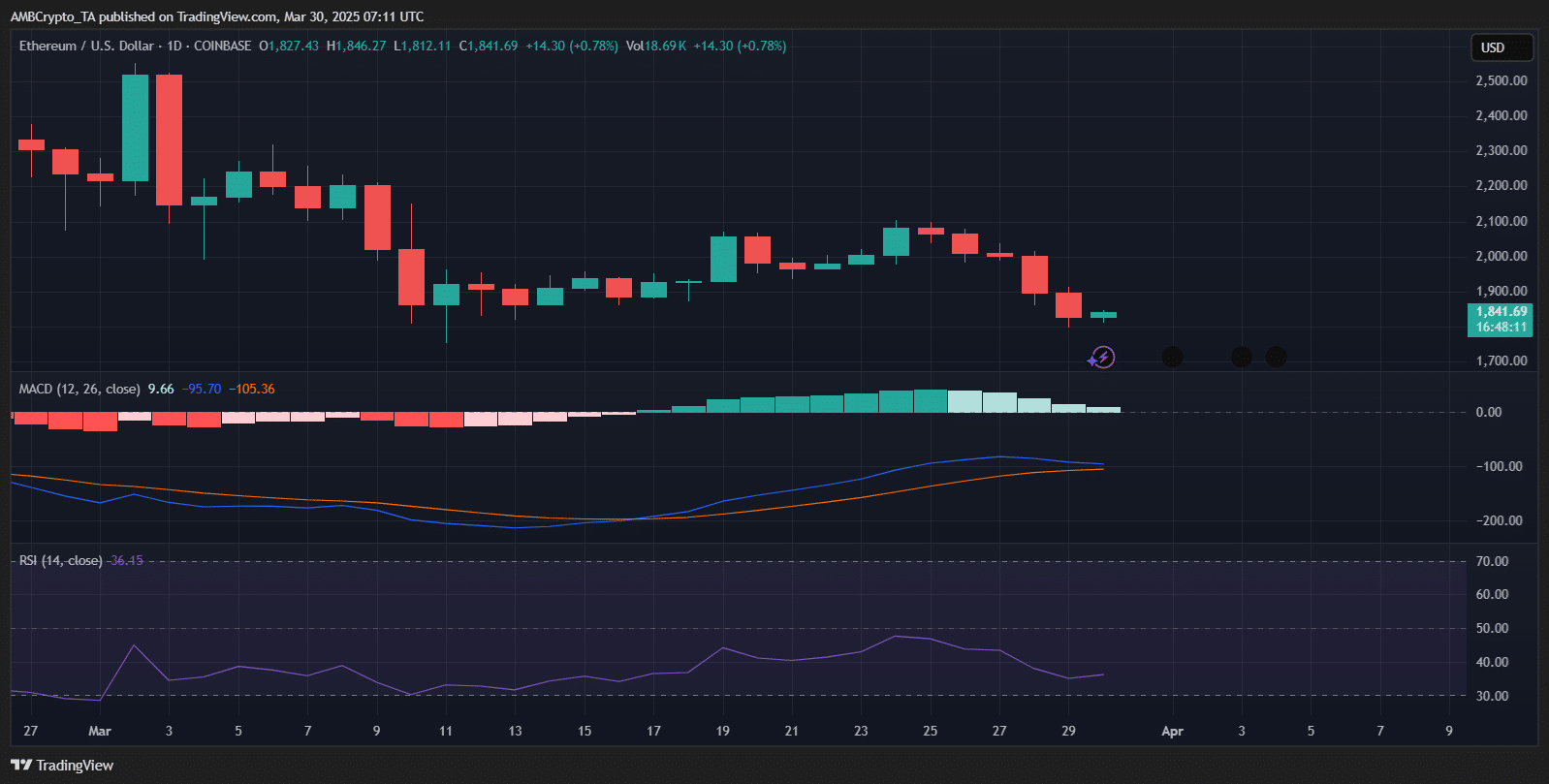

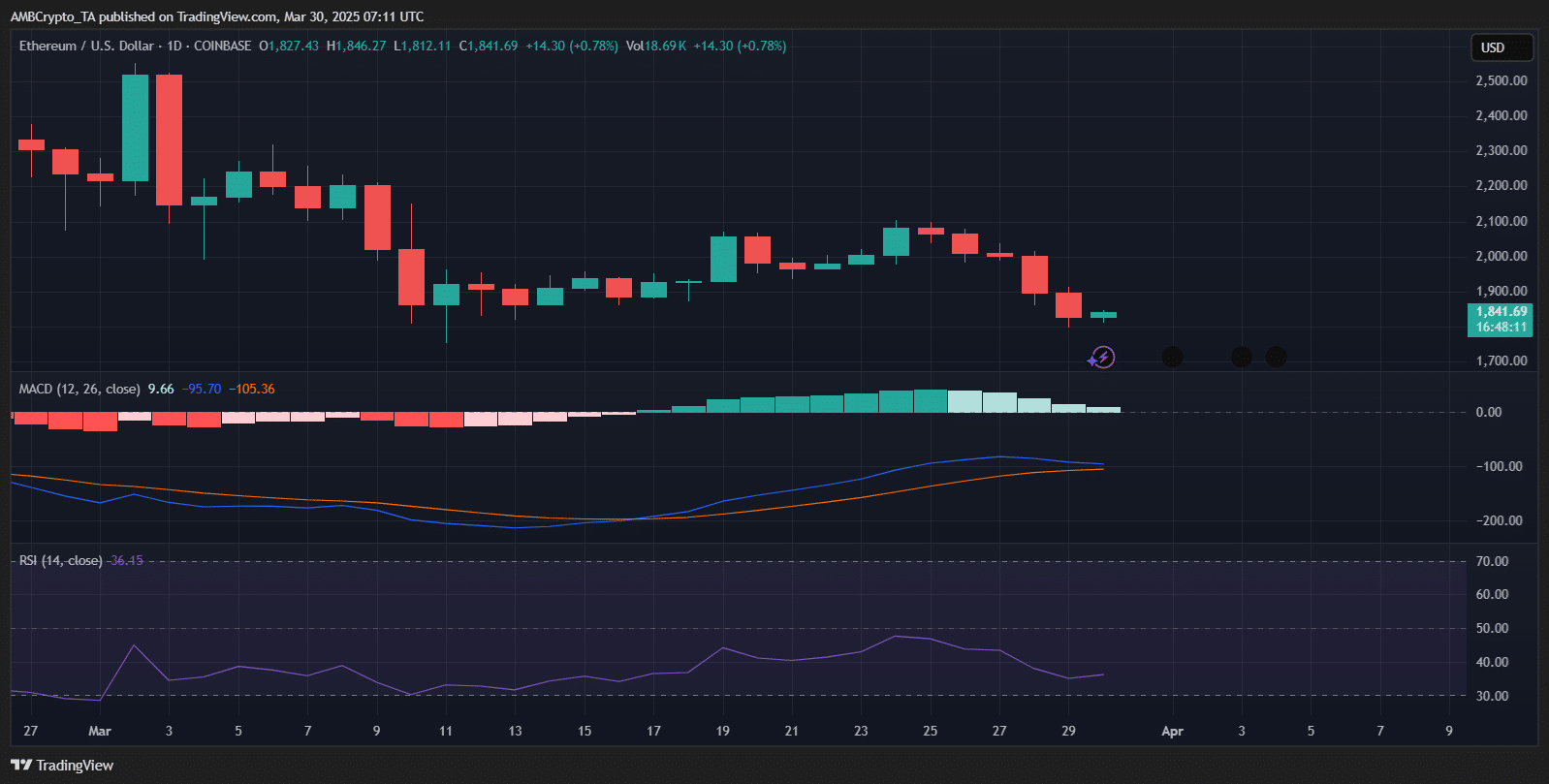

Ethereum Worth Outlook

The Ethereum Each day Chart reveals a slight restoration after a lower of 8% up to now week, and acts at $ 1,841.69 on the time of the press.

The MACD indicator continues Beararh, with the road below the sign line, which means that the continual gross sales strain. The RSI at 36.45 indicated over bought -out circumstances, and factors to a potential reversal if shopping for quantity will increase.

Supply: TradingView

The current worth promotion reveals a consolidation part after a aggressive lower, with assist most likely round $ 1,750- $ 1,700. If Bullish Momentum builds, resistance is predicted close to $ 1,900- $ 2,000.

The general development stays unsure, with an additional drawback potential, except a robust shopping for push comes out.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024